Early Export Sales Commitments and New-Crop Balance Sheets for Corn, Soybeans, and Wheat

On Thursday, May 12, the USDA released its first complete 2022/23 marketing year supply and demand estimates for corn, soybeans, and wheat in the May 2022 WASDE report. These estimates provide an important point of reference for old-crop and new-crop price expectations for these commodities. As noted in the WASDE report, these estimates are subject to considerably uncertainty, given relatively scarce inventories, the ongoing war in Ukraine, and weather conditions in the US which have impeded spring planting and winter crop development.

I review highlights from the May 2022 WASDE report and discuss an important factor to follow in the months ahead affecting new-crop prices: new-crop export sales. In the past few years, we have seen export sales commitments from importers of US corn and soybeans occur earlier than in the past. Current new-crop export sales commitments for corn and soybeans are at record levels for this time of the marketing year. Whether these early sales translate into greater total marketing exports is an open question, especially with the potential for currently high prices to ration commodity demand among price-sensitive importing countries.

Current USDA Supply and Demand Estimates

Table 1 shows the current old-crop (2021/22) and new-crop (2022/23) balance sheets for US corn, soybeans, and wheat as reported in the May WASDE report. USDA projects US corn production to fall and soybean and wheat production to rise in 2022 relative to 2021. 2022 US corn production is expected to decrease by about four percent decline from 2021. Soybean and wheat production are expected to rise approximately five percent.

The primary driver for these changes are planted acreage projections based on survey data from the March 31 Prospective Plantings report. In that report, USDA indicated total 2022 principal crop acres would be relatively similar to 2021 with a substantial but offsetting shifts in acres away from corn to soybeans. Wheat planted acres are expected to increase, but harvested acres are expected to fall due to high abandonment in areas of the southern Great Plains hit by drought.

Lower estimated 2022 US corn production is also the result of lower yield expectations. USDA projected 2022 US corn yield at 177 bushels per acre, a decrease from the 181 bushel per acre long-run trend yield given in the February 2022 Agricultural Outlook Forum balance sheet estimates. Delayed planting progress this spring was cited as the reason for this decrease. Soybean yield estimates remain at the long-run trend level of 51.5 bushels per acre. The all-wheat yield estimate was 46.6 bushels per acre as USDA projects a rebound in spring wheat yields to offset declines in drought-affected winter wheat producing areas.

On the use side of the balance sheet, 2022/23 US corn feed use is expected to decline substantially from the previous marketing year in response to high prices and lower production. Corn exports are also expected to fall slightly. Decreases in corn use are less than expected production declines. More modest changes in use are seen for soybeans and wheat. Below I discuss export sales projections, an important part of corn, soybean, and wheat use in greater detail.

The ending-stocks-to-use ratio given at the bottom of Table 1 provides a summary measure of the overall supply and demand situation. USDA expects the US corn ending-stocks-to-use ratio to fall slightly from 9.6% to 9.3%. Old-crop and new-crop ending inventories are expected to be relatively tight in historic terms; US corn ending stocks have only been below 10% in 7 of 31 marketing years between 1990/91 and 2020/21. Soybean stocks are similarly scarce, though stocks-to-use is expected to increase with higher acreage and production. US wheat stocks-to-use is expected to remain roughly in the middle of its historic distribution, though at the lowest level since 2013/14. While USDA did revise global wheat exports higher and ending stocks lower, this did not translate into greater US wheat exports which might draw down US stocks.

New-crop Export Sales

The May WASDE 2022/23 export projections shown in Table 1 for corn, soybeans, and wheat are roughly similar to 2021/22 levels. Though the 2022/23 export campaign has yet to begin – the corn and soybean marketing year begins on September 1 and the wheat marketing year starts June 1 – data on export sales commitments for next marketing year indicate strong export demand for corn and soybeans. Export sales commitments for wheat are at levels typical of recent years. One open question is whether strong early sales will lead to greater overall exports.

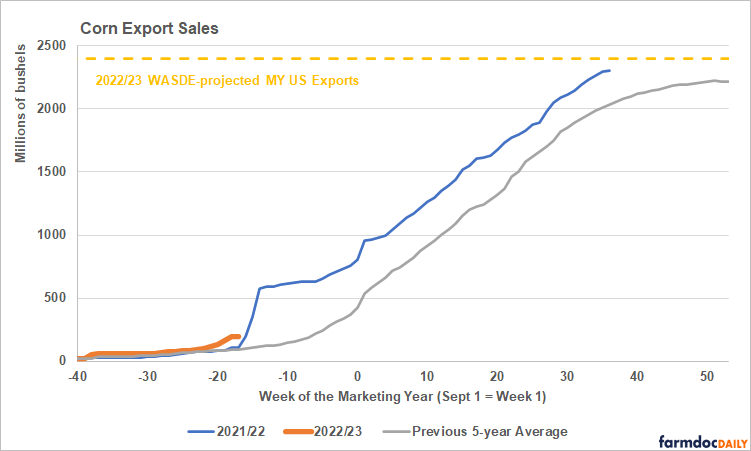

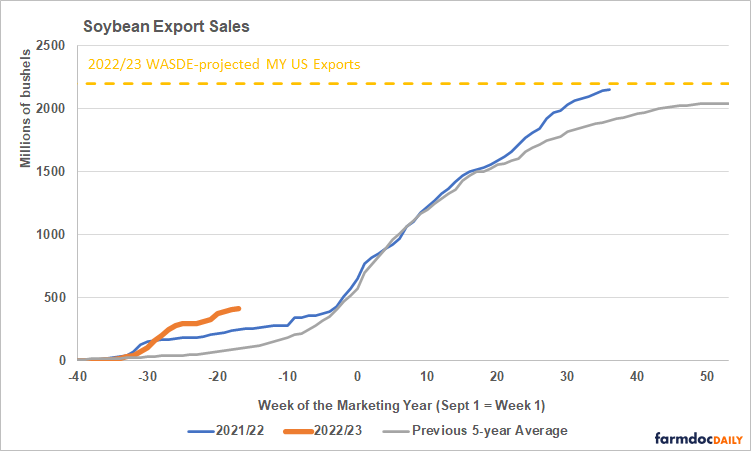

Figure 1 shows US export sales commitments by the week of the marketing year (including both outstanding and accumulated sales after the start of the marketing year) for corn, soybeans, and wheat. US grain and oilseed exporters are “required to report to USDA’s Foreign Agricultural Service (FAS) any sales transaction entered into with a buyer outside the United States” within a week or less of the sale, including sales arranged well in advance of shipment during the marketing year. This means that by the time the marketing year begins, export sales commitments data provides an important leading indicator of the overall strength of export demand for US agricultural commodities. In Figure 1, negative values for the week indicate the number of weeks prior to the beginning of the marketing year.

Figure 1. Cumulative US Export Sales by Commodity and Week of the Marketing year

New-crop 2022/23 export sales (the orange lines in Figure 1) for corn and soybeans show corn sales of approximately 196 million bushels and soybean sales of about 412 million bushels as of May 5. Both are record levels for this time of year. While there is obviously a long way to go until the 2022/23 export campaign is final, existing sales suggest current high prices have yet to seriously deter corn and soybean importers from looking to the US for new-crop supplies.

For wheat, both new-crop and old-crop export sales data are less bullish. New-crop export sales as of May 5 are 89 million bushels, a level typical of the recent past. Old-crop export sales show a significant decline in US wheat exports in 2021/22 compared to the previous 5-year average. Part of this decline can be attributed to poor 2021 yields, particularly in the Northern Great Plains. However, muted indications for new-crop exports combined with relatively high levels of domestic inventories suggest US wheat is not filling the gap in global wheat supplies caused by the war in Ukraine.

Commodity markets will closely watch planting progress and early growing season weather for corn and soybeans in the US Midwest over the next month as well as early indications about the realized effect of drought conditions on US winter wheat yields. Expectations that corn and soybeans will remain relatively scarce are based on the assumption of continued strength in use, especially for exports. High prices do not appear yet to have slowed export demand for US corn and soybeans. However, the export sales pace over the coming months will be closely watch. Like all market indicators in the current environment, it remains subject to considerable uncertainty.

References

United States Department of Agriculture. World Agricultural Supply and Demand Estimates (WASDE -624-2), Released May 12, 2022. https://usda.library.cornell.edu/concern/publications/3t945q76s?locale=en

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.