Policy Priorities for Biomass-Based Diesel

In a farmdoc daily article last week (January 22, 2025), we used a conceptual economic model to show that a binding U.S. Renewable Fuel Standard (RFS) volume mandate takes precedence over tax credits in terms of economic impact on the biomass-based diesel (BBD) market. More specifically, the impact of tax credits is purely distributive because the mandated BBD quantity is unaffected by the credits. In other words, tax credits only alter who pays the cost of incentivizing BBD production and consumption (FAME biodiesel + renewable diesel) at the mandated level, not the level of the mandates. Further, this means that the demand ceiling implied by the RFS volume mandates is unaffected by tax credits. The practical importance of the analysis is that it highlights the pivotal role that annual renewable volume obligations (RVOs) under the RFS play in the outlook for the BBD sector. Based on this insight, the purpose of today’s article is to examine a range of alternative scenarios for implementation of the RFS RVOs for 2026 and what the scenarios imply for the BBD demand ceiling. This is the 23rd in a series of farmdoc daily articles on the renewable diesel boom (see the complete list of articles here).

Analysis

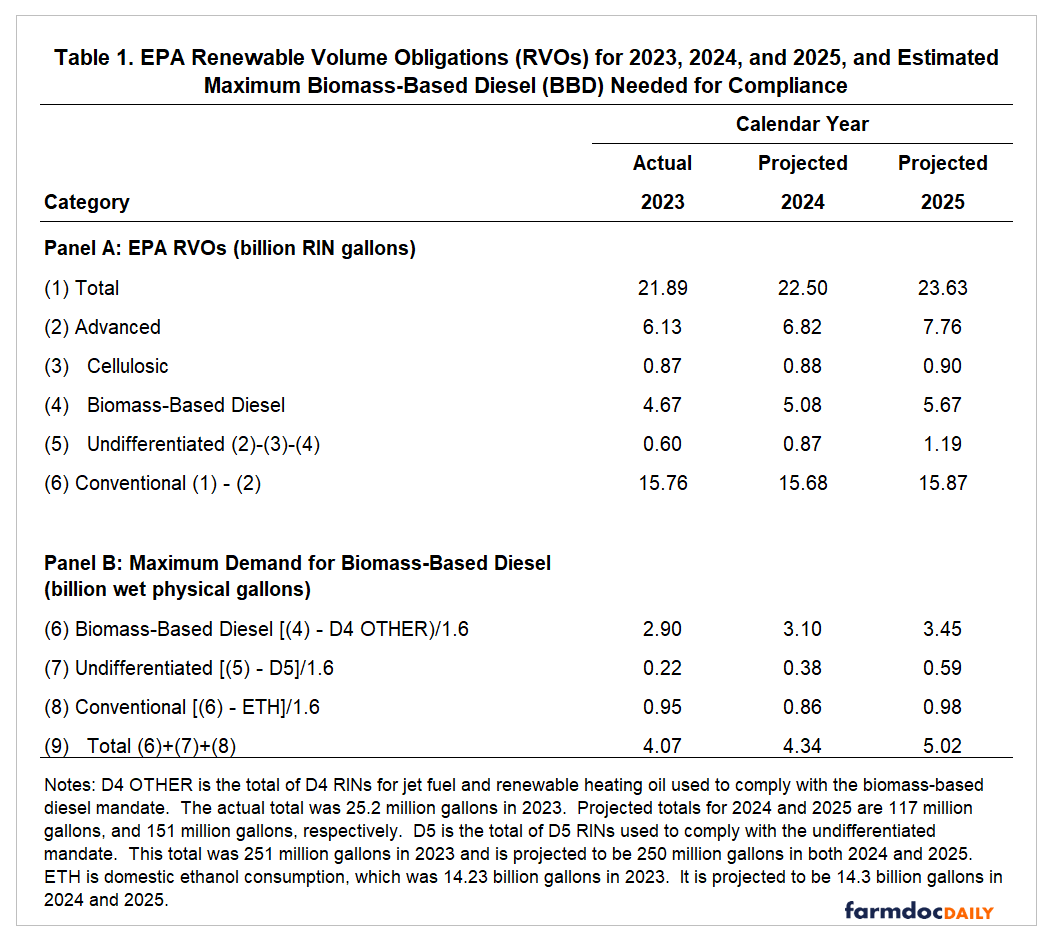

We begin by reviewing our previous estimates of the BBD demand ceiling implied by the RVOs for the RFS over 2023 through 2025. See the farmdoc daily article from January 22nd for complete details regarding the computations. Panel A in Table 1 lists final implemented RVOs for 2023 and our projection of the implemented RVOs for 2024 and 2025. Line 1 lists the total RVO across all mandate categories, which increases from 21.89 billion gallons in 2023 to 23.63 billion gallons in 2025. Line 2 lists the RVOs for the advanced mandate, which is made up of the cellulosic (line 3), BBD (line 4), and undifferentiated (line 5) mandates. The BBD RVO is reported by the EPA in physical gallons, which are converted to RIN gallons in Table 1 by multiplying by 1.6. This reflects a simplifying assumption that about half of BBD will be FAME biodiesel, with a RIN equivalence value of 1.5, and half will be renewable diesel, with a RIN equivalence of 1.7. The implemented RVOs for BBD increased by a billion RIN gallons from 2023 to 2025. The conventional RVO is shown on line 6, and it is the difference between the total and advanced RVOs.

Panel B in Table 1 provides estimates of the maximum number of BBD gallons needed to comply with the proposed RVOs. A key assumption in constructing this part of Table 1 is that BBD is the marginal gallon for filling the undifferentiated and conventional RVOs, as well as the BBD RVO. In essence, BBD is assumed to fill three different “buckets” in the RFS. Also note that the estimates in Panel B are computed in wet physical gallons to facilitate comparisons with physical production.

The key for our purposes is line 9 in Panel B of Table 1, which is the total BBD needed for compliance with the estimates of the implemented RVOs. The estimated maximum total is 4.07 billion (physical) gallons of BBD in 2023, 4.34 billion gallons in 2024, and 5.02 billion gallons in 2025. These are the maximum amounts of BBD that can be supplied in the U.S. market without going over the “RIN cliff” (farmdoc daily, May 31, 2023). In other words, the demand ceiling for BBD in the U.S. ranges from about four to five billion gallons per year between 2023 and 2025.

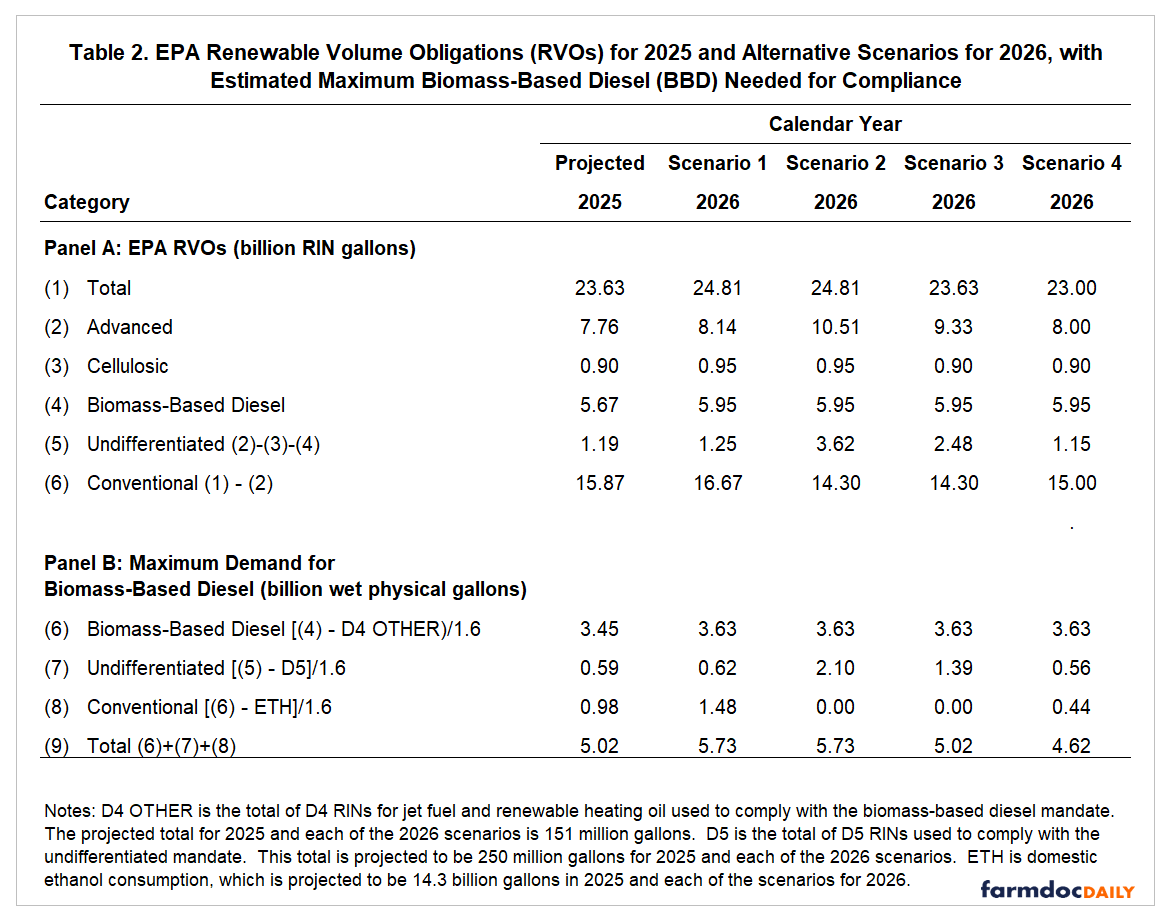

Panel A in Table 2 lists projected RVOs for 2025 and the alternative scenarios we consider for implementation of RVOs in 2026. Note that the projections for 2025 are the same as in Table 1 and are presented as a benchmark for the alternative scenarios. For simplicity, D4 Other RINs, D5 RINs, and domestic ethanol consumption for the 2026 scenarios are assumed to be fixed at 2025 levels. The first scenario for 2026 is an across-the-board five percent increase in the RVOs relative to 2025. The percentage increase is arbitrary and is only meant to represent a scenario where the RVOs increase uniformly and robustly. The total RVO increases by 1.18 billion (RIN) gallons under this scenario. Panel B shows that this scenario results in the BBD demand ceiling increasing by 0.71 billion (physical) gallons to a total of 5.73 billion gallons.

The second scenario for 2026 starts with the same level of the total RVO as in the first scenario, which is 24.81 billion gallons. However, the conventional mandate is assumed to be written down to the level of domestic ethanol consumption, which is projected at 14.3 billion gallons. This scenario reflects the long-held goal of the crude oil refining industry of setting the conventional mandate near the E10 blend wall (e.g., farmdoc daily, July 12, 2018). Since the total RVO does not decline in this scenario, the reduced gallons for the conventional RVO are effectively transferred to the undifferentiated RVO, which as a result, jumps sharply from 1.25 billion gallons under the first scenario to 3.62 billion gallons. Notice that the BBD RVO is assumed to be the same between the first and second scenarios. Panel B shows that demand ceiling is unchanged between the first and the second scenarios. This may seem surprising, but it is simply an artifact of the arithmetic of computing the BBD demand ceiling. More precisely, the gallons of BBD used in the first scenario to fill the conventional RVO are moved to the undifferentiated RVO, with the result that the total projected BBD demand ceiling is unchanged.

In the third scenario for 2026, the total RVO is held constant at the level for 2025, 23.63 billion gallons. In addition, the conventional mandate is assumed to be written down to the level of domestic ethanol consumption in 2026. The BBD RVO of 5.95 billion gallons is assumed to be the same as in the first and second scenarios. Since the total RVO for 2026 under this third scenario is the same as in 2025, the reduced gallons for the conventional RVO are simply moved to the undifferentiated RVO. Consequently, as shown in Panel B, the demand ceiling under the third scenario is the same as the 2025 projection, 5.02 billion gallons. So, even though the BBD mandate (Panel A, line 4) increases under this scenario compared to 2025, the overall BBD demand ceiling does not increase because the changes in the amount of BBD used to comply with the conventional RVO (Panel B, line 8) and the undifferentiated RVO (Panel B, line 7) offset one another.

The fourth scenario for 2026 is the only one that incorporates a reduction in the total RVO compared to 2025. It is reduced to 23 billion gallons compared to 23.63 billion for 2025. While this seems unlikely, it is not out of the realm of possibility. The BBD RVO remains fixed at 5.95 billion gallons, and the conventional RVO is reduced, but not as much as in previous scenarios. The conventional RVO is set at 15 billion gallons, which is the old statutory maximum (e.g., farmdoc daily, September 10, 2019). Panel B of Table 2 shows that the contribution of the BBD RVO gallons to the demand ceiling are the same as before, 3.63 billion gallons. However, the undifferentiated and conventional contributions are smaller than in 2025 so that the total BBD demand ceiling declines by 400 million gallons to 4.62 billion gallons.

The scenarios analyzed here for 2026 highlight the over-riding importance of the total RVO in determining the maximum demand ceiling for BBD. More specifically, the total RVO is directly related to the size of the demand ceiling for BBD. If the total RVO declines the demand ceiling declines and vice versa. This holds even if the BBD RVO does not change because BBD functions as the marginal gallon for filling two other “buckets” in the RFS—the undifferentiated and conventional RVOs. So long as the total RVO increases, one of these other RVOs will increase, thereby increasing the total size of the BBD demand ceiling, potentially by hundreds of millions of gallons per year.

Finally, it is important to note that the analysis of RFS RVOs only applies to the level of BBD demand. Other Federal and state policies can impact the prevalence of imports and feedstock shares in BBD production. For example, tax credits and low carbon fuel programs (e.g., the California LCFS program) may have important impacts on trade and feedstock usage.

Implications

With the changeover in Administrations in Washington, D.C. there is a great deal of uncertainty about several parts of the “policy stack” that support production and consumption of biomass-based diesel (BBD) in the U.S. Our previous work (farmdoc daily, January 22, 2025) shows that not all parts of the policy stack are equally important in terms of supporting the BBD sector. In particular, renewable volume obligations (RVOs) under the Renewable Fuel Standard (RFS) play a pivotal role compared to other policies. Given the crucial role of RVOs, we examine a range of alternative scenarios for implementation of the RVOs for 2026 and what the scenarios imply for the BBD demand ceiling. The analysis highlights the over-riding importance of the total RVO in determining the maximum demand ceiling for BBD. In the scenarios we consider, the total RVO is directly related to the size of the demand ceiling for BBD. In other words, if the total RVO declines the demand ceiling declines and vice versa. This holds even if the BBD RVO does not change because BBD functions as the marginal gallon for filling two other “buckets” in the RFS—the undifferentiated and conventional RVOs. So long as the total RVO increases, one of these other RVOs will increase, thereby increasing the total size of the BBD demand ceiling, potentially by hundreds of millions of gallons per year. The lesson for the BBD sector is clear: keep your eyes on the prize of the level of total RVOs in the upcoming rulemaking for the RFS over 2026 through 2028. This will set the direction for the BBD sector over the next few years, and perhaps even longer.

References

Coppess, J. and S. Irwin. "EPA 2019 RFS Proposed Rulemaking: What You See Is Not What You Get." farmdoc daily (8):128, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, July 12, 2018.

Gerveni, M. and S. Irwin. "Biomass-Based Diesel: It’s Still All About the Policy." farmdoc daily (15):14, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, January 22, 2025.

Gerveni, M., T. Hubbs and S. Irwin. "Is the U.S. Renewable Fuel Standard in Danger of Going Over a RIN Cliff?" farmdoc daily (13):99, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, May 31, 2023.

Irwin, S. and D. Good. "Biofuels Markets and Policy: 20th Anniversary of the farmdoc Project." farmdoc daily (9):168, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, September 10, 2019.

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.