Crop Insurance Product Comparisons

Periodically, discussion pertaining to the elimination of the harvest price option is mentioned in policy circles. The revenue protection product with the harvest price option is widely used in the Corn Belt. This article examines the relative attractiveness of the various crop insurance products for a case farm in west central Indiana. The discussion below focuses on individual products rather than area products.

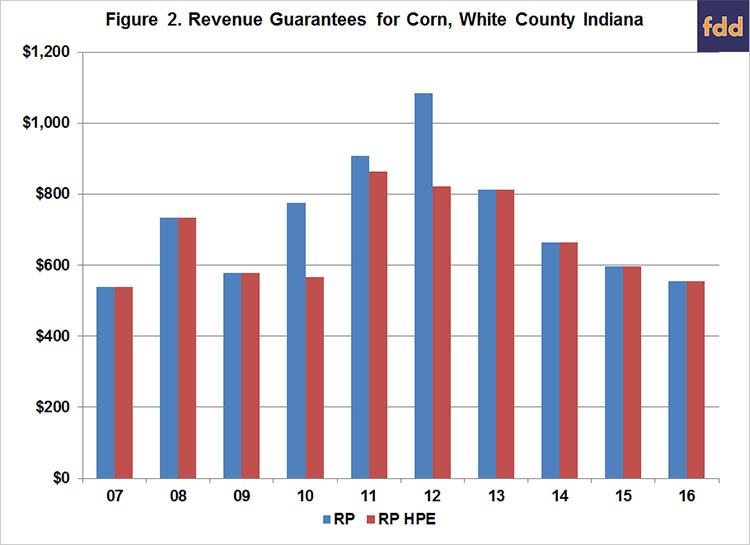

Revenue Guarantees

The revenue guarantee for the revenue protection product that includes the harvest price option (RP) is computed by multiplying the APH approved yield or the trend-adjusted APH approved yield by the coverage level and the greater of the projected price or harvest price. In contrast, the revenue guarantee for the revenue protection product that includes the harvest price exclusion option (RP-HPE) is computed by multiplying the APH approved yield or the trend-adjusted APH yield by the coverage level and the projected price. From these definitions, it is evident that when the projected price is higher or equal to the harvest price, the revenue guarantees for RP and RP-HPE are identical. When the harvest price is greater than the projected price, the revenue guarantee for RP is higher than the revenue guarantee for RP-HPE. Figure 1 illustrates the projected and harvest prices per bushel for corn from 2007 to 2016. The projected price was higher than the harvest price 7 out of 10 years. However, for 2010 and 2012, the harvest price was $1.47 per bushel and $1.82 per bushel higher than the projected price. As we note below, for these two years the RP revenue guarantee was substantially higher than the RP-HPE revenue guarantee.

Using the projected and harvest prices for corn in figure 1 and APH yields for White County Indiana, RP and RP-HPE revenue guarantees were computed for the 2007 to 2016 period (figure 2). The average difference in revenue guarantees for this period was approximately $52 per acre. In percentage terms, the RP-HPE revenue guarantee was on average 7.1 percent lower than the average RP revenue guarantee. Figure 3 illustrates the difference in revenue guarantees by year. The RP revenue guarantee was $209 per acre, $45 per acre, and $263 per acre higher than the RP-HPE guarantee in 2010, 2011, and 2012, respectively. For the remaining years (2007-2009; 2013-2016), projected price was higher than the harvest price, resulting in no difference in the revenue guarantees.

The analysis above focused on corn in White County Indiana. The results for soybeans are similar. The difference in revenue guarantees for the 2007 to 2016 period was approximately $36 per acre. In percentage terms, the RP-HPE revenue guarantee was 7.4 percent below the RP revenue guarantee for soybeans during this period.

Net Payouts

The Illinois FAST Crop Insurance Decision Tool was used to compare relative net payouts for three crop insurance products (RP, RP-HPE, and YP, where YP represents the yield protection product). One of the spreadsheet tabs in the decision tool illustrates the farmer-paid premium, insurance payment, and insurance payment minus farmer-paid premium for specific products, coverage levels, and counties. Insurance payment minus farmer-paid premium is referred to as the net payout in this article. Products were examined for White County Indiana using the 85 percent coverage level.

Data were available in the Illinois decision tool for all three products for the 2011 to 2015 period for corn. The net payouts for RP, RP-HPE, and YP for these five years were $104 per acre, $39 per acre, and $87 per acre, respectively. It is particularly important to note that the payouts for the RP-HPE product were substantially lower than the net payouts for RP and YP in 2012. For 2012, the RP and YP net payouts for corn were $310 and $203 per acre higher than the net payout for RP-HPE.

Given the lower relative revenue guarantee and net payout for the RP-HPE product, if the RP product was not available, farms in White County Indiana would likely examine the relative attractiveness of the YP product. Data was available from 1999 to 2015 in the Illinois FAST decision tool to compare the net payouts for RP and YP. Over this period, the net payouts were $22 per acre for the RP product and $20 per acre for the YP product.

The net payout analysis above focused on corn. The comparisons for White County Indiana for soybeans are similar. The net payouts for RP, RP-HPE, and YP for the 2011 to 2015 period were $16, -$3, and $12, respectively. For the 1999 to 2015 period, the net payouts for RP and YP products were $1 per acre and -$1 per acre.

Summary and Conclusions

This article used a case farm in White County Indiana to compare the relative attractiveness of revenue protection (RP) and revenue protection with the harvest price exclusion (RP-HPE) for corn and soybeans. The revenue guarantees and net payouts were substantially higher for the RP product. Differences in revenue guarantees and net payouts were particularly large in 2012. For 2012, the difference in the revenue guarantee for corn (soybeans) was $263 per acre ($121 per acre) and the difference in net payout was $310 per acre ($68 per acre). If the RP product were not available, farmers would likely examine the yield protection (YP) product as a potential replacement.

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.