How Us Consumers Say They’re Coping With Rising Food Prices: Results From the Gardner Food and Agricultural Policy Survey

Recent reports suggest that inflation is slowing down (Isidore, 2023), yet consumers continue to struggle with higher food prices. Here, we review how consumers say rising food prices have impacted their decisions at the grocery store and the dinner table. Results come from the Gardner Food and Agricultural Policy Survey, which was conducted in November 2022 (farmdoc daily, December 1, 2022). Approximately 1,000 consumers were surveyed using Qualtrics Panels. Respondents were recruited to match the US population in terms of gender, age, income, and geographic region.

It is well documented that rising food prices tend to be most impactful on consumers with low incomes, who spend a larger percent of their income on food. News reports have highlighted that rising food prices may mean reduced access to nutritious foods, which has implications for food security and health (e.g., Fu, 2022; Wiener-Bronner, 2022). We highlight how responses differ across food security status below using the USDA 6-item food security scale with income-based adjustments (Ahn, Smith, and Norwood, 2020).

How Consumers Say They Are Coping with Rising Food Prices

To understand how consumers were handling with rising food prices specifically, we investigated 15 possible coping mechanisms to decrease the cost of food – from switching to cheaper brands to beginning to use a food bank/pantry. For these questions, consumers were asked to indicate which behaviors they began doing due to rising food prices in the last month. If they already engaged in the behavior or if they changed their behavior for another reason (e.g., a new diet), they were instructed not to select the item.

On average, consumers indicated they began engaging in 3.4 coping mechanisms due to rising food prices. Those with very low food security status indicated they engaged in more coping mechanisms. We find that those with high or marginal food security status indicated they engaged in 3.2 coping mechanisms, those with low food security status indicated they engaged in 3.4 coping mechanisms, and those with very low food security status engaged in 4.8 coping mechanisms.

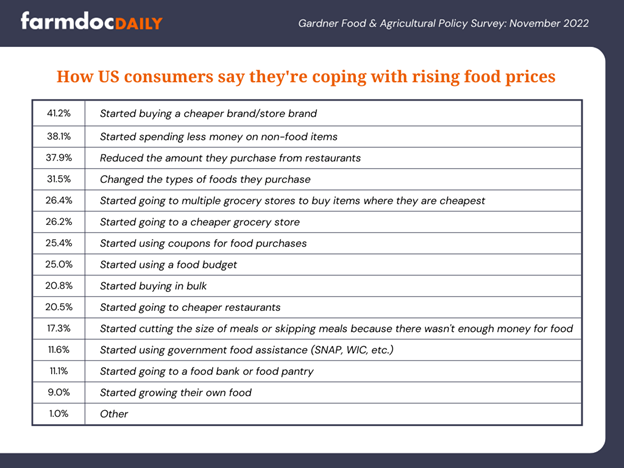

Figure 1 shows the proportion of consumers who indicated they had begun using each coping mechanism. The most common coping mechanisms consumers engaged in this month were switching to cheaper brands or store brands (41.2%) and spending less money on non-food items (38.1%). Reducing amount spent at restaurants (37.9%) was also common. This is in-line with findings from the Consumer Food Insights report, which find reductions in purchasing food away from home this month (Lusk and Polzin, 2022). Another common coping mechanism was changing the types of foods they purchase (31.5%). Importantly, we find that 17.3% of those surveyed indicated they had starting cutting the size of meals or skipping meals this month because there was not enough money for food.

Figure 1. Proportion of Consumers Who Indicated They Had Begun Using Each Coping Mechanisms This Month Due to Rising Food Prices

Additionally, we asked consumers about how the types of foods (e.g., red meat, grains) they purchased changed in the last month due to rising food prices. Participants answered these on a 5-point scale from much less to much more. Participants were also able to indicate they never purchased the item using an “N/A” option. Again, participants were instructed to only answer about changes in their behavior in the last month due to rising food prices. Figure 2 shows the proportion of consumers who indicated they had decreased purchasing of each food category in the last month. The most commonly decreased food types were red meat, seafood, and sweets/snacks, where 51.8%, 48.5%, and 48.6% of consumers said they decreased purchasing in the last month, respectively.

Figure 2. Proportion of Consumers Who Said They Decreased Their Purchasing of Food Categories This Month Due to Rising Food Prices

A higher proportion of those with low food security status indicated they changed the types of foods they purchased this month due to rising food prices than those with high or marginal food security status. Table 1 depicts these differences. These differences have important implications for health and nutrition. For example, 20.9% of those with high or marginal food security status indicated they had reduced their purchasing of vegetables compared to 35.7% of those with low food security status and 43.3% of very low food security status. Similarly, 24.3% of those with high or marginal food security status indicated they reduced their purchasing of fruits due to rising food prices this month, compared to 30.3% of those with low food security status and 50.4% of those with very low food security status. It is also likely that the original amounts of these foods purchased is different by food security status. Research shows that food insecurity is associated the poor dietary patterns, including lower intake of fruits and vegetables (Morales and Berkowitz, 2016). As such, rising food prices are likely to be particularly burdensome on food insecure households.

Table 1. Proportion of Consumers Who Indicated They Had Reduced Their Purchasing of Different Food Types in the Last Month Due to Rising Food Prices, across Food Security Status

| High or Marginal Food Security Status |

Low Food Security Status |

Very Low Food Security Status |

|

| Less Red Meat | 49.4% | 48.9% | 69.1% |

| Less Poultry | 29.0% | 38.7% | 46.0% |

| Less Seafood | 43.7% | 51.9% | 73.2% |

| Less Dairy | 25.9% | 32.9% | 44.8% |

| Less Eggs | 27.3% | 30.1% | 49.2% |

| Less Vegetables | 20.9% | 35.7% | 43.3% |

| Less Fruits | 24.3% | 30.3% | 50.4% |

| Less Grains | 17.7% | 22.6% | 33.6% |

| Less Snacks/Sweets | 48.3% | 41.4% | 59.1% |

Conclusion

Using the Gardner Food and Agricultural Policy Survey we investigated how consumers have been coping with rising food prices, and importantly, how these responses differed by food security status.

Overall, we find that consumers are responding to rising food prices by engaging in cost-reduction behaviors (e.g., buying cheaper brands); results are consistent with coping behaviors expressed in the Gardner 2nd quarter results (farmdoc daily, August 25, 2022). They report reducing the amount purchased on non-food items and cutting down on eating out. Changing the types of foods they purchase was also a commonly reported strategy to reduce costs. Many consumers indicated they had reduced their purchasing of red meat, seafood, and sweets/snacks this month due to rising food prices.

Additionally, we find that rising food prices are affecting food insecure households most. These households report engaging in more coping mechanisms than consumers on average, including reductions of purchasing fruits, vegetables, and protein foods. Such changes are likely to exacerbate existing nutrition and health disparities observed among food insecure households.

References

Ahn,S., Smith, T.A., and Norwood, F.B. “Can Internet Surveys Mimic Food Insecurity Rates Published by the US Government?” Applied Economic Perspectives and Policy. 43(2). Pp. 187-204. 2020.

Fu, J. “‘I felt like I failed’: inflation puts healthy food out of reach for millions of Americans.” The Guardian. September 30, 2022. https://www.theguardian.com/environment/2022/sep/30/inflation-healthy-food-eating-america

Isidore, C. “Wholesale prices show inflation continued to fall in December.” CNN Business. January 18, 2023. https://www.cnn.com/2023/01/18/economy/ppi-wholesale-inflation-december-report/index.html.

Kalaitzandonakes, M., J. Coppess and B. Ellison. "Gardner Food and Agricultural Policy Survey: 2nd Quarter, Impact of Inflation." farmdoc daily (12):128, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, August 25, 2022.

Kalaitzandonakes, M., B. Ellison and J. Coppess. "Rising Food Prices Stress US Consumers, but Views of Food System Hold Steady: Gardner Food and Agricultural Policy Survey, Third Quarter Results." farmdoc daily (12):181, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, December 1, 2022.

Lusk, J. and Polzin, S. “Consumer Food Insights” Center for Food Demand Analysis and Sustainability. 1(10). October 2022. https://ag.purdue.edu/cfdas/wp-content/uploads/2022/11/Report_10-202279.pdf

Morales, M.E., and Berkowitz, S.A. “The relationship between food insecurity, dietary patterns, and obesity.” Current Nutrition Reports. 5(1). Pp. 54-60. 2016.

Wiener-Bronner, D. “Food prices are soaring, and that’s changing how we eat.” CNN Business. September 24, 2022. https://www.cnn.com/2022/09/24/business/food-inflation-habits

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.