Spanning the Globe – Corn, Soybean, and Wheat Production and Exports since 2000: Focus on the Black Sea Area and the U.S.

South America dominates the U.S. view of agricultural production in the rest of the world, in part because it has supplanted the U.S. as the leading producer of soybeans. Such a view is myopic, thus missing important storylines. One of them is the key role of the Black Sea area in the growth of production and exports of corn, soybeans, and wheat since 2000. Another is the implications for U.S. exports of farm commodities.

Methods

Source for the data used in this article is the U.S. Department of Agriculture, Foreign Agriculture Service (USDA, FAS). Data were collected for these areas: Australia, Black Sea, China, European Union (28 countries), India, North America, South America, and the World. The regions listed account for 87%, 99%, and 84% of world production of corn, soybeans, and wheat, respectively; and an even larger share of world exports (94%, 100%, and 93%, respectively). The Black Sea area is composed of Kazakhstan, Russia, and Ukraine. Due to variation in production of agricultural commodities caused by weather and other factors, averages are computed for the crop year periods of 2000-2001 through 2002-2003 and 2014-2015 through 2016-2017.

Current Distribution of Production

Figure 1 illustrates the well-known storyline that wheat production is distributed across the globe, soybean production is concentrated in North and South American, and the distribution of corn production lies between these two distributions. South America and North America account for the largest share of soybean and corn production, respectively. Their share is currently 18 percentage points larger than the share of the next largest producer (North America for soybeans and China for corn). The European Community accounts for the largest share of world wheat production at 21%, with China next largest at 17%.

Change in Distribution of Production since 2000

The Black Sea is the only area with a larger share of world production in 2014-16 than 2000-02 for all 3 crops (see Figure 2). In contrast, North America is the only area whose share of world production of all three crops is at least -0.5% lower in 2014-16. The single largest change since 2000 is a 10 percentage point increase in South America’s share of world soybean production. It is now clearly the world’s leading soybean producer. At the turn of the 21st Century, South and North American were essentially tied with shares of 44% and 42%, respectively.

Change in Distribution of Exports since 2000

Exports have expanded faster than production for all 3 crops since 2000. The growth in exports with production in parenthesis are: corn, 85% (70%); soybeans, 140% (76%), and wheat, 65% (28%). The only area to increase its share of world exports in all 3 crops is the Black Sea (see Figure 3). Share of world corn and soybean exports increased the most for South America, but its share of world wheat exports declined. World export share declined the most for North America, with -23, -9, and -12 percentage point declines for corn, soybeans, and wheat, respectively.

Meat and Animal Product Exports

A topic of recent interest in the U.S. has been indirect exports of grains and oilseeds via increasing exports of meat and animal products. U.S. exports of all meat and animal products tracked by FAS have increased since 2000-02 except for turkey meat. Moreover, U.S. share of world exports increased for all meat and animal products tracked by FAS except for broilers and beef/veal, which declined 14 and 6 percentage points, respectively. Over this same period, South America’s share of world broiler and beef/veal exports increased 15 and 8 percentage points, respectively.

Summary Observations

- The Black Sea area has been a key contributor to the increase in world corn, soybean, and wheat production since 2000.

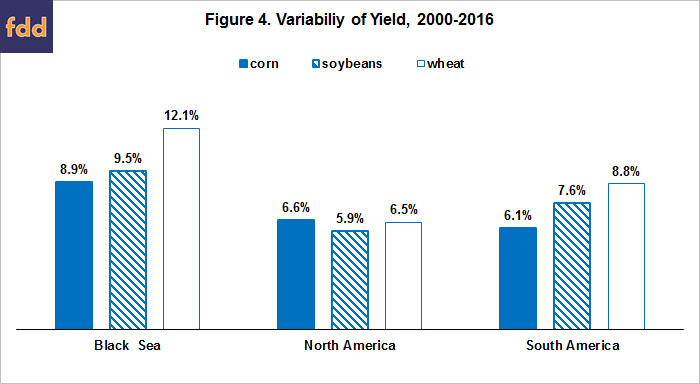

- Reinforcing the need to pay attention to the Black Sea area is its more variable yields than in North and South America (see Figure 4, data note 1, and farmdoc daily, November 11, 2015).

- Since the turn of the 21st Century, the U.S. has seen its share of world exports of corn, soybeans, and wheat decline.

- Since the turn of the century, U.S. share of world exports of most meat and animal products has increased, except for broilers and beef/veal. A factor that has likely contributed to the decline in the U.S. share of world broiler and beef/veal exports is the increasing share from South America. These observations prompt an important question: “Over time, how much does a country’s exports of meat and animal products ultimately rest upon increases in its domestic production of grains and oilseeds?”.

- The U.S. is more dependent on yield to expand production of corn, soybeans, and wheat than the rest of the world as a whole. Between 2000-02 and 2014-16, land harvested for corn and soybeans increased 15 and 62 percentage points less in the U.S. than rest of the world (see Figure 5). Land harvested for wheat declined in the U.S. while increasing in the rest of the world. Reasons for the smaller increase/decrease in the U.S. include little growth in total land in crop production and the high share of land already planted to corn, soybeans, and wheat. In short, it appears that expansion of corn, soybean, and wheat acres in the U.S. will be limited relative to the rest of the world and largely constrained to shifts from other crops.

- Interacting with the previous point is an important change in U.S. farm policy. During the 1973-1980 period of farm prosperity the U.S. eliminated all land retirement programs, including those with a conservation orientation. During the 2006-2013 period of farm prosperity, the U.S. did not eliminate and only moderately reduced land retirement programs, all of which now have a conservation orientation.

- Due to lower U.S. farm returns in recent years, considerable discussion is occurring about expanding land retirement conservation programs, in particular the Conservation Reserve Program (farmdoc daily, May 4, 2017). While sound reasons exist for this discussion, it is important to note that such a policy decision will make it harder to expand U.S. farm exports.

- In summary, for a variety of reasons, it may not be easy to expand U.S. exports of farm commodities. At the very least, sustained expansion of U.S. exports of farm commodities will likely require a significant commitment of resources to increasing U.S. yields.

Data Notes

- Yield variability is measured as the standard deviation of the percent deviation from trend-line yield, a commonly-used measure. A linear trend-line yield is estimated for the crop years from 2000-2001 through 2016-2017 for each area. Given recent evidence for non-linear yield trends in U.S. soybeans (farmdoc daily, May 10, 2017) and Brazil corn (farmdoc daily, February 22, 2017), a non-linear trend-line also is estimated. Statistical evidence for a non-linear trend is close to but not statistically significant for this period. Thus, a linear trend-line yield estimate is used.

References

Coppess, J. "Historical Background on the Conservation Reserve Program." farmdoc daily (7):82, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, May 4, 2017.

Hubbs, T., S. Irwin, and D. Good. "Forming Expectations for the 2017 Brazil and Argentina Corn and Soybean Yields: The Impact of La Niña." farmdoc daily (7):33, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, February 22, 2017.

Irwin, S., T. Hubbs, and D. Good. "What's Driving the Non-Linear Trend in U.S. Average Soybean Yields?" farmdoc daily (7):86, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, May 10, 2017.

U.S. Department of Agriculture, Foreign Agriculture Service. "Production, Supply, and Distribution Online." May 2017. https://apps.fas.usda.gov/psdonline/

Zulauf, C. "Variability in Corn, Soybean, and Wheat Production across the Globe." farmdoc daily (5):210, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, November 11, 2015.

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.