Coronavirus Food Assistance Program, Part 2

At a campaign stop in Wisconsin on September 17, 2020, President Trump announced a second round of Coronavirus Food Assistance Program (CFAP2) payments (Holland and Huffstutter, September 17, 2020; USDA, farmers.gov/cfap). USDA estimates up to $14 billion in new payments under CFAP2. Sign up begins on Monday, September 21, 2020 and will conclude on December 11, 2020. This article reviews the program based on the USDA announcement and the corresponding Cost Benefit Analysis (USDA, CFAP2 CBA).

Payments Overview

CFAP2 will provide farmers with payments in addition to those made under CFAP1 intended to address losses linked to the coronavirus pandemic (farmdoc daily, May 22, 2020; June 9, 2020; September 3, 2020; September 16, 2020; September 17, 2020). As in CFAP1, USDA is applying a $250,000 per person payment limit on CFAP2 payments. CFAP1 payments will not count toward the $250,000 CFAP2 payment limit. Commodity title programs also do not count towards the $250,000 CFAP2 payment.

Farmers can begin making CFAP2 applications on September 21, with a deadline of December 11, 2020. It currently appears that funding available for CFAP2 will be sufficient to make payments; an early application seems prudent, however, and likely will result in quicker access to funds.

The Farm Service Agency (FSA) has provided very good information on CFAP2 on their farmer.gov website (click here for the CFAP2 section), and a Microsoft Excel spreadsheet is available for download to make application. Applications may also be completed and signed through an online portal. Further detail on CFAP2 payments for specific commodities is provided below.

Row Crops

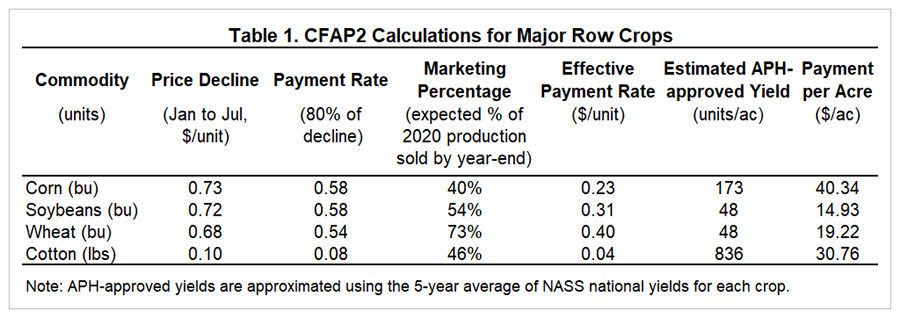

CFAP2 will make payments based on 2020 plantings. CFAP2 divides eligible row crops into two categories: price trigger and flat rate commodities. Price trigger commodities have a specific per-unit payment rate based on the decline in expected harvest-time price between mid-January and late-July (see Table 1). For crops with an available futures market, this is the price of the November or December futures contract. Price trigger crops had to have a 5% price decline to qualify. For the seven price trigger crops, per acre payments will be calculated using an effective payment rate multiplied by the 2020 Actual Production History (APH) yield used for crop insurance. If an APH yield does not exist, the yield used in making payments will be 85% of the Agricultural Risk Coverage (ARC) yield for the county.

As listed in Table 1, effective payment rates are $0.23 per bushel for corn, $0.31 per bushel for soybeans, and $0.39 for wheat. Effective payment rates equal 80% of the price decline from mid-January 2020 to July 2020; that rate is further factored based on the historical marketing during the cropping year.

For price trigger crops, payment minimums of $15 per acre apply. Farms will receive the greater of $15 per acre or the per acre payment calculated using the formula in Table 1. Payment rates for some crops are closer to this minimum. For example, farms with soybean APH yields less than 48 bushels per acre appear to receive the minimum payment.

For other flat rate crops, payments will be made at a $15 per acre rate on alfalfa, amaranth grain, buckwheat, canola, Extra Long Staple (ELS) cotton, crambe (colewort), einkorn, emmer, flax, guar, hemp, indigo, industrial rice, kenaf, khorasan, millet, mustard, oats, peanuts, quinoa, rapeseed, rice, sweet rice, wild rice, rye, safflower, sesame, speltz, sugar beets, sugarcane, teff, and triticale (see, https://www.farmers.gov/cfap/row-crops).

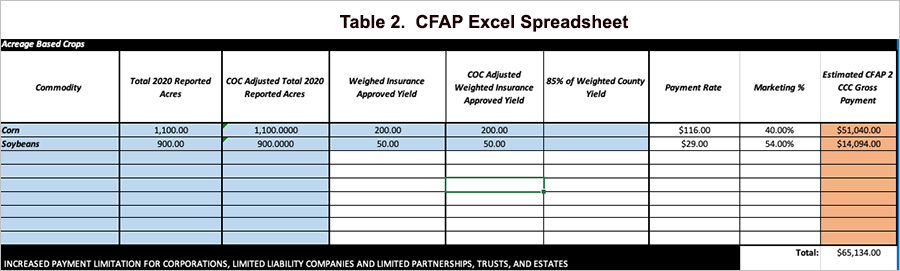

To illustrate the payment calculation, take a Champaign County, Illinois case farm that in 2020 planted 1,100 acres of corn and 900 acres of soybeans. The 2020 APH yields are 200 bushels per acre for corn and 50 bushels per acre for soybeans. The per acre corn payments equals:

- Corn: $45 per acre = 200 APH x $0.2320 effective rate, and

- Soybeans: $15.66 per acre = 50 APH x $0.3132 effective rate.

Both exceed $15 per acre, so the payment minimum does not apply. The completed “Acreage Based Crops” from the FSA CFAP2 spreadsheet is shown in Table 2. This farm would receive $51,400 for corn (1,100 acres x $45 payment per acre) and $15,094 (900 acres x $15.50 per acre). Given only grain operations, this farm would receive $65,134 of CFAP2 payments, well below the $250,000 CFAP2 payment limit.

Beef and Hog Payments: Beef payments will be based on the maximum number of eligible beef cattle in the herd from April 16, 2020 to August 31, 2020, excluding breeding stock and will equal $55 per animal.

Hog payments will be based on maximum number of head between April 16, 2020 to August 31, 2020, but not including breeding stock. The payment rate will be $23 per head.

A lamb and sheep payment will equal $27 per head times the maximum inventory between April 16 to August 31, and breeding stock are not included.

Dairy Payments: Dairy payment will be based on:

- Total actual milk production from April 1, 2020 to August 31, 2020.

- Estimated milk production from September 1, 2020 to December 31, 2020.

For the sum of the two parts, payments will equal $1.20 per hundredweight (cwt.).

Other Payments: The above payments cover most of the payments that will be made on Midwest farms. Additional CFAP2 payments will occur for specialty crops, floriculture, aquaculture, and broilers and eggs.

Additional Background on CFAP2

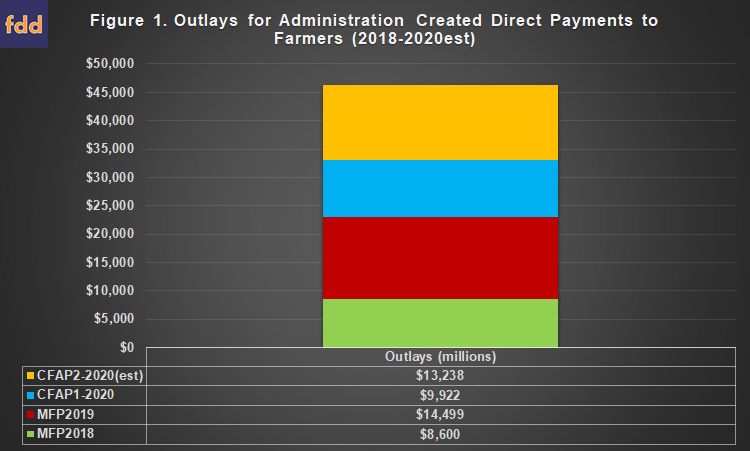

Since 2018, the Trump Administration has delegated significant funds to ad-hoc farm programs. Including the estimated payments under the just-announced CFAP2, total Administration created payments to farmers exceeds $45 billion. Figure 1 illustrates the total spending to date by program, including the Market Facilitation Program (MFP) for 2018 and 2019, as well as CFAP1 and estimated payouts for CFAP2. Note that this amount includes only ad-hoc program payments and does not include expected ARC/PLC farm bill program payments for the 2019 crop that will be made in October 2020.

The CFAP2 announcement closely follows the closing of the signup for CFAP1 on September 11, 2020. To date, USDA reports $9.9 billion in spending for CFAP1 which is 62% of the $15.974 billion estimated for the program, likely as a result of the requirement that inventory be unpriced to receive payments and the unpriced portion being less than initially estimated (farmdoc daily, September 3, 2020; September 17, 2020). CFAP2 appears to use remaining funds from CFAP1 as well as other funding from the Commodity Credit Corporation.

Nearly all agricultural commodities are eligible for CFAP payments, including row crops, livestock, dairy, poultry, eggs and specialty crops. Notable ineligible commodities are hay (except alfalfa) and forages. Cover crop and prevented plant acres are also ineligible.

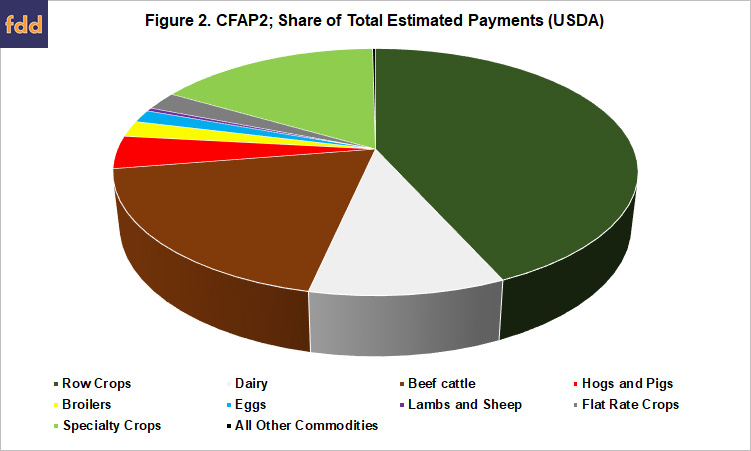

USDA’s cost benefit analysis estimates that roughly 43% of total estimated payments will go to row crop farmers, or approximately $5.7 billion. Figure 2 illustrates the distribution of estimated payments by commodity category.

Discussion

USDA also announced that it is once again using a $250,000 payment limit and a $900,000 adjusted gross income eligibility requirement (unless at least 75% of the income is derived from farming, ranching, or forestry-related activities). A legal entity, such as a corporation, limited liability corporation or limited partnership may increase the payment limit to $500,000 if two different members provide sufficient labor or management, and to $750,000 if three different members provide sufficient labor or management. USDA noted that the same payment limits applied to CFAP1 impacted about 1% of total applicants.

For total estimated payments by crop, USDA used the August 2020 USDA World Agricultural Supply and Demand Estimates for production. That report forecasts total 2020 corn production at 15.3 billion bushels and soybeans at 2.4 billion bushels. Figure 3 illustrates total estimated payments by crop according to USDA.

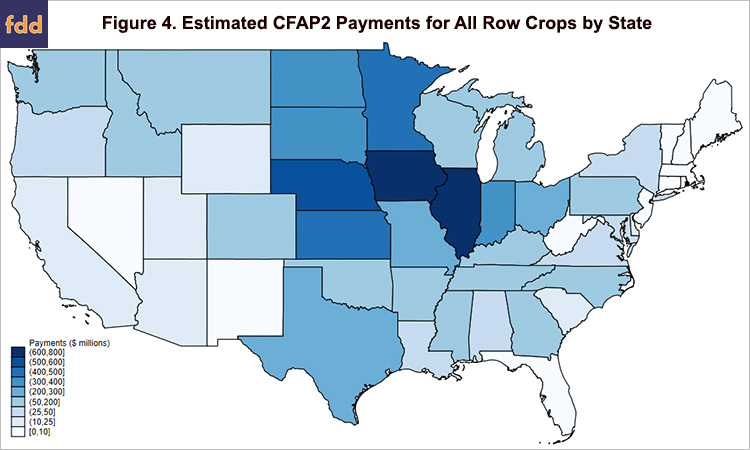

Figure 4 estimates the expected distribution of CFAP2 payments to row crops across states. APH-approved yields are approximated using the 5-year average of NASS state-level yields. Crop acreage is the NASS state-level estimate of 2020 harvested acres. Payment limits are not accounted for in these estimates. Iowa receives the most CFAP2 dollars of any state with an estimated $769 million in payments. Illinois is second with an estimated $678 million. Payments are concentrated in the Midwest and are strongly correlated with the location of corn and soybean acres, the crops with the largest acreage. State-level payments are particularly tied to corn acres because per-acre payment rates for corn are higher than other row crops.

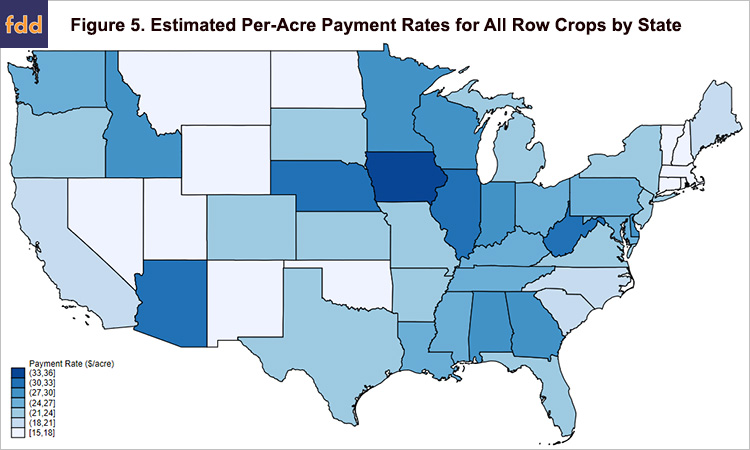

Figure 5 plots the distribution of CFAP2 payments on a per-acre basis. This accounts for the fact that states have differing amounts of cropland. Differences in per-acre payment rates are driven only by crop mix and crop yields, not the total number of acres. This figure shows that per-acre payment rates are remarkably similar across states, with most Corn Belt states receiving payment rates between $25-35/acre. Payment rates in the South are generally similar to those in the Midwest. Payment rates are generally lower in the Great Plains. Differences in per-acre payment rates across states are much lower than previous ad hoc farm payments, especially the second Market Facilitation Program.

Conclusion

Signup for the second Coronavirus Food Assistance Program payments begins today, Monday, September 21, 2020. The program covers a wide range of crops, from traditionally supported row crops to specialty crops, dairy and livestock. Signup is scheduled to end on December 11, 2020, but farmers are advised to undertake signup as early as possible. This is the fourth in a series of ad-hoc farm programs since 2018. Program payments for major row crops are based on price declines in 2020 in the wake of the coronavirus pandemic applied to expected marketings of the 2020 crop prior to the end of the year. Since program calculations rely on farm-level acreage and yield information already known by the USDA Farm Service Agency, USDA is expected to quickly issue payments after applications are finalized and submitted.

References

Holland, S., and P.J. Huffstutter. “In Wisconsin, Trump Announces $13 Billion in Farm Aid.” Reuters, September 17, 2020. https://www.reuters.com/article/health-coronavirus-usa-farmers/update-4-in-wisconsin-trump-announces-13-billion-in-farm-aid-idUSL1N2GE27E

Janzen, J., J. Coppess and N. Paulson. "CFAP Payments to Date and Possible Future Ad Hoc Farm Payments." farmdoc daily (10):160, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, September 3, 2020.

Janzen, J., J. Coppess and N. Paulson. "The Distribution of CFAP Payments across Commodities and States." farmdoc daily (10):167, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, September 17, 2020.

Paulson, N., G. Schnitkey, J. Coppess, C. Zulauf and K. Swanson. "Coronavirus Food Assistance Program (CFAP) Rules Announced." farmdoc daily (10):95, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, May 22, 2020.

Swanson, K., N. Paulson, G. Schnitkey, J. Coppess and C. Zulauf. "CFAP Applications for Livestock and Dairy." farmdoc daily (10):105, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, June 9, 2020.

U.S. Department of Agriculture, farmers.gov. “Coronavirus Food Assistance Program 2.” Accessed September 21, 2020. https://www.farmers.gov/cfap

U.S. Department of Agriculture, farmers.gov. “Coronavirus Food Assistance Program 2 for Row Crop Producers.” Accessed September 21, 2020. https://www.farmers.gov/cfap/row-crops

U.S. Department of Agriculture, farmers.gov. “Coronavirus Food Assistance Program2: Cost-Benefit Analysis.” Accessed September 21, 2020. https://www.farmers.gov/sites/default/files/documents/CBA%20CFAP2%200915%20%281%29.pdf

Zulauf, C., G. Schnitkey, K. Swanson, J. Coppess and N. Paulson. "Trade and COVID-19 Ad Hoc Payments by Commodity." farmdoc daily (10):166, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, September 16, 2020.

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.