2022 Commodity Program Decision: ARC-CO – PLC Decision Indicator

This article is a follow up to the farmdoc daily article of December 9, 2021. It discussed a price ratio that had an 81% accuracy in predicting if ARC-CO (Agriculture Risk Coverage – county) or PLC (Price Loss Coverage) paid more per base acre over the 2014-2020 crop years. The price ratio was calculated as: (the current crop year’s US December cash price divided by the upcoming crop year’s effective reference price) (hereafter, December cash – reference price ratio). This ratio is calculated for the upcoming 2022 crop year. The 2022 program decision must be made by March 15, 2022.

2022 Decision

Commodity program options are ARC-CO, PLC, and ARC-IC, a farm version of ARC. These options are briefly discussed in Data Note 1. For most farms, the decision is ACR-CO or PLC. ARC-IC’s highest share of US base acres was 3.9% during the 2019 and 2020 crop years.

The proposed ARC-CO vs. PLC decision indicator is that PLC is expected to pay more per base acre when the December cash – reference price ratio is less than 100%. ARC-CO is expected to pay more per base acre when the ratio equals or exceeds 100%. The decision indicator reflects that PLC makes no payment for a program commodity if its US market year price is below its effective reference price. The December cash price is reported at the end of January and is obtained from QuickStats (US Department of Agriculture National Agricultural Statistical Service (USDA NASS)). USDA FSA (Farm Service Agency) has released the 2022 effective reference price. Thus, all data needed to calculate the decision indicator are currently available.

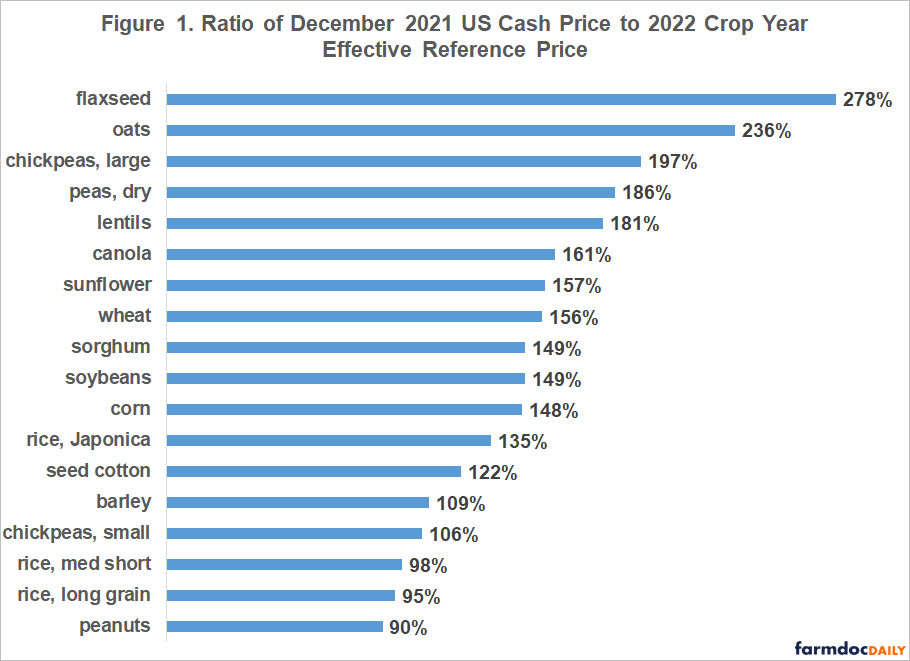

Ratio of the December 2021 US cash price to the 2022 crop year effective reference price can be calculated for 18 program commodities (see Figure 1 and Data Note 2). The ratio exceeded 100% for 15 program commodities. The exceptions were peanuts and both long grain and medium-short grain rice. Corn, soybeans, and wheat had price ratios of 148%, 149%, and 156%, respectively.

The analysis in the December 9, 2021 farmdoc daily article reported that the December cash – reference price ratio was 100% accurate in predicting that ARC-CO paid more per base acre when the price ratio exceeded 120%. Primary reason for this accuracy was that PLC rarely made a payment. The 2022 decision indicator exceeds 120% for 13 of the 18 program commodities in Figure 1. Exceptions are peanuts, long grain rice, short-medium grain rice, small chickpeas, and barley.

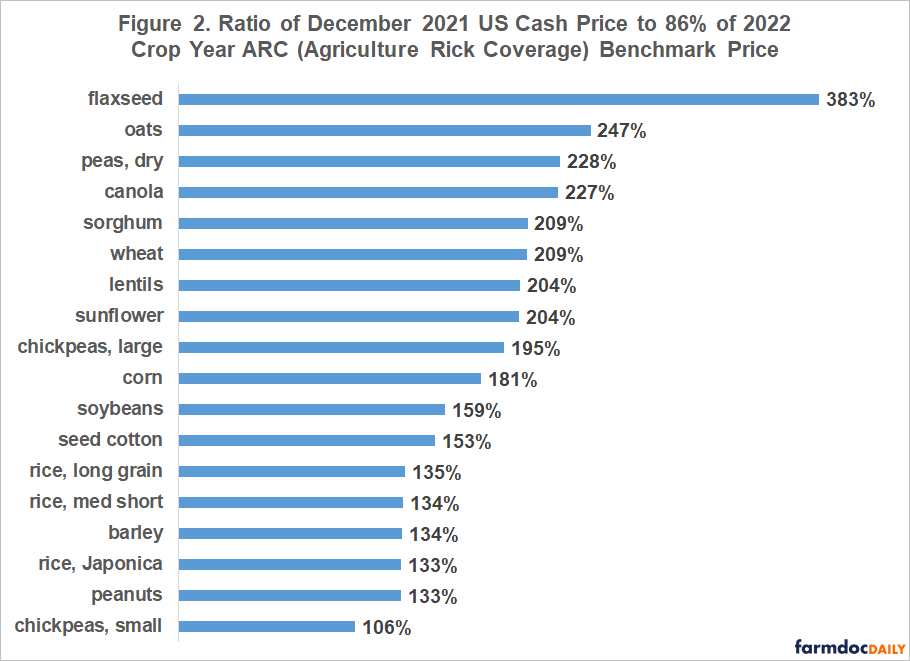

In making the 2022 program decision, it is important to understand that ARC will likely make little to no payment and, if ARC makes a payment, it will likely be made only to some not all base acres in ARC-CO or ARC-IC. Market price is above, usually much above 86% of the ARC benchmark price for the 2022 crop year (see Figure 2). ARC makes payments when market price is below 86% of the ARC benchmark price and yield equals its 5-year Olympic average. The ARC benchmark price for the 2022 crop year is calculated using the 2016-2020 crop years. It thus includes little of the higher price period that began in the summer of 2020. In fact, the average ratio in Figure 2 (187%) exceeds the average ratio in Figure 1 (153%). Nevertheless, ARC, unlike PLC, can make payments for low yields, but; given how much market price exceeds 86% of the ARC benchmark price, ARC will make a payment for the 2022 crop year only if county or farm yield is substantially below its Olympic average yield for the 2016-2020 crop years.

Summary Observations

Given current market prices, payments by both ARC-CO and PLC are expected to be little to none for the 2022 crop year.

However, the program decision indicator suggests average payment per base acre for the 2022 crop year is likely to be higher for ARC-CO than PLC for most program commodities, including corn, soybeans, and wheat. The reason is that PLC is unlikely to make payments while ARC could make a payment if county or farm yields are notably below 2016-2020 levels.

PLC is expected to make a higher average payment per base acre for peanuts, long-grain rice, and short-medium grain rice. However, the expectation is marginal for both rice types since their price indicator ratios are close to 100% (see the December 9, 2021 farmdoc daily article for a discussion of prediction accuracy by the value of the December cash – reference price ratio).

The expected little-to-no payments by ARC-CO and PLC for most program commodities does not mean these commodity programs are functioning poorly. Market value of production is likely to be profitable at currently expected prices and yields. This comment does not mean that subsequent events, including the increase in cost of production, might prompt a redesign of these programs.

An additional factor farmers may want to consider when making the 2022 commodity program decision involves crop insurance Supplemental Coverage Option (SCO). It is available only for acres elected into PLC. It is NOT available for acres elected into ARC-CO or ARC-IC. The potential tradeoffs in buying SCO as well as crop insurance Enhanced Coverage Option (ECO) is discussed in the farmdoc daily article of February 15, 2022.

Data Notes

- ARC-CO is a revenue decline program, where decline is defined relative to 86% of a county benchmark revenue based on revenue from the market for 5 recent crop years. PLC is a low US price program, where low is defined relative to 100% of a reference price set by Congress. ARC-IC makes payments when average per acre actual revenue from all program crops planted on an ARC-IC farm unit is less than 86% of its per acre benchmark revenue. An ARC-IC farm unit is the sum of a producer’s share in all FSA farms the producer enrolls in ARC-IC in a state. ARC benchmark revenue is calculated using 5-year Olympic averages (high and low values removed) of county (ARC-CO) or farm (ARC-IC) yield and US crop year price. ARC-CO and PLC pay on 85% of base acres; ARC-IC pays on 65% of base acres. ARC-CO and ARC-IC have a 10% per acre payment cap. PLC’s payment cap depends on the difference between a crop’s reference price and loan rate. The effective reference price is a floor on ARC price for a year. PLC payment yield differs by farm based on its yield over a historical period. ARC-IC calculations are more complex. The October 29, 2019 farmdoc daily article discusses situations when ARC-IC is an option to consider.

- There are currently 23 covered program commodities. No US December cash price is reported for crambe, mustard, rapeseed, safflower, and sesame. Price for temperate Japonica rice is the medium-short grain rice price for California. California grows almost all US Japonica rice. The price used for medium-short grain rice is the medium-short grain price for other states (i.e. excluding California).

References and Data Sources

Schnitkey, G., C. Zulauf, N. Paulson and K. Swanson. “Enhanced Coverage Option: Return and Risk Results.” farmdoc daily (12):20, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, February 15, 2022.

US Department of Agriculture, Farm Service Agency. February 2022. ARC/PLC program. https://www.fsa.usda.gov/programs-and-services/arcplc_program/index

US Department of Agriculture, National Agricultural Statistical Service. February 2022. QuickStats. http://quickstats.nass.U.S.da.gov/

Zulauf, C., B. Brown, G. Schnitkey, K. Swanson, J. Coppess and N. Paulson. “The Case for Looking at the ARC-IC (ARC-Individual) Program Option.” farmdoc daily (9):203, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, October 29, 2019.

Zulauf, C., G. Schnitkey, K. Swanson and N. Paulson. “Does December Cash Price Help Predict If ARC-CO or PLC Pays More Next Year?” farmdoc daily (11):164, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, December 9, 2021.

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.