The Farm Safety Net: The Good and Not So Good

USDA recently announced that they project net farm income to decline for a third straight year in 2016, and is expected to be the lowest since 2002 (USDA-ERS, 2016). Government payments are to rise to $13.9 billion which if realized would represent approximately 25 percent of net farm income. U.S. net farm income has declined 56 percent from its recent peak of $123.3 billion in 2013.

Turning to crop income in Indiana, projections of earnings per acre for 2016 (assuming fully-loaded costs) are -$135 for corn and -$88 for soybeans assuming yields of 165 for corn and 50 for soybeans and expected prices of $3.60 for corn and $8.90 for soybeans, respectively (Dobbins et al., 2016). These projections include farm program payments and participation in the crop insurance program. A few years ago, the crop insurance guarantees were high enough to cover most, and in some years, all total costs, effectively mitigating downside risk. As shown by Schnitkey (2016), in 2016, crop insurance guarantees are considerably below total costs of production for corn and soybeans. Though important to revenue in 2016, farm program payments are unlikely to make up the shortfall represented by the decline of the crop insurance guarantee. This article will illustrate the ability of the farm safety net in the form of crop insurance and farm program payments to buffer downside risk.

The Public Sector Safety Net

The public sector safety net that is now in place to buffer crop farmers from the economic downturn has two dominant components (not including disaster assistance and other programs such as low interest emergency loans) – payments received under the farm program (ARC-CO, ARC-I, or PLC), and subsidized crop insurance. The majority of Midwest corn and soybean farmers chose the Agricultural Revenue Coverage – County Option (ARC-CO) farm program option which in essence provides a payment per base acre of corn and soybeans that depends on the level of yields and prices – details of the computations are provided in Keeney (2014). The crop insurance program provides an indemnity payment to farmers if prices and/or yields decline, depending on the program and coverage level chosen. The most common program choice is revenue protection (RP) which buffers gross revenue from price and/or yield reductions – coverage level choices range from 50 to 85 percent of market revenue.

When the crop insurance and farm programs were initiated, it was anticipated that they would provide an effective safety net for farmers who might encounter significant price and/or yield reductions due to changing market conditions or weather/disease events. But crop insurance indemnities adjust to market conditions over time. If prices systematically decline, the potential indemnity also declines. Farm program payments under the ARC-CO program are capped, and they decline as market prices increase. So in contrast to the most recent direct payment program that resulted in a pre-specified amount of income and cash irrespective of market prices, under the current program higher prices may result in more income from the market and less from the government in many circumstances (a “dead zone”). Also, it is important to note that cash payments from the ARC-CO program are not received until approximately a year after the crop is harvested, so they are not available to meet cash flow requirements in the year of actual production.

Given these characteristics of the safety net, how effective will it be in buffering the financial stress that crop farmers are currently facing? The numerical analyses below provide insight into the answer to that question.

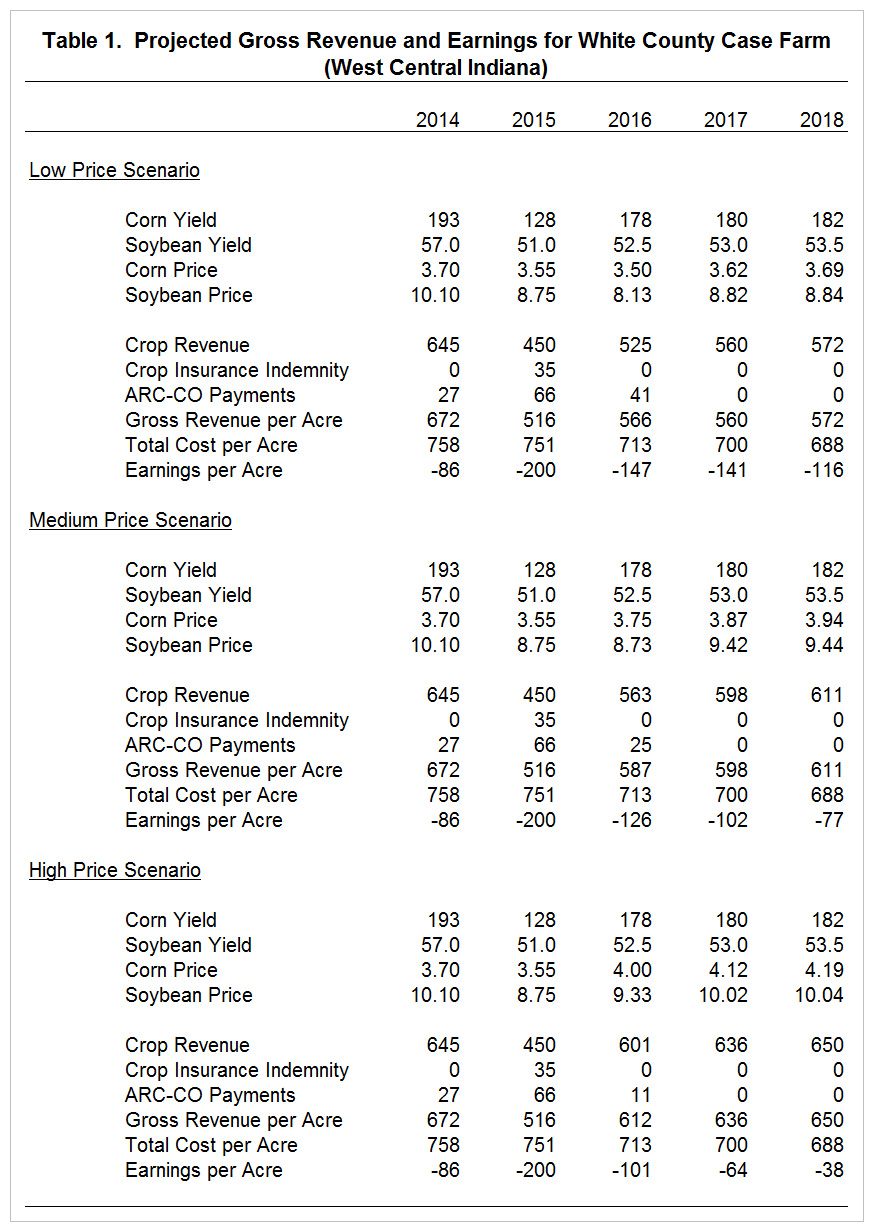

Illustration Using an Indiana Case Farm

Average projected gross revenue and earnings for the 2014 to 2018 period are presented in table 1 for an Indiana case farm in west central Indiana (White County). Actual county yields were used for 2014 and 2015. Crop prices for the 2014/15 and 2015/16 crop years were estimated using the April 2016 WASDE report (USDA, 2016). Trend yields were used to estimate 2016, 2017, and 2018 crop yields. The medium price forecasts for these years were obtained from FAPRI; these prices are $3.75, $3.87, and $3.94 for corn, and $8.73, $9.42, and $9.44 for soybeans for the crop years 2016/17, 2017/18, and 2018/19, respectively. The low price scenario and the high price scenario assumed that corn (soybean) price was $0.25 ($0.60) lower and higher, respectively, from 2016/17 to 2018/19, than the medium price forecasts. Purdue crop budgets for average productivity soil and cash rent estimates reported in the latest Purdue cash rent and land value survey (Dobbins and Cook, 2016) were used to estimate production costs for 2014, 2015, 2016. With the exception of cash rents, the other production costs were assumed to remain constant in 2017 and 2018. Cash rent per acre was assumed to decline 5 percent in 2017 and in 2018.

Crop insurance indemnity payments and ARC-CO program payments in table 1 were computed using the price and yield estimates described above. The crop revenue, crop insurance indemnity, ARC-CO payment, gross revenue, total cost, and earnings per acre figures presented in table 1 assume a corn/soybean rotation. The corn yield in 2015 was low enough to trigger a crop insurance indemnity payment. Estimated earnings in 2014 and 2015 for the corn/soybean rotation were -$86 and -$200 per acre, respectively. For 2016, projected ARC-CO payments range from $11 to $41 per acre, and earnings per acre from -$147 to -$101 per acre. ARC-CO payments are not expected in 2017 or 2018. Estimated earnings per acre range from -$64 to -$141 for 2017 and from -$38 to -$116 for 2018.

Sensitivity of ARC-CO Program Payments to Prices and Yields

Table 2 examines the sensitivity of earnings and ARC-CO payments per acre for 2016. The corn and soybean yields in table 1 (i.e., trend yields) and the medium price scenario in table 1 were used for the base yield and base price combination in table 2. It is also important to note that table 2 excludes crop insurance premiums and indemnity payments. Five yield and five price scenarios or 25 price/yield combinations are illustrated in table 2. Figure 1 illustrates the sensitivity of ARC-CO payments to changes in price and yield. The maximum ARC-CO payments for corn and soybeans in 2016 are $65 and $51, respectively. Maximum program payments, or the cap, occur for all of the price scenarios under the 30 percent lower yield scenario; for the three lowest price scenarios under the 20 percent lower yield scenario; for the two lowest price scenarios under the 10 percent lower yield scenario; and for the lowest price scenario under the base yield scenario. Conversely, the ARC-CO payments would be zero for the highest price scenario under the base yield scenario, and for the two highest price scenarios under the 10 percent higher yield scenario. Earnings per acre in table 2 range from -$319 per acre for the lowest price and lowest yield combination to $41 per acre for the highest price and highest yield combination.

To gauge the interaction between ARC-CO payments and market price increases in more detail, let’s examine the results in the fourth and fifth columns of table 2. The difference in earnings per acre when prices increase from 10 percent higher to 20 percent higher than the base depends on the yield scenario examined. This difference in earnings averages $42 per acre, and ranges from $22 for the 20 percent lower yield scenario to $62 for the highest yield scenario. To understand what is going on here it is important to remember that the ARC-CO payments depend on national prices and county yields. For some yield scenarios, the increase in gross revenue and margins resulting from a price increase is partially muted by a decline in the ARC-CO payments. As an example, for the 20 percent lower yield scenario, the ARC-CO payment declines from $57 per acre under the 10 percent higher price scenario to $34 per acre under the 20 percent higher price scenario. In essence, as we move from a 10 percent higher price to a 20 percent higher price for the 20 percent lower yield scenario, the improvement in gross revenue and earnings from higher prices is partially offset by reductions in government payments, so the net effect on earnings is partially muted. Specifically, because of the reduction in the ARC-CO payments, the resulting increase in earnings per acre resulted from the price increase is only one-half as large as it would have been under a scenario in which the ARC-CO payments remained the same.

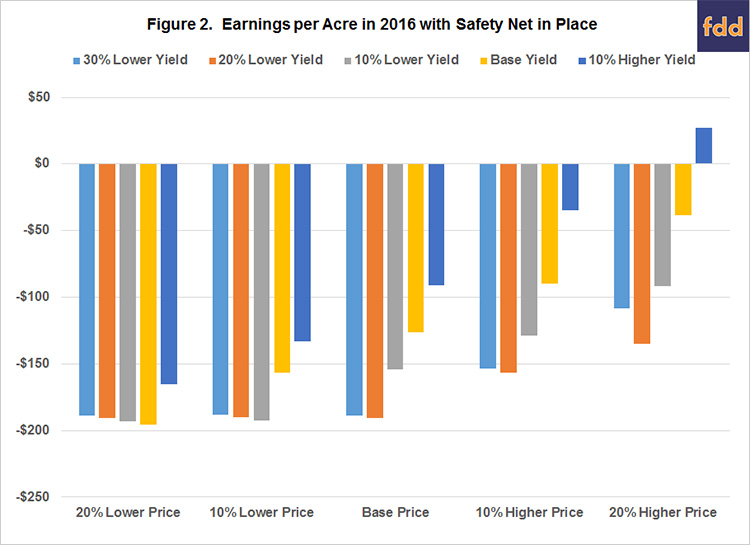

Sensitivity of Farm Safety Net to Prices and Yields

Table 3 examines the sensitivity of the farm safety net (ARC-CO program payments plus crop insurance) in 2016 to changes in price and yield. As in table 2, there are 25 price/yield combinations. An 80 percent revenue protection coverage level is used for the illustrations in table 3. The farm safety net per acre in table 3 is computed by adding the ARC-CO payment to the crop insurance indemnity. Earnings per acre for each combination are illustrated in figure 2. Crop insurance is very important when yield is 30 percent lower than the base yield; when yield is 20 percent below the base yield and price is lower than the base price; and when yield is 10 percent lower than the base yield and price is 20 percent below the base price. Though crop insurance was very helpful for these combinations of lower prices and yields, earnings per acre are still below a negative $150 per acre for 14 of the 25 price/yield combinations in table 3. For the price/yield combinations for which a crop insurance indemnity payment was made, earnings per acre ranged from -$108 per acre to -$195 per acre. For these same combinations in table 2 (which excluded crop insurance premiums and indemnity payments), earnings per acre ranged from -$162 per acre to -$319 per acre. The only price/yield combination in table 3 with a positive projected earnings per acre was the highest price and yield combination. Though helpful, the farm safety net only partially mitigates downside risk.

Summary and Conclusions

This article examined earnings per acre projections for a case farm in west central Indiana. ARC-CO payments were significantly higher under a low price scenario than under a high price scenario. However, the difference in ARC-CO payments between the two price scenarios did little to stem the increase in red ink between the two scenarios. Moreover, under the price and yield scenarios examined in this paper, annual projected earnings per acre were negative from 2014 to 2018 for the case farm. The results also illustrated the gaping holes in the farm safety net. Even with ARC-CO payments and crop insurance indemnity payments, over one-half of the price/yield combinations examined had negative earnings that exceeded $150 per acre. The decline in the crop insurance revenue guarantee since 2012 has contributed to the large decline in the case farm’s ability to mitigate downside risk, and further adjustment of the ARC-CO payments and crop insurance indemnities to expected future continued weak market conditions suggest that the farm safety net will likely be lowered further in 2017 and 2018.

References

Dobbins, C.L. and K. Cook. "The Bears Control the 2015 Indiana Farmland Market." Center for Commercial Agriculture, Purdue University, August 2015. https://ag.purdue.edu/commercialag/Pages/Resources/Farmland/Land-Prices/Bears-Control-Farmland.aspx

Dobbins, C.L., M.R. Langemeier, R. Nielsen, T.J. Vim, S. Casteel, W. Johnson, and K. Wise. "2016 Purdue Crop Cost & Return Guide." ID-166-W, Purdue Extension, March 2016. https://ag.purdue.edu/commercialag/Documents/Resources/Mangagement-Strategy/Crop-Economics/Crop%20Budget/2015_09_01_Langemeier_Purdue_Crop_Budgets.pdf

Food and Agricultural Policy Research Institute. "U.S. Baseline Briefing Book: Projections for Agricultural and Biofuel Markets." FAPRI-MU Report #02-16, March 2016. http://www.fapri.missouri.edu/wp-content/uploads/2016/03/FAPRI-MU-Report-02-16.pdf

Keeney, R. "Agriculture Risk Coverage-County," Center for Commercial Agriculture, Purdue University, December 2014. https://ag.purdue.edu/commercialag/Pages/Resources/Agricultural-Policy/2014-Farm-Bill/Agriculture-Risk-Coverage-County.aspx

Schnitkey, G. "Crop Insurance Guarantees Compared to Total Costs Over Time." farmdoc daily (6):70, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, April 12, 2016.

U.S. Department of Agriculture (USDA), Office of the Chief Economist. World Agricultural Supply and Demand Estimates. WASDE - 551. April 12, 2016. http://www.usda.gov/oce/commodity/wasde/index.htm

USDA-ERS. "Dips in Farm Sector Profitability Expected in 2016." Farm Sector Income & Finances. Accessed April 28, 2016. http://www.ers.usda.gov/topics/farm-economy/farm-sector-income-finances/highlights-from-the-farm-income-forecast.aspx

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.