The Price Loss Coverage (PLC) Option in the 2018 Farm Bill

Farmers and landowners can now decide whether to receive commodity title payments from either Agricultural Risk Coverage at the county level (ARC-CO) or Price Loss Coverage (PLC) for each covered commodity with base acres on the farm; or through Agricultural Risk Coverage at the individual level (ARC-IC) for all covered commodities on the farm. For the 2019 and 2020 program years, the deadline for the decision is March 15th, 2020. This article describes the PLC option contained in 2018 Farm Bill. The ARC-CO option was described in a previous farmdoc daily article. Future articles will deal with making choices between PLC and ARC-CO, as well as when ARC-IC is the appropriate alternative.

Differences between 2014 and 2018 PLC Programs

PLC existed in the 2014 Farm Bill and continues in the 2018 Farm Bill with the following modifications:

- The 2018 Farm Bill introduced the “effective reference price” to payment calculation. The effective reference price can be higher than the statutory reference price, potentially resulting in higher PLC payments than under the 2014 Farm Bill. More detail on this provision will be provided in the following section.

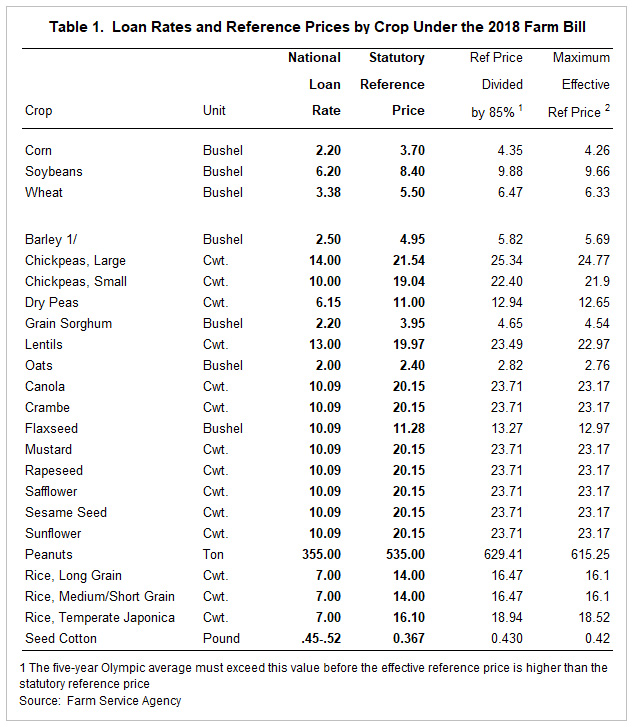

- The 2018 Farm Bill increased the national loan rates (see Table 1 for loan rates). The major impact of this change is on the loan program. National loan rates also enter into the calculations of maximum PLC payments.

- The 2018 Farm Bill allows PLC yields to be updated. The updated yields then will be used to calculate per base acre payments. More information will be provided in the “PLC Yields and Updating” section.

- For the 2018 Farm Bill, the choice between commodity title programs is not binding over the life of the 2018 Farm Bill. By March 15th, 2020, farmers and land owners will choose for the 2019 and 2020 program years. A yearly decision then can be made for 2021, 2022, and 2023. For the 2014 Farm Bill, the commodity title choice was made for all program years from 2014 to 2018.

Effective Reference Price under PLC

PLC provides assistance based only on low prices, making payments when the MYA price is below the effective reference price. The effective reference price is the higher of the:

- Statutory reference price, or

- 85% of the Olympic average of the five previous MYA prices, lagged by one year.

The effective reference price cannot exceed 115% of the statutory reference price.

Table 1 shows statutory reference prices under the 2018 Farm Bill, which are unchanged from the 2014 Farm Bill. The column named “Ref Price Divided by 85%” shows the value the five-year Olympic average price must exceed before the effective reference price is higher than the statutory reference price. Also shown is the maximum effective reference price, which is 115% of the statutory reference price. Take corn as an example. The statutory reference price is $3.70 per bushel. The effective reference price will be above the statutory reference price when the five-year Olympic average exceeds $4.35 per bushel. The maximum effective price is $4.26 per bushel.

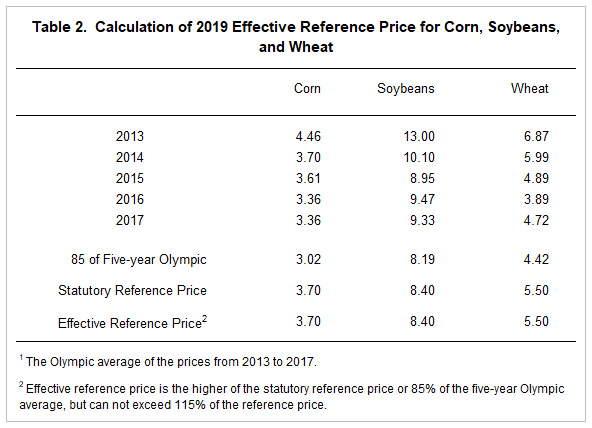

Table 2 shows the calculation of 2019 effective reference prices for corn, soybeans, and wheat. Corn will be used to illustrate effective reference price calculations. The statutory reference price for corn is $3.70 per bushel. For 2019, the Olympic average of MYA prices from 2013 to 2017 are used in the comparisons. Note that the calculation does not include the most recent past year, which is 2018, for the 2019 effective reference price calculation. This lagging feature was added in the 2018 regulations and will continue into the future; it allows the effective reference price to be known when decisions are being made between commodity title programs. For 2019, 85% of the Olympic average is $3.02 (see Table 2), which is below the statutory reference price. As a result, the effective reference price is $3.70.

Note that the escalator clause does not cause the effective reference price to be above the statutory reference price for corn, soybeans, or wheat in 2019 (see Table 2). Effective reference prices for 2020 also will be at statutory reference prices, as 2018 prices cannot cause 85% of the five-year Olympic averages to exceed the statutory reference prices. As a result, the statutory reference prices will be the effective reference prices for 2019 and 2020, the years for which farmers and land owners will be making the program decision by March 15, 2020. Moreover, it is highly unlikely that the effective reference prices will be above statutory reference prices for the remaining years of the farm bill running from 2001 through 2023. (For more discussion on the reference price escalator see farmdoc daily, February 21, 2019).

PLC Payments

In 2019, PLC will make payments whenever the MYA price is below the effective reference prices shown in the previous section. The 2019 market year for corn and soybeans runs from September 2019 to August 2020. As a result, the 2019 MYA price for corn and soybeans will not be known until September 2020. The marketing year for wheat began in June 2019 and will end in May 2020.

When the marketing year average price is below the effective reference price, a per bushel payment rate is calculated. The payment rate equals the effective reference price minus the higher of the MYA price or the national loan rate.

As an example, suppose the 2019 MYA price for corn is $3.60. The $3.60 MYA price is less than the $3.70 reference price, resulting in a payment. Since the $3.60 MYA price is above the $2.20 national loan rate, the per bushel payment rate equals $.10 ($3.70 effective reference price – $3.60 MYA price).

The PLC payment per base acre equals .85 times the payment rate times the PLC yield. Take the above corn example with a $0.10 payment rate. If a farm has a 150 bushel per acre PLC yield, the 2019 payment would be $12.75 per base acre. (.85 x $0.10 payment rate x 150 PLC yield). This payment could be reduced further due to sequester.

PLC Yields and Updating

Each Farm Service Agency (FSA) farm has PLC yields for each program crop with base acres on that farm. Through time, opportunities existed to “update” these program yields in some of the farm bills. For example, the 2014 Farm Bill allowed farmers to keep the existing program yields or update them to 75% of the average of yields on the farm from 2008 to 2012, with the use of yield plugs (see farmdoc daily, April 3, 2014). As a result, the current PLC yields could be based on 2008-2012 averages or on much older yields, depending on updating decisions.

The 2018 Farm Bill again allows farmers the following two choices for each program crop on a farm:

- Keep the existing program yield, or

- Update the yield to a percentage of the average from 2013 through 2017, again with the use of yield plugs.

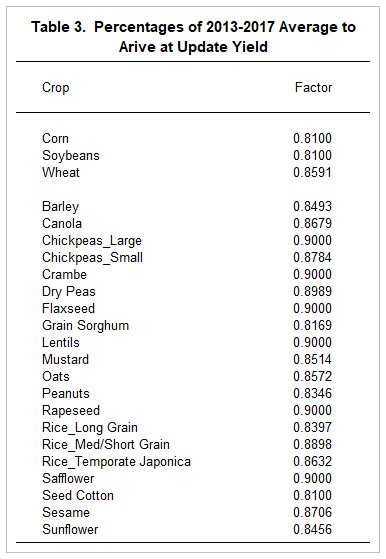

The percentage of the 2013-2017 average varies by crop (see Table 3). Corn and soybean yields will be .81 of the 2013 to 2017 average. Wheat will be .8591 of the 2013 to 2017 average. More detail on the yield factors by crop is provided in farmdoc daily articles on February 20, 2019 and March 22, 2019.

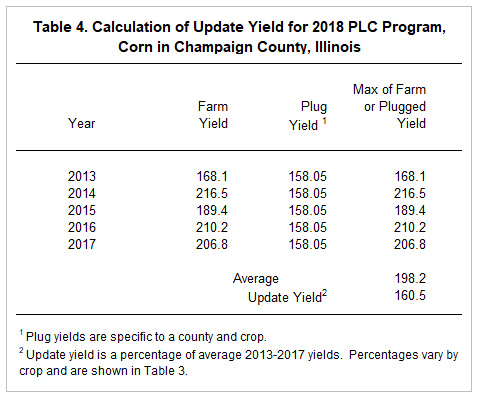

Table 4 shows an example for yield updating for a farm in Champaign County, Illinois. The 2013 through 2017 yields are example yields for this farm that happen to be county yields. Each farm in Champaign County will use its own yields. Corn in Champaign County has a yield plug of 158.05 bushels per acre. If any of the 2013 through 2017 yields are below 158.05, the 158.05 plug yield would be used instead of the actual yield. The 2013-2017 average is 198.2and .81 times this average is 160.5 bushel per acre. If the 160.5 bushels per acre is above the current program yield, it will be beneficial to update the PLC yield.

Farmers can make updating decisions for each crop on a FSA farm. For example, corn and soybean yields could be updated while not updating wheat yields. Farmers should compare the update yield to the current program yield and only update those crops with higher updated yields.

If yields are updated, documentation should be obtained for the 2013 though 2017 yields as this documentation may be requested at some point in the future. Crop insurance records can serve as documentation and will be the best source of documentation if crop insurance has been purchased.

Updated yields will apply to payments from the 2020 to 2023 program years. Existing PLC yields will be used for the 2019 program year.

Summary

We provide a summary of PLC in this article. A past farmdoc daily article (September 17, 2019) provided a summary of ARC-CO. Future articles will evaluate making choices between ARC-CO and PLC, as well as describe ARC-IC. Farmers can run payment calculation scenarios for their farms using the Gardner-farmdoc tool, available here. Our next webinar on farm programs will be offered on September 27th at 8:00 am.

References

Paulson, N., J. Coppess and T. Kuethe. "2014 Farm Bill: Updating Payment Yields." farmdoc daily (4):60, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, April 3, 2014.

Schnitkey, G., J. Coppess, N. Paulson, C. Zulauf and K. Swanson. "Weekly Farm Economics: The Agricultural Risk Coverage — County Level (ARC-CO) Option in the 2018 Farm Bill." farmdoc daily (9):173, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, September 17, 2019.

Zulauf, C., G. Schnitkey, K. Swanson, J. Coppess, and N. Paulson. "Understanding the 2018 Farm Bill PLC Yield Update: Corn, Soybean, Sorghum, and Upland Cotton by State." farmdoc daily (9):51, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, March 22, 2019.

Zulauf, C., G. Schnitkey, K. Swanson, J. Coppess and N. Paulson. "Understanding the 2018 Farm Bill PLC Yield Update: Which Program Commodities Have a Higher Update Yield at the US Market Level?." farmdoc daily (9):30, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, February 20, 2019.

Zulauf, C., J. Coppess, G. Schnitkey, N. Paulson and K. Swanson. "2018 Farm Bill Reference Price Escalator for 2019 Market Year." farmdoc daily (9):31, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, February 21, 2019.

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.