Supplemental Coverage Option (SCO) in Wheat

The Risk Management Agency recently released information necessary to calculate Supplemental Coverage Option (SCO) premiums for wheat. In this article, the basics of SCO are illustrated with an example from Washington County, Illinois. Comments on risk considerations associated with SCO are given at the end of this article. SCO will have risk management benefits when the maximum coverage level for the COMBO product is 75%. In counties where 85% coverage levels are available, SCO products offer limited potential to reduce the probability of low gross revenues. Previous articles provide more detail on SCO (farmdoc daily, April 24, 2014).

Eligibility and Description of the Supplemental Coverage Option

The 2014 Farm Bill instituted a new crop insurance product called the Supplemental Coverage Option (SCO). To be eligible for SCO, a farmer must:

- Not select the Agricultural Risk Coverage (ARC) option for receiving commodity program payments under the 2014 Farm Bill. In most cases, this means that the farmer selects to receive commodity programs using Price Loss Coverage (PLC). For 2015 wheat policies, farmers will not have made commodity program choices by the crop insurance deadline. For only 2015, farmers will be allowed to withdraw acres enrolled in SCO later if they decide to enroll in ARC. Withdrawals of acres from SCO will be allowed until December 15th or the acreage reporting date, whichever is earlier.

- Plant wheat in a county for which an SCO product is offered. Figure 1 shows counties for which wheat SCO contracts will be offered in 2015. RMA may expand county offerings in 2016 and following years.

- Insure wheat using the COMBO product under the Revenue Protection (RP), Revenue Protection with Harvest Price Exclusion (RPwExcl), or Yield Protection (YP) plan. SCO will not be available to farmers using the Area Risk Protection Insurance (ARPI) policies. ARPI policies make payments based on county yields or revenues and include Area Risk Plan (ARP), Area Risk Protection with the harvest price exclusion (ARPwExcl), and Area Yield Protection (AYP) plans.

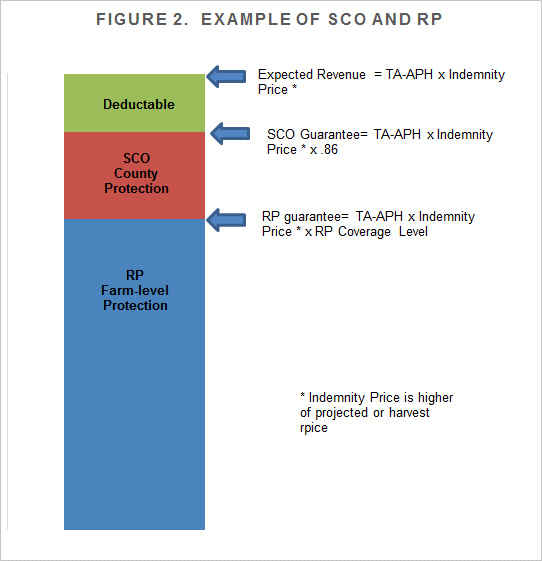

SCO is a county-level product that provides protection from an 86% coverage level down to the coverage level of the underlying COMBO product. Take, for example, an SCO product combined with an underlying RP product at the 75% coverage level. SCO will provide protection in the range from 86% to 75% of the farm revenue guarantee, triggered by shortfalls in county revenue. SCO will provide protection based similar to that in the underlying COMBO product. If RP is the underlying COMBO product, SCO will provide revenue protection. If RPwExcl is the underlying product, SCO will provide revenue protection without harvest price increase provisions. If YP is the underlying product, SCO will provide yield protection.

A Washington County, Illinois Wheat Example with an Underlying RP Product

SCO mechanics are illustrated for wheat in Washington County, Illinois. RP is the underlying product. The Trend-Adjusted Actual Production History (APH) yield is 60 bushels per acre and the 2015 projected price is $6.00 per bushel. (The projected price for 2015 is not known at this point. The $6.00 price is used as an example.)

In concept, SCO provides additional protection from 86% of RP’s expected revenue down to the 75% coverage level of the RP policy (see Figure 2). However, the SCO payment will not be triggered by farm revenue losses. Rather SCO payments will be triggered based on county revenue. Payments under SCO will be illustrated in the following two subsections: the first section provides cases when the harvest price is less than the projected price, the second section shows a case when the harvest price is greater than the projected price.

Harvest price less than projected price

RP will be purchased at a 75% coverage level giving a minimum guarantee under RP of $270 per acre:

- $270 = $6.00 projected price x 60 TA-APH yield x .75 coverage level.

SCO will make payments in a range from 86% down to the 75% coverage level of the RP product. The maximum payment is based on expected farm revenue, times the range of the SCO payment. For the example, the maximum payment when the harvest price is less than the projected price is $40 per acre:

- $40 = $6.00 projected price x 60 TA-APH yield x (.86 – .75 RP policy)

Note that the maximum payment depends on a farm’s TA-APH. Farms with higher TA-APH yields will have higher maximum SCO payments, and vice versa.

How much of the maximum revenue will be paid depends on county revenue relative to a county guarantee. The county guarantee is based on the projected price times the expected yield set by the RMA. The expected county yield is the same as is used in ARPI products. Washington County has an expected county yield of 62.8 bushels per acre. When harvest price is below projected price, SCO will make payments when county revenue is below $324 per acre:

- $324 = $6.00 projected price x 62.8 expected county yield x .86.

The maximum county payment occurs when county revenue is below the expected revenue times the coverage level of the RP policy. For the example, maximum payments occur when county revenue is below $283 per acre:

- $283 = $6.00 project price x 62.8 expected county yield x .75 coverage level.

Take a $5.00 harvest price and a 50 bushel county yield. County revenue is $250 per acre ($5.00 harvest price x 50 bushels county yield). The $250 county revenue is below $283 where the maximum payment occurs. Hence, SCO will make a payment equal to $40 per acre.

As another example, take a $5.00 harvest price and a 60 bushel county yield. County revenue is $300 per acre ($5.00 harvest price x 60 county yield). The $300 revenue is $24 less than the $324 maximum, but greater than $283 where maximum SCO payments occur. The $24 is 58% of the range from the $324 to $283 (.58 = ($324 – $300) / ($324 max – $283 limit)). The 58% shortfall is multiplied by the $40 maximum payment to arrive at a payment of $23 per acre ($23 = $40 x .58).

Harvest price above the projected price

With RP as the underlying COMBO product, the maximum SCO payment and county triggers are recalculated given that the harvest price is higher than the projected price. As an example, take a $7.00 harvest price, which is above the $6.00 projected price. In this case, the maximum payment is:

- $46 = $7.00 harvest price x 60 TA-APH yield x (.86 – .75 RP policy)

SCO will make payments when county revenue is below $361 per acre:

- $378 = $7.00 harvest price x 62.8 expected county yield x .86.

The maximum SCO payment when a 75% RP policy is selected occurs when county revenue is below $315 per acre:

- $330 = $7.00 harvest price x 62.8 expected county yield x .75 coverage level.

Take a county yield of 50 bushels per acre. In this case, county revenue is $350 per acre ($7.00 harvest price x 50 county yield) and the shortfall is 58% (.58 = ($378 – $350) / ($378 – $330). The payment then is $27 per acre ($46 maximum payment x .58 shortfall).

Premiums

Premiums for the Washington County example are shown in Table 1. RP premiums are for an enterprise unit with 100 acres. The TA-APH yield is 60 bushels, the APH yield is 55 bushels, the projected price is $6.00, and the volatility is .21.

Table 1 contains three columns of premiums. The column labeled RP gives the premium costs of the RP policy. Premiums range from $2.41 per acre at a 50% coverage level to $7.97 for a 75% coverage level.

The column labeled SCO gives farmer-paid premium for the SCO policy. For example, a $7.00 premium is associated with an SCO policy associated with an underlying RP policy with a 50% coverage level. This SCO policy provides county coverage from 86% to a 50% coverage level. As can be seen in Table 1, SCO premiums tend to decrease with higher coverage levels. SCO premium costs are $6.00 per acre for a SCO range of 86% to 55%, $6.00 for 86% to 60%, $6.00 for 86% to 65%, $5 for 86% to 70%, and $4 from 86% to 75%. Higher RP coverage levels lower potential losses under SCO, leading to reduced premium costs.

The final column is labeled “RP plus SCO”. This shows premiums given a purchase of the RP policy plus the SCO premium. It gives the total premium costs given an RP and SCO purchase. Total costs are $9.41 for RP and SCO at a 50% coverage level. The premium cost is $11.97 at a 75% coverage level.

Commentary

Several observations:

- SCO provides protection in the range from 86% down to the coverage level of the COMBO product, but losses are triggered based on county revenues or yields. Thus, it is possible for the farm to have a loss from 86% down to the COMBO coverage level while the county does not experience a loss. In these cases, SCO will not make a payment because SCO triggers on county results. Alternatively, SCO could trigger a payment while the farm does not have a loss. Lowering RP coverage levels and using SCO will not provide insurance payments which match farm revenue losses as closely as RP at higher coverage levels.

- In Washington County, COMBO products currently are not available at higher than 75% coverage levels. Because SCO has a higher coverage level of 86%, use of SCO will provide within year protection not available from a COMBO product. If an 85% COMBO product was available – as is the case in many counties outside Illinois – additional risk protection offered by SCO is limited to a one percent range from 86% to 85%.

- Even if 85% coverage levels are available, however, farmers may still find SCO advantageous. Given the subsidies involved, SCO payments should exceed farmer-paid premiums over time. In any given year, payments may not exceed premiums. However, averaging payments minus farmer-paid premiums over a ten-year period likely will result in a positive amount. In Washington County, for example, SCO to the 75% coverage level is expected to have payments exceed farmer-paid premium by about $6 per acre. These payoffs should be compared to those of the underlying RP policy if the RP coverage level is reduced.

- SCO does not include prevented planting provisions. The underlying COMBO product does. Lowering the COMBO product’s coverage level will lower prevented planting payments, when they occur.

- To take SCO, farmers will not be allowed to enroll in ARC. ARC offers risk management benefits that differ and may exceed those of SCO. These tradeoffs will be examined in articles to be released in the future.

References

Paulson, N., and J. Coppess. "Further Discussion of the Supplemental Coverage Option." farmdoc daily (4):75, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, April 24, 2014.

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.