Decreasing 2016 Cash Rents on Professionally Managed Farmland and Lags in Cash Rent Changes

Cash rents on professionally-managed farmland likely will decrease for the 2016 cropping year. Rents on non-professionally managed farmland likely will decrease as well. However, projected rent decreases are not large enough to cause farmers to have positive returns in 2016 given current projections of commodity prices and costs. The lagged relationship between returns and cash rents still exists.

2016 Expected Cash Rents on Professionally-Managed Farmland

Each year, the Illinois Society of Professional Farm Managers and Rural Appraisers conducts a survey of its membership (see here for more detail). In this survey, managers are asked the cash rent for the current year and expectations for next year. This survey provides a good indicator of rents on professionally-managed farmland. Managers give averages and expectations for four classes of farmland productivity:

- Excellent – expected corn yields over 190 bushels per acre,

- Good – Expected corn yields between 170 and 190 bushels per acre,

- Averages – expected corn yields between 150 and 170 bushels per acre, and

- Fair – expected corn yields less than 150 bushels per acre.

For excellent quality farmland, the average cash rent on professionally-managed farmland was $374 per acre in 2014 (see Table 1). Cash rents decreased to $350 per acre in 2015, a reduction of $24 per acre. Current expectations are for cash rents to continue the decrease in 2016. Expected rent in 2016 is $318 per acre, a $32 decrease from the 2015 level. Similar decreases are projected for all land classes:

- Good quality farmland: a $28 per acre decrease to $267 per acre,

- Average quality farmland: a $31 decrease to $219 per acre,

- Fair quality farmland: a $23 decrease to $177 per acre (see Table 1).

These professionally-managed cash rents typically are higher than “average” cash rents which include all farmland, the majority of which that is not professionally-managed. In 2014, for example, excellent productivity farmland had an average cash rent of $293 per acre, $81 less than the $374 per acre for professionally-managed farmland (see Table 1). While $293 per acre is the average, there is a large range in rents, with some rents considerably below average, just as there are rents above average.

Returns and Rents over Time

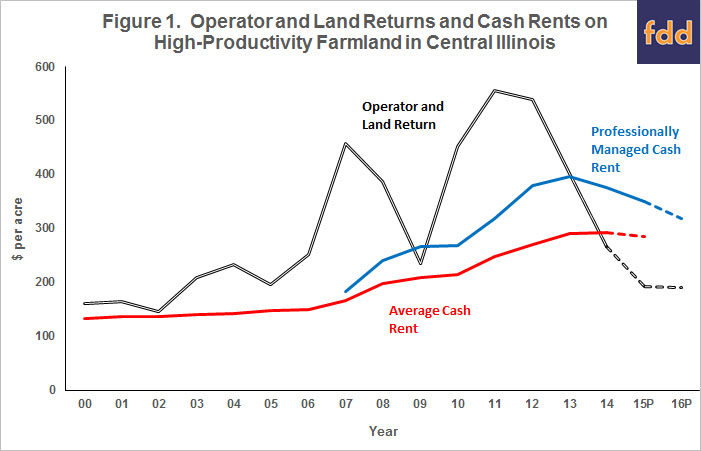

In recent years, professionally-managed averages have reacted faster than the “average” rent to changes in operator and land returns. Operator and land returns are the returns left to split between farmer and land owner. If the operator and land return equals $300 per acre and cash rent is $250 per acre, the farmer receives $50 per acre ($300 operator and land return minus $250 cash rent). Operator and land returns for high-productivity farmland in central Illinois are shown in Figure 1 for the years from 2000 to 2014, with projections given for 2015 and 2016. Note that operator and land returns increased beginning in 2007 and reached highs in 2011 and 2012. Since 2012, operator and land returns have decreased.

Figure 1 also shows the average cash rent for high-productivity farmland in central Illinois. These rents increased from $132 in 2000 up to $150 per acre in 2006. From 2006 through 2014, average cash rents increased from $150 per acre up to $293 per acre, an increase of $143 per acre. Note that the average cash rent increased in 2014 even as the average operator and land return decreased, lending support to the lagged relationship between returns and rents. In 2015, average cash rents are projected to decrease slightly to $286 per acre.

The first year the Illinois Society collected cash rents on professionally-managed farmland was in 2007. In 2007, the professionally-managed farmland cash rent was $183 per acre, $17 higher than the average cash rent. Like average cash rents, professionally-managed cash rents increased; however, the increase was faster than the average cash rent. In 2013, cash rents on professionally-managed farmland were $396 per acre, $82 per acre higher than the average. The difference between professionally-managed and average cash rents increased from $17 per acre in 2007 up to $106 per acre in 2014.

Now the difference between professionally-managed and average cash rents is becoming less, primarily because cash rents on professionally-managed farmland are coming down faster than the average cash rent. In 2015, the professionally-managed rent $64 higher than the average cash rent, down from a $106 difference in 2014.

Lagged Cash Rents

Cash rent changes typically lag changes in operator and land returns. After 2007, several years passed before cash rents increased substantially as a result of higher returns. Similarly, cash rents decreases are lagging the decreased in operator and land returns that began in 2013.

In 2014, both the average and professionally-managed cash rents were above operator and land returns, indicating losses to farmers on cash rental arrangements. If projections hold, 2016 will be the third year in a row in which cash rents are above operator and land returns.

Implications

Cash rents likely will decrease in 2016. However, projected reductions will not be enough to cause farmer returns to become positive. Obviously, it isn’t cash rent alone that needs to decrease. Other non-land costs have to decrease as well (see farmdoc daily, September 9, 2015).

Of course, the 2016 operator and land return projection depend on prices, yields, and costs. In preparing the 2016 returns forecast, a price of $3.85 per bushel is used for corn and $9.00 per bushel for soybeans is used. Higher prices or lower non-land costs could cause higher returns. The possibility of higher revenues suggest using variable cash lease arrangement so that landowners can share in higher revenues if they occur (see farmdoc daily, September 9, 2015).

References

Illinois Society of Professional Farm Managers and Rural Appraisers. "Land Values Across State Following Commodity Price Trends - Down." Released September 1, 2015, accessed September 22, 2015. http://www.ispfmra.org/index.php/2015/09/02/land-values-across-state-following-commodity-price-trends-down/

Schnitkey, G. "Cutting $100 per Acre in Costs for Corn and Soybeans." farmdoc daily (5):160, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, September 1, 2015

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.