The 2025 Farm Bill What-If Tool

On December 21, 2024, the U.S. Congress passed, and President Biden signed into law, the American Relief Act of 2025. That Act extended the 2018 Farm Bill into 2025, resulting in another year of farmers facing the decision between Price Loss Coverage (PLC) and Agriculture Risk Coverage (ARC) for commodity program support.

Farmers have until April 15th to make or change decisions, a month longer than in recent years. The farmdoc 2025 Farm Bill What-if Tool — a Microsoft Excel spreadsheet — has been revised to analyze the 2025 decisions. Overall, ARC at the county level (ARC-CO) appears to be the program choice most likely to result in the largest payments for corn, soybean, and wheat base acres. At very low prices, however, PLC will make higher payments, particularly for corn and wheat.

2025 PLC and ARC-CO Decisions

The recent one-year extension of the 2018 Farm Bill means that farmers will once again face the decision between the PLC, county, and individual versions of ARC programs offered through the Commodity Title.

- Price Loss Coverage (PLC) is a crop-specific fixed price support program that triggers payments if the marketing year average (MYA) price falls below the commodity’s effective reference price. Payments are made on 85% of historical base acres (see farmdoc daily, September 24, 2019).

- Agricultural Risk Coverage at the county level (ARC-CO) is a crop-specific county revenue program. ARC-CO triggers payments if actual revenue (MYA price times county yield) falls below 86% of the benchmark revenue (product of benchmark price and trend-adjusted historical benchmark yield for the county). Payments are made on 85% of historical base acres (see farmdoc daily, September 17, 2019).

- Agricultural Risk Coverage at the individual level (ARC-IC) is a farm-level revenue support program. Like ARC-CO, payments are triggered if actual revenue falls below 86% of the benchmark. If an FSA farm unit is enrolled in ARC-IC, information for all commodities planted in the current year is combined together in a weighted average to determine benchmark and actual revenues. If a farmer enrolls multiple FSA farms in the same state, all farm units are combined in determining the averages for actual and benchmark revenues. Payments are made on 65% of historical base acres (see farmdoc daily, October 29, 2019).

Decisions are made for each Farm Service Agency (FSA) farm unit. PLC and ARC-CO are commodity-specific and can be mixed and matched on the same FSA farm or across different FSA farms (i.e., PLC for one commodity, ARC-CO for another on the same FSA farm or using different programs for the same crop on different FSA farms).

2025 Effective Reference and ARC Benchmark Prices

The effective reference price levels for 2025 are set at the higher of 1) a crop’s statutory reference price or 2) 85% of the Olympic average of prices over the five marketing years from 2019 to 2023. After eliminating the low and high prices over the five years considered, the Olympic average is computed as the simple average of the three remaining prices. If applicable, the effective reference price is capped at 115% of a crop’s statutory reference price.

The 2025 effective reference price for corn is $4.26 per bushel (see Table 1). The five-year Olympic average is well above the $3.70 statutory reference price and is capped at 1.15 times the effective reference price or $4.26 per bushel. Similarly, the 2025 effective reference price for soybeans is above the $8.40 statutory reference price and is capped by 1.15 times the statutory reference price or $9.66 per bushel. Had the 1.15 been higher in the 2018 Farm Bill, corn and soybeans would have had higher effective prices in 2025. Wheat’s effective reference price for 2025 is $5.56, slightly above the $5.50 statutory reference price but below the maximum of 1.15 times the statutory reference price.

ARC program benchmark prices for each commodity are based on the Olympic average of the five prices used in the benchmark calculation. Prices used are the larger of the crop’s effective reference price for the current year (2025 in this case) and the actual MYA prices over the five preceding marketing years with a single-year lag (i.e., 2019 to 2023 for the 2025 program year). Higher prices in recent marketing years, along with the use of the effective reference prices as minimums for each year used in the calculation for corn, soybeans, and wheat, result in an increase in the ARC benchmark prices for 2025 compared with 2024 and earlier years.

ARC benchmark prices for 2025 are $5.03 for corn, $12.17 for soybeans, and $6.72 for wheat (see Table 1). Benchmark prices for all three crops are well above effective reference prices. A key analysis price is 86% of the ARC benchmark price. Since ARC-CO’s guarantee is 86% of the guarantee, ARC-CO will pay at prices below 86% when yields are at or below the benchmark yields (note that ARC-CO can pay at higher yields as well if prices are lower). Comparing 86% of the ARC benchmark price to the effective reference price provides an indication of whether PLC or ARC-CO might have a better chance of triggering payments. The further 86% of the ARC benchmark price is above the effective reference price, the higher the chance ARC-CO will be more likely to trigger greater support than PLC:

- 86% of corn’s ARC benchmark price is $4.33. This is 1.5% above corn’s $4.26 effective PLC reference price.

- 86% soybeans’ ARC benchmark price is $10.47. This is is 8.3% above soybean’s $9.66 PLC effective reference price.

- 86% of wheat’s ARC benchmark price is $5.78. This is 3.9% above wheat’s $5.56 PLC effective reference price.

Corn

An updated 2025 version of the Excel-based Farm Bill What-If Tool is now available and can be downloaded directly here. The calculator can compare the PLC and ARC-CO program payment scenarios for individual yield and price scenarios. It also provides a tabular comparison of PLC and ARC-CO payments across a range of MYA price and county yield levels.

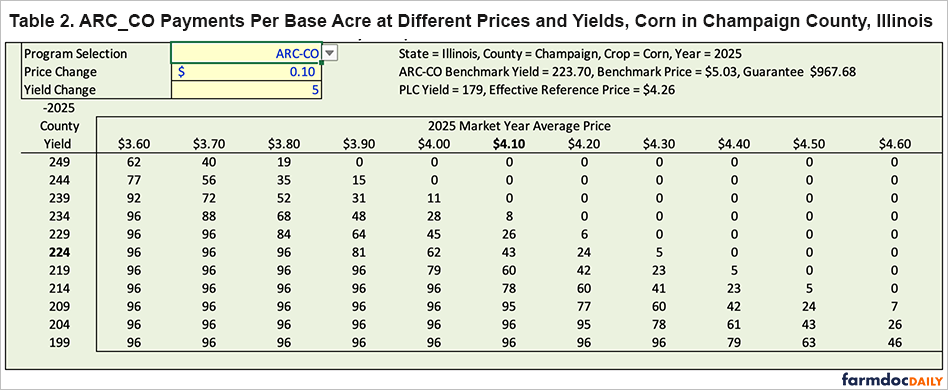

Table 2 shows ARC-CO payments per base acre for non-irrigated corn in Champaign County, Illinois for different county yields and MYA prices. The county yields in the rows of the table are centered at 224 bushels per acres, which is close to the ARC-CO benchmark yield for non-irrigated corn in Champaign County of 223.7 bushels per acre for 2025. The prices across the columns are centered at $4.10 per bushel. ARC-CO would trigger payments at a $4.10 MYA price for Champaign county corn yields below 234 bushels per acre, and would equal $43 per base acre with a county yield near the benchmark level of 224 bushels per acre ARC-CO payments would reach their maximum of $96 per acre at yields below 204 bushels per acre.

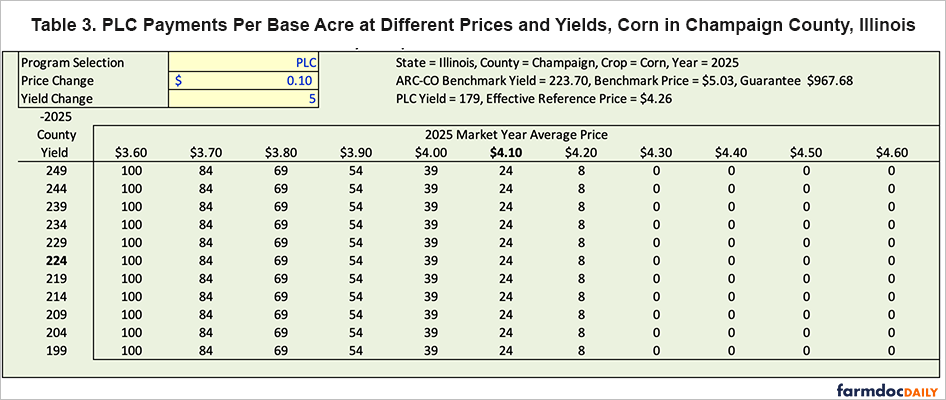

PLC payments will occur if the 2025 MYA price falls below the $4.26 effective reference price, and county yield does not matter in the calculation. Using a 179 bushel per acre PLC yield, the average for Champaign county, PLC would trigger a $24 payment per base acre at a $4.10 MYA price (Table 3). PLC payments increase with lower prices. At a $3.60 MYA price, payments would reach $100 per base acre.

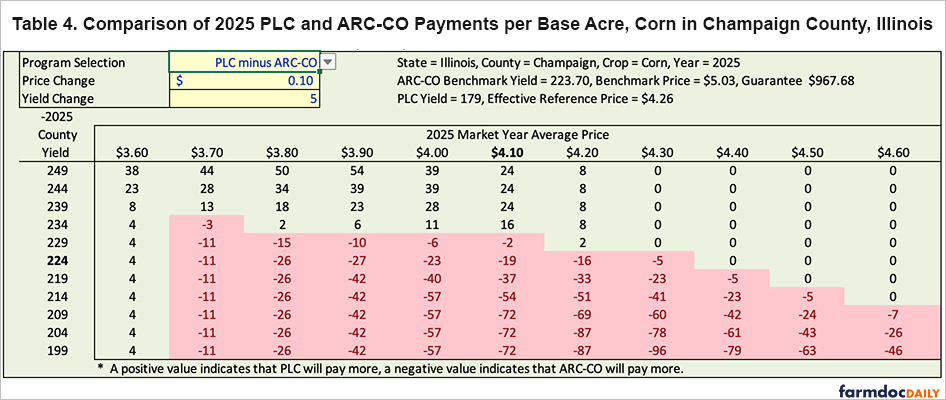

Table 4 shows PLC minus ARC-CO payments. ARC-CO will trigger payments across a range of scenarios, including those with lower yields and higher prices. PLC would trigger larger payments than ARC-CO in a range of scenarios with yields above benchmark and prices below the effective reference price. PLC would also trigger larger payments when prices are sufficiently low (for example, a corn MYA of $3.60 or lower) as ARC-CO would reach its maximum payment level.

ARC-CO will trigger larger payments than PLC over most likely yield and price combinations for corn. However, if one is concerned about very low MYA prices, PLC may be the appropriate choice.

Soybeans

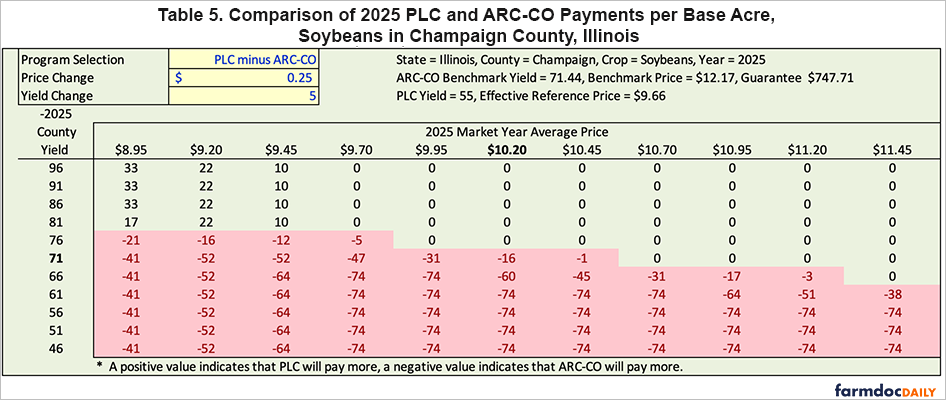

Table 5 shows PLC minus ARC-CO payments for soybeans in Champaign County, Illinois. PLC payments are given for a 55 bushel per acre PLC yield, the average for the county. ARC-CO will tend to trigger larger payments than PLC for soybean prices above $ 9.70 per bushel. PLC will tend to trigger higher payments at lower prices if yields are above 81 bushels per acre. ARC-CO will make the same or higher payments than PLC under what would be expected to be more likely yield-price scenarios for soybeans.

Wheat

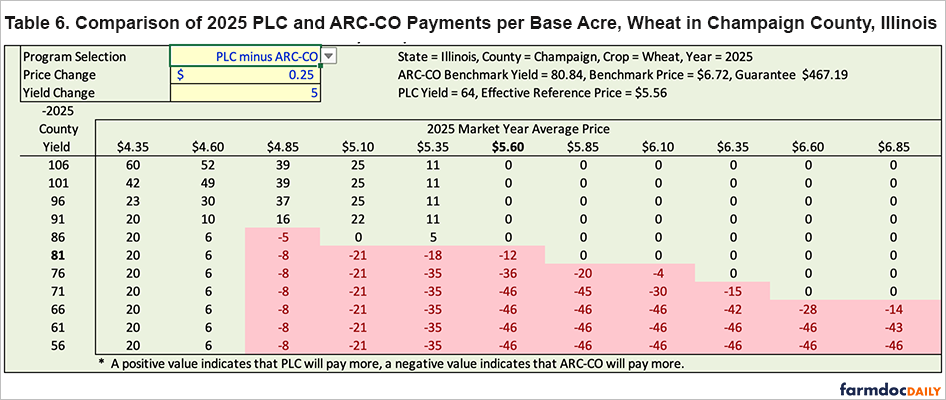

Table 6 shows PLC minus ARC-CO payments for wheat in Champaign County, Illinois. The PLC yield is 65 bushels per acre, the county average. At prices above $4.85, ARC-CO will make higher payments at yields below 86 to 81 bushels per acre. Under the most likely price scenarios, ARC-CO will make higher payments than PLC. Still, PLC will make higher payments for MYA prices below $4.85, as well as with prices from $4.85 to $5.56 with yields sufficiently above the county benchmark.

Summary

Due to lower expectations on commodity title prices, commodity title programs likely will have higher expected payments in 2025 than in recent years. Based on high ARC benchmark prices compared with PLC effective reference prices, ARC-CO seems more likely to trigger larger payments under most price-yield scenarios. However, PLC could make higher payments at very low MYA prices, particularly for corn and wheat.

The decision deadline for the 2025 farm program decision has been moved back a month, from March 15th in previous years, to April 15th. While delaying the decision until closer to the deadline has some drawbacks, such as the potential to spill into and disrupt the early part of the spring planting season and putting a strain on Farm Service Agency staff, waiting will also provide producers with more potentially useful information. This is particularly true for wheat, as the 2025 marketing year is already underway and more information about wheat production in other major productions regions of the world will be available.

We will continue to provide information and analysis to aid producers in their 2025 farm program decisions with future farmdoc daily articles and other resources prior to the enrollment deadline.

References

Farm Bill What-If Tool. Updated for 2025 and made available on January 27, 2025. https://farmdoc.illinois.edu/fast-tools/arc-co-plc-model

Schnitkey, G., J. Coppess, N. Paulson, C. Zulauf and K. Swanson. "The Agricultural Risk Coverage — County Level (ARC-CO) Option in the 2018 Farm Bill." farmdoc daily (9):173, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, September 17, 2019.

Schnitkey, G., C. Zulauf, K. Swanson, J. Coppess and N. Paulson. "The Price Loss Coverage (PLC) Option in the 2018 Farm Bill." farmdoc daily (9):178, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, September 24, 2019.

Zulauf, C., B. Brown, G. Schnitkey, K. Swanson, J. Coppess and N. Paulson. "The Case for Looking at the ARC-IC (ARC-Individual) Program Option." farmdoc daily (9):203, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, October 29, 2019.

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.