Price Response to Plant-Based Meat in the U.S. Beef Market: Part II

This is the last in a series of six articles from the author’s master’s thesis about plant-based meat. Previous articles in this series are: farmdoc daily, July 22, 2021, July 29, 2021, August 5, 2021, August 12, 2021, and August 19, 2021. The full thesis manuscript is available here.

Introduction

This final installment of the Meatless Meat article series builds off of last week’s article about the beef price response to competition from plant-based meat in the U.S. market. Last week’s article described how competition between ground beef and plant-based ground meat would ripple through the entire beef market using price elasticities from recent literature about the U.S. beef market. This article presents an accounting identity which can be used to estimate the price response in different beef markets, based on the portion of the ground beef market captured by plant-based meat.

U.S. Beef Prices

Figure 1 displays the historical relationships of beef prices in the U.S. market from 2013-2021. The data comes from the USDA Agricultural Marketing Service’s MPR Datamart. The time series data used for this study are the prices from formulated sales of national weekly boxed beef cuts. Three different beef cuts were selected to represent the prices for choice, select, or sub-prime cuts of beef: flank steak (choice), flank steak (select), and ground beef (81% lean). The steer price is a National Weekly Direct Slaughter price for all steer grades, formula net purchase type.

The relationships among beef prices did not change significantly during the years 2013-2019, but the 2020 market shock from the COVID-19 pandemic disrupted those relationships. In order to make price response estimates, it is assumed that the beef market was in equilibrium from 2013-2019, so pricing data from that time period can be used to observe how changes in the ground beef market would affect prices in other beef markets.

Accounting Identity for Beef Market Price Response

An accounting identity that reflects the historical relationship between beef prices can be used to estimate prices in a new equilibrium after a shift in supply or demand in the ground beef market. This accounting identity is represented by the equation:

Pground beef ** = (Pfs* – a – c * Pchoice/select* )/b

Where Pfs* = fed steer price given change in quantity supplied, Pchoice/select* = average choice/select steak price given a change in quantity supplied, and Pground beef ** = ground beef price given change in quantity supplied or demanded.[1]

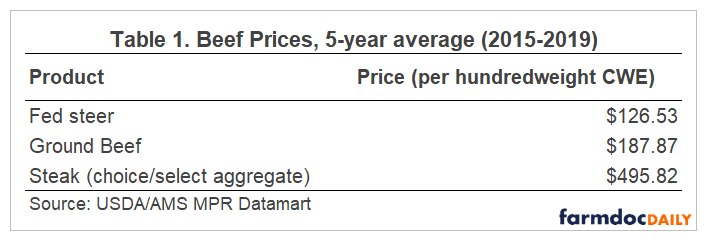

Five-year averages of beef prices (2015-2019), listed in Table 1, are used as inputs for the model.

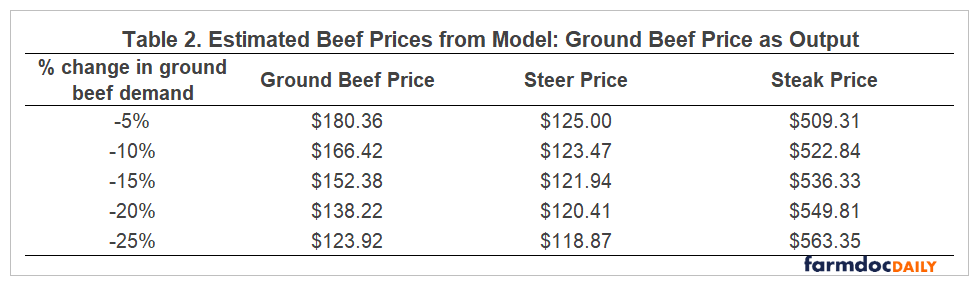

Table 2 lists the price changes in beef markets based on varying percentage declines in the demand for ground beef. These figures were calculated by applying price elasticities relative to the change in supply or demand to the 5-year averages for beef prices, as well as coefficients taken from an OLS regression of the 2013-2019 beef prices, and plugging those figures into the accounting identity with the ground beef price as the output.

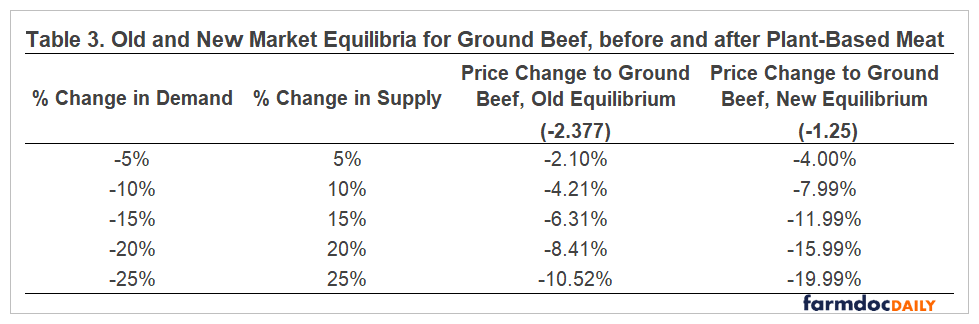

In comparison with the price elasticities from the literature, the OLS accounting identity estimates a greater price drop to ground beef when fed steer and choice/select market linkages are considered. Using these two sources, this analysis expects that ground beef prices will drop between 2.10% and 4.00% if its market shrinks by 5%. The low end of the range comes from the price elasticity of demand estimated by Lusk & Tonsor (2016), and the high end of the range comes from the OLS regression, implying a new price elasticity of supply and demand for ground beef: -1.25. This new figure means that ground beef is still an elastic good because its quantity supplied/demanded changes more than the price change, but it is less elastic than Lusk & Tonsor’s estimate. This elasticity estimate is different from Lusk & Tonsor’s because it reflects the linkage between ground beef and other beef markets. The model implies that the ground beef market, and its price elasticities, will change when plant-based meat enters the market. However, the model also assumes that the steer and steak price elasticities will remain the same, since plant-based meat will not be competing directly with them. The beef market will have to reach a new equilibrium after plant-based meat’s growth stalls.

Table 3 displays the differences in price change in ground beef according to the old and new price elasticity, representing the old and new market equilibria for ground beef, before and after plant-based meat.

When considering these results, it is also important to consider the assumptions made in the analysis. Three key assumptions were made in this analysis: the first was that the demand change in the ground beef market would spur a proportionate supply change in fed steer and choice/select markets. The second assumption was that the markets of the three beef products are linked, which was corroborated by historical price data and the OLS Regression on that data, as well as by joint product theory. The third assumption was that the historical data used in the analysis reflected a market in equilibrium, and the market will be in equilibrium when plant-based meat enters the market. Pricing data from the COVID-19 pandemic was not incorporated in the model, and it is assumed that the relationships between the three beef markets will remain the same in a post-COVID, restabilized market.

Summary and Conclusions

The Meatless Meat article series evaluated the potential for the plant-based meat industry to capture market from the U.S. livestock industry. The plant-based meat industry has emerged in light of widespread criticism of the livestock industry, especially about its environmental impacts. Claiming to produce a product superior to meat in terms of nutrition, taste, and environmental impact, plant-based meat companies intend to capture as much of the meat market as possible in order to reform the commercial food system and reduce natural resource degradation.

To fully understand the implications that this new product would have on the U.S. food system, it is important to consider the factors that would drive and limit its growth. This article series identified the main factors as consumer acceptability and willingness-to-pay, economic feasibility of producing the products at scale and pricing them competitively with meat, and the livestock industry’s response to competition in terms of marketing campaigns, lobbying campaigns, and price competition. Relevant studies about consumer acceptability of meatless meat estimate that 25-30% of the U.S. market would switch to meatless meat if it achieved price parity with meat. This is not yet a viable scenario, however, because both plant-based meat and lab-grown meat have not yet optimized production in order to market their products widely, at competitive prices. Finally, this figure does not consider the reaction from the livestock industry that would occur if meatless meat began to take its market. The second part of this analysis illustrated livestock’s initial price response to this competition, focusing on plant-based competition with ground beef because it is expected that this would be the first market that the competition would occur in.

In summary, the livestock industry’s response to competition from plant-based meat will challenge plant-based meat’s expansion. Since ground beef is a joint product, the ground beef market is linked to both the steer and choice and select beef markets. If plant-based meat captures part of the market from ground beef, ground beef prices will decrease, prompting a supply cut and price cut in the fed steer market. In turn, assuming that demand for choice and select cuts stay the same, their prices will increase as a result of a reduction in supply in the fed steer market. This new equilibrium in the beef market will make it more difficult for plant-based meat to compete with beef, since ground beef will undercut the price of plant-based meat.

Further studies about the livestock industry’s response to plant-based meat could challenge these assumptions: additional details about beef farmers’ revenue sources could provide a better estimate of how farmers would adjust supply in response to a drop in the fed steer market. The linkages of the beef markets, as well as consumer behavior, could have changed as a result of the pandemic, in which case post-COVID market prices would need to be used to estimate new price elasticities and a new model. Future research also could characterize lab-grown meat’s competition with the livestock industry. Plant-based meat only produces viable substitutes for ground meat, but lab-grown meat has demonstrated the capability to grow steak. If it is able to scale up and drive down its production costs, the lab-grown meat industry could complement plant-based meat’s competition with livestock; this partnership would be better suited to complete with joint-products such as beef.

Note

[1] This identity was derived from an OLS regression of the 2013-2019 beef prices displayed in Figure 1. The full regression analysis is recorded in the master’s thesis from which the Meatless Meat article series was derived. The full thesis is linked above.

References

Lusk, Jayson and Tonsor, Glynn. (2016.) “How Meat Demand Elasticities Vary with Price, Income, and Product Category. Applied Economic Perspectives and Policy, vol. 38(4), 673-711.

USDA/Agricultural Marketing Service MPR Data Mart.

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.