U.S. Crop Insurance Since 1996

Overview

This article begins a three-part series on the implications of the 2014 farm bill for (1) U.S. commitments on farm subsidies under the current World Trade Organization (WTO) Agreement and (2) current attempts to revitalize the Doha Round negotiations for new WTO trade rules. This article specifically addresses the growth in crop insurance due to its importance for both topics.

Data

on crop insurance is from the U.S. Department of Agriculture (USDA), Risk Management Agency (RMA) “Summary of Business“. Value of field crop production data comes from USDA, National Agricultural Statistical Service (NASS) Quick Stats website and “Crop Values Annual Summary“. Initial year is 1996, the first crop year in which revenue insurance, now the dominant insurance product, was offered.

Growth in crop insurance

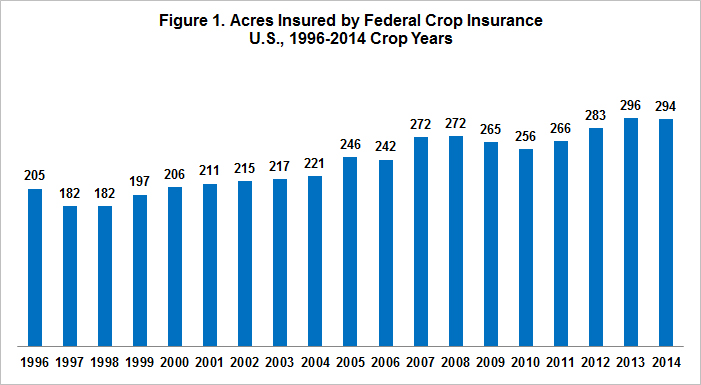

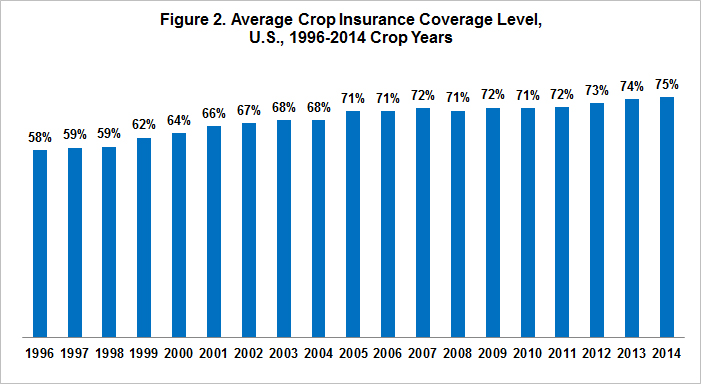

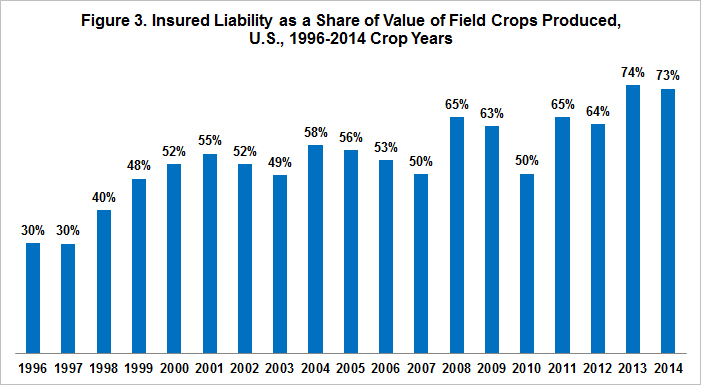

is commonly illustrated using acres insured. They increased from 205 million in 1996 to 294 million in 2014 (Figure 1). As sizable as a 44% increase is, it understates growth. Average coverage, determined using acres at each coverage level, also increased: from 58% in 1996 to 75% in 2014 (Figure 2). In particular, share of acres covered at 80% and 85% rounded to 0% in 1996, a stark contrast to 2014’s 21% share. Insured liability, which includes both factors increased by 331%, from $35 to $110 billion. However, insured liability overstates growth since it includes the impact of higher prices since 2006. To reduce the impact of prices, insured liability can be divided by the value of U.S. field crops. This ratio increased from 30% in 1997 to 73% in 2014 (Figure 3), an increase of 141%. Because insurance has a minimum deductible of 10% for area (county) insurance and 15% for individual farm insurance, insured liability is now between 81% and 86% of the potential value of U.S. field crop production that can be insured.

Growth in net insurance payment to farms

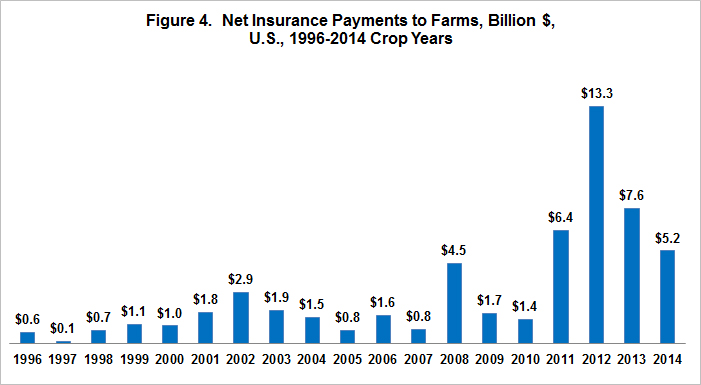

is one measure of changes in public policy’s incentive to buy crop insurance. Net farm insurance payments (also called net indemnities) equal insurance indemnities (payments) made to farms minus the insurance premium farms paid. Average annual net farm insurance payments increased from $0.7 to $6.8 billion from the 1996-2000 to 2010-2014 crop year periods (Figure 4). Several factors impact the increase, including higher prices; but a key factor is public policy’s decision to reduce the share of premiums paid by farms. This share has declined by half, from 74% in the early 1990s to 38% in recent years. It is important to note that net insurance payments to the crop sector do not mean every insured crop farm receives a payment. A farm must have a loss relative to the insurance it buys to receive a payment.

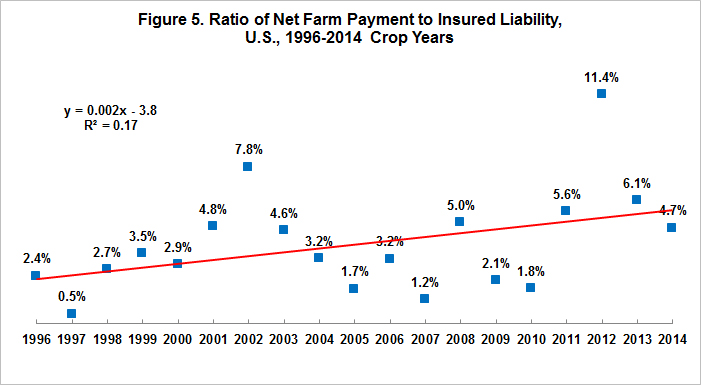

A common argument heard throughout the history of U.S. crop insurance is that increasing subsidies would bring less risky farms into the risk pool. The implication is that this consideration may reduce the cost of farm incentives measured on an insured liability basis. Figure 5 thus presents the ratio of net farm insurance payments to insured liability. Since 1996, this cost-to-liability ratio certainly has not decreased and, if anything, has increased.

Variation by crop

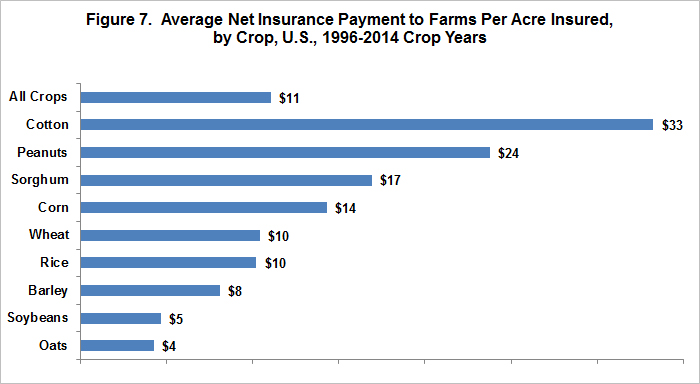

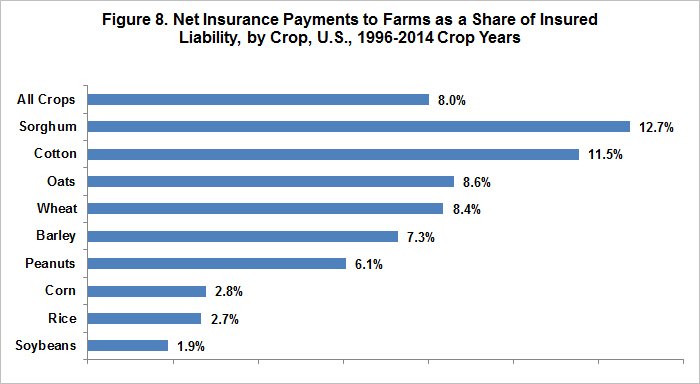

is a key feature of U.S. crop insurance. This feature is illustrated for the historically important farm program crops using cumulative net farm insurance payments since 1996 (Figure 6), average net farm insurance payment per insured acre (Figure 7), and net farm insurance payment per dollar of insured liability (Figure 8). Cotton is the only crop in the top three on all three metrics. Corn dominates cumulative net insurance payments since 1996, accounting for 39% of the $55 billion. However, it ranks in the middle on net payment per insured acre and near the bottom on net payment per dollar of insured liability. Despite being the second largest acreage crop, soybean ranks near the middle on cumulative payments due to being next to lowest on net payment per insured acre. Soybean is lowest on net payment per dollar of insured liability.

Summary Observations:

- Crop insurance has become a pillar of the U.S. farm safety net with annual net insurance payments coming to exceed direct payments that were eliminated in the 2014 farm bill.

- Direct payments retain significant support in the farm sector. Because net insurance payments vary by year while direct payments were fixed, a factor that will color the next farm bill debate is whether net insurance payments continue to exceed the foregone direct payments.

- Crop insurance, as currently designed, is approaching full market penetration for U.S. field crops.

- Expanding subsidies to presumably induce lower risk farms to buy crop insurance has not reduced and may have increased net farm insurance payments per dollar of liability insured. This observation raises a policy question: Should crop insurance be a smaller program targeted to a well-defined set of farmers rather than seeking to be a program for all farms? Other risk management options exist, including self-insurance, and may be a more efficient use of a farm’s and society’s resources. The right size and structure of crop insurance needs exploration.

- A key feature of U.S. crop insurance is sizable variation by crop. Many potential explanations exist. On one extreme, the variation may result from growing crops in different agro-climates with differing susceptibility to production stress. On the other extreme, the differences may result from a program structure that favors some crops. Whatever set of explanations is correct, the growth and now size of crop insurance makes its fairness more likely to be a policy issue going forward. This should be expected to be one of the key questions that frame the next farm bill debate. To help appropriately frame this debate, a full explanation of why payments vary by crop is needed.

- The farm safety net includes more than crop insurance. Hence, crop insurance needs to be understood within its role in the broader farm safety net. The next article in this series will explore how crop insurance in the context of the entire farm safety net fits within U.S. commitments regarding World Trade Organization rules on subsides to agriculture.

This publication is also available at http://aede.osu.edu/publications.

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.