Corn and Soybean Revenue Projections for 2016 and 2017

While considerable uncertainties still exist, revenue projections for 2016 and 2017 are provided in this article for the average of high-productivity farms located in central Illinois. The 2016 revenue projections provide an indication of whether 2016 will be a better or worse income year than 2015, a year in which net incomes on many grain farms were extremely low. The 2017 projection provides information useful when making cash rent, input purchase, and crop choice decisions for 2017. Overall, revenue for 2016 likely will be lower than in 2015. Continued low revenues should be expected for 2017, meaning that cost cutting must continue.

Historic Revenues

Gross revenues will be projected for high-productivity farmland in central Illinois. To provide context, historic returns for the years between 2009 through 2015 are given for corn (see Panel A of Table 1) and soybeans (panel B). These revenues are summarized from grain farms enrolled in Illinois Farm Business Farm Management. They represent averages across many farms, meaning that some farms have higher and some farms have lower revenues. Historical values are taken from a publication entitled Revenues and Costs for Corn, Soybeans, Wheat, and Double-Crop Soybeans.

Per acre gross revenue consists of four items:

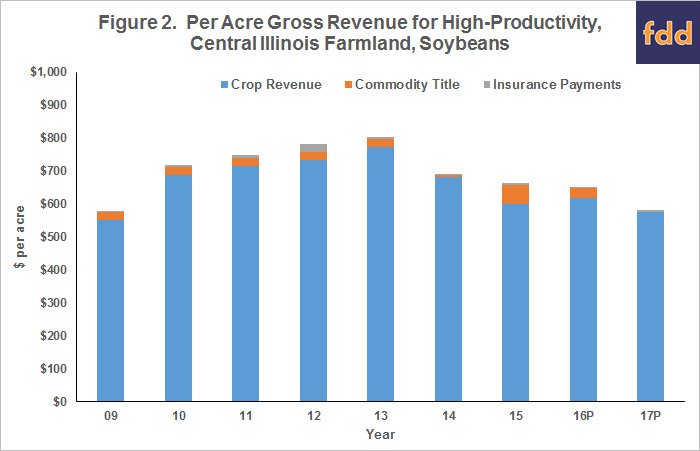

- Crop revenue equals yield per acre times price per bushel. Between 2009 and 2015, crop revenue for corn ranged from a low of $695 per acre in 2009 to a high of $1,086 in 2011. For soybeans, crop revenue ranged from a low of $552 per acre in 2009 to a high of $774 per acre in 2013.

- ARC/PLC or ACRE payments. ACRE was a commodity title program under the 2008 Farm Bill that made payments for corn in 2009. Across central Illinois farms, this payment averaged $8 per acre in 2009. ARC (Agricultural Risk Coverage) and PLC (Price Loss Coverage) are commodity title programs under the 2012 Farm Bill. ARC made payments in 2014 and is projected to make payments in 2015. Since ARC and PLC make payments on base acres and not planted acres, the same ARC payment is used for both corn and soybeans. ARC made an average of a $4 per acre payment in 2014 and is projected to make a $57 per acre payment in 2015. The 2015 payments will be received in October 2017, and will vary across counties.

- Other government payments are direct payments under the 2008 Farm Bill. Direct payments average $24 per acre in 2009 through 2012 and $22 per acre in 2013. No further direct payments will be received as the direct payments were eliminated in the 2012 Farm Bill.

- Crop insurance proceeds represent payments from crop insurance products. Mostly, these products are revenue products such as Revenue Protection. For corn, payments ranged from a low of $5 per acre in 2009 to a high or $295 per acre in 2012, the drought year. For soybeans, crop insurance proceeds ranged from a low of $3 per acre in 2009 and a high of $26 per acre in 2012. As with all values shown in Table 1, crop insurance payments are averaged across farms. Some farms will have low payments and some will have high, with variations across farms depending on crop insurance product and coverage choices, as well as yield differences across farms. In all years, a portion of farms will have low yields, resulting in some payments in each year.

Gross revenue is the sum of the above four items. For corn, gross revenue reached a high in 2012 of $1,192 per acre. In each year since 2012, gross revenue for corn has decreased. In 2015, gross revenue was $842 per acre, a decrease of $350 from the 2012 high. For soybeans, gross revenue was the highest in 2013 at $802 per acres. Similar to corn, gross revenue has decreased in each year. In 2015, gross revenue for soybeans was $663 per acre, $150 below the 2013 high.

2016 Gross Revenue Projections

Table 1 also shows projected gross revenue for 2016. Panel A gives projections for corn. At this point, yields in Illinois appear to be excellent (see Nafziger for a discussion). As a result, a 220 bushel per acre yield estimate is used for 2016, which is below the record-setting 231 bushel per acre average in 2014.

A corn price of $3.50 is used in 2016 projections. This value is close to current harvest time bids, and $.10 per bushel below the midpoint of the 2016/17 range in the July WASDE report. Given a 220 bushel per acre yield and a $3.50 corn price, crop revenue is projected at $770 per acre, up slightly from the 2015 crop revenue of $754 per acre, but still considerably below gross revenues for 2010 through 2012 (see Table 1).

ARC payments for 2016 are projected at $30 per acre. This is an average of corn and soybean ARC payments across central Illinois. The 2016 ARC-CO payments will vary across counties, with some counties having zero payments while other counties having large payments. These 2016 commodity title payments will be received in the fall of 2017.

Crop insurance proceeds are projected at $10 per acre. At the current time, December corn contracts are trading near $3.35 per acre, well below the $3.86 projected price. Given a harvest price of $3.35, yields slightly below guarantee yields would trigger payments at an 85% coverage level. However, yields likely will be above average on most farms, resulting in no insurance payments. Still, a small crop insurance payment is built into revenue projections to reflect the fact that some farms will have poor yields.

Gross revenue for corn is projected at $810 per acre in 2016, down $32 from the $842 average for 2016. This suggest a continuation of low incomes, particularly for farms that were unsuccessful in cutting costs.

There is some optimism that yield could be higher than the 220 bushel per acre average in Tables 1. It is not likely that higher average yields would result in higher revenues. Higher yields would result in reductions in ARC payments. Moreover, average price likely would decrease if yields were higher. All these suggest, that high yields will not take Illinois farmers out of a low revenue situation.

Soybean projections for 2016 are shown in Panel B. At this point in time, considerably more uncertainty exists about soybean yields than for corn. However, it seems reasonable to expect above trend yields. A 65 bushel per acre yield is used for the 2016 yield. A $9.50 price results in $618 per acre of crop revenue, slightly above the $599 per acre average in 2015

Soybean gross revenue is projected at $654 per acre, down $10 per acre from the $664 level in 2015. Gross revenue is lower in 2016 than in 2015 because of lower ARC-CO payments.

2017 Gross Revenue Projections

Projection for 2017 are based on prices currently offered on future contracts. A $3.50 per bushel price is used for corn and a $9.00 price is used for soybeans (see Table 1). Compared to 2016, the 2017 forecast price is the same for corn and $.50 lower for soybeans. Trend yields of 200 bushel per acre for corn and 64 bushel per acre for soybeans are used in 2017 projections. Crop revenue is $700 per acre for corn, down by $70 per acre from 2016 levels because of lower projected yields. Soybean gross revenue for 2017 is projected at $576 per acre, down by $42 from the 2016 level primarily because of lower prices.

No ARC-CO payments are projected for 2017. The benchmark prices for corn and soybeans used to calculate ARC guarantees are declining. Trend yield and 2017 forecast prices will not trigger payments.

Corn gross revenue is projected at $710 per acre, down from $100 acre from the 2016 projection. If the 2016 and 2017 projections hold, a continuing pattern of revenue decreases will exist since 2012 (see Figure 1). Price decreases contributed to this revenue decline. In 2012, corn price was near $7.00 per bushel. Corn prices have been below $4.00 since 2013. For 2016 and 2017, prices continued lower to a projected $3.50 per bushel average. Moreover, reduced revenue is projected because of lowering ARC payments.

Soybean gross revenue is projected at $581 per acre, down by $72 from the 2017 level. Gross revenue for soybeans has been on a downward trend since 2014 (see Figure 2). Prices were above $13.00 per bushel in 2011 and 2012. Soybean prices have decreased to levels below $10 per bushel, with a $9.00 per bushel projection used for 2017. Reduction in commodity title payments also play into lower gross revenue projections.

Commentary

Much can happen to cause both prices and yields to change from the 2016 and 2017 projections shown here. For example, options markets suggest considerable variability in the price of the December 2016 Chicago Mercantile Exchange (CME) corn contract, with a 12% chance the December contract having a price above $4.00 per bushel, and a 20% chance that the December price will be below $3.00 per bushel (see farmdoc daily July 28, 2016).

Even given this uncertainty, it seems reasonable to expect another low income year in 2016. Revenue likely will be down from 2015 levels. Lower revenue could result in lower 2016 net incomes if farmers did not cut costs sufficiently to cover revenue decreases. Revenue projections shown above are for the average of central Illinois on high-productivity farmland. Some farms will have lower incomes and some will have higher incomes. Those farms that have lower yields will tend to have lower incomes, and vice versa.

When making 2017 decisions, it seems prudent to expect low revenues into 2017, with a fairly good chance that revenues will be lower in 2017 as compared to 2016. Hence, there will be a continuing need to cut costs, particularly for those operations with low amounts of working capital.

References

Sherrick, B. "Implied Probabilities for Corn and Soybeans Prices for 2016." farmdoc daily (6):142, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, July 28, 2016.

Schnitkey, G. "Revenue and Costs for Corn, Soybeans, Wheat, and Double-Crop Soybeans, Actual for 2009 through 2015, Projected 2016." Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, June 2016.

Nafziger, E. "Is the 2016 corn crop as good as it looks?" The Bulletin, Pest Management and Crop Department Information for Illinois, July 27, 2016. http://bulletin.ipm.illinois.edu/?p=3696

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.