Variability in Corn, Soybean, and Wheat Production across the Globe

Introduction

Annual changes in production are a key determinant of price variability for corn, soybeans, and wheat. Production variability can occur across the globe, but it is usually of most significance when it occurs in a country or region that is a large producer of the crop. This article compares the annual variability of production for groups of countries that each account for roughly 10% or more of production of the crop and have a common geographic or economic tie. Canada-U.S. (Can-U.S.) and the European Union (EU) occupy the mid-to-upper range of production variability. Production variability is lower for China-India (Chi-Ind) and Argentina-Brazil-Paraguay-Uruguay (Arg-Brz-Par-Uru) and higher for Kazakhstan-Russia-Ukraine (Kaz-Rus-Ukr).

Country Groupings, Data Source, and Discussion Parameters

The country groups noted above can be described broadly as North America, Europe, large Asian consumer-producers, South America, and the former Soviet Union. Each group produces 10% or more of world production for at least one crop. No attempt is made to defend this grouping as optimal since alternative groups are equally defendable. The groups nevertheless provide insight into production variability across the globe.

Except for the EU, the data begin with the 1987 crop year, the first year data are available separately for the countries that composed the Soviet Union. Data for the EU do not start until the 1999 crop year. Source for the data is the U.S. Department of Agriculture, Foreign Agriculture Service “Production, Supply, and Distribution Online“.

The data are discussed by crop. To provide perspective on production variability, the share of world production of a crop by country group is discussed. Then, annual variability is discussed. Annual variability is measured as the standard deviation of the year-to-year percent change in production and its components, harvested acres and yield.

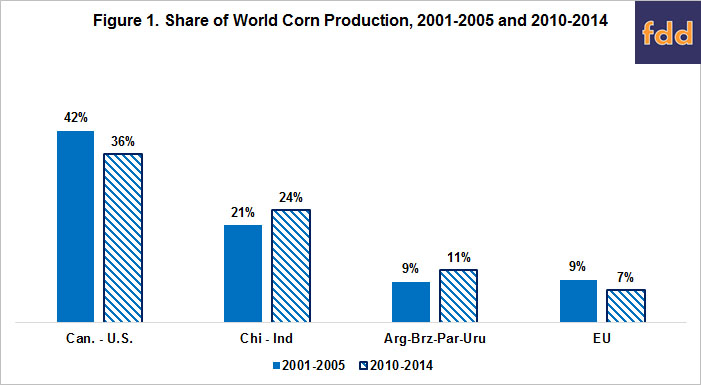

Corn

Four of the county groups contributed roughly 10% or so of world production in either or both 2001-2005 and 2010-2014 (see Figure 1). These two periods are before and at the end of the recent period of extended farm prosperity. Canada-U.S. accounted for the largest share of world corn production in both periods but its share declined from 42% to 36%. The shares of China-India and South America increased while the EU’s share declined. China-India and South America are making inroads into U.S. dominance. In assessing these county groups, it is worth noting that, in 2014, the U.S. accounted for 97% of Canada-U.S. corn production while China accounted for 90% of China-India corn production.

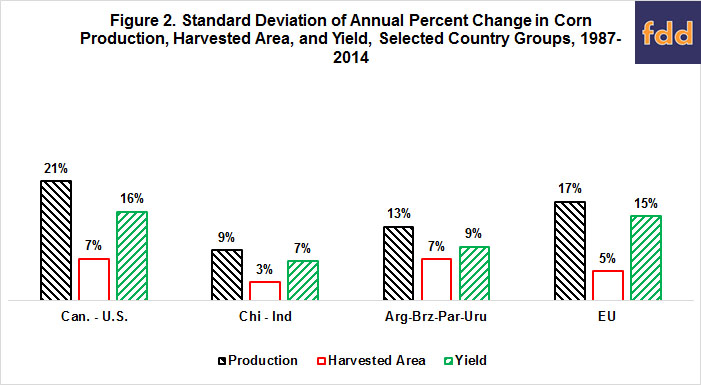

Annual variability of production is lowest for China-India (see Figure 2). Variability of both its harvested area and yield is the lowest of the four country groups. The South American country group also has a low variability of production. Their low variability of yield is striking, especially relative to Canada-U.S. Production variability for the EU is similar to that of the U.S. Combining the patterns that emerge from Figures 1 and 2 implies that variability of world production of corn likely has declined since 2000 as the share of production increased in less variable production regions.

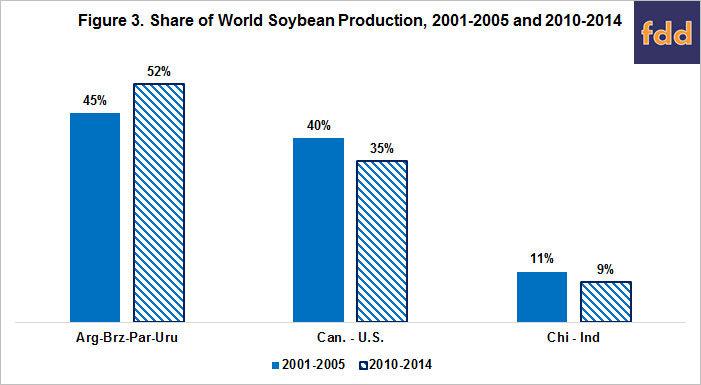

Soybeans

South America now produces over half of the world’s soybeans while the U.S. share is just above one-third (see Figure 3). However, the key feature is the overwhelming dominance of South plus North America. Together they account for over 85% of world soybean production. Adding in China-India brings the share to over 95%.

Unlike corn, soybean production variability is quite similar for the three main country groups (see Figure 4). China-India again has the lowest production variability due to its low yield variability.

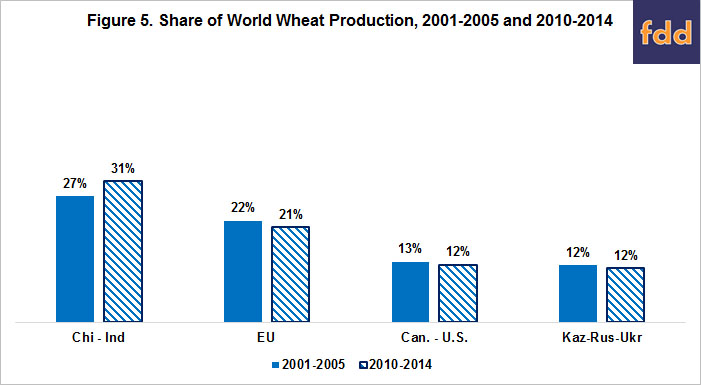

Wheat

As commonly noted, wheat production is more dispersed than corn and, especially, soybean production (see Figure 5). But, it is also worth noting that, for 2010-2014, the four country groups for corn accounted for 79% of world corn production while the four country groups for wheat accounted for 75% of world wheat production. So, at least at the four country group level, the dispersion of wheat production is not that much different than the dispersion of corn production. And, China-India plus the European Union account for over 50% of world wheat production.

Wheat production variability is notably smaller for China-India than for the other country groups (see Figure 6). In contrast, production variability is notably higher for the former Soviet Union countries. Moreover, variability of wheat production in Kazakhstan-Russia-Ukraine (27%) is higher than for any other crop-country group combination. The next highest variability of production is Canada-U.S. corn at 21%. For a more complete discussion of the emergence of Kazakhstan-Russia-Ukraine as a major actor in the world wheat trade, see the October 11, 2012 farmdoc daily article, “Kazakhstan, Russia, Ukraine (KRU) and World Grain Markets.”

Summary Observations

- As with any data driven analysis, the findings depend on the data. The data used in this article begin with the 1987 crop year (1999 crop year for the EU). While approaching 30 years in length, it is reasonable to ask whether this observation period is long enough for a variable such as production variability. In short, a different observation period may generate different findings.

- Given the preceding caveat, this analysis suggests the following observations for those who wish to follow markets but have limited time to do so:

- The condition of wheat production in Kazakhstan-Russia-Ukraine and of corn production in Canada-U.S., particularly the U.S., bears close scrutiny on an on-going basis.

- If time permits, the condition of corn production in the European Union and of wheat production in Canada-U.S. also bears watching.

- The low variability of production in China-India is probably due to irrigation and perhaps labor intensive farming. Whatever the cause, the historical period examined in this study suggest that, relative to the other country groups examined in the article, production variability is less likely to emerge in these two large consuming-producing countries. While not as likely, production variability nevertheless does occur in both countries.

- It will be interesting to watch the interplay between corn production variability in the U.S. and South America. Given that the relative difference in production variability observed since 1987 holds into the future, South America’s lower variability of corn production could give it a competitive advantage over the U.S. as a reliable supplier of corn.

References

Zulauf, C. "Kazakhstan, Russia, Ukraine (KRU) and World Grain Markets." farmdoc daily (2):197, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, October 11, 2012.

USDA Foreign Agriculture Service. "Production, Supply, and Distribution Online." https://apps.fas.usda.gov/psdonline/

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.