2014 Farm Bill Decisions: Base Acre Reallocation Option

This article discusses the one-time option the owner of an Farm Service Agency (FSA) farm has to reallocate, but not increase, its base acres. The article concludes that this decision is important because of the emerging low prices, because Price Loss Coverage (PLC) and Agriculture Risk Coverage (ARC) pay on base acres, and because the change in base acres can be substantive. For a broader policy discussion of the base acre reallocation option, see an article by Nick Paulson and Jonathan Coppess titled “2014 Farm Bill: Reallocating Base Acres” (farmdoc daily, March 6, 2014).

Background

PLC and ARC-CO (ARC-county) programs make payments for a covered crop on 85% of the covered crop’s base acres on an FSA farm. Payment acre determination is more complex for ARC-IC (ARC individual coverage) but in general equals 65% of total base acres on an ARC-IC farm, including, in most instances, any generic (former cotton) base acres planted to a covered crop for the crop year.

Decision Framework

- Decision rests with the owner of the FSA farm.

- Decision is for an FSA farm, applies to all covered crops on the FSA farm, and takes effect beginning with the 2014 crop year.

- Total base acres on an FSA farm cannot increase. They can only be reallocated.

- Choices are:

-

- retain base acres as of 9/30/2013, including generic (former cotton) base acres which cannot be reallocated, OR

- reallocate 9/30/2013 base acres, other than generic base acres, according to the ratio of (a) 4-year average for the 2009-2012 crop years of a covered crop’s acres planted or prevented from planting on the FSA farm to (b) 4-year average for the 2009-2012 crop years of all covered crops’ acres planted or prevented from planting on the FSA farm.

- The crop must have been planted for harvest, grazing, haying, silage, or other similar purposes.

- Prevented planting must be due to conditions beyond the producer’s control, including drought, flood, and other natural disasters.

- All years are included regardless of whether or not acres were planted to a covered crop.

- Base acres can include double cropped acres but only if the Secretary of Agriculture has determined that double cropping is an established practice in the area. In other areas, if 2 crops were planted on the same acre in the same year, the owner may elect 1 but not both covered crops for inclusion in calculating the 4-year average of base acres.

- Generic base acres are automatically retained but cannot be reallocated.

- The base acre reallocation decision is independent of the payment yield update decision. Base acres can be reallocated without updating payment yield, and vice versa.

- If no decision is made, the owner retains current base acres, including generic base acres.

- For an FSA farm, total, including generic, base acres, cannot exceed the FSA farm’s actual cropland acres (unless double-cropping is an approved practice).

- Table 1 provides an example. It includes most situations discussed above. Note the reallocation option does not change total base acres (100 acres in both options) even though land was planted to a non-covered crop (alfalfa). The farmer in this example will confront the decision of whether or not to reallocate base acres from oats and wheat to soybeans.

Summary Observations

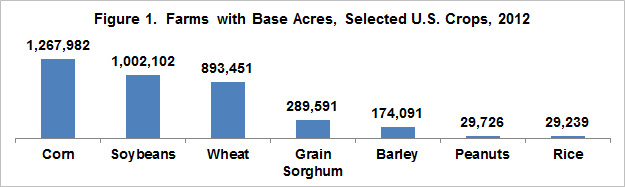

- An FSA farm is generally determined on the basis of ownership and thus can differ notably from a farm operator’s farm. To illustrate, in 2012, 1,267,982 farms had corn base acres. In contrast, the 2012 Census of Agriculture reports that only 348,530 farms harvested corn. See Figures 1 and 2 for similar information on other crops. Other than peanuts, which has more farms harvesting the crop; operational farms number only 7.5% (grain sorghum) to 30% (soybeans) of the number of farms with base acres for the crop.

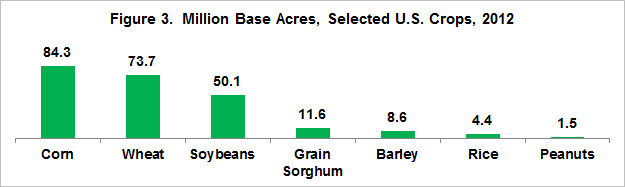

- The preceding implies the average FSA farm is notably smaller than the average farm operation, except for peanuts. For example, corn base acres per FSA corn farm averages 66 (84.3 million corn base acres divided by 1.27 million FSA farms with a corn base, see Figures 3 and 1). In contrast, planted corn acres per farm harvesting corn averages 279 (97.2 million planted corn acres divided by 0.35 million farms harvesting corn, see Figures 4 and 2).

- The smaller size of FSA farms, the rotation of crops, the inclusion of years with 0 acres planted to a covered crop when calculating the reallocated base acres, and the changing mix of crops in the U.S. (more corn and soybean acres) mean reallocated base acres can differ notably from current base acres for an FSA farm.

- The potential for a notable change in base acres, the use of base acres to calculate ARC and PLC payments, and the continuing decline in prices mean the base acre reallocation decision is important.

- Comparing base with planted acres by crop in 2012 suggests the most common base reallocation decision will involve whether to increase corn and soybean base acres in place of current grain sorghum, barley, and especially wheat base acres (compare Figures 3 and 4). In 2012, base acres were 18 million higher than planted acres for wheat but 12 and 27 million less than planted acres for corn and soybeans, respectively.

- The decision to reallocate base acres will revolve around which of 2 likely perspectives the FSA farm owner brings to the decision:

-

- One perspective is to minimize the financial risk associated with production. Given this perspective, the owner will most likely elect the base acre allocation closest to the expected crop mix on the FSA farm during the 2015 through 2018 crop years. Because future plantings are usually more similar to more recent plantings, the 2009-2012 reallocated bases are probably the more likely choice given this perspective.

- The second perspective is to maximize government payments. Economists have found that this perspective has generally driven past government program decisions by farmers. However, there is a catch this time: ARC and PLC payments are more uncertain than most past government program payments. In short, the decision involves uncertainty as opposed to known government payments. Thus, the ability to maximize government payments will depend upon the FSA farm owner’s ability to forecast accurately yield and price over the 2015 through 2018 crop years.

- Economists have consistently found the ability to forecast price with any degree of accuracy is limited. Given the likely importance of the ability to forecast price accurately in making the base reallocation decision, as well as the ARC vs. PLC decision, the next two posts in this series will examine this topic.

Addendum

Other Base Acre Provisions That Might Affect Base Acre Reallocation Decision

- An FSA farm with 10 or fewer total base acres is generally not eligible to receive PLC or ARC payments. This provision does not apply for (a) a socially disadvantaged farmer or rancher or (b) a limited resource farmer or rancher.

- The limit on planting fruits, vegetables (other than mung beans and pulse crops), or wild rice on base acres is modified. Under the 2014 farm bill, payment acres on an FSA farm are reduced in any crop year if these crops are planted on more than 15% of base acres for farms in PLC or ARC-CO or on more than 35% of base acre for farms in ARC-IC. Payment acres are the base acres upon which payments are received, such as 85% of base acres for ARC-CO and PLC. This provision provides some flexibility to plant non-program crops on the share of base acres that do not receive any program payment but does not provide any subsidy for planting the non-program crop on payment acres. This provision does not alter the base acres on an FSA farm.

- Base acres, including generic (former cotton) base acres, generally are adjusted when entering or exiting Conservation Reserve Program contracts.

- The Secretary of Agriculture is to proportionately reduce base acres, including any generic (former cotton) base acres, on an FSA farm for which land has been subdivided and developed for multiple residential units or other nonfarm uses if the land is unlikely to return to agricultural use and unless the owner can demonstrate that the land is or will be in agricultural use.

Background on Current Base Acres

Current counter-cyclical base acres largely reflect average acres planted or considered planted either during 1991 through 1995 or 1998 through 2001. This choice was given farmers by the 2002 farm bill. For an extensive discussion of the 2002 farm bill decision, see C. Edwin Young, David W. Skully, Paul C. Westcott, and Linwood Hoffman, “Economic Analysis of Base Acre and Payment Yield Designations Under the 2002 U.S. Farm Act,” Economic Research Report ERR-12, September 2005 (As of July 24, 2014, USDA Economic Research Service website)

This publication is also available at http://aede.osu.edu/publications.

References

Paulson, N., and J. Coppess. "2014 Farm Bill: Reallocating Base Acres." farmdoc daily (4):42, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, March 6, 2014.

Young, E., D. Skully, P. Westcott, and L. Hoffman. "Economic Analysis of Base Acre and Payment Yield Designations Under the 2002 U.S. Farm Act." Economic Research Report No. (ERR-12) 46 pp, September 2005. Accessed July 24, 2014. http://webarchives.cdlib.org/sw15d8pg7m/http:/ers.usda.gov/Publications/err12/

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.