The Weather Risk Premium in Coffee Futures Prices

Note: This article was written by University of Illinois Agricultural and Consumer Economics Ph.D. student Esteban Vizcarrondo and edited by Joe Janzen. It is one of several excellent articles written by graduate students in Prof. Janzen’s ACE 527 class in advanced agricultural price analysis this fall.

Growing season weather events like drought, frost, or flood are a big deal in many agricultural commodity markets. In the period before these events do or do not occur, how do futures markets price the associated event risk? In this article, we look at the Arabica coffee futures market and risk of frost events in Brazil, a major producer. When futures prices on average decline during the growing season over many years, some interpret this as evidence for a weather risk premium (Li et al., 2017, Janzen 2021). Descriptive evidence from the harvest-time September coffee futures contract prices suggests that traders may price a small frost risk premium into coffee futures, similar to one found for growing season weather in US corn futures.

Coffee Production

Coffee is grown in the tropics, thriving in environments that receive consistent rainfall and humidity, cool temperatures averaging around 70 degrees Fahrenheit due to elevation, and an absence of frost. Important coffee producing nations are scattered throughout South and Central America, Asia, and Africa. In the US, Hawaii and Puerto Rico produce small amounts of specialty Arabica coffee. Brazil is far and away the world’s leading coffee producing nation; Brazil grows approximately 30-40% of world production, and the majority of Brazilian production is the Arabica type (USDA Foreign Agricultural Service, 2023). The world predominantly consumes Arabica, which constitutes about 70% of global production, while the Robusta type holds most of the remaining market share, at around 20-30% at any point. Coffee plants are perennials which follow a biennial cycle which for Brazil results in lower production in odd numbered years.

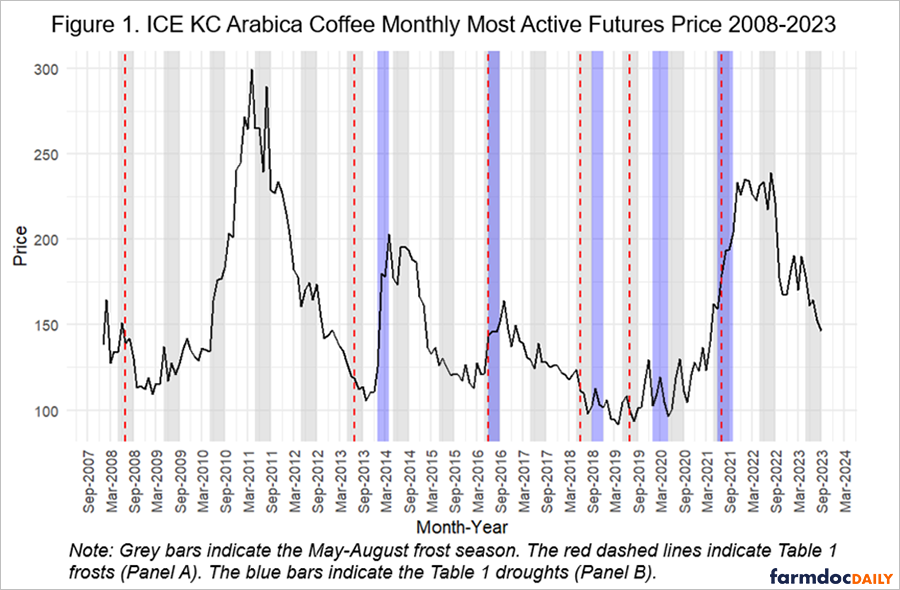

Arabica coffee cash and futures market contracts have been traded in New York for physical delivery continually since 1882. These contracts are currently traded on the Intercontinental Exchange or ICE under with ticker symbol KC. The ICE KC market is the global benchmark for Arabica coffee prices. Figure 1 shows the price history of ICE KC coffee futures since 2008 (Source: Bloomberg).

Coffee And Frosts

Coffee production can be significantly diminished by frost. In Brazil, frosts occur in the May-August winter period, though there is some concern about changing weather patterns altering frost timing due to climate change. Arabica coffee production, which thrives at higher altitudes, may be more vulnerable to frost especially when the coffee plants are crippled by droughts. Arabica coffee production may also be more susceptible to frost when frost events follow periods of drought.

Events in 2021 illustrate the potential impact of frost and drought on coffee futures markets. At the end of July 2021, a frost event in Brazil negatively affected the coffee harvest. This frost, one of the most severe in past two decades, was significant because coffee producers in Brazil were already grappling with the repercussions of drought during the previous season. At the same time, the coffee economy was also dealing with supply and demand shocks associated with Covid-19. In a low-inventory environment, these shocks spiked ICE KC futures prices.

Table 1, Panel A provides a more complete accounting of major and minor frost events affecting Brazil’s coffee crop (Source: USDA). Frost events may have larger production impacts when they follow periods of drought, as outlined in Table 1, Panel B. Notable frost events are also indicated with red lines in the price history of ICE KC futures shown in Figure 1. While prices have spiked around the time of frost events, prices fall in many years during the period when frosts may occur.

These patterns suggest that a risk premium associated with coffee production in Brazil might be most pronounced before the May-August period which is when the weather events are actualized. During the May-August period, the compounding effects of earlier drought conditions and the subsequent frost events can significantly impact coffee yields and quality. This understanding is fundamental for stakeholders in the coffee industry. This highlights the importance of focused risk management strategies during these key months.

Figure 1 shows monthly ICE KC prices since 2008 with the red dashed lines representing Brazil coffee frosts, the grey bars represent the May-August period for which frosts may occur while the blue bars represent the drought periods.

| Table 1. Significant Frost and Drought Events in Brazilian Arabica Coffee Production | |

| Date | Panel A: Description of Frost Event |

| Jul – 2008 | Localized frost in certain coffee-growing regions, minor national impact. |

| Jul – 2013 | Limited frost impact in some parts of the coffee-growing belt. |

| Jun – 2016 | Localized frost affecting regions, especially in Paraná and parts of São Paulo. |

| Jun – 2018 | Isolated frost events in specific coffee-growing areas without significant national impact. |

| Jul – 2019 | Frost reported mainly in Paraná with minimal impact on the major coffee-producing state of Minas Gerais. |

| Jul – 2021 | Severe frost event affecting major coffee-growing states, including Minas Gerais and São Paulo. |

| Panel B: Description of Drought Event | |

| Jan – Mar 2005 | Minor drought events reported, with localized impact on coffee production. |

| Jan – Mar 2014 | Major drought in Southeast Brazil, severely affecting coffee-growing regions. |

| Jun – Aug 2016 | Moderate drought conditions, impacting some coffee-producing areas. |

| Sep – Nov 2018 | Prolonged dry spells in key coffee-growing regions, affecting crop yields. |

| Jan – Apr 2020 | Sporadic drought conditions reported, with variable impact on coffee production. |

| Jun – Sep 2021 | Major drought, one of the worst in recent decades, drastically reducing Arabica coffee output. |

| Source: United States Department of Agriculture (USDA) Foreign Service Brazil Coffee Reports | |

The Weather Risk Premium

Generally, risk premia are the return or reward received by traders for assuming price risk. The risk premium is an oft-debated concept in financial markets across a range of financial assets, including agricultural commodity futures. In its basic form, a risk premium is calculated as the difference between the current price for future delivery (reflected in the futures contract price) and the expected spot price at the delivery date. A non-zero risk premium indicates the presence of risk-related compensation priced into the current futures price. The risk premium may reward buyers or sellers depending on whether it is negative or positive.

A weather risk premium applies this idea to situations where weather events generate the price risk assumed by traders. In agricultural commodities like coffee, this premium may arise due to the risk of supply shocks caused by adverse weather conditions like droughts and frosts. In the case of coffee, September represents the harvest-time futures contract month. There is some perceived risk of a weather event in the May-August frost period that could reduce supply deliverable against the September contract. Concern that prices could spike if a frost event is realized may generate a risk premium in September futures prices – the futures contract is priced greater than the expected spot price. If the weather event does not occur, traders holding short positions realize gains as prices fall, representing the reward for assuming this weather-related risk. Since frost events are unrealized more often than not, prices should on average fall in this way over many years in the presence of a weather risk premium.

Analysis of September ICE KC Futures Prices

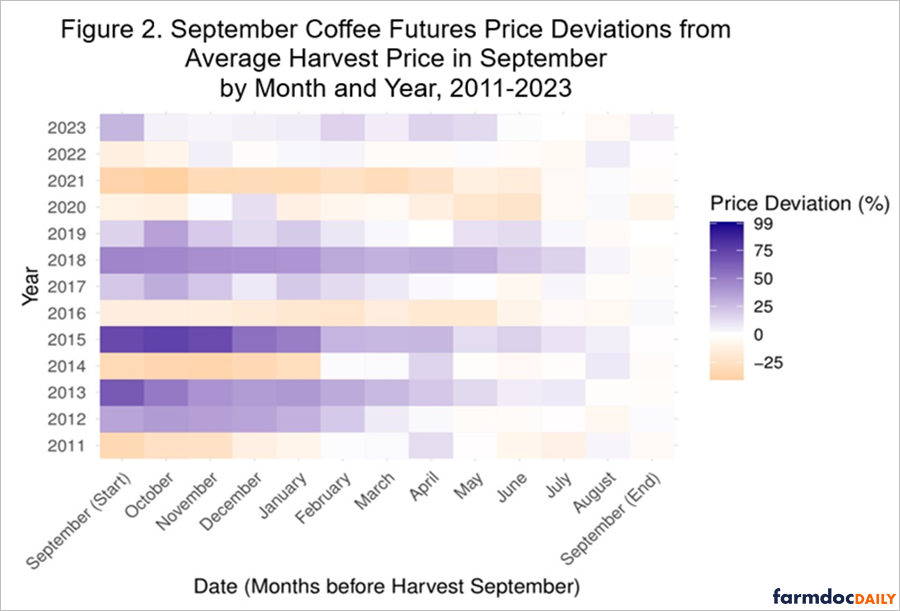

To examine the presence of a weather risk premium in coffee futures prices, I analyzed the variation in the monthly average prices of the September futures contract relative to the prevailing price at the typical end of the Brazil harvest season (September) after frost events are or are not realized. Figure 2 shows seasonal price deviations from the price in September maturity price for each year. To make these deviations comparable across years, they are calculated as a percentage of the prevailing price in September. For instance, monthly prices of the September 2021 futures contract (which ranged between $1.12 to $1.90 per pound), are calculated as a percentage of the average price of the same contract in September 2021, which was $ 1.87 per pound. Blue bars indicate prices above the September harvest time price; orange bars indicate prices below the September harvest time price.

Prices are in general above the September price at some point during the life of the September futures contract. This premium is more pronounced following years of high prices and low crop inventories, as observed during 2015 and 2017. In these scenarios, the market perceives a heightened risk of weather events driving up prices due to limited inventory buffers. However, when these risks don’t materialize, prices often decline from May to September. There are two notable exceptions: 2016 and 2021 which were both years with frost and drought in Brazil. In these years, prices rise through the trading period for the September futures contract. Figure 2 shows major price changes within a given pre-harvest period typically occur in one direction, with substantial fluctuations both above and below harvest prices being uncommon. Significant price movements in coffee futures are rare in the final trading months, with smaller deviations during and after the May-August period.

To summarize the data in Figure 2, we calculate summary statistics by month across the thirteen years in our sample. Figure 3 illustrates the distribution of September coffee futures price deviations from the harvest-time price by month. The plot shows the average deviation from the September price each month, along with the standard deviation, and min-max ranges throughout the observed period. Pre-harvest September coffee futures prices are, on average, higher than harvest-time prices throughout the pre-harvest period. The premium declines as the crop year progresses, achieving the maximum in September (start) of +13%, falling to +8% in February, and further to +3% in May. These positive average deviations between pre-harvest futures prices for harvest-time delivery and the prevailing price harvest time are suggestive evidence for a weather risk premium.

In the context of coffee, futures prices before harvest are generally higher than at harvest but show a wide historical range. The light gray shaded area in Figure 3 represents the extreme deviations, with prices potentially 100% higher to 40% lower than harvest-time prices. The dark gray shaded area, denoting one standard deviation from the mean, indicates that about two-thirds of the time, prices vary between 11-26% above and 1-8% below the harvest-time price. This range demonstrates the variability and risk factors influencing coffee futures pricing.

Implication

The analysis of coffee futures pricing above, combined with earlier analysis of US corn markets (Li et al., 2017, Janzen 2021) suggests markets incorporate weather risks, not just realized weather events, into prices. This has significant implications for farmers. The presence of a weather risk premium indicates fluctuating pre-harvest prices, often higher than at harvest. This variability, shown in Figures 2 and 3, underscores the importance of price risk management for farmers. By understanding these market dynamics, farmers can make better-informed decisions about the use of pre-harvest forward sales and/or futures hedging.

References

Asplund, R. (2022, May 11). Coffee soars as Frost threatens Brazil’s coffee crop. Barchart.com. https://www.barchart.com/story/news/8318472/coffee-soars-as-frost-threatens-brazil-s-coffee-crop

Arabica Coffee 4/5 Dec ’23 futures contract specifications. Barchart.com. (n.d.). https://www.barchart.com/futures/quotes/XF*0/profile

Bloomberg L.P. (2023). Monthly price data for KC ICE futures: 2008-2023 [Data set]. Bloomberg Terminal.

Janzen, J. "The Weather Risk Premium in New-Crop Corn Futures Prices." farmdoc daily (11):88, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, June 2, 2021.

Li, Z., Hayes, D. J., & Jacobs, K. L. (2017). The Weather Premium in the U.S. corn market. Journal of Futures Markets, 38(3), 359–372. https://doi.org/10.1002/fut.21884

USDA Foreign Agricultural Service. (2023). GAIN: Global Agricultural Information Network. Retrieved from https://gain.fas.usda.gov/#/home

USDA Foreign Agricultural Service. (2023). Reports. Retrieved from https://usdabrazil.org.br/en/reports/.

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.