Beneath the Label: A Look at Generic Base Acres

A recent farm bill hearing before the House Ag Committee included concerns about how cotton farmers were treated by the 2014 Farm Bill (see, Farm Policy News, April 6, 2017). Comments indicated a concern that cotton farmers were lacking assistance. To better understand the situation this article looks into the generic base acres created by the 2014 Farm Bill.

Background

Congress removed cotton from ARC and PLC in the 2014 Farm Bill. This was done because the U.S. had suffered a substantial loss to Brazil in a dispute before the World Trade Organization over cotton assistance. Removing cotton was necessary to settling that dispute and to avoid retaliation from Brazil on U.S. exports. In place of ARC or PLC, cotton farmers were provided a supplemental crop insurance policy that they could purchase with an 80% subsidy level on the premium. Called STAX, this policy permitted cotton farmers to add area-wide insurance coverage on top of individual policies (see, farmdoc daily, June 30, 2016). Cotton also remained a loan eligible commodity in the Marketing Loan Assistance (MAL) program.

To deal with cotton base acres that were no longer eligible for cotton payments, Congress created a unique category of base acres called “generic base acres.” Generic base acres were defined as the number of cotton base acres from the 2008 Farm Bill that were in effect on September 30, 2013 (P.L. 113-79). The 2014 Farm Bill also permitted farmers to make a one-time reallocation of the base acres on their farm that did not include generic base acres (see e.g., farmdoc daily, July 24, 2014).

Figure 1 compares USDA-NASS planted acres to cotton and the base (2008 to 2013) or generic acres (2014 to 2016) from USDA data. FSA data indicates approximately 17 million generic bases on enrolled farms, with another 2 million on non-enrolled farms for crop years 2014 through 2019 (see, FSA ARC/PLC Program data). Cotton’s base or generic acres have consistently exceeded the planted acres for cotton, which is not unusual given that base acres were established more than a decade ago when planted acres were higher. For example, both corn and wheat base acres exceed planted acres nationwide while soybeans typically have more planted acres than base.

Generic Base Acres and Planting Attributed to Them

As designed, generic base acres provide significant flexibility. Farmers holding generic base are permitted to plant those generic base acres to any other commodity. Generic base acres planted to a covered commodity may be recognized as base acres for the respective covered commodity, effectively increasing the farm’s base acres that are eligible for program payments. This also functions to potentially recouple farm payments with planting decisions, an issue that will be explored further in a later article. When planted to a covered commodity, FSA attributes the generic base acres to the farm’s base acres for the respective covered commodity. If total planted acres to covered commodities on the farm exceed the generic base, then the generic base acres are attributed to each covered commodity proportionally (i.e., covered commodity planted acres for each, divided by total covered commodity planted acres). Importantly, generic base acres that are attributed to any covered commodity are able to receive ARC or PLC program payment for that covered commodity.

Attributing generic base acres on a farm is calculated in one of two ways. First, if the total acres planted to covered commodities is less than the generic base, then the generic base acres are attributed to existing base acres in an amount that is equal to the planted acres of the covered commodity. For example, a farm with 100 base acres of wheat and 100 generic base acres plants 50 acres of wheat, 50 generic base acres would be attributed to wheat, increasing the wheat base and making a total of 150 base acres available for ARC or PLC payments.

If the total acres planted to covered commodities exceeds total generic base on the farm then the generic base acres are attributed to each covered commodity in a proportion equal to the planted acres of the respective covered commodity to the total planted acres to covered commodities. For example, if a farm has 100 base acres of wheat, 100 base acres of peanuts and 100 generic base acres the farm has 200 base acres subject to ARC and PLC payments that can be increased by generic base. If the farmer plants 175 acres of peanuts and 125 acres of wheat the farmer can receive ARC or PLC payments on all 300 acres. In that case, 58 of the generic base acres would be attributed to peanuts and 41 to wheat.

As these examples demonstrate, generic base provides a method for increasing the base acres that receive payments. This is an opportunity that is only available to farmers holding generic base acres (i.e., farmers involved with farms that historically planted cotton). This feature of generic base acres can result in payments on prior cotton base and farmers with generic base acres are potentially receiving ARC or PLC program payments. They are not receiving payments for cotton base but they could receive payments for those generic acres attributed to a covered commodity.

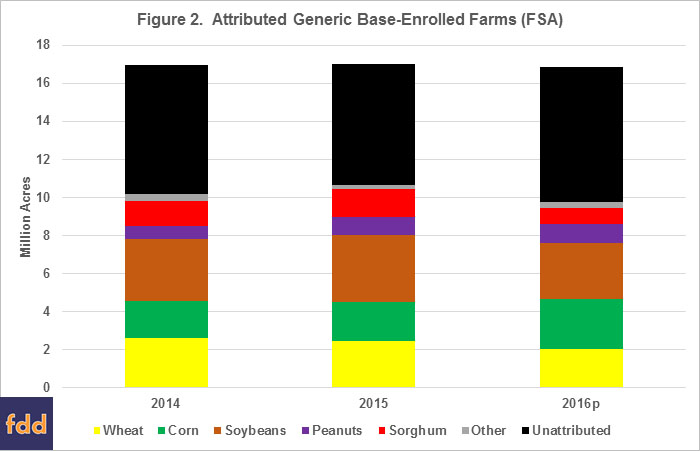

Figure 2 illustrates the nationwide breakdown of generic base acres on enrolled farms attributed to other covered commodities in the 2014 and 2015 crop years, as well as the preliminary data for the 2016 crop year, using FSA program data. According to FSA, 60 percent of generic base acres on enrolled farms were attributed to covered commodities in 2014 and over 63 percent of generic base acres on enrolled were attributed in the 2015 crop year. Preliminary data for the 2016 crop year indicates a slight decrease to 58 percent of generic base on enrolled farms attributed to covered commodities. This means that approximate 60 percent of generic base acres were eligible to receive ARC or PLC payments in the first three crop years of the 2014 Farm Bill.

The generic base acres attributed to covered commodities have the potential to receive payments under the ARC and PLC programs, but actual payments depend on revenue or price triggers (respectively) for the programs and covered commodities. Previously, we discussed total ARC-CO and PLC payments per base acre in the 2014 and 2015 crop years and compared payments across crops (see, farmdoc daily, March 9, 2017). This provides an indication of the relative value of the decision to plant generic base acres to covered commodities. For example, peanut base received $288.77 per acre compared to wheat at $23.22 per acre and this expected payment may factor in to farmer planting decisions. This goes to the issue of the recoupled nature of generic base acres and will be explored in a future article.

For purposes of understanding assistance to cotton farmers, FSA provides a breakdown of payments on generic base acres by covered commodity for the 2014 and 2015 crop years. Figure 3 illustrates those payments for the five covered commodities with the most attributed generic base acres in the 2014 and 2015 crop years. In total, FSA reports that generic base acres received $592.7 million in the 2014 and 2015 crop years, $357 million from PLC payments and $235 million from ARC-CO payments. FSA also reported that 9.7 million generic base acres received payments in 2015 and 2.2 million in 2014. This means that of the generic base acres planted to covered commodities, 22 percent received payments in 2014 at an average value of $66.76 per paid generic base acre and 91 percent received payments in 2015, at an average value of $45.73 per paid generic base acre.

The payments illustrated in Figure 3 are just those payments made on generic base acres planted to covered commodities not the total assistance available to cotton farmers from the 2014 Farm Bill. For example, cotton farmers also received two years of Cotton Transition Assistance Payments totaling $487 million for fiscal years 2015 and 2016. In terms of total program benefits, upland cotton received $1.309 billion in Federal outlays in fiscal year 2015 and $781 million in fiscal year 2016 outlays. These outlays do not include ARC or PLC payments on attributed generic base acres discussed above. Those payments for the 2014 crop year correspond with Federal outlays in fiscal year 2016 because programs use marketing year averages and are to be made after October 1; adding them brings the total to about $930 million.

Conclusion

Contrary to the concerns raised at the recent House Agriculture Committee farm bill hearing, cotton farmers were not completely left out of the 2014 Farm Bill. Cotton farmers could receive four types of Federal assistance. First, a farmer planting cotton could purchase crop insurance, including the highly subsidized STAX program only available for cotton. Second, cotton remains eligible to use the marketing assistance loan program, including loan gains or Loan Deficiency Payments as a backstop to low prices. Third, farmers with former cotton base received two years of transition assistance payments. Fourth, if the farmer has generic base acres and planted the acres to a covered commodity, the farmer could potentially receive ARC or PLC payments on those attributed generic base acres. Estimates of payments on attributed generic base combined with Federal outlay data demonstrate that cotton producers and farmers with generic base acres have received substantial assistance from the 2014 Farm Bill.

Appendices

Good, K. "Farm Bill: Cotton Issues a Significant Concern." Farm Policy News, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, April 6, 2017.

Paulson, N., and G. Schnitkey. "Use of the SCO and STAX Insurance Programs in 2015." farmdoc daily (6):123, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, June 30, 2016.

Zulauf, C., G. Schnitkey, J. Coppess, and N. Paulson. "ARC-CO and PLC Payments for 2014 and 2015: Review, Comparison, and Assessment." farmdoc daily (7):44, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, March 9, 2017.

Zulauf, C., N. Paulson, J. Coppess, and G. Schnitkey. "2014 Farm Bill Decisions: Base Acre Reallocation Option." farmdoc daily (4):138, Department of Agricultural and Consumer Economics, University of Illinois, July 24, 2014.

USDA Farm Service Agency. ARC/PLC Program Data. https://www.fsa.usda.gov/programs-and-services/arcplc_program/arcplc-program-data/

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.