Implications of Rising Power Costs for 2024

Recent articles have examined the rising direct (i.e., inputs) costs associated with corn and soybean production in Illinois (see farmdoc daily, September 26 and November 14, 2023). Today’s article shifts focus to power costs, which predominately come from a farm operation’s machinery and equipment but also include utilities.

Similar to direct costs, power costs per acre have generally trended upwards and tracked with per acre return levels on Illinois grain farms since 2000. While varying considerably, power costs relative to crop revenue have averaged around 14% for corn and 16% for soybeans.

Given the expectation for lower returns for the 2023 and 2024 crop years, identifying strategies to reduce power costs may become important over the next few crop years. Most cost reducing strategies rely on reducing capital purchases.

Trends in Power Costs on Illinois Farms

Historical data on power costs (2000 to 2022) comes from the Illinois Farm Business Farm Management Association. Projections for the 2023 and 2024 crop years come from the August 2024 release of Illinois crop budgets and historical revenue and costs for Illinois grain crops. The power category includes costs associated with machinery (depreciation, repairs, hire, fuel, and oil), light vehicles, and utilities. Machinery costs historically make up most of total power costs.

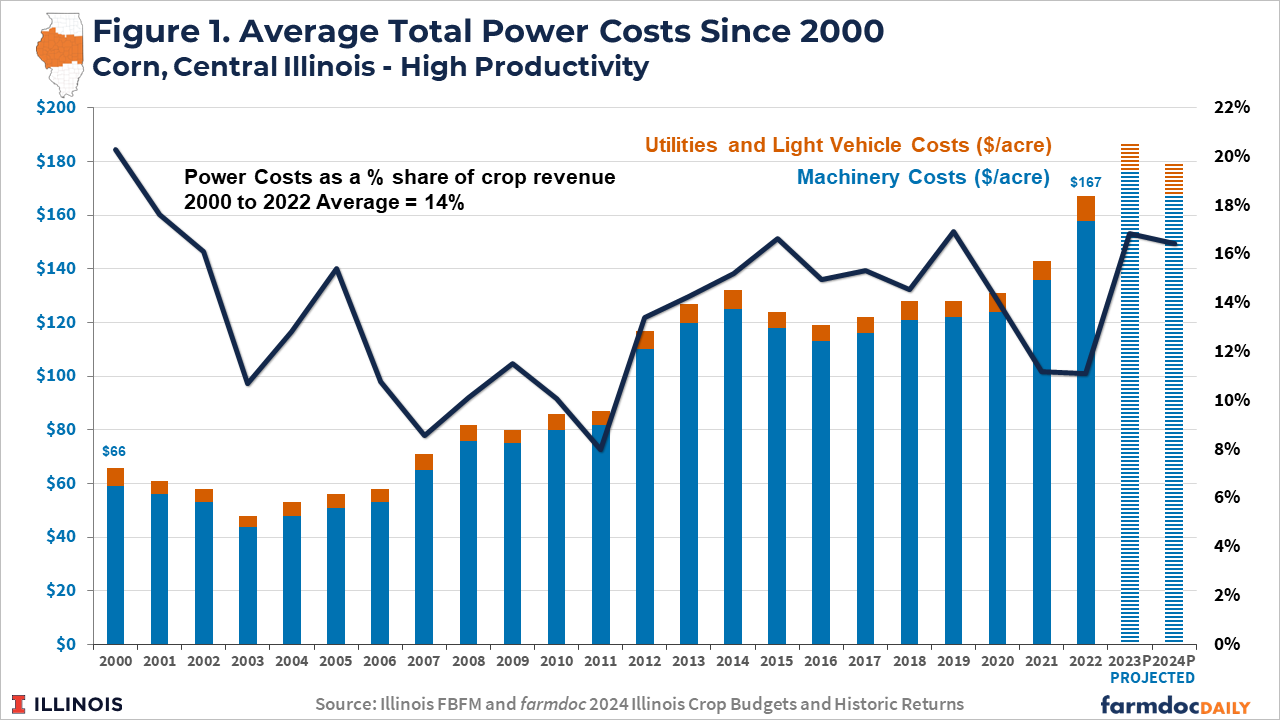

Figure 1 illustrates the growth in power costs on a per acre basis since 2000 for corn acres in central Illinois. Costs associated with machinery have accounted for over 90% of total power costs each year. There has been a general upward trend in power costs, increasing from $66 per acre in 2000 to $167 per acre in 2022. This implies an annualized growth rate of about 4% over that time period. This compares with a 7% average annual growth rate for crop revenues and direct costs (see farmdoc daily, September 26, 2023). Power costs are projected higher, at $187 per acre, for the 2023 crop year and are expected to decline slightly to $179 per acre for 2024. In relative terms, power costs have averaged 14% of crop revenues on central Illinois corn acres since 2000.

Power costs tend to track returns, with more rapid increases experienced during the high return period from 2007 to 2013 and in recent years since 2020. Power costs tend to plateau, or even decline slightly, during multi-year periods of lower returns, such as the first half of the 2000s and from 2014 to 2019. As with trends in direct costs, power costs tend to exhibit a 1- to 2-year lag in tracking adjustments in revenue and return levels. Reductions typically come from 1) reductions in fuel costs from energy-price declines and 2) reductions in depreciation as farmers reduce capital purchases.

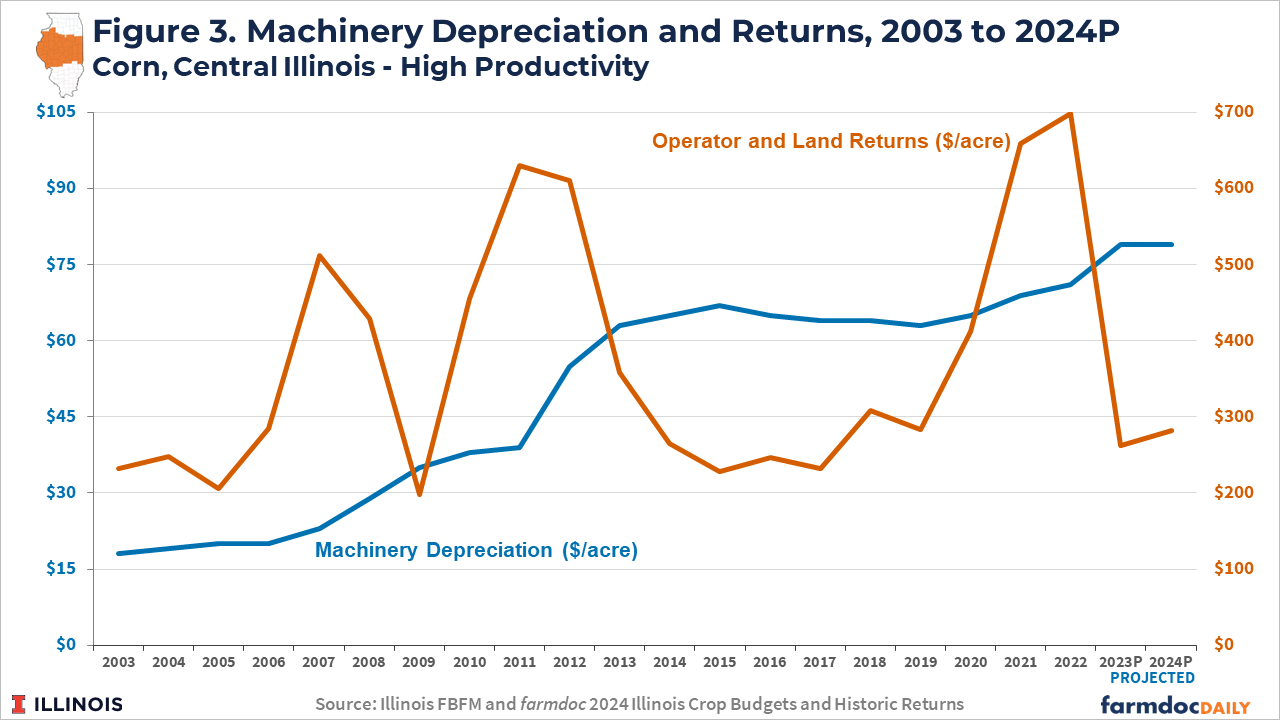

The relationship between power costs and returns is linked strongly to farms’ capital purchase activity. Importantly, Illinois FBFM’s reported machinery depreciation – a major component of power costs – has been a measure of economic depreciation since 2003. Thus, changes in depreciation over time reflect, at least partially, an operation’s investment (or disinvestment) in their owned machinery complement. High return periods lead to more capital purchases as farm operations update their machinery and implement tax management strategies (see farmdoc daily, March 19, 2021).

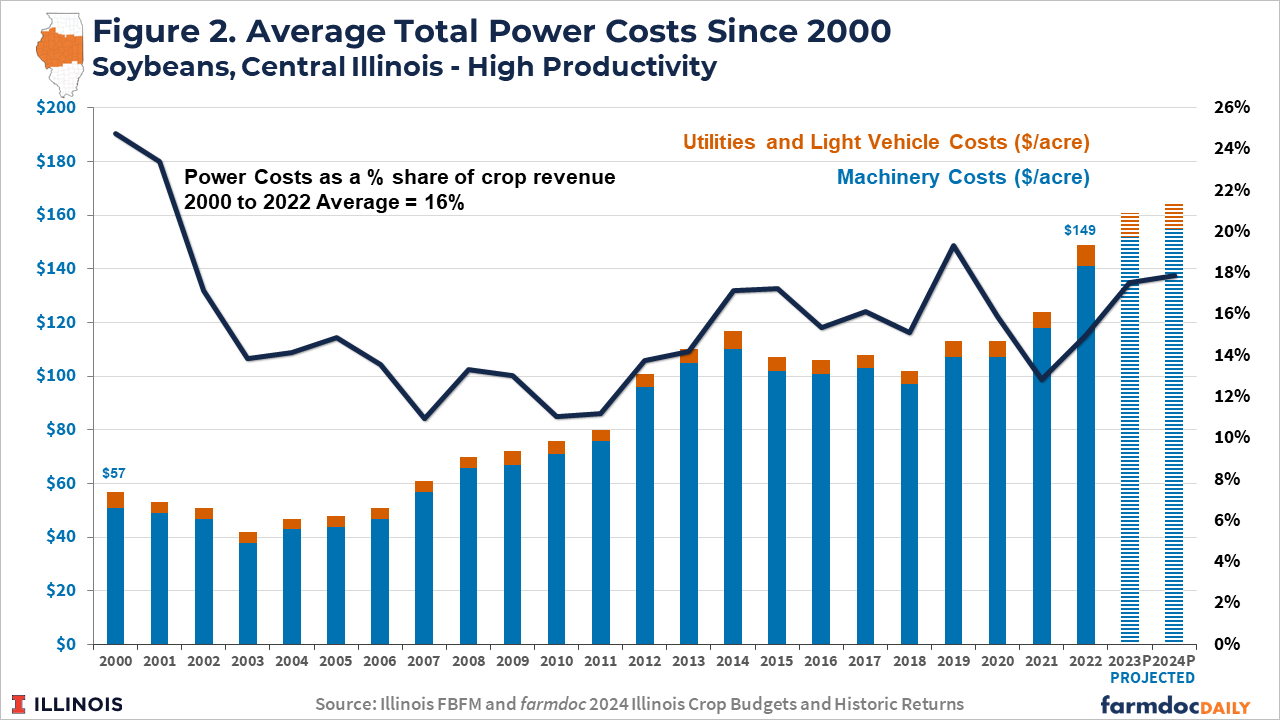

Figure 2 illustrates growth in power costs on a per acre basis for soybean acres in central Illinois. Costs have increased from $57 per acre in 2000 to $149 per acre in 2022. Typically, soybean production often uses fewer tillage passes and has lower costs for harvest operations compared with corn (Lattz and Schnitkey, 2023). While per acre power costs for soybeans tend to be lower than those for corn, the historical trends and relationship to revenues and returns are quite similar. On a relative basis, power costs have averaged 16% of soybean revenues since 2000.

Figure 3 plots the machinery depreciation component of total power costs with operator and land returns for corn acres in central Illinois since 2003. This highlights the increase in machinery depreciation observed during higher returns and the plateaus experienced during lower returns as farm operations reduce capital purchases and machinery investment to manage reduced cash flows.

Implications for 2024 and Beyond

With the return outlook for 2024 and beyond suggesting a return to lower revenues, cost reducing strategies may be key to ensuring profitable returns or minimizing losses in the coming crop years. Reducing power costs can be difficult, as recent capital purchases will tend to lead to persistent economic depreciation cost levels as well as ongoing maintenance and operating costs for the equipment.

Power cost reduction strategies have been covered and discussed in previous articles heading into the last lower return period in 2014 (see farmdoc daily, February 18, 2014). Strategies should focus on ensuring appropriate sizing of the operation’s machinery complement given total acreage. This is particularly important for harvest and tillage operations, where achieving low per acre machinery costs through efficient combine and tractor choices, given the operation’s total acreage, can be a major differentiating factor for more highly profitable farms. Reducing or limiting tillage operations, to the extent possible, can be an effective way to lower power costs to address lower return prospects in individual years.

Conclusions

As with direct production costs, power costs associated with corn and soybean production have trended upward over the past 20 years for farms in central Illinois. Costs associated with economic depreciation are directly linked with capital purchase activity, which tend to track with return levels.

Given the outlook for lower returns in 2023, 2024, and beyond, producers should be thinking about ways to reduce and control costs, including power costs.

Acknowledgment

The authors would like to acknowledge that data used in this study comes from farms across the State of Illinois enrolled in the Illinois Farm Business Farm Management (FBFM) Association. Without their cooperation, information as comprehensive and accurate as this would not be available for educational purposes. FBFM, which consists of 5,000 plus farmers and 65 professional field staff, is a not-for-profit organization open to all farm operators in Illinois. FBFM field staff provide on-farm counsel with computerized recordkeeping, farm financial management, business entity planning and income tax management. For more information, please contact the State Headquarters located at the University of Illinois Department of Agricultural and Consumer Economics at 217-333-8346 or visit the FBFM website at www.fbfm.org.

References

Lattz, D. and G. Schnitkey. 2023 Machinery Cost Estimates: Summary, September 2023.

Paulson, N., G. Schnitkey, C. Zulauf and J. Colussi. "The Rising Costs of Soybean Production in Illinois." farmdoc daily (13):208, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, November 14, 2023.

Paulson, N., G. Schnitkey, C. Zulauf, J. Colussi and J. Baltz. "The Rising Costs of Corn Production in Illinois." farmdoc daily (13):175, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, September 26, 2023.

Schnitkey, G. "Controlling Costs with Lower Crop Revenues: Machinery Costs." farmdoc daily (4):30, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, February 18, 2014.

Zwilling, B. "The Impact of Power and Equipment Costs on Illinois Grain Farms." farmdoc daily (11):42, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, March 19, 2021.

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.