Crop Insurance Guarantees Compared to Total Costs Over Time

Crop insurance guarantees for Revenue Protection (RP) will be well below total costs for corn and soybeans across the Midwest in 2016 unless harvest prices are dramatically above projected prices. Guarantee have decreased from 2012 through 2016, causing the difference between total costs and guarantee levels to increase over time. The difference between costs and guarantees will not shrink until a combination of higher prices or lower costs occurs.

Crop Insurance Guarantees

Revenue Protection (RP) is the most popular crop insurance product, being used to insure 76% of the acres planted to corn in 2015 (farmdoc daily, January 20, 2016). RP is a revenue insurance whose guarantee will increase if the harvest price is above the projected price. The mathematical form of the guarantee is:

- max (projected price, harvest price) x guarantee yield x coverage level

where

- Projected price is based on futures contracts. The projected prices for corn and soybeans grown in the Midwest are set based on the average of settlement prices on the Chicago Mercantile Exchange during the month of February (December contract for corn, November contract for soybeans).

- Harvest price is again based on settlement prices of futures contracts. For corn and soybeans in the Midwest, averages during the month of October are used. In the above calculation, the price used in the calculation is capped at two times the projected price.

- Guarantee yield usually is the Trend Adjusted Actual Production History (TA-APH). When complete data exists, the TA-APH yield equals the previous ten years of yields on that insurance unit, adjusted upward to account for trend.

Coverage level is selected by the farmer. It ranges from 50% to 85% in 5% increments.

In the following discussion, focus is given to the minimum revenue guarantee, without considering potential increases caused by a higher harvest price. The minimum revenue guarantee provides the farmer the crop insurance safety net for a year. As an example of calculating the minimum revenue guarantee, take the 2016 projected price of $3.86. For a 196 bushel per acre TA-APH yield and an 85% coverage level, the minimum revenue guarantee is $643 (196 guarantee yield x $3.86 projected price x .85 coverage level).

The minimum revenue guarantee will depend on the level of the projected price. The projected price for corn averaged $2.48 per bushel between 2000 and 2006. Projected prices then increased, with the highest projected price of $6.01 occurring in 2011 (see Table 1). Since 2011, the projected price has decreased each year. Projected prices were $5.68 in 2012, $5.65 in 2013, $4.62 in 2014, $4.15 in 2015, and $3.86 in 2016.

Revenue Guarantees Over Time

Figure 1 shows revenue guarantees on RP products with 65%, 75%, and 85% coverage levels from 2000 to 2016. These guarantees are for products sold in Logan County, Illinois. Guarantee yields used in the calculations are the average guarantee yields for the respective coverage levels in Logan County. The guarantee yield increased from one year to the next in most years. For the 85% coverage level, the guarantee yield was 161 bushels per acre in 2001, increasing to 196 bushels per acre in 2015. Since 2016 is unavailable, the 2015 guarantee yield of 196 bushels per acre is used in the calculation of the 2016 guarantee.

On an 85% coverage level product, the guarantee was $929 per acre in 2012. From this 2012 high, the guarantee decreased each year. The guarantee was $900 per acre in 2013, $740 per acre in 2013, $692 per acre in 2014, and $642 per acre in 2016. From its high in 2012, the insurance guarantee has decreased $287 per acre. This decrease is due to the lower projected prices in years since 2012.

Figure 1 also includes total costs for producing corn on farmland that is cash rented (taken from Revenues and Costs of Corn, Soybeans, Wheat, and Double-Crop Soybeans). Note that total costs increased until 2013, and then have remained relatively stable. Revenue guarantees for 85% coverage levels exceed total costs in three years: 2007, 2009, and 2011. These years were unusual: Prices had risen while costs had not reached their highest levels, leaving guarantees above total costs.

If guarantees do not increase because of higher harvest prices, farmers will incur significant losses before crop insurance payments bring total revenue up to the guarantee level. In 2016, total costs on cash rent farmland are projected at $830 per acre. Average guarantees in Logan County are $452 per acre on a 65% coverage level, $542 per acre on a 75% coverage level, and $642 per acre at an 85% coverage level. Before payments occur, the farmer would incur a loss of $378 per acre at a 65% coverage leave ($830 total cost – $452 guarantee), $288 at a 75% coverage level, and $188 at an 85% coverage level.

Higher harvest prices could increase guarantees to the level of total costs. At an 85% coverage level, a harvest price above $4.98 per bushel would result in a guarantee equal to $830 per acre, the estimate of total costs in 2016. A $4.98 price is 29% higher than the $3.86 projected price. Since 1972, October settlement prices were more than 29% higher than projected prices in only two years: 1988 and 2012. In both years, severe droughts occurred in the Midwest. While a drought of that size is possible, chances are that a drought that size will not happen.

A similar situation exists for soybeans (see Figure 2). The 2016 projected price is $8.85 and the average guarantee yield in Logan County is 57 bushels per acre. Guarantees are $307 on a 65% coverage level revenue product, $381 on a 75% coverage level product, and $431 per acre on an 85% coverage level product. Total costs for soybean production on cash rent farmland are projected at $629 per acre. Total costs exceed the 85% guarantee by $198 per acre.

Guarantees and Costs in Other States

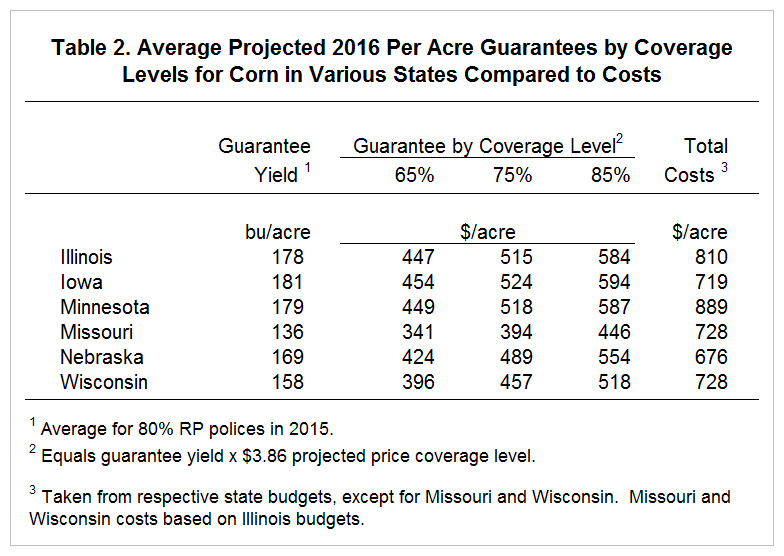

RP guarantees being below costs is a widespread situation. Guarantees were calculated using average APH yields for various states. Total costs are above guarantees for all states for corn (see Table 2) and soybeans (see Table 3).

Commentary

Crop insurance is an important Federal safety net program. One characteristic of crop insurance is that the projected price resets each year based on market conditions that exist during that year. Decreasing projected prices in recent years now result in guarantees being much lower than total costs, placing farmers at high risks of losses. Farmers will face the potential of high losses in the future until a combination of higher prices or lower total costs occurs.

References

Schnitkey, G. "Crop Insurance Premiums and Use in 2015 and 2016." farmdoc daily (6):12, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, January 20, 2016.

Schnitkey, G. "Revenue and Costs for Corn, Soybeans, Wheat, and Double-Crop Soybeans, Actual for 2009 through 2014, Projected 2015 and 2016." Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, December 2015.

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.