Policy Design Case Study: EQIP and the Inflation Reduction Act

August has arrived; named by the Ancient Romans for Augustus Ceasar, it is the last full month of the summer season and the beginning of the end of the dog days of summer (Boeckmann, June 28, 2024; Andrew, July 18, 2024; Avet, Terrebonne Parish Library; Boeckmann, June 21, 2024). It is also when Congress takes its annual month-long recess, a practice that traces to 1968 (U.S. Senate, August 11, 2023; Staneck, August 4, 2014). With no Farm Bill on the horizon, this week’s article returns to the Inflation Reduction Act and analysis of the conservation investments by USDA. In terms of policy design, the IRA offers a potential case study via implementation of the Congressional direction on use of the funds and how practices drive allocations.

Background

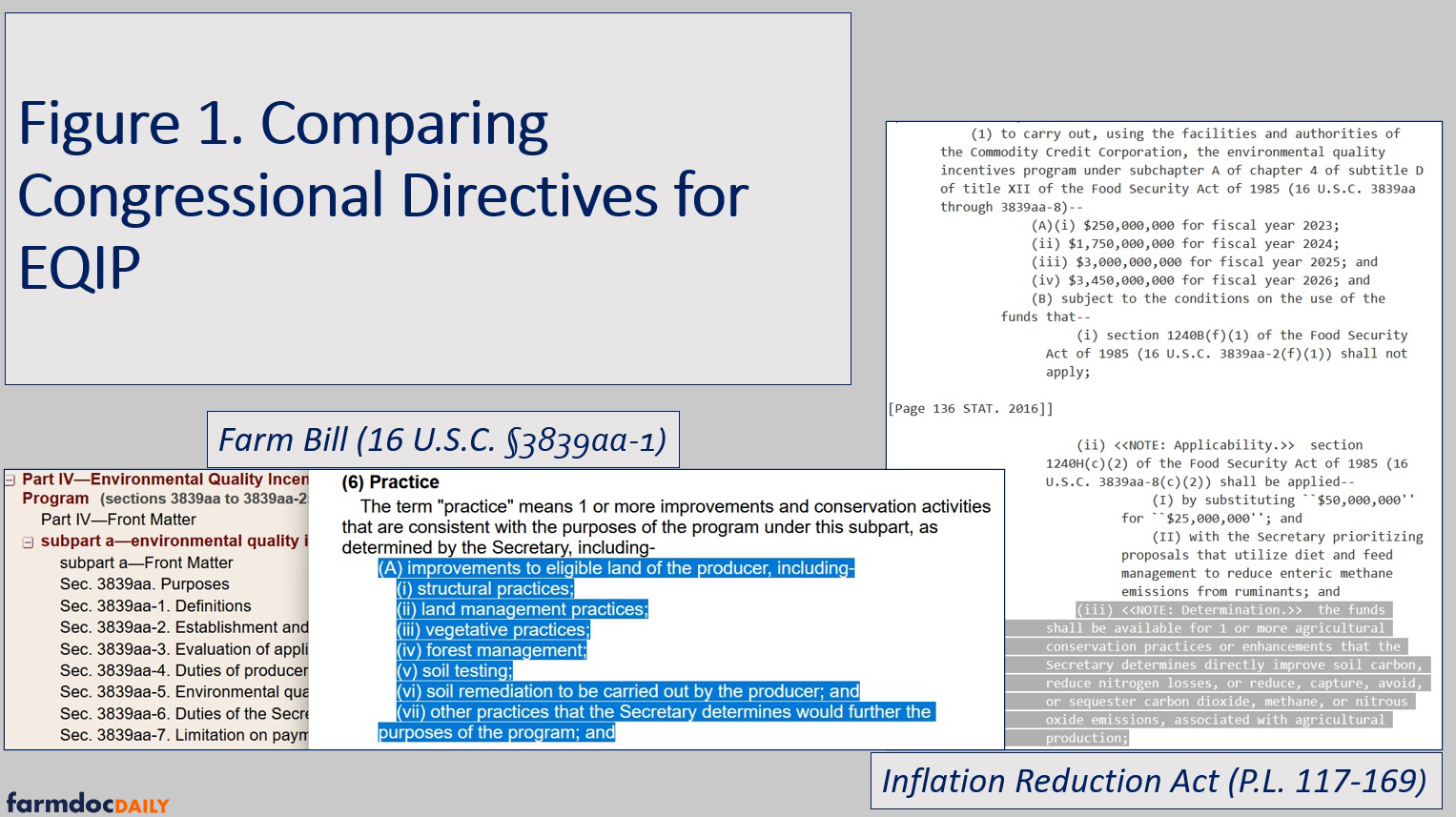

On August 16, 2022, President Joe Biden signed into law the Inflation Reduction Act of 2022 (P.L. 117-169). Among other things, the Inflation Reduction Act (IRA) included an $18 billion investment of additional funds appropriated to four Farm Bill Conservation programs: Environmental Quality Incentives Program (EQIP); Conservation Stewardship Program (CSP); Agricultural Conservation Easement Program (ACEP); and Regional Conservation Partnership Program (RCPP). Technically, Congress appropriated specific additional funding for each program which is known as Budget Authority (BA). The funds appropriated are available to USDA to spend on conservation practice assistance to farmers. Importantly, Congress limited the use of the funds for only those conservation practices that USDA determined “directly improve soil carbon, reduce nitrogen losses, or reduce, capture, avoid, or sequester carbon dioxide, methane, or nitrous oxide emissions, associated with agricultural production” (P.L. 117-169). Figure 1 summarizes a comparison of the Congressional directives in the Farm Bill and the IRA for EQIP.

The conservation funding in the IRA provides a potential policy design case study because Congress both added funding and limited the use of that funding. Depending on how USDA operates the allocation of this additional funding, the IRA can provide useful comparisons with the conservation programs in the Farm Bill, which are the same programs but with different funding levels and for more practices. The discussion below reviews the data reported by USDA’s Natural Resources Conservation Services for Inflation Reduction Act funding through the Environmental Quality Incentives Program (EQIP), which is the primary working-lands conservation program and provides cost-share assistance for adopting conservation practices (NRCS: RCA Data Viewer; see also, farmdoc daily, April 13, 2023).

Discussion

In the Inflation Reduction Act, Congress appropriated a total of $8.45 billion of additional funds to EQIP for the limited set of practices quoted above. The appropriations were in fixed amounts through fiscal year (FY) 2026 but are available for NRCS to obligate through FY2031. For FY2023, Congress appropriated $250 million; by comparison, the Farm Bill provided $2.025 billion for EQIP in FY2023 for a total of $2.275 billion in EQIP funding, of which IRA is about 11% (16 U.S.C. §3841). NRCS has translated the appropriations and Congressional directive for FY2023 and FY2024 (see, USDA-NRCS, “Climate-Smart Mitigation Activities” and “Climate-Smart Agriculture and Forestry (CSAF) Mitigation Activities List for FY2024,” November 2023 and for FY2023). Close observers will note that NRCS reports funding for some practices that are not listed. NRCS explains that some conservation practices “facilitate the management or the function” of a listed practice, although not meeting the Congressional intent or not having a “quantifiable benefit” and provides examples. While understandable, this does raise questions about whether such practices should be receiving the limited IRA funds or should be funded through existing Farm Bill funds. This may also present a question of timing, in that the appropriated funds increase from FY2023 to FY2026 which may argue for starting with a more limited set of practices before increasing them.

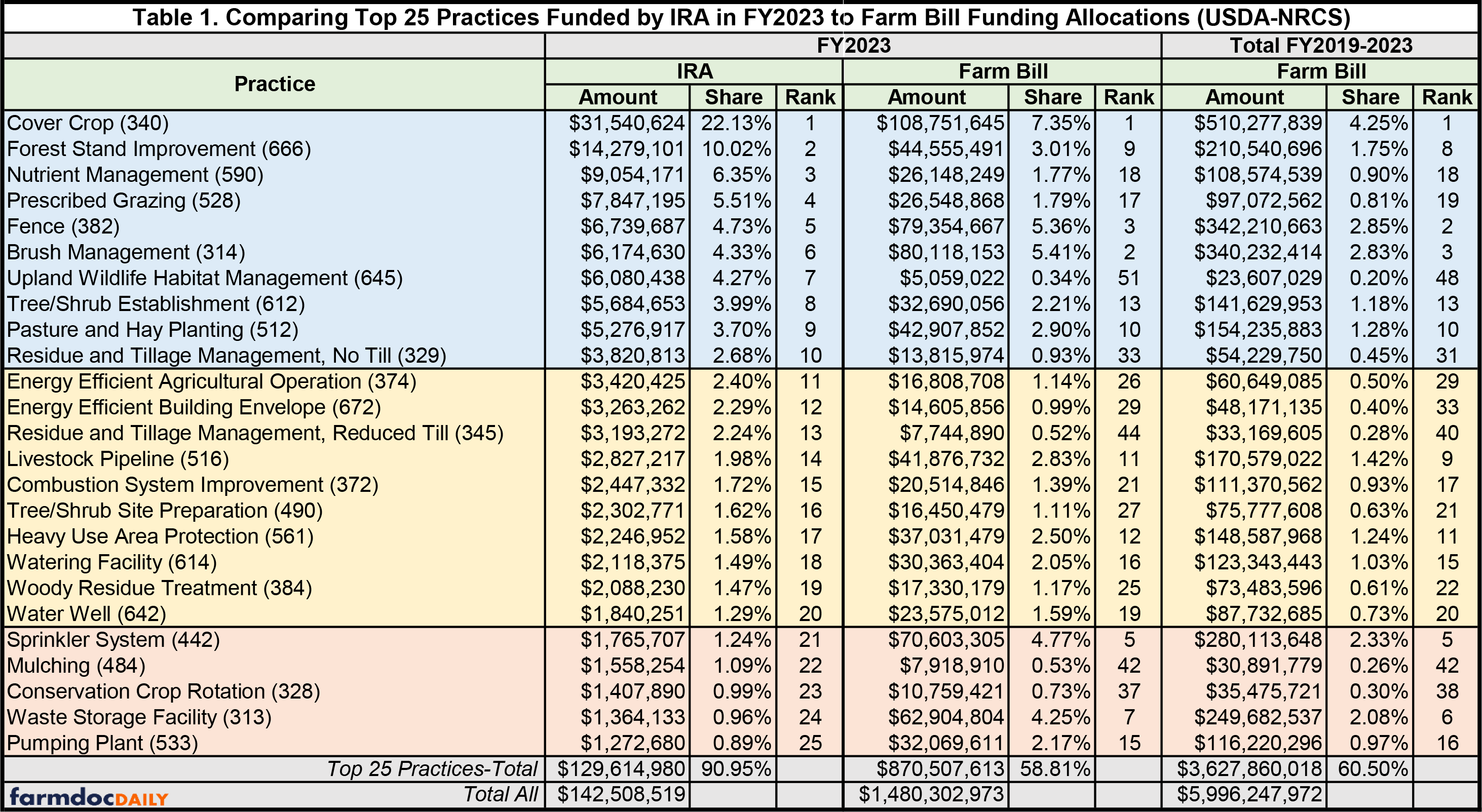

NRCS reports a wealth of data on conservation practices and funding (NRCS: RCA Data Viewer). Depending on the specific download (Total, State, Congressional District, or County), NRCS reports between $126.7 million (County) and $144.6 million (State) in total obligations for FY2023 from the IRA EQIP appropriations. The IRA funds account for nearly 9% of total EQIP conservation spending in FY2023 (both Farm Bill and IRA). Using the Total download, NRCS reports 155 practices received funding from Farm Bill EQIP funds in FY2023 (249 practices have received some funds from 2019 to 2023) and 82 practices received funding from the IRA EQIP appropriation. Overall, 9% of IRA funding for EQIP is allocated to roughly 53% of the total practices funded by Farm Bill. Table 1 provides more detail on the top 25 practices funded with IRA appropriations, including amount, share of total IRA funding and ranking. Table 1 also compares IRA funding in FY2023 with the FY2023 Farm Bil funding and the total Farm Bill funding from FY2019 to FY2023 for the top 25 IRA funded practices. For example, cover crops received the largest share of IRA and Farm Bill funding with 22% of IRA funds and 7% of FY2023 (4.25% of FY2019-2023) Farm Bill funds allocated to that practice.

In the Farm Bill, Congress authorized categories of practices eligible to receive EQIP funding and allocates at least half of the funds for livestock production and grazing management (16 U.S.C. §3839aa-1; 16 U.S.C. §3839aa-2). In the IRA, Congress directed that the additional funds be used for a subset of those practices but left much to the discretion of USDA. Decisions by USDA officials as to which practices meet Congressional determine the allocation of funds among the States and farmers. The Policy Design Lab has been updated to include the IRA funding for EQIP with visualizations for the funds spent in FY2023 (see farmdoc daily, April 13, 2023). It also applies that allocation of funds to the total Budget Authority to project the allocations by State and conservation practices for the entire IRA appropriation. Users can select visualizations by conservation practice for analysis of funding allocations by State, including multiple practices for comparative and performance analysis.

In the table below the map, further data on performance is available and users can compare the amounts paid for the practice by State, as well as select the percentage to view which States received the most for that practice. The table also includes the practice instance counts reported by USDA. All data can be exported to a CSV file for further use and analysis. Selecting cover crops, for example, indicates that Iowa ($3.4 million; 10.97%), Missouri ($3.1 million; 9.99%), Arkansas ($2.5 million; 7.97%), Mississippi ($.4 million; 7.65%), and Georgia ($2.1 million; 6.84%) were the top five recipients of funds for that practice. Overall, Texas was the top recipient of EQIP IRA funds in FY2023 ($12.3 million; 10.12%), followed by California ($5.9 million; 4.81%), Mississippi ($5.2 million; 4.28%); Arkansas ($4.7 million; 3.87%), and New Mexico ($4.4 million; 3.6%). Notably, this generally aligns with EQIP Farm Bill funding allocations from 2018 to 2022, also available from the Policy Design Lab (https://policydesignlab.ncsa.illinois.edu/eqip).

Concluding Thoughts

The impasse over Farm Bill reauthorization continues into the annual August Congressional recess. A potential lame duck session after the elections remains the only option for reauthorization but is a considerable longshot and the odds of another extension increase. Unless and until Congress changes it, the additional conservation investments enacted in the Inflation Reduction Act of 2022 will continue. To date, NRCS has provided a wealth of data on program operation, including for the IRA. This commendable increase in transparency permits and furthers analysis of these important policies. The additional funding for EQIP from the IRA coupled with restrictions on the use of those funds for a subset of practices offers comparisons that help explore policy design issues as explored in this article and updated visualizations by the Policy Design Lab (https://policydesignlab.ncsa.illinois.edu/ira).

References

Andrew, Scottie. “We’re in the thick of the ‘dog days of summer.’ We can thank the ancient Greeks for that.” CNN.com. July 18, 2024. https://www.cnn.com/2024/07/18/us/dog-days-of-summer-explained-cec/index.html.

Avet, Gretchen. “How August Got Its Name.” Terrebonne Parish Library. https://mytpl.org/project/how-august-got-its-name/.

Boeckmann, Catherine. “What and When Are the Dog Days of Summer?” Almanac.com, June 28, 2024. https://www.almanac.com/content/what-are-dog-days-summer.

Boeckmann, Catherine. “How Did the Months Get Their Names?” Almanac.com. June 21, 2024. https://www.almanac.com/how-did-months-get-their-names.

Coppess, J. and A. Knepp. "A View of the Farm Bill Through Policy Design, Part 1: EQIP." farmdoc daily (13):69, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, April 13, 2023.

Stanek, Becca. “No More Hearings, No More Bills, Congress Is Headed Out for Summer.” Time.com. August 4, 2014. https://time.com/3060041/congress-summer/.

U.S. Senate. Senate Historical Office. “Senate Stories: Give Us a (Summer) Break: Origins of the August Recess.” August 11, 2023. https://www.senate.gov/artandhistory/senate-stories/give-us-a-summer-break.htm.

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.