Cotton STAX and Modified Supplemental Coverage Option: Concerns with Moving Crop Insurance from Risk Management to Income Support

The Farm Bill version reported by the House Agricultural Committee would modify Supplemental Coverage Option (SCO), a crop insurance policy that provides county-level coverage. Because the modifications proposed for SCO would make it very similar to the STAX insurance program for cotton, we evaluate the historical performance of STAX to provide indications of how modified SCO could operate. Since it was first available in 2015, STAX has paid over 50% of the time and has averaged $37 per insured acre more in insurance payments than farmer-paid premiums, making STAX more like an income support program rather than a crop insurance program. Income supports often increase cash rents and land values, thereby negating a portion of the risk protection offered by crop insurance. Moreover, STAX and the modified SCO could influence planting decisions, adding distortions to the market that decrease prices and lower farm income.

Description of Cotton STAX and Modified SCO

The Stacked Income Protection Plan for Upland Cotton (STAX) was enacted by Congress in the 2014 Farm Bill. At the time, upland cotton base acres were excluded from the two commodity title programs (ARC and PLC) in response to a settlement of the World Trade Organization (WTO) dispute with Brazil and four other countries over cotton subsidies (farmdoc daily, April 13, 2017; January 11, 2018). STAX was effectively an alternative to PLC and ARC, along with a Cotton Transition Assistance Program (CTAP). In 2018, Congress created seed cotton as a covered commodity and allowed seed cotton base to be eligible for ARC and PLC payments in 2018 (farmdoc daily, February 14, 2018). Congress prohibited farmers from using cotton STAX on farms enrolled in PLC or ARC for seed cotton (7 U.S.C. §1508b). STAX remains a commodity title alternative for cotton.

STAX provides county-level coverage in five-point increments from a maximum of 90% down to a minimum of 70% and the coverage is “stacked” on top of underlying coverage or can be purchased separately as a stand-alone policy. If a farmer chooses a 90% coverage level, STAX will pay when county revenue falls below 90% of expected revenue. If county revenue is 85%, STAX would pay an indemnity for a 5% loss: 90%—85%. The full 20% range is paid if actual county revenue is below 70% of expected county revenue.

STAX’s premium is subsidized at 80%, meaning that farmers pay 20% of the total premium. The Risk Management Agency (RMA) sets the total premium with the goal that premiums should average 14% higher than indemnity payments. The 14% is a loss reserve. As a result, the loss ratio—which equals indemnity payments divided by total premium—should average .88 over time. Given proper premium setting, indemnity payments should average 4.4 times more than farmer-paid premiums for STAX. In general, at a coverage level below 100% of the expected, the policy should pay less than 50% of the time.

The House proposes modifying SCO so that it would similarly provide county coverage from a 90% coverage level with an 80% premium subsidy (see farmdoc Daily, June 4, 2024, for a discussion of SCO and ECO). Three provisions differ between modified SCO and STAX:

- Farmers can purchase a protection level of up to 1.2 for STAX but are only allowed to buy a protection level to 1.0 for SCO. A 1.2 protection level increases both premiums and payments by 20% relative to a 1.0 protection level.

- STAX is limited to a minimum band from 90% to 70%, while SCO can offer coverage below 70% when the COMBO product is below 70%.

- If STAX is used on an FSA farm, the farmer is ineligible for seed cotton commodity title payments (ARC or PLC). For SCO, farmers would be prohibited from taking ARC as the commodity title alternative but could take PLC. If SCO coverage is modified to 90% with an 80% subsidy, there does not appear any justification for excluding farmers who elect ARC from purchasing SCO.

Performance of STAX

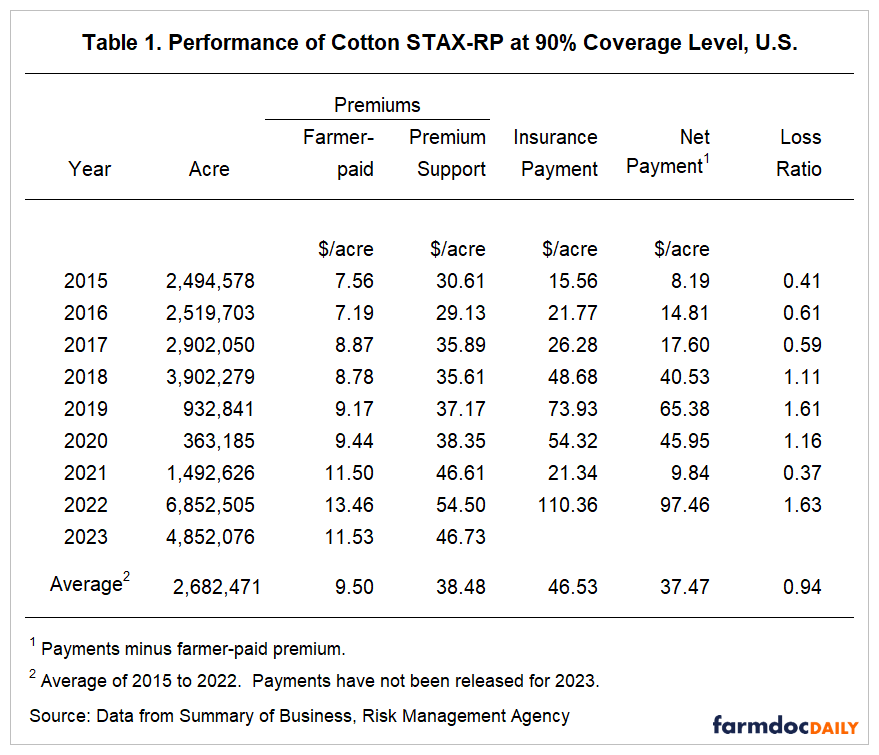

Table 1 shows performance of STAX that mimics Revenue Protection (RP) as the underlying product and has a 90% level. Other products not reported in Table 1 have coverage levels below 90% and provide RP with harvest price exclusion protection. Since the SCO enhancement increases coverage levels to 90% and most farmers choose RP, we use STAX-RP 90% as representative of proposed changes to SCO. Moreover, STAX-RP 90% accounts for 91% of insured STAX acres.

Since its inception, STAX-RP 90% has had an average enrollment of 2,683,471 acres (see Table 1), about 26% of acres enrolled in cotton crop insurance programs. STAX enrollment increased steadily from 2,494,578 acres in 2015 to 3,902,279 acres in 2018, a typical pattern as farmers become more familiar with a new program. Notably, STAX acres fell in 2019 to 932,841 acres and then again in 2020 to 363,185 acres. The introduction of seed cotton commodity title program in 2018 may have impacted these declines. As noted above, farmers must choose between STAX for upland cotton and PLC/ARC for seed cotton but could not elect both. This pattern reversed in recent years as acres enrolled in STAX increased while seed cotton base acres enrolled in PLC and ARC dropped. In 2022, STAX-insured acreage levels exceeded all previous years, with enrollment of 6,852,505 acres and 4,852,076 acres in 2023. These amounts represent 53% and 48% of insured cotton acres in those years, respectively.

From 2015 to 2022, farmers paid an average of $9.50 per acre (see Table 1). Premium support averaged $38.48 per acre. On average, farmers received $37.47 more in indemnity payments than they paid in premiums (i.e., net payments in Table 1). The loss ratio averaged .94, close to the 0.88 loss ratio target.

From 2015 to 2022, cotton STAX was sold in 572 counties. On average, STAX paid 59% of the cases in which it was offered. Given historical performance, farmers should expect to get a STAX indemnity payment in over 50% of the years. Performance did vary across counties. Of the counties in which purchases were made in all years from 2015 to 2022, one county received a payment in only one year: Fayette County, Tennessee. On the other hand, five counties in Georgia received payments in all years: Baker, Dougherty, Miller, Turner, and Webster.

Overall, STAX performance can be summarized by:

- Farmers paid less in farmer-paid premiums than they received in indemnity payments; Farmers averaged a net payment of $37.47 per acre.

- STAX made payments in 59% of the years, a puzzling high incidence rate given that coverage below the expected revenue usually has incidence rates less than 50%.

- Federal premium support averaged $38.47 per acre.

- The loss ratio of .94 was near the .88 target loss ratio.

Delivery of Federal Subsidies to Farmers through Crop Insurance

Crop insurance premiums have always been subsidized, with the goal of inducing farmers to use crop insurance to manage the considerable risks of farming. The historic costs of insurance are likely one of the main reasons farmers were reluctant to purchase crop insurance. Premiums must have significant subsidies before most acres of a crop are insured. If crop insurance subsidies went away, multi-peril crop insurance offered by RMA would dwindle in use, thereby making it difficult to offer an actuarily sound program. Still, the goal of that subsidization is to help farmers manage the risks of production, thereby avoiding problems with farm financial instability. High subsidies at high coverage levels cause crop insurance to be more like an income support program than a risk program. With cotton STAX, farmers receive a payment in most years that exceed farmer-paid premium. Similarly, modified SCO will be more like an income support program than a risk management program.

Income support programs do have negative consequences. A portion of the income support becomes capitalized into cash rents and farmland prices (see Kirwin and Roberts). That is, the income support increases both cash rents and land prices, thereby increasing costs. To a certain extent, the increase in costs caused by capitalization of payments increases the risks that farm revenue falls below costs, negating some of the risk management offered by the crop insurance product.

When tied to a planted crop, income support programs have the potential to influence acreage decisions, thereby distorting markets and lowering crop prices. STAX and modified SCO are tied to acreage decisions as the crop must be planted to receive insurance. The U.S. Department of Agriculture budgets for cotton in the U.S. indicated that gross value of production minus all costs except farmland averaged $23.09 per acre from 2015 to 2022 (see Economic Reporting Service, Commodity Costs and Returns). A $37 net indemnity from STAX more than doubled the average return. Farmers could plant more acres of cotton because of a $60 total return ($37 net indemnity from STAX Plus $23 net return) rather than only a $23 return from the market. Overall, more acres lead to higher supply, which then has historically led to lower prices and reduced farm incomes, thereby further offsetting risk management benefits from the policy.

Summary

High subsidy rates and area-based coverage for the existing STAX program for cotton and proposed modifications to SCO for a large group of other crops result in policies that behave less like traditional crop insurance and more like policies that deliver subsidies to farmers. Income support programs can increase cash rents and land values. Those increased costs then negate a portion of the risk protection offered by the crop insurance policies. Because they are tied to acreage decisions, cotton STAX and modified SCO could distort planting decisions. If taken to the extreme, income support programs can cause severe market distortions, higher supplies, and lower commodity prices.

Older research conducted by agricultural economists indicated that crop insurance was relatively free of distorting impacts, but that research was conducted when crop insurance was at much lower coverage levels and lower subsidy rates. Both cotton STAX and a modified SCO occur at high coverage levels with high subsidy levels. Cotton STAX is limited to one crop grown predominately in one region. Modified SCO will impact many crops and all regions of the U.S. It raises substantial concerns for farmers, crop insurance, and the federal taxpayer to enact a program with potentially adverse impacts over much of the U.S.

STAX came into existence because of a trade dispute brought on by acreage impacts from high support levels. To enact a remedy that then exaggerated those problems for a larger set of crops would be ironic.

References

Coppess, J., G. Schnitkey, N. Paulson and C. Zulauf. "Beneath the Label: A Look at Generic Base Acres." farmdoc daily (7):68, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, April 13, 2017.

Coppess, J., G. Schnitkey, N. Paulson and C. Zulauf. "Reviewing the Latest Cotton Proposal." farmdoc daily (8):5, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, January 11, 2018.

Coppess, J., N. Paulson, G. Schnitkey and C. Zulauf. "Farm Bill Round 1: Dairy, Cotton and the President’s Budget." farmdoc daily (8):25, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, February 14, 2018.

Kirwan, B. E. and M. J. Roberts. 2016. Who Really Benefits from Agricultural Subsidies? Evidence from Field Level Data. American Journal of Agricultural Economics. Volume 98(issue 4), pages 1095-1113. https://doi.org/10.1093/ajae/aaw022

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.