2014 Farm Bill: Estimated Payment Sizes for County ARC and SCO for Corn in Illinois

Today’s post continues the historical analysis of the new County ARC and Supplemental Coverage Option programs created in the 2014 Farm Bill. Last week’s post (available here) focused on the likelihood of payments being triggered by yield or revenue losses. This post provides estimates of relative payment size based on the same historical data. More details on the new commodity program options can be found here. Details on SCO can be found here and here.

Historical Analysis

Illinois county yield data and national marketing year average prices for corn from 1972 through 2013 were collected from NASS. Corn futures price data was also used to collect base and harvest insurance prices over the same time period. This historical data was then used to put together an historical analysis of the county ARC and SCO programs from 1977 through 2013 (the 1972 to 1976 data was needed to develop county ARC revenue guarantees beginning in 1977).

For each year in the analysis, actual revenues or yields were compared to their respective program guarantees to determine if program payments would have been triggered. County ARC triggers payments if actual revenue (MYA price times county yield) falls below 86% of the benchmark revenue (based on previous 5 years of MYA prices and county yields). SCO triggers payments if actual revenue (harvest price times county yield) or yield falls below expected revenue or yield (based on county trend yields and insurance prices).

The historical analysis was done under the same assumption as those used last week, namely:

- The minimum corn price used in setting the ARC program benchmark price was $2.35 from 1972 through 2006, and $3.70 from 2007 through 2012. The $2.35 price represents the average MYA corn price from 1972 through 2006 and was also the price which would have triggered payments under the repealed counter-cyclical program.

- County trend yields used to determine expected yield or revenue for the SCO program were estimated using a simple linear trend regression over the 1972 to 2013 period.

The estimated payment sizes provided in the results and discussion section below are given as a percentage of the program’s guarantee. For County ARC, the reported average payment sizes are given as a percentage of the county’s ARC revenue guarantee. For SCO, the reported average payment sizes are given as a percentage of the expected county yield (in the case of SCO coupled with yield protection) or expected county revenue (in the case of SCO coupled with some form of individual revenue plan).

Results and Discussion

Table 1 below reports the average payment size for the County ARC and SCO programs. Also included in the table is an average payment size, conditional on a payment occurring. This conditional measure is the average payment size considering only years in which a payment would have been triggered. Three cases for SCO coverage are considered. One when SCO is coupled with yield protection (YP), another where SCO is coupled with revenue protection with the harvest price exclusion (RP-HPE), and finally SCO coupled with revenue protection (RP). For each SCO scenario, a coverage level of 75% was chosen in an attempt to provide an appropriate comparison with the County ARC program. County ARC covers losses between 86% and 76% of the county revenue guarantee – a 10% band of revenue coverage. SCO with 75% coverage covers county yield or revenue losses between 86% and 75% of county yield or revenue guarantee – an 11% band of yield or revenue coverage.

The average payment size for the County ARC program across IL counties was estimated to be 1.65% of the guarantee. The average payment size for SCO with 75% YP is slightly lower at 1.61%. Average payment sizes for SCO with RP-HPE and RP are larger at 2.36% and 2.94%, respectively.

To provide an example of the expected payment levels for these programs at current price and yield levels, consider a county with an expected trend yield of 185 bushels per acre, and an ARC county yield guarantee of 170 bushels per acre. These numbers would be fairly typical of counties in central IL for 2014.

Using an estimated county ARC price guarantee for 2014 of $5.30 per bushel, the ARC revenue guarantee would be $901 per acre. The expected county ARC payment in this case would be approximately $14.87 per acre (1.65% x $901 = $14.87).

For SCO with 75% YP, the expected payment size would be roughly 3 bushels per acre (1.61% x 185 = 2.98). Using the 2014 base insurance price for corn of $4.62 that translates to an expected payment size of $13.76 per acre ($4.62 x 2.98 = $13.76). For SCO with RP-HPE and RP, the expected payment sizes would be $20.17 (2.36% x $4.62 x 185 = $20.17) and $25.13 (2.36% x $4.62 x 185 = $25.13) per acre, respectively.

The conditional average payment size for County ARC was estimated to be 4.26% of the ARC revenue guarantee. For SCO coverage, the conditional average payment sizes range from 3.52% of the county yield guarantee when coupled with YP to over 4% of the county revenue guarantee when coupled with RP-HPE or RP.

These numbers indicate that, on average in IL, expected payments from County ARC might be fairly comparable to those of SCO coupled with 75% yield protection but less than SCO coupled with some form of 75% revenue coverage. Note that these estimates are for gross program payments, and do not include the farmer-paid premium associated with SCO. Furthermore, these estimates do not consider any net payments received from the producer’s underlying plan of insurance (i.e. YP, RP-HPE, RP, or ARP) or, in the case of SCO coverage, the Price Loss Coverage commodity program. Note that the SCO average payment estimates would be larger if the individual coverage level was reduced and vice versa.

The average payment sizes for SCO do provide some measure of what the “actuarially fair” premium rate might be for SCO. However, actual rates for SCO determined by the Risk Management Agency will most certainly differ from those reported here due to differences in estimation methodology and various loadings that will be added to their estimated fair premium rates.

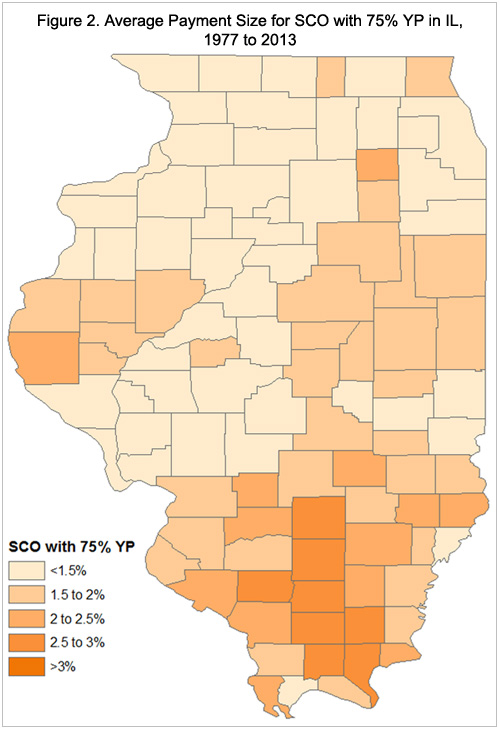

The maps in figures 1 through 4 report the estimated county-level average payment sizes for each program example, illustrating the variation across all Illinois counties. In Figure 1, the average payment size for County ARC varies from 0.7% to as high as 2.5% of the county ARC revenue guarantee. The largest average payments for County ARC tend to be focused in western, northeaster, and southeastern IL counties.

Figure 2 illustrates average relative payments sizes for SCO coupled with 75% YP. Average program payments range from as low as 0.5% to as much as 2.8% of expected county yield. The largest average payments for SCO with 75% YP tend to be focused in western, eastern, and southern IL counties where yield variation is greater than in the northern and central parts of the state.

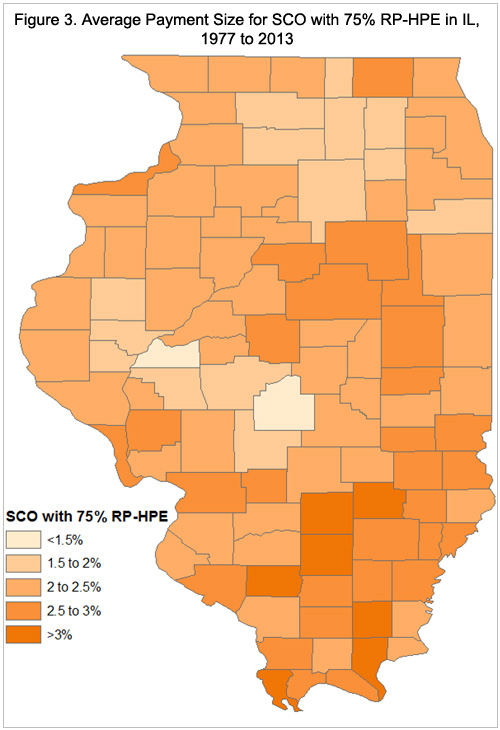

Figures 3 and 4 illustrate average relative payment sizes by county for SCO coupled with 75% RP-HPE and RP, respectively. Average payment sizes for SCO coupled with 75% RP-HPE range from 1.4% to 3.3% of the expected county revenue. The range for average payments for SCO coupled with 75% RP is 1.9% to 3.9% of expected county revenue. The largest expected payment sizes, in relative terms, tend to be located in counties in eastern and southern IL.

Conclusions

Continuing with the historical analysis of the County ARC and SCO programs introduced last week, estimates of average payments sizes for the programs were computed for corn acres across Illinois counties. The average payment size across IL counties for County ARC is comparable to that of SCO when coupled with 75% yield protection. SCO coupled with either RP-HPE or RP is estimated to trigger relatively larger payments. However, there is considerable variation in estimated payment sizes across Illinois counties for all programs. In relative terms, average payment sizes tend to be consistently larger in southern Illinois counties due to the higher level of yield variation relative to the northern and central regions of the state.

While the expected payment size estimates provide one comparison across the new revenue-based commodity and crop insurance programs that producers will have access to in the coming years to supplement their crop insurance coverage, additional factors need to be considered. First, the size of expected and actual SCO payments will differ when coupled with individual plans at different coverage levels. The 75% coverage level examined here was chosen to make the SCO coverage band similar to that offered by the County ARC program. Additionally, the premium cost associated with SCO coverage, and the potential to receive Price Loss Coverage payments, should be factored in to the comparison. Future posts will continue to analyze the programs introduced in the 2014 Farm Bill to provide more information for farmers and landowners in making their commodity and crop insurance program decisions.

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.