Understanding ARC-CO: Transition Assistance vs. Support Assistance

The Agriculture Risk Coverage – County (ARC-CO) program was elected for 93% of corn base acres, 97% of soybean base acres, and 56% of wheat base acres. ARC-CO differs from previous farm programs, most importantly because it replaces traditional support assistance, in part, with transition assistance. Understanding the transition and support components of ARC-CO is a key to maximizing its value to managing a farm over time.

Policy Background

Traditional farm programs, such as the Price Loss Coverage (PLC) program in the 2014 farm bill, provide assistance when price declines below a reference or target price. Moreover, the reference price is fixed by Congress, resulting in progressively larger program payments the lower market price is relative to the reference price. A higher payment cushions the impact of lower price on farm revenue when market price is below the reference price. This offset feature is often stated as either (1) the reference price puts a floor under farm revenue or (2) the program provides support assistance at the reference price. The implication of support assistance for farm management is that it reduces the amount of adjustment farms need to make to prices below the reference price.

ARC-CO replaces some support assistance with transition assistance. The transition assistance occurs when revenue declines enough relative to a benchmark revenue. The benchmark revenue is based on a 5-year Olympic moving average of price and yield. A transition payment can occur even when the revenue decline results from a decline in price above the reference price. The assistance is transitory because the benchmark revenue will decline as revenue declines. However, ARC-CO also retains part of the traditional support assistance provided by PLC because the price used to calculate its benchmark revenue cannot be less than the crop’s reference price. A key policy compromise in the 2014 farm bill is that access to transition assistance when price is above the reference price requires a reduction in traditional support assistance. The reduction is largely achieved through two mechanisms: (1) ARC-CO payments per acre are capped at 10% of the benchmark revenue per acre and (2) ARC-CO coverage starts at 86% not 100% of benchmark revenue. In summary, ARC-CO is a new hybrid farm program that combines transition assistance with a lower level of support assistance.

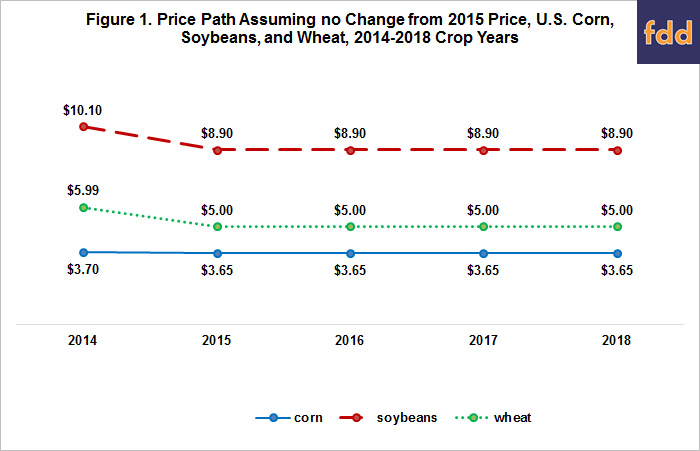

Illustration 1 – Flat Price for 2015-2018 (see Figure 1)

Corn, soybean, and wheat prices for the 2016 through 2018 crop years are set equal to the mid-point of the price range forecast for the 2015 crop year in the November 2015 World Agricultural Supply and Demand Estimates (WASDE). Yields for the 2016-2018 crops are set at the average U.S. yield per planted acre for the 2015 crop based on data in the November 2015 Crop Production report. Given these assumptions, ARC-CO payment indicators are estimated to decline substantively beginning with the 2016 crop of corn and 2017 crop of soybeans and wheat (see Figure 2). A $0 payment indicator is estimated for the 2018 crops. Figure 2 illustrates the transition nature of ARC-CO payments for the 2014 and 2015 crops. These payments largely reflect 2009-2013 crop year prices that were above the $3.70, $8.40, and $5.50 reference prices for corn, soybeans, and wheat, respectively. Payments decline as the benchmark revenue adjusts downward to reflect the lower prices for the 2013 and subsequent crop years. The phrase, “payment indicator,” is used because the yield is for the U.S., not for an individual farm.

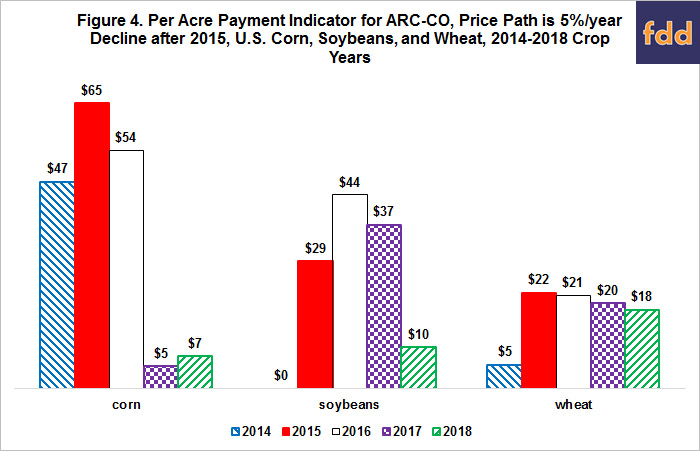

Illustration 2 – Price Declines 5%/year after 2015 (see Figure 3)

Compared with Illustration 1, ARC-CO per acre payment indicators in Illustration 2 are higher for 2016-2018 (see Figure 4). Increases are double digits for corn in 2016, soybeans in 2016-2018, and wheat in 2017-2018. The higher payments reflect not only the 5%/year decline in market prices but also the ARC-CO provision that the price used to compute ARC-CO’s benchmark revenue cannot be less than the reference price. The reference price is used instead of the market price starting with the 2015 crop year for corn and wheat and with the 2017 crop year for soybeans. The importance of using the reference price increases the longer is the number of years in which the substitution occurs and the lower is the market price relative to the reference price. For the 2018 crop year, ARC-CO payment indicators are $0 for corn, $1 for soybeans, and $7 for wheat if market prices are used. In comparison, ARC-CO payment indicators are $7 for corn, $10 for soybeans, and $18 for wheat when the higher reference price is used instead of the lower market price (see Figure 4). Thus, the estimated ARC-CO payment indicators for 2018 are mostly support, not transition, payments as they largely reflect the use of the reference price instead of market price.

Illustration 3 – Price Declines 10%/year after 2015 (see Figure 5)

Interestingly, the ARC-CO payments in this Illustration 3 are largely transition positions since using market prices instead of reference prices results in only a small decrease in the level of the ARC-CO payment indicators. In other words, the decline in price is so steep that large payments would occur using the Olympic moving average of market prices. Compared with Illustration 2, per acre payment indicators do not increase much for soybeans in 2016 and 2017 and not at all for wheat in 2016-2018 despite the steeper drop of prices in Illustration 3. The reason is that the payment indicators for these crop-year combinations in Illustration 2 are at or close to the 10% cap on ARC-CO per acre payments. In contrast, the 10% cap is not effective for corn in 2017-2018 and soybeans in 2018 in Illustration 2. Thus, the per acre payment indicator increases markedly for these crop-year combinations when comparing Illustration 3 with Illustration 2. Another indication of the importance of the 10% cap on per acre payment, as well as ARC-CO’s 86% coverage level, is a comparison of ARC-CO and PLC per acre payment indicators for the 2018 crops when prices decline 10%/year after 2015: corn: $52 for ARC-CO vs. $117 for PLC, soybeans: $36 for ARC-CO vs. $61 for PLC; and wheat: $18 for ARC-CO vs. $71 for PLC.

Summary Observations

- ARC-CO differs from previous farm programs.

- It is a hybrid program that adds transition assistance to support assistance.

- The compromise for adding transition assistance is a reduced level of support assistance when market price is below the reference price. The reduction is implemented primarily through ARC-CO’s 10% cap on per acre payment and coverage that starts at 86%, not 100%, of benchmark revenue.

- The 10% per acre payment cap is an addition to the traditional limit on payments to a payment entity. The interplay of these two payment limits could be an interesting feature of the next farm bill debate given the attention devoted to payment limits in recent farm bill debates.

- ARC-CO payments for the 2014 and 2015 corn, soybean, and wheat crops are transition payments resulting largely from prices in 2009-2013 that were above the reference price.

- ARC-CO will make little-to-no payments for the 2017 and 2018 corn, soybean, and wheat crops if prices stay at current levels. The 2014-2015 crop year payments disappear as ARC-CO’s benchmark revenue declines to reflect the decline in prices that began in 2013.

- ARC-CO will continue to make payments for the 2016-2018 crops of corn, soybeans, and wheat if prices slide further. Moreover, payments will remain large if the slide exceeds 5%/year. However, ARC-CO payments will be notably lower than PLC payments for the 2017 and 2018 crops if prices continue to slide. This situation reflects the compromise embedded in ARC-CO: access to transition assistance at prices above the reference price in return for smaller support assistance when prices are below the reference price. A key reason for ARC-CO’s lower support assistance than PLC in this situation is the 10% cap on ARC-CO’s payment per acre.

- The transition assistance feature of ARC-CO is very important to understand. Farmers need to treat ARC-CO payments for the 2014 and 2015 crops as if they will disappear. A useful strategy is to use them to strengthen cash balances by paying down debt or increasing cash reserves. Transition payments provide an opportunity for adjustments. Failure to make adjustments may jeopardize the farm’s survival.

- When assessing ARC-CO’s transition payments, it is important to consider that, as the U.S.-Brazil cotton case illustrates, continuing to make large price or revenue based payments to a crop can lead to a trade distortion case at the World Trade Organization (WTO). Transition assistance has not been contested in a WTO case but, at least conceptually, it should be more likely to survive a WTO challenge than a fixed reference price program that makes large support payments over an extended time. A successful challenge of ARC-CO or PLC at the WTO would likely become a key consideration in writing the next farm bill.

- CAVEAT: This discussion has focused on the impact of prices on revenue because it simplifies the presentation. However, yields are an important determinate of ACR-CO payments as 2014 crop year payments clearly illustrate and 2015 payment will likely illustrate (see farmdoc daily November 24, 2015).

References

Schnitkey, G. "Estimates of 2015 ARC-CO Payments." farmdoc daily (5):219, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, November 24, 2015.

U.S. Department of Agriculture, National Agricultural Statistics Service, World Agricultural Outlook Board. Crop Production. Released November 10, 2015. http://usda.mannlib.cornell.edu/usda/nass/CropProd//2010s/2015/CropProd-11-10-2015.pdf

U.S. Department of Agriculture, World Agricultural Outlook Board. World Agricultural Supply and Demand Estimates, WASDE-547. Released November 10, 2015. http://usda.mannlib.cornell.edu/usda/waob/wasde/2010s/2015/wasde-11-10-2015.pdf

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.