Report Reaction Shows Differing Corn and Soybean Market Conditions

Changes in projected US corn and soybean yields were the big news in the USDA World Agricultural Supply and Demand Estimates (WASDE) and Crop Production reports released Thursday, October 12. Lower yields reduced estimated available supply and led prices for both crops higher following the report release. However, the soybean price reaction was considerably larger than that for corn. The report reaction serves as further evidence that market conditions differ by crop: the corn market is adequately supplied and corn prices are comparatively low and stable. The soybean market remains tight with relatively high and variable prices. Going forward, the corn market offers sellers low prices in the near term, but comparatively strong and stable returns to storage. The soybean market is more uncertain, particularly as the situation with low Mississippi River system water levels crucial to soybean export movement is being resolved.

Relative changes in supply and price

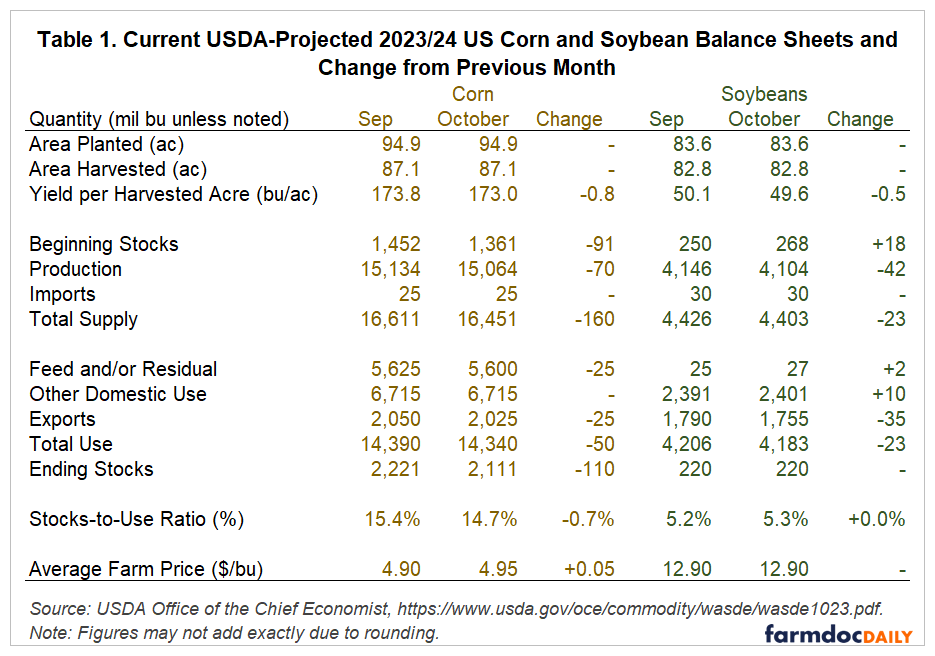

USDA’s National Agricultural Statistics Service (NASS) lowered their 2023 US national average yield estimate for both corn and soybeans. Corn yield fell 0.8 bushels per acre from 173.8 projected in September to 173.0 bushels per acre. This was larger than the decrease predicted by average of analysts’ pre-report forecasts which was 173.5 bushels per acre. Similarly, NASS dropped its soybean yield estimate from 50.1 to 49.6 bushels per acre or 0.5 bushels per acre. The average of analysts’ pre-report soybean yield forecasts was 49.9 bushels per acre. Planted and harvested acreage estimates were unchanged, so lower yield led to lower estimated production.

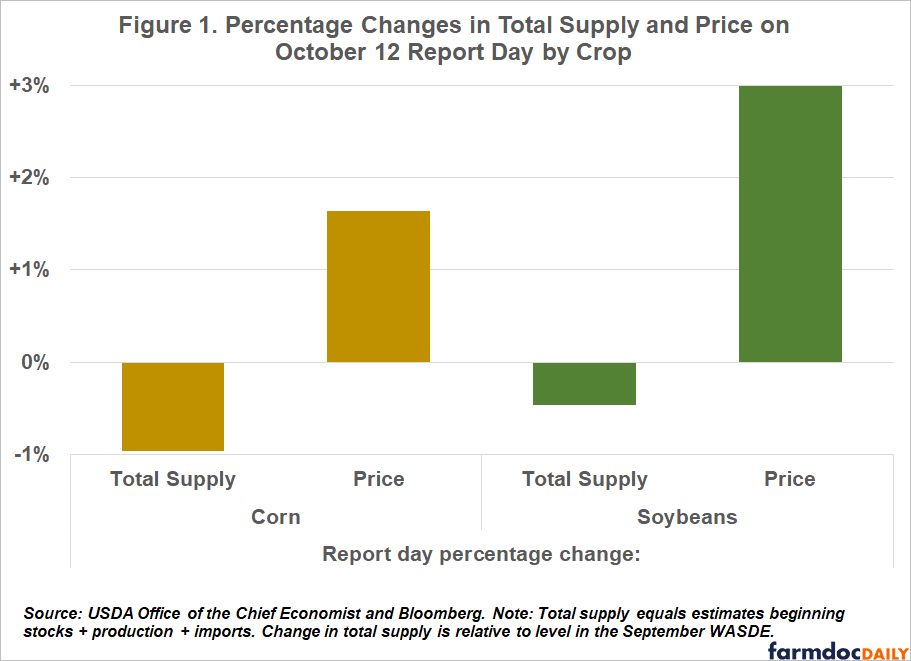

Total available supply in the US, equal to the sum of beginning stocks, production, and imports, was also cut in the October WASDE report. These supply changes were the result of significant revisions to both production and beginning stocks to reflect data released in the September 30th Grain Stocks report. To compare the magnitude of the reported supply shocks across crops, Figure 1 shows the percentage change in total supply between the September and October reports. Total supply for corn fell nearly one percent. For soybeans, total supply declined about half of one percent.

Corn and soybean futures prices increased in response to forecasts of lower available supply. On the report day, the nearby December corn futures contract increased eight cents per bushel to $4.96/bushel. The nearby November soybean futures contract rose nearly 38 cents per bushel to $12.90/bushel. Both prices were just shy of psychologically important levels of $5/bushel for corn and $13/bushel for soybeans.

Figure 1 compares the change in total supply to observed changes in price. In percentage terms, the corn price rose 1.6% while the soybean price rose 3.0%. Note that the decline in available supply for soybeans was smaller than that for corn, but the price increase was larger. The market’s reaction to the report demonstrates how price response is a function of the state of the market and how current market conditions differ substantially for corn and soybeans.

Supply-Demand Balance and Price Volatility

Table 1 shows the full US commodity balance sheets for corn and soybeans for the 2023/24 marketing year. Previous month’s projections and month-to-month changes are provided for reference. Along with changes in total supply discussed above, USDA made small adjustments changes to projected 2023/24 commodity use for both crops. Corn exports remain high relative to the 1.67 billion bushels in corn exports observed in the previous 2022/23 marketing year.

The overall state of each crop market is summarized in Table 1 by the stocks-to-use ratio given at the bottom of the table. The October report lowered the US corn stocks-to-use ratio from 15.4% to 14.7%. However, this level remains high in historic terms, particularly in light of below-10% stocks-to-use ratios in the previous three marketing years. For soybeans, the stocks-to-use ratio actually rose slightly in the October WASDE report, but the stocks-to-use level – at around 5% – can be characterized as historically tight.

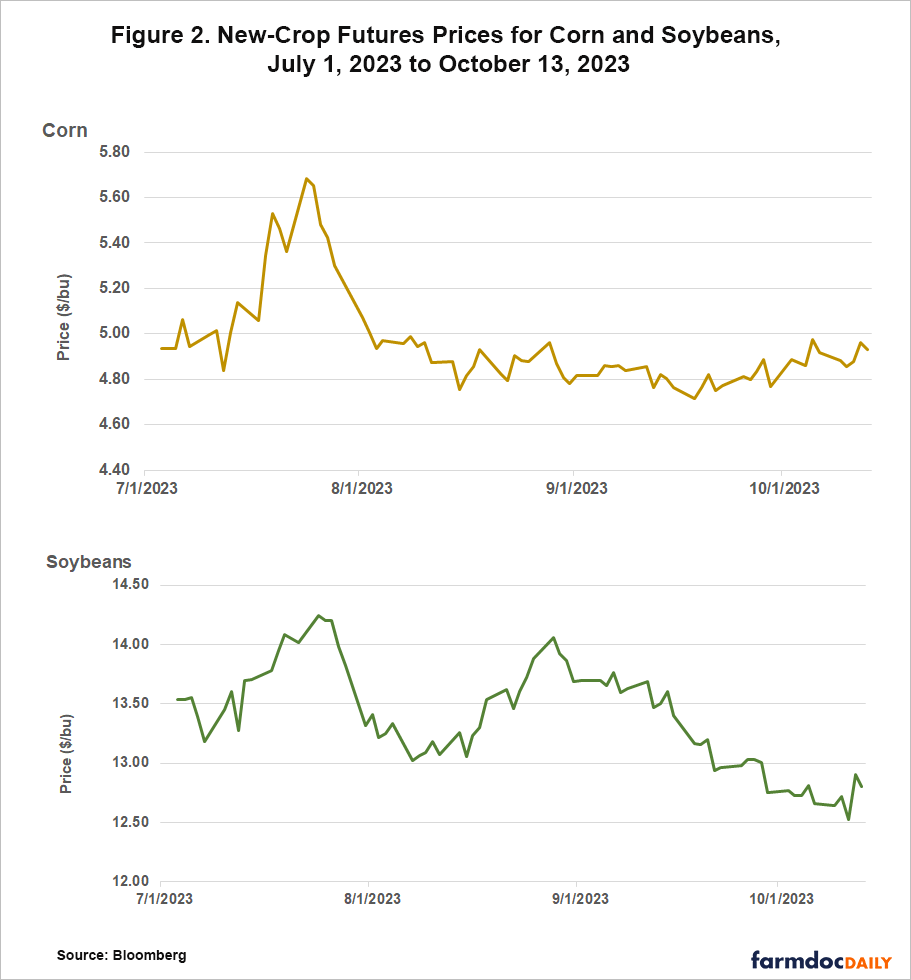

The economic theory of storable commodity pricing suggests there are two basic market conditions: i) high stocks with low, stable prices and ii) low stocks with high, volatile prices. Last week’s report reaction suggests the corn market is in former condition while the soybean market is in the latter one. New-crop futures price dynamics since summer 2023 confirms this idea. Figure 2 shows prices for the December 2023 corn futures and November 2023 soybean futures contracts; each represents the value of crop at and after the current harvest. Since the sharp rally observed in late July, corn futures have traded in a narrow range between $4.70 and $5.00/bushel. Soybeans have shown considerably more movement, fluctuating between $12.50 and $14.00/bushel.

Note that the presence of higher and more volatile prices in soybeans relative to corn does not forecast forthcoming price levels. It only suggests that soybean price changes are likely to be relatively larger because soybean stocks are insufficient to mitigate the impact of future supply and demand shocks. Current stocks and price levels do not dictate what news will come about supply and demand; they are only informative about the nature of the price reaction.

As the US harvest concludes, corn and soybean market fundamentals will be driven by news about global usage and South American supply (See farmdoc daily October 17, 2022). We should continue to observe a wider trading range for soybeans, which represents both an opportunity and a threat for farmers considering whether to sell or store after harvest. Prospects for soybean exports appear good and barge rates on the Mississippi River have declined in the past two weeks. In contrast, significant rallies are unlikely for corn. Forward corn bids show modest returns to post-harvest storage from both futures carry and basis appreciation. Corn and soybean sellers must choose which market condition suits their preference for risk.

References

Janzen, J. " WASDE Recap: Corn and Soybeans at a Turning Point." farmdoc daily (12):157, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, October 17, 2022.

Wright, Brian D. "The economics of grain price volatility." Applied Economic Perspectives and Policy 33, no. 1 (2011): 32-58.

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.