2016 Marketing Gain Impacts on Income Statements Will be Limited

Often, marketing gains on grains have a significant impact on grain farm net incomes. For example, marketing gains accounted for roughly 30% of 2014 net income. Marketing gains occur when selling prices of old-crop grains differ from end-of-year inventory values. Recent price increases lead to some hope for increased marketing gains in 2016. Estimates here suggests marketing gains of $12.23 per acre for corn and $16.82 per acre for soybeans. These gains will have a positive impact on 2016 incomes, but 2016 net incomes still are projected very low.

Marketing Gain Explained

An underlying principle of income statement preparation is to match revenues with costs. For most grain farms, this means that income statements prepared for the 2015 calendar year reflects costs and revenues associated with 2015 production. Not all of 2015 production has been sold at the end of 2015 on most grain farms. In these cases, values must be placed on unsold grains so that a 2015 income statement reflects revenues associated with unsold production. This is usually accomplished by valuing grains at prevailing market prices at the end of the year. These grain inventory values are shown on the 2015 end-of-year balance sheet, and the 2015 income statement includes revenue for grain inventory changes from the beginning to ending of the year. This process results in yearly income statement reflecting income from that year’s production, plus any marketing gains on grains produced in the previous year but priced in the current year, as well as changes in valuations on other items made on end-of-year balance sheets.

Marketing gain or loss occurs when grain is sold at different prices than the end-of-year inventory price. Take corn at the end of 2015 as an example. Illinois Farm Business Farm Management (FBFM) used a $3.60 per bushel price for 2015 end-of-year inventory valuation. If 105 bushels of corn is unsold and not priced, the balance sheet has a corn inventory value equal to $378 per acre (105 bushels per acre x $3.60 valuation price). If this corn is sold for $3.70, $.10 higher than the end-of-year inventory price, the resulting marketing gain is $10.50 ($.10 gain x 105 bushels).

Marketing gains or losses occur most every year and can have a significant impact on net income. In 2014, for example, marketing gains averaged near $30 per acre on farms and accounted for 30% of net farm income (farmdoc daily, May 27, 2015). Therefore, when examining income statements for grain farms, having an understanding of marketing gains or losses from the previous year’s crop is important in understanding reported income for that year. Moreover, estimating marketing gains will provide a baseline for evaluating 2016 net farm incomes on grain farms.

2016 Marketing Gain for Corn

Marketing gains can vary tremendously across farms as grain marketings vary across farms. In this article, marketing weights published by the National Agricultural Statistical Service (NASS) will be used to represent selling patterns in order to access marketing gains.

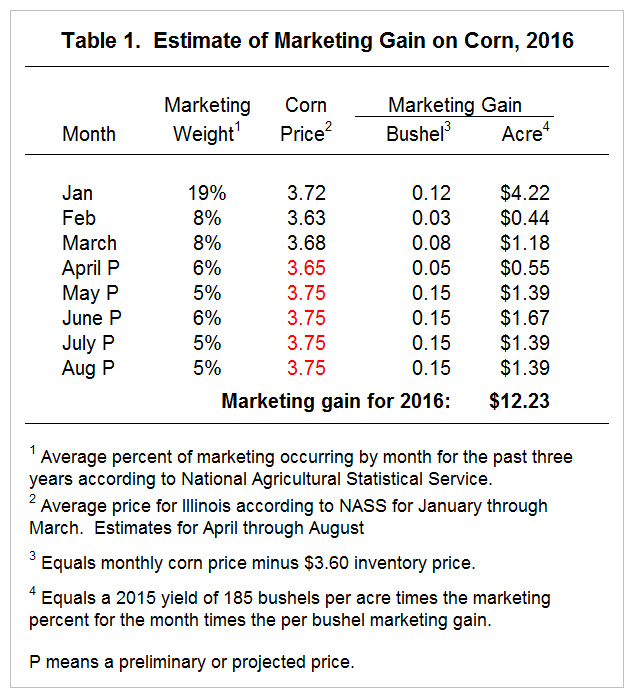

Marketing weights published by NASS indicate 57% of the production was marketed in the year following production. Marketing weight averaged over the past three years indicate that 19% of the grain was marketed in January (see Table 1). After January, marketing weights are 8% for February and March and then average between 5% and 6% per month from April to August.

The average 2015 yield on high-productivity grain farms in central Illinois was 185 bushels per acre. If 57% is marketing in the following year, the 185 bushel yield gives results in 105 bushels per acre of inventory. For FBFM farms, end-of-year inventories were valued at $3.60 per bushel.

Again, marketing gains will occur when the selling price differs from the inventory price. Marketing gains are calculated using average prices received by Illinois farmers. In January, the average price received was $3.72 per bushel, resulting in a $.12 per bushel marketing gain at a $3.60 inventory price. Given that 19% of the 185 bushels are marketed in January, the marketing gain is $4.22 per acre for January (see “Jan” line in Table 1). Through the month of April, marketing gains total $6.39 per bushel ($4.22 for January + $.44 for February + $1.18 for March + $.55 for April).

Prices have risen in the past month. Using $3.75 as the price for May through June results in a $12.23 per acre marketing gain for 2016, adding $5.84 per acre to the already existing marketing gain through April. A higher price will result in a higher marketing gain. A $4.00 per bushel price from May through August results in a $21.93 per acre gain for the year.

2016 Marketing Gain for Soybeans

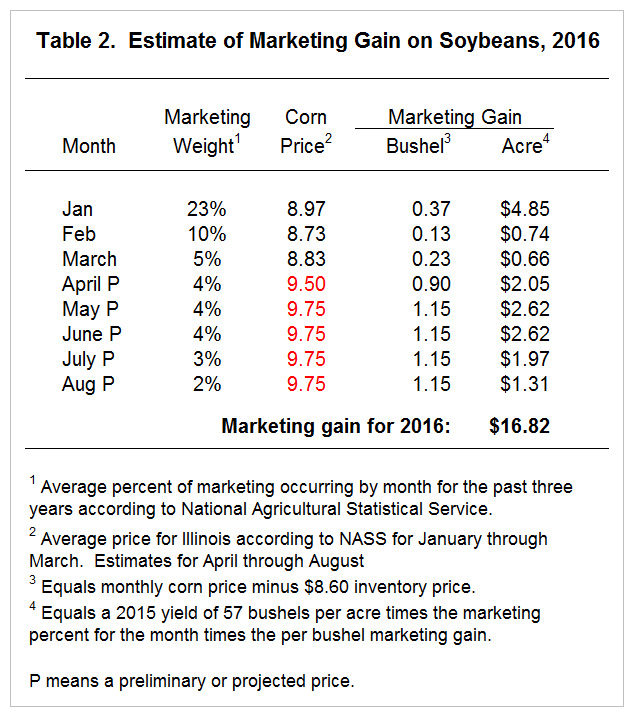

The same procedures used to estimate corn marketing gains were used to estimate soybean marketing gain (see Table 2). The end-of-year inventory value for soybeans is $8.60 per bushel and 57 bushels per acre is the average yied in Illinois. Through April, marketing gain on soybeans total $8.30 per acre. Prices have risen and a $9.75 per bushel soybean price is used from May through August, resulting in a $16.82 per acre marketing gain. Higher prices in remaining months would result in higher 2016 marketing gains. A $10 per bushel soybean price in June through August results in a $18.10 per acre marketing gain.

Summary and Commentary

Marketing gains will be positive for many grain farms in 2016. Estimates suggest average gains of $12.23 per acre for corn and $16.82 per acre for soybeans. For a farm with 60% of its acres in corn and 40% in soybeans, these marketing gains average $14.06 per acre. These estimates will vary across farms because of differences in grain selling practices.

These marketing gains will have positive contributions to 2016 net farm incomes. For a 1,500 acre farm with 40% of its acres share rented, the $14.06 marketing gain estimate suggests a $16,872 contribution to net income (i.e., full $14.06 gain on owned and cash rent acres and half that ($7.03) on share rent acres). A $16,872 marketing gain will increase income, but income projections for 2016 will be low. At current prices, 2016 production is projected to contribute $4,425 of income (farmdoc daily, April 26, 2016), giving a total income of $21,297 per farm. Incomes at this level will result in continued deterioration of working capital.

Recent increases in cash prices, particularly on soybeans, are welcome and provide needed additional cash flows. However, NASS marketing weights suggest that these price increases will have a limited impact on incomes. At this point, most of 2015 grain production has been sold if historical marketing patterns hold. According to NASS weights, 21% of corn and 14% of soybeans are marketed from May through August. At this point, hopes of income increases hinge more on increases in new crop prices than on increases in old crop prices.

References

Schnitkey, G. "2016 Net Farm Income Projections Under Different Price Scenarios." farmdoc daily (6):80, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, April 26, 2016.

Schnitkey, G. "Marketing Gains Impacts on 2014 and 2015 Net Incomes on Grain Farms." farmdoc daily (5):97, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, May 27, 2015.

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.