Weather Shocks and Seasonal Commodity Market Returns: Evidence from Zambia’s Maize Market

Note: This article was written by University of Illinois Agricultural and Consumer Economics Ph.D. student Protensia Hadunka and edited by Joe Janzen. It is one of several excellent articles written by graduate students in Prof. Janzen’s ACE 527 class in advanced agricultural price analysis this fall.

Grain farmers are typically encouraged to take advantage of seasonal price patterns by storing after harvest and selling later in the season when prices tend to be higher. In both developed and developing countries, governments provide various supports to grain farmers to encourage storage. However, negative seasonal returns are possible; they occur when grain prices later in the season are lower than those during the preceding harvest period. In the absence of functioning forward markets, seasonal storage is not an arbitrage opportunity: farmers cannot hold grain in storage and earn certain profit, rather, doing so entails significant price risk. In many developing countries, farmers can only access spot markets and farmers frequently do not take advantage of seasonal storage opportunities (Mason and Myers, 2013).

What drives negative seasonal returns? We focus on one major factor: weather-driven production shocks that affect the harvest in the next production cycle. The storage period is also often the growing season for the next harvest. This article examines the correlation between rainfall during this growing/storage season and negative seasonal market returns for grain stored from the previous harvest.

Our evidence on grain market seasonality comes from the maize market in Zambia. Maize is how most of the world refers to what in the United States is called corn. In Zambia, maize is the staple crop. We find years with drought see an increase in the prevalence and size of positive seasonal maize market returns, whereas in years with good precipitation, negative returns are observed. If seasonal market returns are driven by unpredictable (or hard to predict) weather shocks, our results suggest avoiding grain storage may be risk-reducing for farmers.

A comprehensive understanding of the impact of droughts on seasonal market returns can help farmers, traders, and policymakers make better decisions to address seasonal price variability. For food insecure countries in sub-Saharan Africa such as Zambia, better understanding of agricultural markets is crucial. Agricultural production shocks may be more frequent due to climate change and many countries in the region find it difficult to adequately accommodate the escalating demand for food in the face of resulting price volatility (Madzivhandila et al., 2016).

Our results are also applicable to farmers outside southern Africa. For farmers who have access to forward markets (as is the case for many grain commodities in the US) our results highlight the importance of locking in returns from seasonal price patterns through forward sales. Farmers who forward sell can secure a marketing premium relative to the current spot price by making forward sales and delivering grain later. Failing to sell forward comes with price risk that is related to forthcoming weather. Unless the farmer can also predict the weather, he or she cannot ensure that holding unpriced grain in storage will be profitable. This result holds whether we consider maize production in Zambia or corn production in Illinois.

Maize market seasonality in Zambia

This study uses data from the Zambian Statistics Agency, ZamStats. We collect monthly average maize price data for all 74 districts in Zambia for the period from 2002 to 2021. Zambian districts are typically smaller than US states but larger than counties in the US Midwest. Additionally, we use district-level crop yield data from the Crop Forecast Survey (CFS), covering the same period. Rainfall data is from the Climate Hazards Center InfraRed Precipitation with Station data (CHIRPS) repository, known for its high-resolution background climatology providing more accurate estimations of precipitation means and variation. From these rainfall data, we have a standardized precipitation index (SPI) which measures deviations from average or expected precipitation in a designated period. SPI values are standardized to have a mean of zero and a standard deviation of one. In our context in Zambia, SPI values below -0.45 should be considered indicative of a drought.

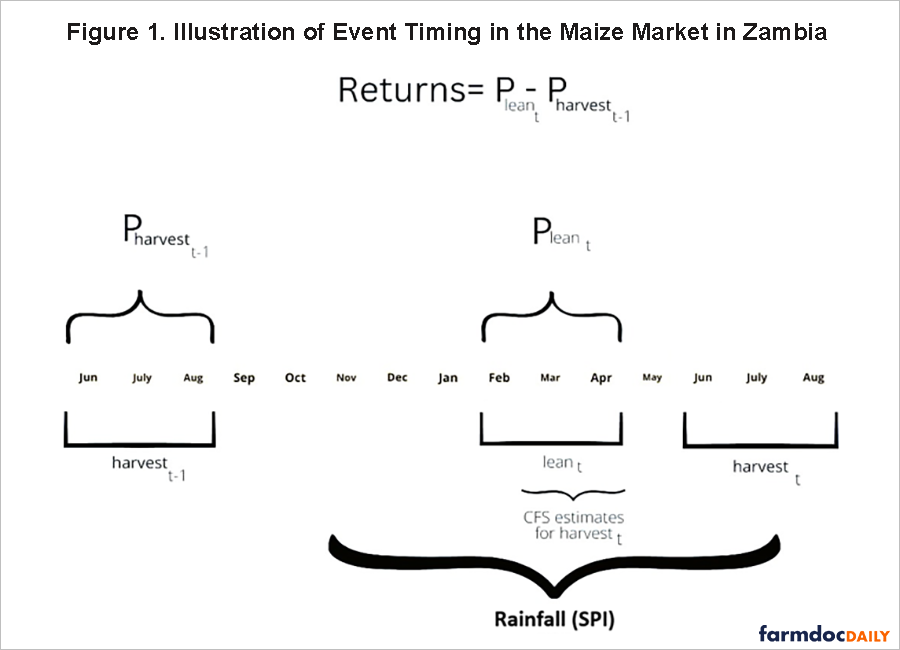

To understand how weather and other factors affect market returns, understanding the timing of agricultural operations is important. In Zambia, the typical agricultural season runs from November to August, aligning with rainfall patterns. Harvest, when crop supplies are relatively abundant, occurs in the dry season between June and August. The period between February and April is the lean season. Both maize production outcomes and storage profitability hinge on observed rainfall leading up to the harvest period. in Zambia. During this period, maize stocks from the previous harvest are depleted, typically leading to higher prices than those that prevailed at the previous harvest (Caswell et al., 2020; Simtowe and De Groote, 2021). However, if a large harvest is expected, prices in the lean season may collapse and negative seasonal returns may occur.

We outline this seasonality in Figure 1. We call the calendar year in which we observe a given lean season as year t. During this period, we observe both market prices and a seasonal precipitation index (SPI) affecting production harvested in year t. We calculate the returns to storage as the difference between the lean season price in year t and the harvest price in the previous calendar year t-1.

To understand how precipitation affects seasonal market returns, consider the timing of rainfall affecting the period t harvest relative to the lean season in Figure 1. The possibility of storage between the lean season and the subsequent harvest period links prices between the February-April lean season and the later June-August harvest period. When farmers, traders, and others anticipate in the lean season a favorable harvest, they will release more of their own stocks before the next harvest, lowering lean season prices. This anticipation effect may be impacted by the size of the previous harvest; if last year’s rainfall was good and stocks are already ample, farmers may release large supplies on the market in the lean season in anticipation of a big upcoming harvest.

In the opposing case where farmers anticipate a below-normal harvest, farmers tend to withhold their maize in the lean season, especially when the farm household may rely on stored maize for its own consumption. This same situation may see many farmers making purchases of maize during the lean season. Both actions – reducing available supply and increased demand – push prices higher resulting in positive seasonal market returns. This case occurs when the period t harvest is predicted to be small. One example of anticipation occurred in the El Nino-affected 2014/15 agricultural season when the Zambia Meteorological Station forecast poor weather.

Precipitation and seasonal market returns

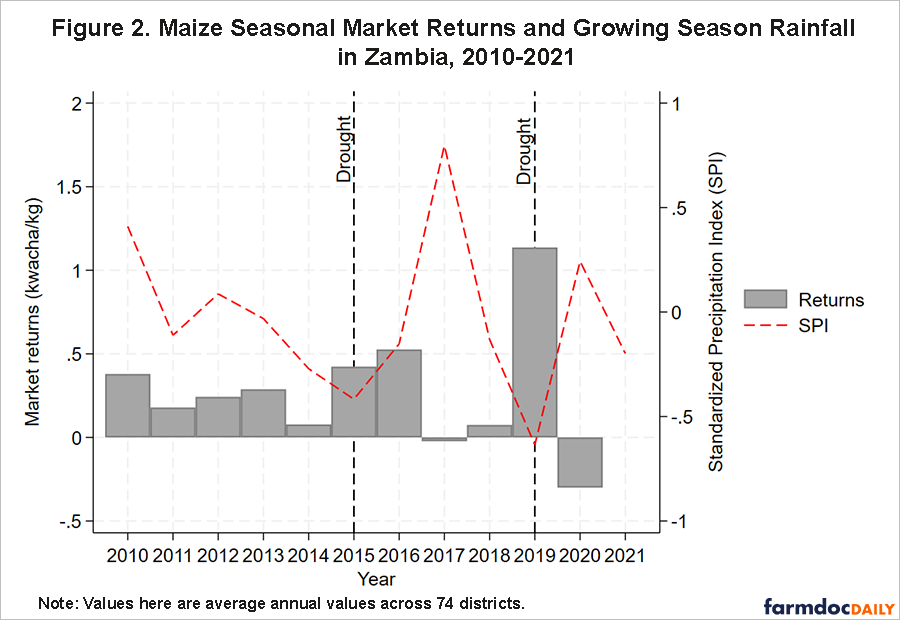

We compare rainfall during the growing season to seasonal market returns. In Figure 2, we overlay for each year the average SPI and market returns across the 74 districts our sample and assess correlation. For visual clarity, we limit our presentation of the results to the period from 2010 to 2021. Generally, we find that during drought years, markets exhibited positive seasonal returns. In years with ample rainfall, farmers reported negative seasonal returns.

Zambia experienced a plentiful maize harvest in the agricultural seasons of 2016/17 and 2020/21, attributed to favorable rainfall conditions (Chisanga et al., 2018). Despite this agricultural success, Zambian maize markets experienced negative seasonal returns during these years. We posit that the mechanism connecting poor returns to storage to the current year’s precipitation is farmer selling induced by expectations of elevated crop supply in the coming harvest period.

There are two drought years in our sample period. Zambia experienced a drought in the agricultural seasons of 2014/15 and 2018/2019, leading to below-normal maize production in the market (Maggio and Sitko, 2019; Guido et al., 2020; Hove and Kambanje, 2019). Zambia experienced El Nino conditions during the 2014/15 agricultural season, leading to below-average rainfall and drought. Similarly, in the 2018/19 agricultural season, the country encountered another bout of drought. When farmers anticipate a subpar harvest based on widely available forecasts from entities such as the Zambia Meteorological Station, they tend to withhold their maize, refraining from selling. Instead, they increase purchases of the existing maize supply, causing a surge in demand. This heightened demand propels lean season prices upward, resulting in positive market returns for those who have available supplies in storage.

Implications

Our analysis shows negative rainfall shocks are associated with positive seasonal storage returns. Our evidence comes from Zambia, a country reliant on maize as a staple crop. In the face of such droughts, which may become more frequent due to climate change, ensuring affordable lean season prices for staple crops like maize becomes more important. There may be a role for government in targeting grain storage interventions to such periods to mitigate food security impacts of elevated lean season prices.

We also find positive rainfall shocks that increase crop production are associated with negative seasonal storage returns for crops harvested in the previous production period. Our study suggests farmers should carefully consider the probability of negative returns before storing grain based on the seasonal tendency for prices to rise after harvest. This seasonal pattern is a tendency, not a certainty. For farmers with access to forward markets, using forward contracted sales rather than holding grain unpriced in storage can mitigate the risk of negative returns. In contexts where such forward markets are absent, governments and farmer organizations may seek to encourage their development.

References

Caswell, Bess L, Sameera A Talegawkar, Ward Siamusantu, Keith P West, and Amanda C Palmer (2020). “Within-person, between-person and seasonal variance in nutrient intakes among 4-to 8-year-old rural Zambian children”. British Journal of Nutrition 123.12, pp. 1426–1433. https://doi.org/10.1017/S0007114520000732

Chisanga, Brian, Mitelo Subakanya, and Mirriam Makungwe (2018). “Getting it right: How to make grain trade work for Zambia”. In: Indaba Agricultural Policy Research Institute (IAPRI) Working Paper 144. https://doi.org/10.13140/RG.2.2.11325.92643

Guido, Zack, Andrew Zimmer, Sara Lopus, Corrie Hannah, Drew Gower, Kurt Waldman, Natasha Krell, Justin Sheffield, Kelly Caylor, and Tom Evans (2020). “Farmer forecasts: Impacts of seasonal rainfall expectations on agricultural decision-making in Sub-Saharan Africa”. Climate Risk Management 30, p. 100247. https://doi.org/10.1016/j.crm.2020.100247

Hove, Lewis and Cuthbert Kambanje (2019). “Lessons from the El Nino–induced 2015/16 drought in the Southern Africa region”. Current directions in water scarcity research. 2, pp. 33–54. https://doi.org/10.1016/B978-0-12-814820-4.00003-1

Madzivhandila, Tshilidzi, S Sibanda, and FA Gwelo (2016). “Africa Agriculture Status Report 2016”. In: Africa Agriculture Status Report 2016, p. 19.

Maggio, Giuseppe and Nicholas Sitko (2019). “Knowing is half the battle: Seasonal forecasts, adaptive cropping systems, and the mediating role of private markets in Zambia”. Food Policy 89, p. 101781. https://doi.org/10.1016/j.foodpol.2019.101781

Mason, Nicole M., and Robert J. Myers. (2013) “The effects of the Food Reserve Agency on maize market prices in Zambia.” Agricultural Economics 44(2): pp. 203-216. https://doi.org/10.1111/agec.12004

Simtowe, Franklin, and Hugo De Groote. "Seasonal participation in maize markets in Zambia: Do agricultural input subsidies and gender matter?" Food Security 13 (2021): 141-155. https://doi.org/10.1007/s12571-020-01106-y

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.