The Emerging Cannabis Market in Illinois: Prices, Taxes, and Supply Constraints

Note: This article was written by University of Illinois Agricultural and Consumer Economics Masters in Agricultural and Applied Economics student Joseph Peterson and edited by Joe Janzen. It is one of several excellent articles written by students in Prof. Janzen’s ACE 527 class in advanced agricultural price analysis this fall.

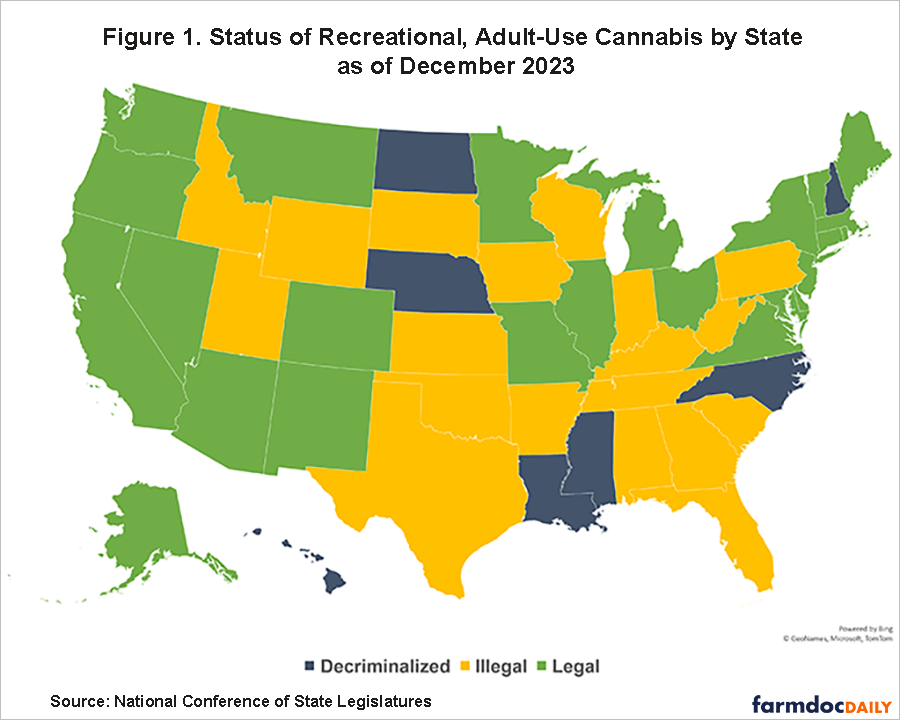

The production and sale of recreational adult-use cannabis is now legal in 24 US states, including Illinois (see Figure 1). However, the legal cannabis market in each state is distinct because federal laws limit interstate trade and thus the full arbitrage of cross-state price differences for legal cannabis. We describe this emerging market and show there are significant price disparities between states. Recreational cannabis prices in Illinois are among the highest in the country (Headset, 2023), more than double prices in nearby Michigan. Illinois also imposes higher retail taxes than Michigan does.

We explore the relationship between pre-tax prices for cannabis and restrictions on production. In Illinois, the state Department of Agriculture regulates production and puts strict licensing requirements on producers. Comparing prices with the number of producer licenses and licensed production capacity in Illinois and Michigan, we find limited growth in licensing has been associated with higher prices.

Growth in Cannabis Sales Since Legalization

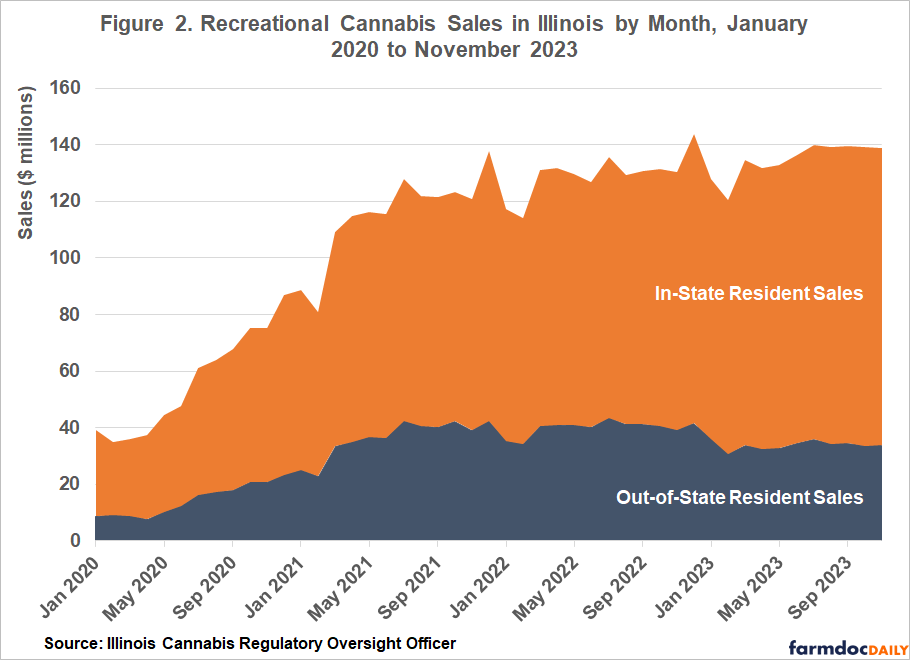

Illinois legalized the sale of recreational cannabis on January 1st, 2020. Since that time, cannabis sales quantity and value have grown. Figure 2 plots the retail value of cannabis sales by month since legalization as reported by the Illinois Cannabis Regulatory Oversight Officer. Sales grew rapidly between January 2020 and summer 2021 as the industry developed following legalization. Since the summer of 2021, cannabis sales have consistently been between $120-140 million dollars per month. Comparisons of sales figures across all US states show Illinois has the third largest cannabis market after California and Michigan. (Headset, 2023) While the total value of recreational cannabis sales in Illinois shown in Figure 2 has been flat since mid-2021, the number of units sold has continued to rise. This implies the price per unit has fallen.

Figure 2 shows in-state residents are responsible for a majority of recreational cannabis sales in Illinois, though out-of-state residents make up about a quarter of sales. Illinois attracts out-of-state consumers from bordering states shown in Figure 1 – Indiana, Iowa, Kentucky, and Wisconsin – where recreational cannabis remains illegal. In some states where cannabis remains illegal, possession of small quantities has been decriminalized, though Figure 1 shows this does not apply to any state bordering Illinois.

Missouri is the only state bordering Illinois to legalize recreational cannabis, with legal sales in Missouri beginning on February 3, 2023. Though it does not share a land border with Illinois, Michigan is another nearby state where recreational cannabis is legal. Legal cannabis markets in other states may reduce the prevalence of out-of-state resident sales, particularly if those states have lower prices than Illinois. As these nearby states boost production, develop supply chains, and improve marketing, Illinois may lose sales to out of state residents. Figure 2 shows that cannabis sales to out-of-state residents have declined, with 2023 sales slightly below levels seen in 2022.

Sales decreases are a threat to tax revenue in Illinois. Illinois governor Jay Pritzker has touted cannabis taxes as a substantial source of state tax revenue (Hensel, 2023). Illinois has excise taxes on sales of recreational cannabis at the producer and retail levels. The Cannabis Cultivation Privilege Tax charges in-state growers a 7% tax of gross sales receipts. At the retail level, the Cannabis Purchaser Excise Tax is 10% and 25% for cannabis with adjusted THC level below 35% and above 35%, respectively, or a 20% tax for cannabis-infused products. These taxes, combined with the 6.5% state sales tax and local sales taxes, comprise a significant component of the price paid by the cannabis consumer. (Illinois Department of Revenue, 2023).

Comparatively high tax rates may divert sales to other states, particularly those with lower prices. In Michigan, excise tax rates are a flat 10% and the state sales tax rate is 6%. In Missouri, the excise tax rate for recreational cannabis is 6% and sales tax is 4.2%.

Prices

To place Illinois cannabis prices in context, we consider the monthly average price per gram of cannabis flower relative to prices in a nearby state, Michigan, with a similarly long price history. Flower, rather than extracts, infusions, and other products, is the traditional form of consuming cannabis and makes up the largest share of total sales; it is 42% of the Illinois market. We use the Michigan cannabis market for comparison using data from the Michigan Cannabis Regulatory Agency. Michigan legalized recreational cannabis on December 6, 2018, just over one year prior to Illinois.

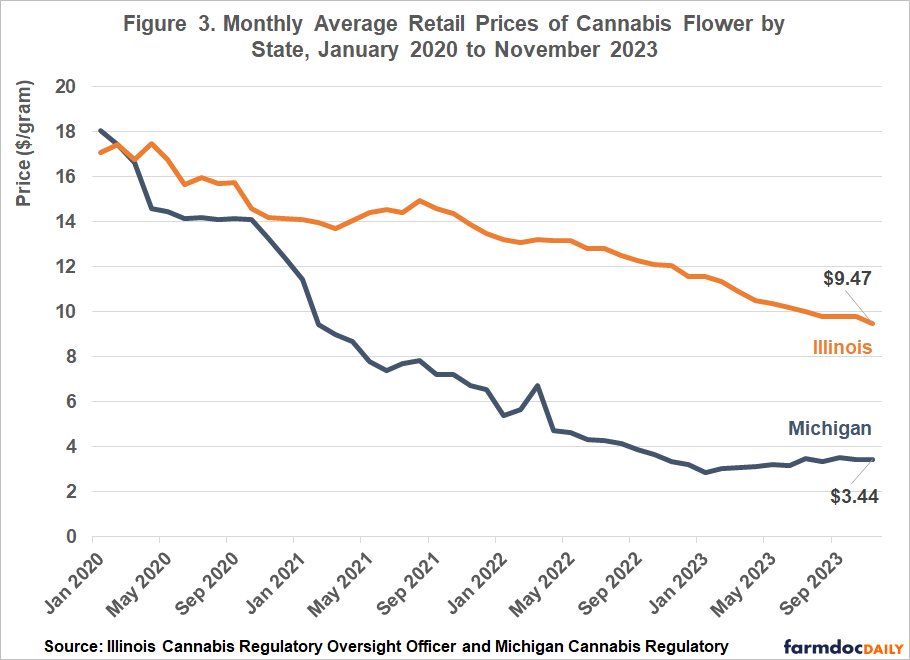

Retail cannabis prices shown in Figure 3 for both Illinois and Michigan have been in decline since January 2020, but prices in Michigan have fallen much more. While Michigan and Illinois flower prices were similar in early 2020, Michigan prices have declined about 80%, dropping from around $18 per gram to $3.44 per gram in November 2023. Illinois’ cannabis price was $17.06 per gram in January 2020 and fell 42% to $9.47 per gram in November 2023.

Why have cannabis prices diverged between Illinois and Michigan? Both supply and demand factors may be relevant, but we suggest that demand – the willingness to pay for cannabis – is similar in each state. Illinois and Michigan are both Midwest states with comparable population size and demographic characteristics. One caveat is that per-capita economic activity and household income are higher in Illinois (Bureau of Economic Analysis, 2023). We instead look for explanations related to the supply side of the cannabis market.

Cannabis Production Licensing

We assess cannabis supply using data available from public sources from both Illinois and Michigan. Illinois publishes limited information on the state of cannabis production. Michigan, in contrast, provides monthly reporting on the number of plants under cultivation and other metrics.

One measure comparable across states is cannabis production licensing. The Illinois Department of Agriculture regulates cannabis cultivation. As in all states where cannabis production is legal, growing cannabis is subject to strict licensing requirements which may limit the ability of producers in high-price states to respond to high prices with increased supply.

Illinois issues two types of licenses for cannabis producers: craft grower and cultivation center. The craft grower license allows for cultivation and packaging of wholesale cannabis products. Craft grower operations may have up to 14,000 square feet of plant canopy. The number of licenses was previously limited to 150 licenses, but this limit was never binding and was eliminated in 2023. As of mid-2023, only 88 craft grower licenses were issued, with 40 issued August 2021 and 48 issued in June 2022. (Illinois Department of Agriculture, 2023)

Cannabis producers in Illinois licensed as cultivation centers can perform the same functions as craft growers, plus they may also process products infused with cannabis. This license allows for up to 210,000 square feet of growing space. There is a statewide limit of thirty licenses, but this cap is also not yet binding. The state issued twenty-one cultivation center licenses at the time of legalization and the number of licenses issued has remained unchanged.

Michigan’s licensing system is different from Illinois. Michigan has licenses for class A, B, and C adult-use growers. These licenses differ based on the number of plants, rather than the production capacity in square feet. A Class A license allows for no more than 100 cannabis plants, a Class B license allows for no more than 500 plants, and a Class C allows for a maximum of 2,000 plants (Michigan State Information System, 2023). Class C licenses make up most issued licenses in the state compared to a small amount of Class A and B licenses (Michigan Cannabis Regulatory Agency). Michigan does not cap issuance of Class A and Class C licenses. and processing of applications is relatively quick.

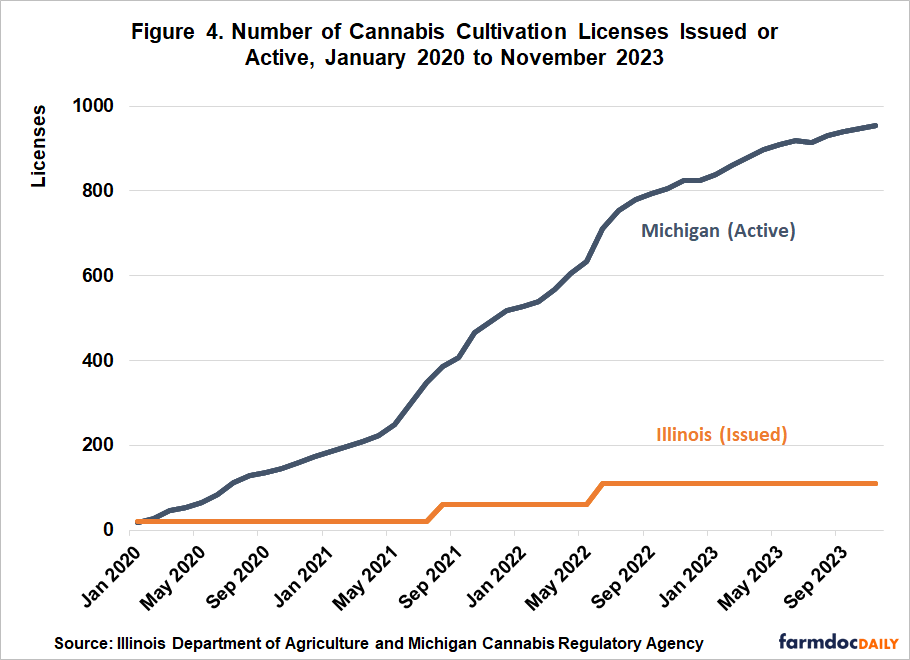

We quantify changes over time in the number of cultivation licenses by state in Figure 4. Note that Michigan reports the number of active licenses while Illinois reports only issued licenses. Michigan has nearly 1,000 active recreational-use cultivation licenses, far more than the 109 issued licenses in Illinois. Michigan continues to bring online new licenses each month. However, the number of licenses is not directly comparable because licenses allow different production quantities and growers do not have to produce the maximum allowed under license.

We attempt to convert the number of cultivation licenses in Illinois to the licensed production capacity in number of plants. Michigan data show the number of plants under cultivation is close to the number of active licenses multiplied by the maximum number of plants allowed under each license type. To estimate a similar quantity for Illinois, we take the maximum square footage allowed for cultivation applicable to each license type and multiply it by the number of licenses issued and assume a plant-to-space ratio of one plant per square foot. This gives a total current licensed production capacity of about 5.6 million plants, or more than three times the Michigan quantity. We view this figure as unrealistic; however, Illinois publishes no data on the plants under cultivation so adjusting this figure requires some assumptions.

We calculate an adjusted licensed production capacity based on actual Illinois license numbers, an assumed plant density of one plant per square foot, and an assumed ratio of cultivation area to maximum allowable area of 0.3 based on published cultivation space figures for a number of existing cultivation centers (See: Arco Murray and Schiller, 2020) This adjustment factor assumes cultivation centers have an average of 63,000 plants and craft growers have an average of 4,200 plants.

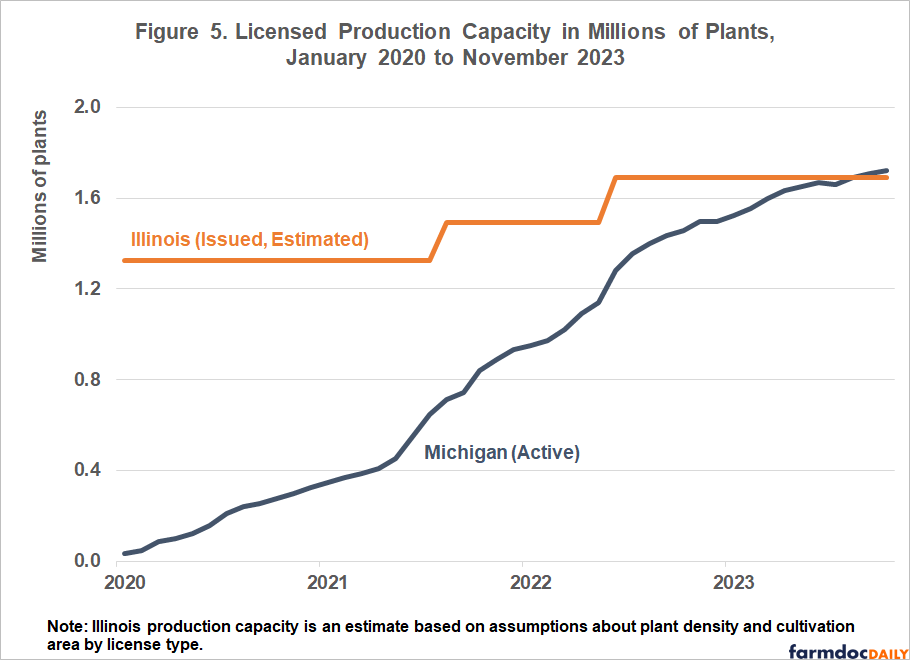

Figure 5 shows our estimated licensed production capacity by state. Illinois’ capacity is large but static over time, while Michigan grows steadily and exceeds Illinois by the end of our sample period. We recognize that licensed capacity may not equal actual production, but since our objective is to quantify supply restrictions rather than supply itself, we view this licensed capacity estimate as an informative measure.

Implications

While it is difficult to determine the degree to which high cannabis prices in Illinois are the result of production constraints, there is strong correlation between changes in licensed production capacity and price. As production capacity has grown in Michigan over time, prices there have fallen more than in Illinois. Illinois began the legal recreational cannabis era with substantial licensed production capacity but has since allowed few additional entrants to the market.

We conclude that production licensing constraints are one contributor to cross-state differences in prices. There are other potential supply constraints. The time and effort needed to successfully apply for a license is one. That Illinois’ caps on licenses issued have yet to bind suggests these time and effort costs may be significantly higher than in other states. Rapid growth in the number of licensed producers in Michigan suggests licensing requirements there may be less burdensome. Additional non-regulatory barriers to production such as access to capital required to plan and begin production, supply chain coordination, and other factors may differ across states; these are beyond the scope of this analysis.

To fully understand budding state-level recreational cannabis markets, better data on supply and demand is necessary. It is difficult to anticipate how the Illinois cannabis industry will evolve in the future without better access to data on production and use. Accurate and timely information about supply and demand is important for well-functioning agricultural markets (Janzen, 2022) We note that Michigan publishes significantly more detailed information on production than Illinois does. In providing cannabis industry data, Illinois may want to follow the lead of its neighbor.

References

Bureau of Economic Analysis. 2023. “GDP by State.” https://www.bea.gov/data/gdp/gdp-state

Headset. (2023, July 26). “A deep dive into the Illinois Cannabis Market.” Headset Industry Reports. https://www.headset.io/industry-reports/a-deep-dive-into-the-illinois-cannabis-market

Hensel, Andrew. (2023, September 5). “Despite Illinois' high cannabis prices, Pritzker praises market.” The Center Square. https://www.thecentersquare.com/illinois/article_52554f1a-4910-11ee-b03c-a787fb5f72c2.html

Illinois Cannabis Regulatory Oversight Officer. 2023. “Sales Figures” https://cannabis.illinois.gov/research-and-data/sales-figures.html

Illinois Department of Agriculture. 2023. Personal communication.

Illinois Department of Revenue. 2023. “Cannabis Tax Frequently Asked Questions” https://tax.illinois.gov/research/taxinformation/other/cannabis-tax-frequently-asked-questions.html#faq-1whattaxesaredueonsalesofcannabisinthestateofillinois-faq

Janzen, J. "The Export Sales Data Snafu." farmdoc daily (12):138, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, September 9, 2022.

Michigan Cannabis Regulatory Agency. 2023. “Statistical Reports” https://www.michigan.gov/cra/resources/cannabis-regulatory-agency-licensing-reports/cannabis-regulatory-agency-statistical-report

Michigan State Information System. 2023. “Michigan Marijuana Cultivation License”. https://michigancannabis.org/licensing/cultivation

National Conference of State Legislatures. 2023 “Cannabis Overview” https://www.ncsl.org/civil-and-criminal-justice/cannabis-overview

Schiller, Melissa. 2020. “Cresco Labs Completes Expansion of Illinois’ Largest Cannabis Cultivation Facility in Lincoln.” Cannabis Business Times, April 16, 2020. https://www.cannabisbusinesstimes.com/news/cresco-labs-completes-expansion-cannabis-cultivation-facility-lincoln/

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.