The Export Sales Data Snafu

On August 25, the USDA’s Foreign Agricultural Service released its weekly Export Sales Report using a new reporting system. Based on some implausible values in this report, regular users of these data began to suspect the report was inaccurate. USDA quickly retracted the report and postponed further export sales report releases. (For more details, see: Maltais and Osipovich, 2022 and Huffstutter and Plume, 2022.) On September 1, 2022, USDA announced it would revert to its legacy export sales reporting system until it can resolve its technology issues. Public reporting of export sales data is expected to resume on September 15, 2022.

The absence of regular export sales reports raises at least two questions. First, what is the state of export sales for the old-crop 2021-22 and new-crop 2022-23 marketing years for corn and soybeans? USDA export sales data are available up to August 11, 2022. Late August and early September are an atypical time for export sales information. As the old-crop corn and soybean marketing year ends on August 31, this time period often sees old-crop export commitments cancelled or moved from one marketing year to the next. As a result, week-to-week changes in old-crop export sales commitments are often flat or negative in late August. At the same time, new-crop sales are typically large relative to other weeks of the year.

Based on the information we do have, prospects for old-crop US corn and soybean exports are mixed. Corn exports are unlikely to reach expected marketing year totals if now-unobservable export sales commitments in late August followed typical historic patterns. Predicting new-crop export sales in the absence of USDA data is more difficult for reasons noted above.

A second, broader question pertains to the value of having publicly available USDA export sales data for agricultural commodity markets. What will be lost by not having export sales reports released each week? Obviously, the lack of export sales reporting does not preclude exporters from arranging new sales. Trade in agricultural commodities will not cease. Neither does it eliminate all public information. Export Sales Reports are just one data item among many provided by USDA and other sources. However, greater uncertainty about export sales may generate some trade frictions.

Past instances where USDA reports were not released due to federal government shutdowns shed some light on this question. Analysis of those cases suggests options-implied volatility and thus the cost of risk management using options was elevated. However, those shutdowns affected nearly all USDA data products which would be expected to have a larger effect.

The State of US Corn And Soybean Export Sales

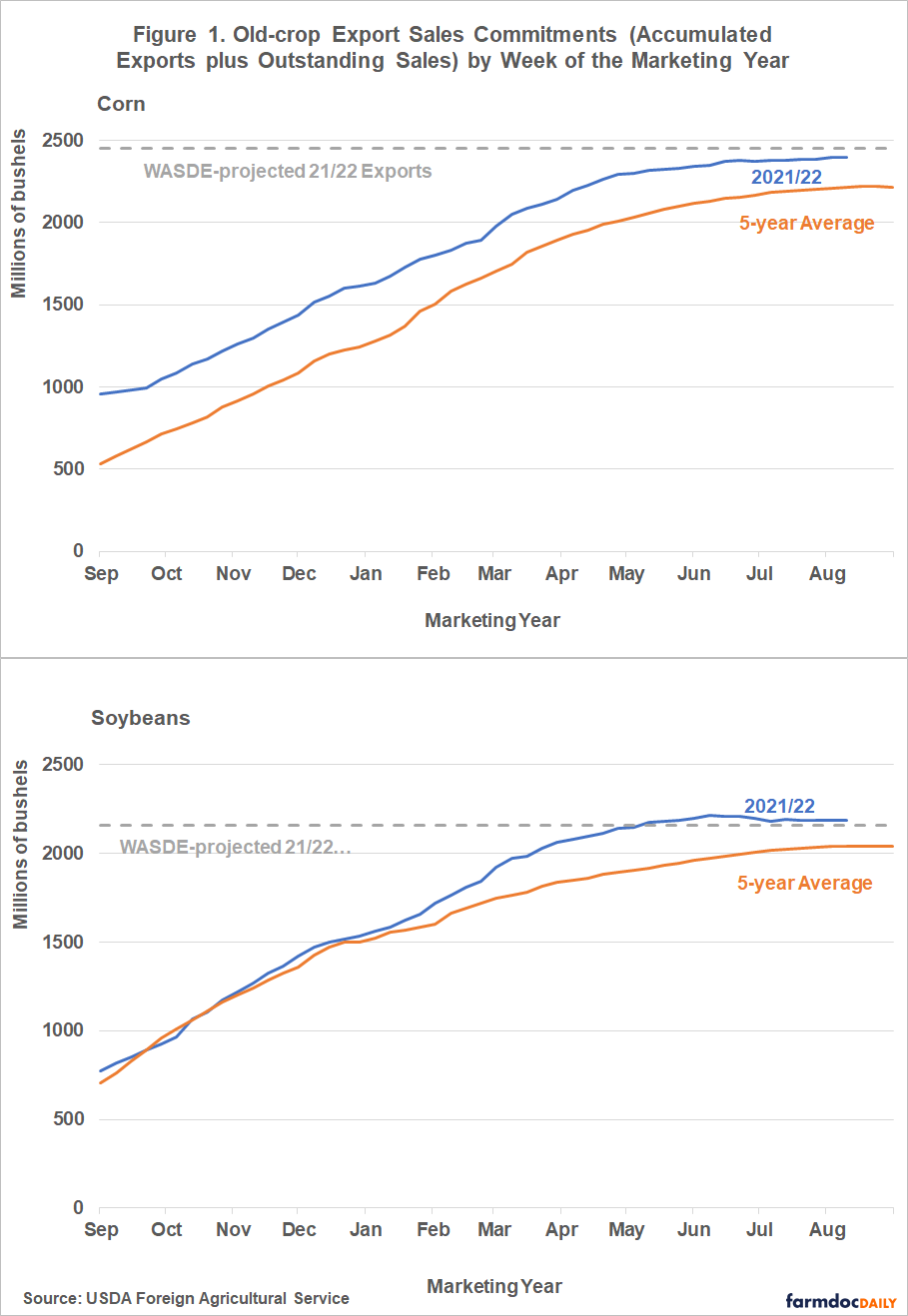

Old-crop corn and soybean export sales for the 2021-22 marketing year have both been strong, higher than the previous 5-year average though below record levels set in the previous 2020/21 marketing year. USDA’s most recent World Agricultural Supply and Demand Estimates (WASDE) from August project 2021/22 US exports of 2,450 million bushels for corn and 2,160 million bushels for soybeans.

Data from the Export Sales Report helps market watchers ascertain whether actual exports are likely to hit WASDE-projected levels. These data shown in Figure 1 suggest US exports will likely reach the WASDE-projected level for soybeans, but not for corn. Total soybean export commitments (accumulated exports to data plus outstanding sales) were about 2,190 million bushels or 30 million bushels above the WASDE-projected level. Total corn export commitments were approximately 2,400 millions bushels or 50 million bushels below the WASDE-projected level.

What likely happened in the final three weeks of the marketing year for which data were reported? Most remaining outstanding sales are typically converted to actual exports, but some previously announced old-crop sales are canceled or postponed to the new-crop marketing year. The net result is essentially no week-over-week change in export commitments, as shown by the 5-year average shown in Figure 1. In some years, export commitments decline at the end of the marketing year. For example, 2020/21 corn export sales commitments declined by about 15 million bushels in the final three weeks of the marketing year.

In the absence of actual export sales reports from USDA, it is unreasonable to expect 50 million bushels in corn export sales to materialize. Meanwhile, 2021/22 soybean export sales will reach WASDE-projected levels even if some outstanding sales commitments were cancelled in the final weeks of the marketing year. The obvious limitation to this conclusion is that it assumes the present will be similar to the past.

New-crop export sales are more difficult to pin down in the absence of regular weekly export sales data. The initial weeks of a new marketing year are typically one of the most active times of year for export sales. For instance, the average week-over-week change in export sales commitments in the first five weeks of a new marketing year observed between 2016 and 2020 is about 57 million bushels per week for corn and just over 75 million bushels for soybeans. The range of historical outcomes during this period is large. The loss of USDA export sales data during late August and early September implies greater uncertainty about the state of export demand during a period where export demand may be volatile.

What Is Lost When Export Sales Reports Aren’t Reported?

The broad rationale for USDA information provision on agricultural commodity markets is as follows: better information about supply and demand conditions allows traders to discover market prices that more accurately reflect the value of those commodities. More accurate prices then improve resource allocation decisions along the supply chain. (Gouel, 2020)

More accurate pricing can take two broad forms: price levels and price variability. Economic analysis has shown that the release of USDA reports, especially the monthly WASDE reports, cause observed price levels to adjust, indicating that the reports contain valuable information about underlying supply and demand conditions. Studies have also shown that expectations about price variability, represented by options prices, decline when reports are released.

But what happens when this public information is not available? This is a more difficult question to answer because USDA has consistently provided public information to commodity markets since the 19th century. Detailed data like that in the WASDE and Export Sales reports has been available since the 1970s. However, two recent studies (Adjemian, Johansson, McKenzie and Thomsen, 2018 and Goyal and Adjemian, 2021) consider unique cases where federal government shutdowns stopped the release of the October 2013 and January 2019 WASDE reports. These studies found no evidence that corn and soybeans were mispriced, but some indication of higher market volatility in the absence of these reports. Specifically, decreases in options-implied volatility and options prices that typically follows the release of USDA reports was not observed in October 2013 and January 2019.

The temporary absence of USDA Export Sales Reports may have a similar impact as did these missing WASDE reports. However it is important to note that export sales data are only one piece of market-relevant information; the WASDE report contains a more comprehensive picture of commodity supply and demand. There may be slightly elevated price volatility in the absence of export sales reports over the next few weeks and additional volatility on September 15 when export sales reporting resumes as market prices are reconciled with new data.

References

Adjemian, M. K., R. Johansson, A. McKenzie, and M. Thomsen. “Was the Missing 2013 WASDE Missed? Applied Economic Perspectives and Policy 40(2018): 653-671. https://doi.org/10.1093/aepp/ppx049

Gouel, C. “The Value of Public Information in Storable Commodity Markets: Application to the Soybean Market.” American Journal of Agricultural Economics 102(2020): 846-865. https://doi.org/10.1002/ajae.12013

Goyal, R. and M. K. Adjemian. “The 2019 Government Shutdown Increased Uncertainty in Major Agricultural Commodity Markets.” Food Policy 102, 102064. https://doi.org/10.1016/j.foodpol.2021.102064

Huffstutter, P.J. and K. Plume. “U.S. Retracts Agriculture Data After Faulty Release Sends Traders Scrambling.” Reuters, August 25, 2022. https://www.agriculture.com/markets/newswire/update-1-us-retracts-agriculture-data-after-faulty-release-sends-traders-scrambling

Maltais, K. and A. Osipovich. “Garbled Government Data Release Flusters Grain Traders.” The Wall Street Journal, updated August 26, 2022. https://www.wsj.com/articles/garbled-government-data-release-flusters-grain-traders-11661537912

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.