Revised 2024 Illinois Crop Budgets

We present revisions to the 2024 Crop Budgets for Illinois, highlighting changes from our January release for high-productivity farmland in central Illinois while discussing the more general trends across regions. We have revised corn and soybean prices down, while cost adjustments were mixed. Farmer return projections for corn are improved across regions, while soybean return expectations are improved for southern Illinois but similar or lower for other regions. However, farmer return projections remain negative for both corn and soybeans across regions assuming average cash rent levels.

Budget Revisions

The 2024 Crop Budgets for Illinois were initially released in August of 2023 (farmdoc daily, August 29, 2023). As is customary, we revised budgets in January 2024 (farmdoc daily, January 9, 2024). Today’s budget revision reflects our final full release of 2024 projections and includes adjustments in revenues and costs for the 2022 and 2023 crop years based on information from the Illinois Farm Business Farm Management Association (FBFM), as well as changes to 2024 projections based on commodity and input market changes since January.

Two farmdoc publications provide additional details on budget and historical return updates for corn, soybeans, and wheat across all Illinois regions. These are the 2024 Crop Budgets for All Regions and Revenue and Costs for Illinois Grain Crops, both of which can be accessed under the Management section of farmdoc.

The revisions to 2024 projections can be summarized by:

- A downward revision to the 2024 soybean price from $11.50 to $11.30.

- Changes to various cost categories, generally leading to slightly lower costs across regions, which are based on observed costs for the 2023 crop and updated projections for 2024.

- Improvements in corn returns across regions. Lower soybean returns in northern and central Illinois, and improved soybean returns in southern Illinois. Farmer return projections, which account for regional average cash rents, remain negative across regions for corn and soybeans.

Projected Prices

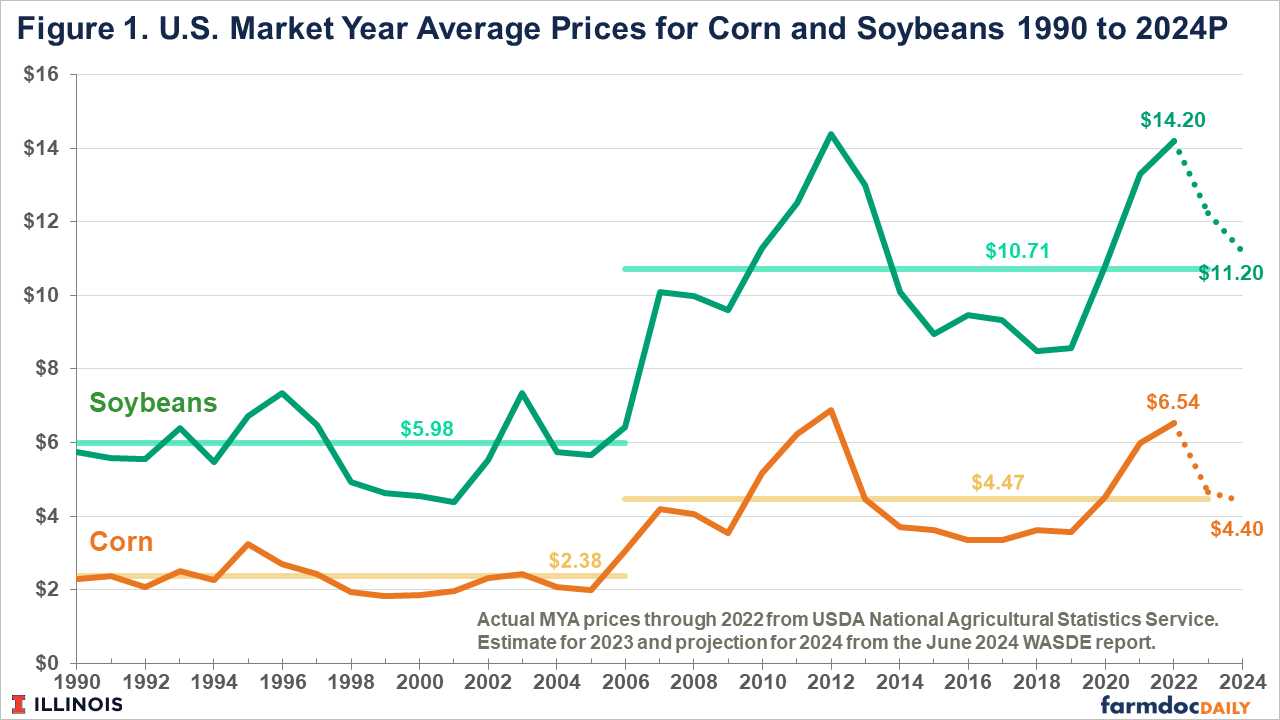

Corn and soybean prices have continued to decline relative to previous highs in the 2022 marketing year. Figure 1 shows the marketing year average (MYA) prices from 1990 through 2022, with the most recent estimates for 2023 and 2024 from USDA’s June WASDE report. USDA’s current projection for 2024 prices for corn and soybeans are $4.40 and $11.20, respectively. These price projections represent returns to price levels closer to MYA averages since 2006 ($4.47 for corn and $10.71 for soybeans).

Our budget revision includes a corn price of $4.50 and soybean price of $11.30 for Illinois for 2024. The soybean price represents a $0.20 reduction compared with our January budgets. The prices in our budgets reflect a combination of recent fall grain bids in Illinois, assumptions about farmers’ marketing activities, USDA’s WASDE projections, and the futures-based forecasting approach utilized by USDA’s Economic Research Service.

Costs and Returns

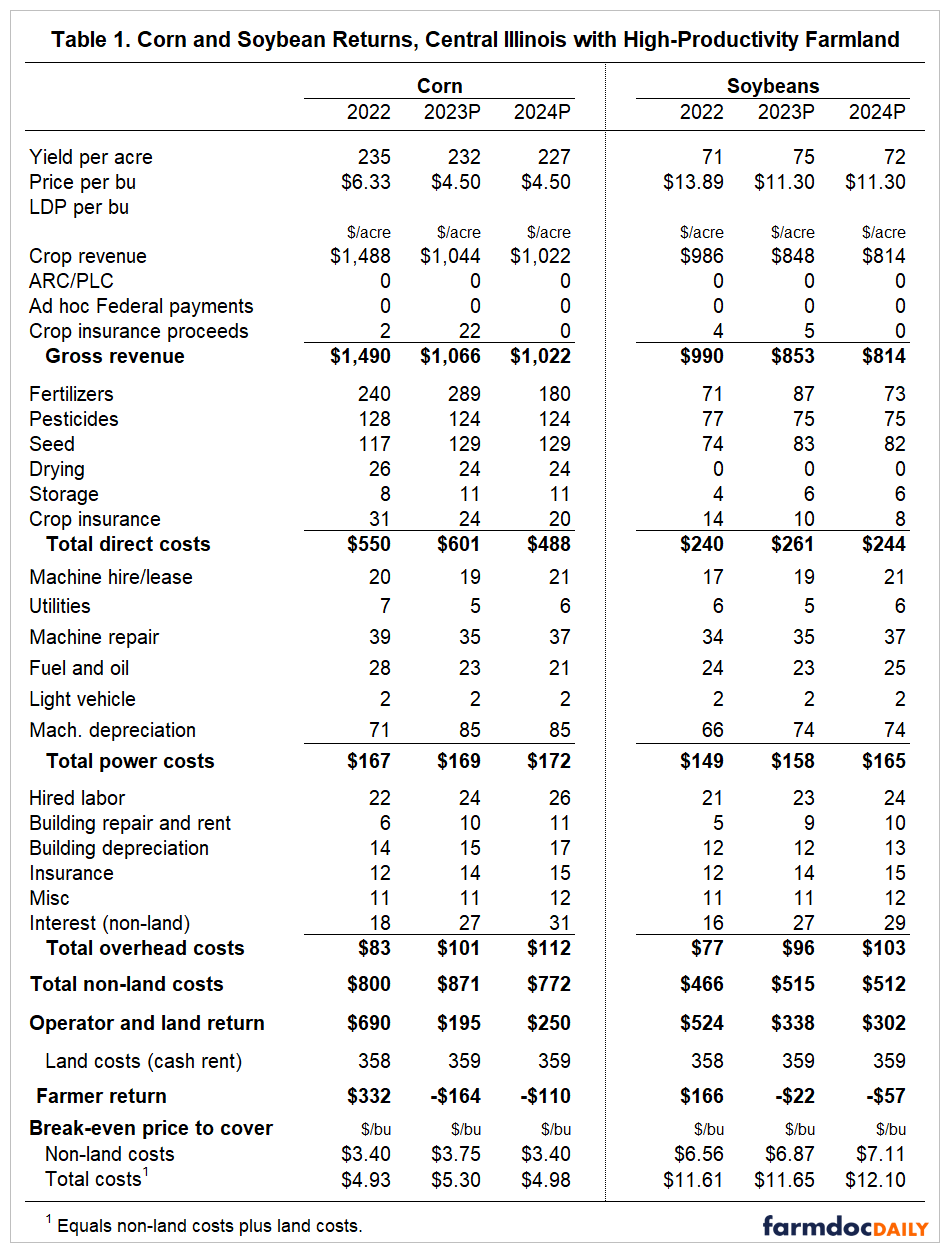

Table 1 reports revenues, costs, and returns for corn and soybeans in the central Illinois region on high-productivity farmland. The 2022 and 2023 figures are summarized from grain farms enrolled in Illinois FBFM.

Estimates for 2023

The 2023 figures remain estimates as farmers continue to market the 2023 crop and further revisions to insurance proceeds and some cost categories are common.

Adjustments to budgets for 2023, relative to the January release, include improved crop yields, lower prices, and updated estimates of crop insurance indemnity payments, as well as adjustments to costs reflecting information from FBFM records. Higher than earlier projected costs result in lower corn returns, and slightly improved soybean returns, for 2023 compared with our January projections for central Illinois.

Revised Projections for 2024

The 2024 figures are our revised crop budget projections. We continue to assume trend yields across regions, which are 227 bushels per acre for corn and 72 bushels per acre for soybeans in central Illinois. As previously discussed, the soybean price is revised down from $11.50 (in January) to $11.30.

The most significant cost adjustments for corn are reductions for pesticides and crop insurance premiums in the direct cost category and in fuel and oil under power costs. Lower crop insurance premiums reflect the lower projected prices, relative to the past few years, that were established in February. Overhead cost projections are increased due mainly to higher interest costs. Farmer return projections for central Illinois improve relative to January but remain negative. The break-even corn price to cover non-land costs is now estimated at $3.40 per bushel, while the break-even to cover all costs, assuming an average cash rent level, is $4.98 per bushel.

Insurance premiums for soybeans are reduced down while interest charges are increased. Soybean returns remain fairly similar to January projections. The break-even soybean price to cover non-land costs is estimated at $7.11 per bushel. The break-even soybean price estimate increases to $12.10 per bushel to cover all costs.

Adjustments to costs for other regions in Illinois were similar for 2024. Relative to January, projections for pesticides, crop insurance premiums, and some power costs have been reduced for corn. Lower direct cost projections for soybeans are mainly due to insurance premium reductions while power cost projections remain similar to or higher than January projections. Higher interest charges have increased overhead costs projections for both corn and soybeans in most regions.

Figure 2 shows historical operator and land returns and average cash rent levels for a 50-50 corn-soybean rotation on high-productivity farmland in central Illinois. The net effect of lower prices and elevated non-land costs results in 2023 and 2024 operator and land returns falling back below $300 per acre – levels last experienced in multiple years from 2014 to 2019. Increases in average cash rent levels since 2020 result in negative overall return estimates for 2023 and projected for 2024.

Commentary

Commodity price declines since 2022 combined with production costs at elevated levels have resulted in projected operator and land returns declining to levels experienced from 2014 to 2019. Current cash rent levels continue to imply negative farmer returns for corn and soybeans across all regions of Illinois for 2024.

Much can still change that would impact return projections for 2024. Higher returns could be realized if prices improve due to positive demand shocks or negative shocks to supplies from areas outside the U.S. that could increase commodity prices.

Lower returns could also occur. For example, excessive rain across much of the central and upper Corn Belt could negatively impact crop yields. Pest pressures during the remainder of the growing season could increase costs. Moreover, the risk of further downward price pressures continues to exist if the U.S. or other major production regions of the world have stronger than expected crop yields, or if demand weakens (see farmdoc daily article from May 13, 2024 for further discussion). Crop insurance, commodity programs, and the potential for other Federal assistance could partially offset some of these lower return scenarios.

Current projections suggest a second consecutive year of low to negative returns for many farms. Further cost adjustments and strategies should be considered and implemented, particularly if current commodity price levels persist as planning for the 2025 crop year approaches.

Acknowledgment

The authors would like to acknowledge that data used in this article comes from Illinois Farm Business Farm Management (FBFM) Associations across the state. Without their cooperation, information as comprehensive and accurate as this would not be available for educational purposes. FBFM, which consists of 5,000 plus farmers and 65 plus professional field staff, is a not-for-profit organization available to all farm operators in Illinois. FBFM field staff provide on-farm counsel with recordkeeping, farm financial management, business entity planning and income tax management. For more information, please contact the State FBFM Office located at the University of Illinois Department of Agricultural and Consumer Economics at 217-333-8346 or visit the FBFM website at www.fbfm.org.

References

Janzen, J. "Sizing Up Potential Downside Risk for New-Crop Corn and Soybean Prices." farmdoc daily (14):90, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, May 13, 2024.

Paulson, N. and G. Schnitkey. "Revised 2024 Crop Budgets." farmdoc daily (14):6, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, January 9, 2024.

Schnitkey, G., N. Paulson, C. Zulauf and J. Baltz. "2024 Crop Budgets." farmdoc daily (13):157, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, August 29, 2023.

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.