Measuring Farm Policy, Part 1: Cash Receipts and Program Payments

February finds farm bill reauthorization frozen in the uncertainty of extended continuing resolutions and ongoing dysfunction in Congress (Hill and Downs, January 22, 2024; Downs and Brown, January 29, 2024; Abbott, January 28, 2024; Baethge, January 18, 2024; Weaver, January 22, 2024; Hagstrom, January 19, 2024). Challenges on the floor of the Senate and the increasingly dysfunctional House are matters of concern, but of greater concern is the complete lack of any progress by either committee; farm bill reauthorization has not stalled, it has not gotten started. This lack of progress cannot be blamed on the larger, headline distractions that have Congress careening from debt ceilings, to battles over the Speaker of the House, to funding the government through annual appropriations or continuing resolutions. Impasse at the committee level indicates a fundamental disagreement over specific policy priorities. This article initiates a series measuring farm policy from different angles in search of perspectives on the impasse.

Background

The complex, complicated, and extraordinarily difficult, legislative process with which most everyone is familiar depends on, and begins with, the work at the committee level. Each will have to report its version of legislation to begin the daunting task of the Madisonian double majority (see e.g., farmdoc daily, January 12, 2023). Legislation must run a political gauntlet that is time-consuming and demanding, made more so by a campaign-shortened legislative calendar. It is therefore disconcerting that an entire year of the 118th Congress has passed with little public information about the priorities for farm policy. What little is known has trickled out mostly as rumors in the press, but it all points to a single major impediment: a demand to increase (at least some of) the reference prices in the Price Loss Coverage (PLC) farm payment program. Critically, no actual proposal for increasing reference prices has been produced. There has been no clarity on which crops or what reference price levels and this precludes any analysis about the impacts of such a proposed change. If raising reference prices is a policy priority, the silence on that priority is deafening. In the absence of clarity on this rumored priority, the experiences and outcomes from farm program payments as enacted in the last two Farm Bills provides valuable context for consideration and possible lessons that could be applied.

Discussion

How to measure farm programs and policy? The annual budget baseline from the Congressional Budget Office (CBO) is one critical and necessary measure (see e.g., farmdoc daily, March 2, 2023). Other measures can be drawn from the data reported by USDA’s Economic Research Service, which offers levels of granularity below the topline and baseline produced by CBO (USDA-ERS, November 30, 2023). Among other things, that information offers comparative perspectives on farm policy.

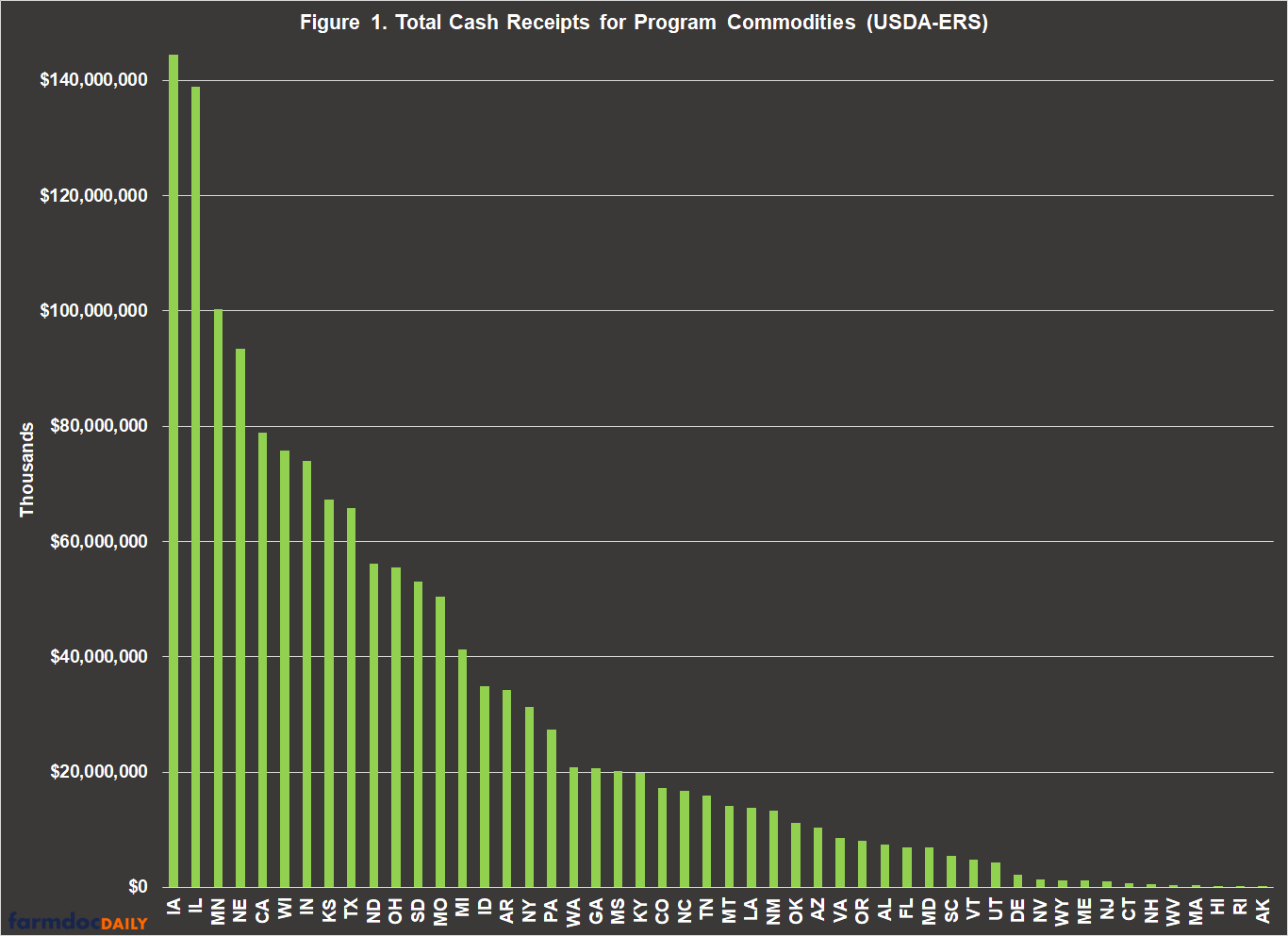

While ERS reports on all sectors of agriculture, the farm payment programs only provide payments to farmers with base acres of 23 listed commodities defined as “covered commodities” in the statute, as well as to dairy farmers who enroll in the Dairy Margin Coverage Program. To begin taking the measure of farm payment programs, Figure 1 illustrates the total cash receipts by state for the program commodities (the 23 covered commodities and dairy) as reported by ERS during the two previous farm bill timeframes (2014 to 022). The states are presented from the highest cash receipts for these commodities (Iowa) to the lowest (Alaska).

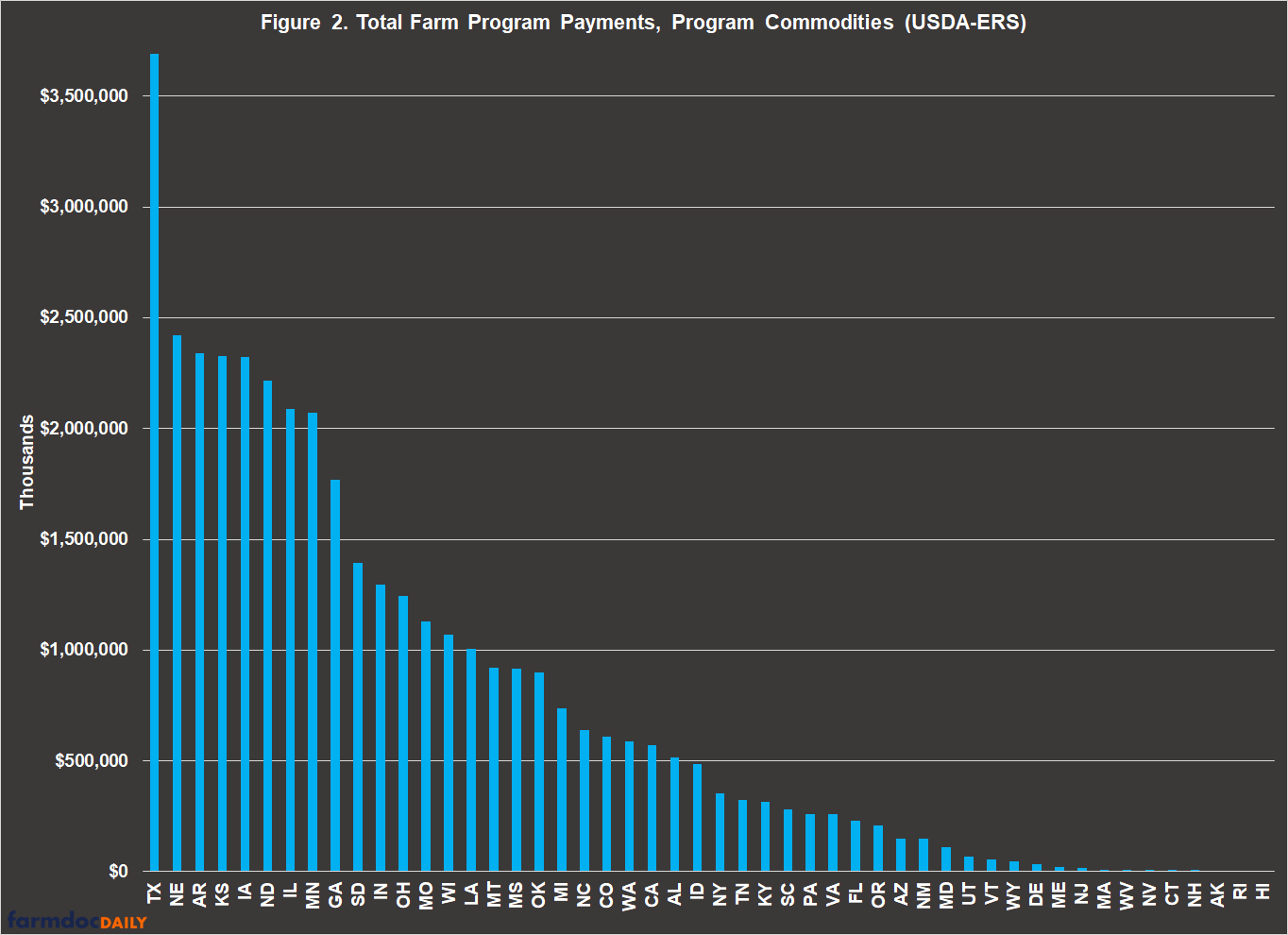

ERS also reports all direct government payments to farmers. Figure 2 illustrates the total payments by state for the farm payment programs (Agriculture Risk Coverage, Price Loss Coverage, Marketing Assistance Loans, and Dairy Margin Coverage) for the same two Farm Bill time frames. Again, the states are ranked from the highest average farm program payments (Texas) to the lowest (Hawaii).

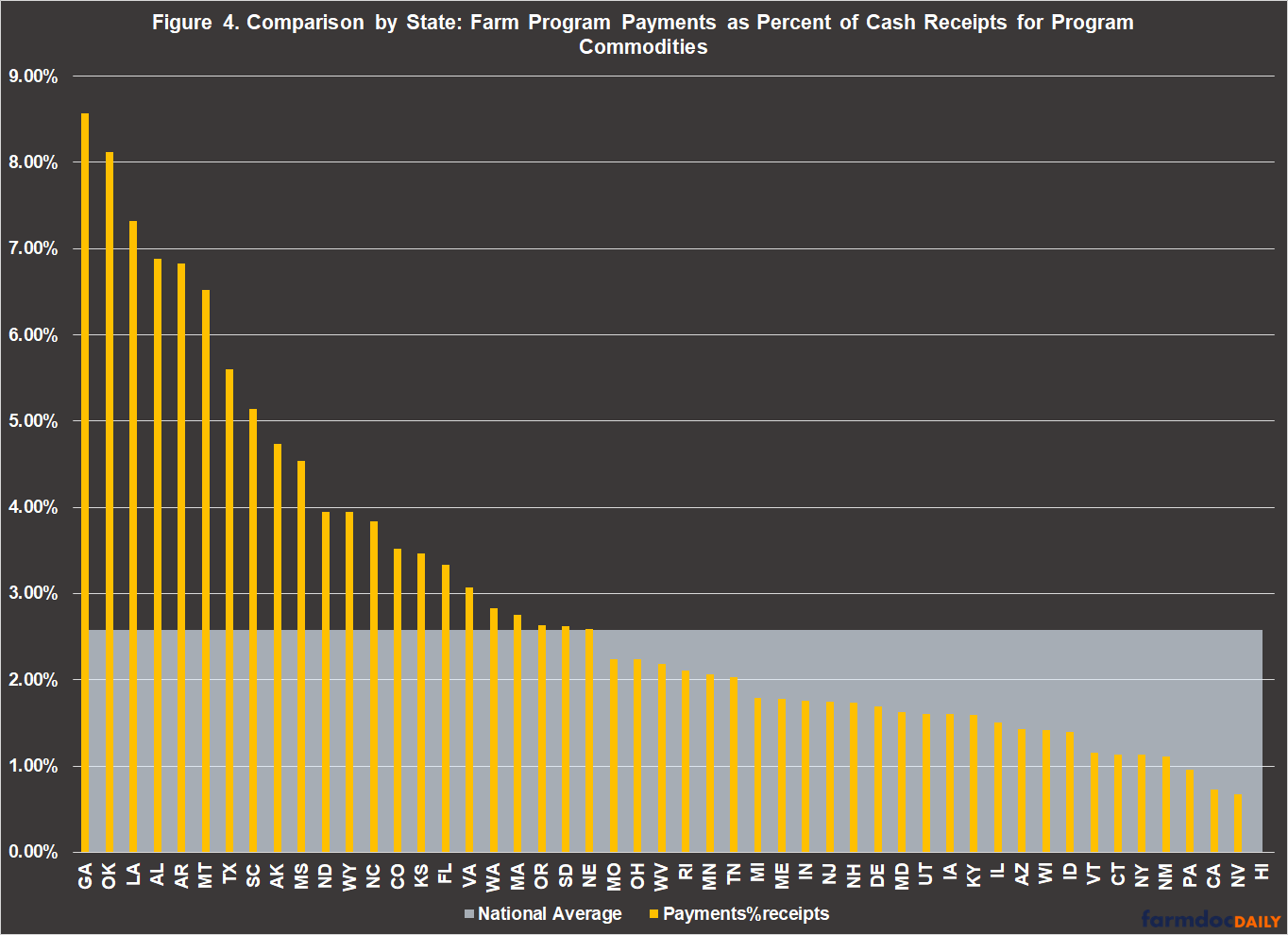

Figure 3 maps a comparison of farm program payments in Figure 2 and cash receipts for those crops that receive the payments (Figure 1). The comparison for each state uses the total farm payments as a percent of the total cash receipts for the commodities that receive the payments. The map uses the average for the entire 2014 to 2022 timeframe, but also includes separate percentages for 2014 to 2018 and for 2019 to 2022, approximating the previous two farm bills (respectively). For additional perspective, the average share of program commodities cash receipts to all commodities cash receipts in these years is also included. The national percentage from 2014 to 2022 was 2.58%; it was 3.33% from 2014 to 2018, and 1.83% from 2019 to 2022. Nationally, the program commodities account for 41% of the cash receipts for all commodities in those years.

Figure 4 illustrates the data in Figure 3 with farm program payments as a percentage of cash receipts for the program commodities, by state and ranked from highest (Georgia, 8.57%) to lowest (Hawaii, 0%).

As viewed through a comparison of farm program payments to cash receipts for those commodities that receive the payments, the programs in the previous two farm bills have disproportionately benefitted farmers in some states with notable differences among the states primarily producing program commodities. Of course, this is only one measure and a single angle with which to view the issue. Future articles will use other measures for additional comparisons and context, providing perspectives from multiple angles.

Concluding Thoughts

This method for measuring farm policy indicates important disparities among the states, including the states primarily producing the program commodities. These disparities are by this point rather familiar to those who follow farm policy and politics. By this measure—farm program payments as a percent of cash receipts for the program commodities—farmers in the southern states have benefitted disproportionately from farm policy in the two previous farm bills. While it may not always be welcomed, reality strikes a discordant note only to those that don’t want it heard. It remains notable that an issue of this magnitude—the demand to increase the reference prices that trigger payments in the Price Loss Coverage (PLC) program—remains a complete mystery after an entire year. To the extent that it presents the most critical impediment to beginning farm bill reauthorization at the committee level, then progress cannot be achieved absent a concrete proposal—which crops and what reference price levels—has been put forward, analyzed and evaluated. Reauthorization proceeds through consideration, negotiation, and debate; it is public policy, after all, which entails the expenditure of taxpayer funds. The onus to make the public case is on the proponents of the policy or priority. For now, evaluation includes reviewing the results and experiences of the policy as it has operated.

References

Abbott, Chuck. “Farm bill debate will continue into ‘the meat’ of 2024 election.” FERN’s Ag Insider, thefern.org, January 28, 2024. https://thefern.org/ag_insider/farm-bill-debate-will-continue-into-the-meat-of-2024-election/.

Baethge, Joshua. “Stabenow lays out farm bill priorities.” FarmProgress.com. January 18, 2024. https://www.farmprogress.com/farm-policy/stabenow-lays-out-farm-bill-priorities.

Coppess, J. "A Deeper Dive into the February 2023 CBO Baseline: Title I Commodities Programs." farmdoc daily (13):38, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, March 2, 2023.

Coppess, J. "Considering Congress, Part 4: The Double Majority." farmdoc daily (13):6, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, January 12, 2023.

Downs, Garrett and Marcia Brown. “Appropriators clear crucial hurdle for funding USDA.” Politico.com. January 29, 2024. https://www.politico.com/newsletters/weekly-agriculture/2024/01/29/appropriators-clear-crucial-hurdle-for-funding-usda-00138287.

Hagstrom, Jerry. “Boozman Silent on Stabenow Farm Bill Letter.” DTN/Progressive Farmer. January 19, 2024. https://www.dtnpf.com/agriculture/web/ag/news/article/2024/01/19/boozman-silent-stabenow-farm-bill.

Hill, Meredith Lee and Garrett Downs. “Lawmakers clash over farm bill future.” Politico.com. January 22, 2024. https://www.politico.com/newsletters/weekly-agriculture/2024/01/22/lawmakers-clash-over-farm-bill-future-00136891.

Weaver, Amber. “Senate Ag Chair Debbie Stabenow on the Farm Bill: ‘Time to get serious.’” RFDtv.com, January 22, 2024. https://www.rfdtv.com/senate-ag-chair-debbie-stabenow-on-the-farm-bill-time-to-get-serious.

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.