Brazil’s 2024–25 Corn Harvest Grows, But Exports Projected to Decrease

Brazil’s 2024–25 corn harvest is expected to be the second largest in the country’s history, with a projected 5 billion bushels, according to the National Supply Company (Conab), the country’s food supply and statistics agency. The volume is higher than last year and above previous projections due to favorable rainfall in April and May that has benefited most of the second-crop corn regions—responsible for 78% of Brazil’s total corn production in the current season. Despite the large harvest, Brazilian corn exports in 2025 are projected to decline due to rising domestic demand from animal feed producers and the expanding corn ethanol industry. This article explores the key factors behind Brazil’s strong corn crop and its implications for the United States—the world’s top corn producer and exporter—in the months ahead. Currently, Brazil is the world’s second-largest corn exporter.

Harvest May Be the Second Biggest in History

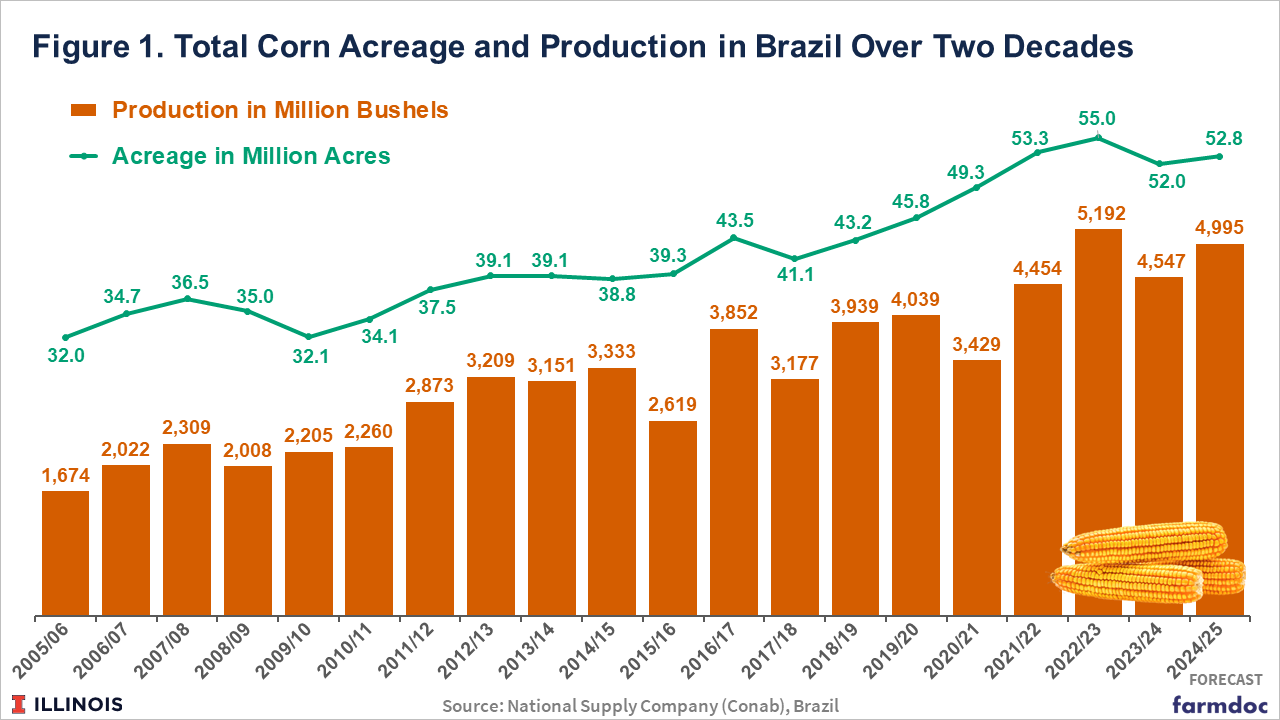

The latest estimate from Conab suggests that Brazil’s 2024–25 corn harvest—including the first, second, and third crops—will total 4,995 million bushels, an increase of 448 million bushels (10%) compared to the previous season (see Figure 1). Some private consultancies project even higher production, forecasting the corn harvest between 5.1 and 5.4 billion bushels. This should be Brazil’s second-largest corn crop on record, behind only the 2022–23 season—when the country surpassed 5 billion bushels for the first time.

The expected strong harvest is largely attributed to high yield potential, as planted area increased only slightly by just 1.5% from last year—from 52 million acres to 52.8 million acres (see Figure 1). According to Conab, average yields are projected to reach a record 95 bushels per acre this season—8% higher than last year. These strong yields are primarily driven by the performance of second-crop corn, known as safrinha, which is planted immediately after the summer soybean harvest. Satellite-derived Normalized Difference Vegetation Index (NDVI) analysis in the major safrinha corn areas of the Center West, Southeast, and South Regions indicates vegetation health that far exceeds average (USDA, 2025). Much of this increase occurs because drought concerns are not prevalent this year. Last year’s crops were hampered by drought-induced low yields.

Second Crop Benefit from Good Weather

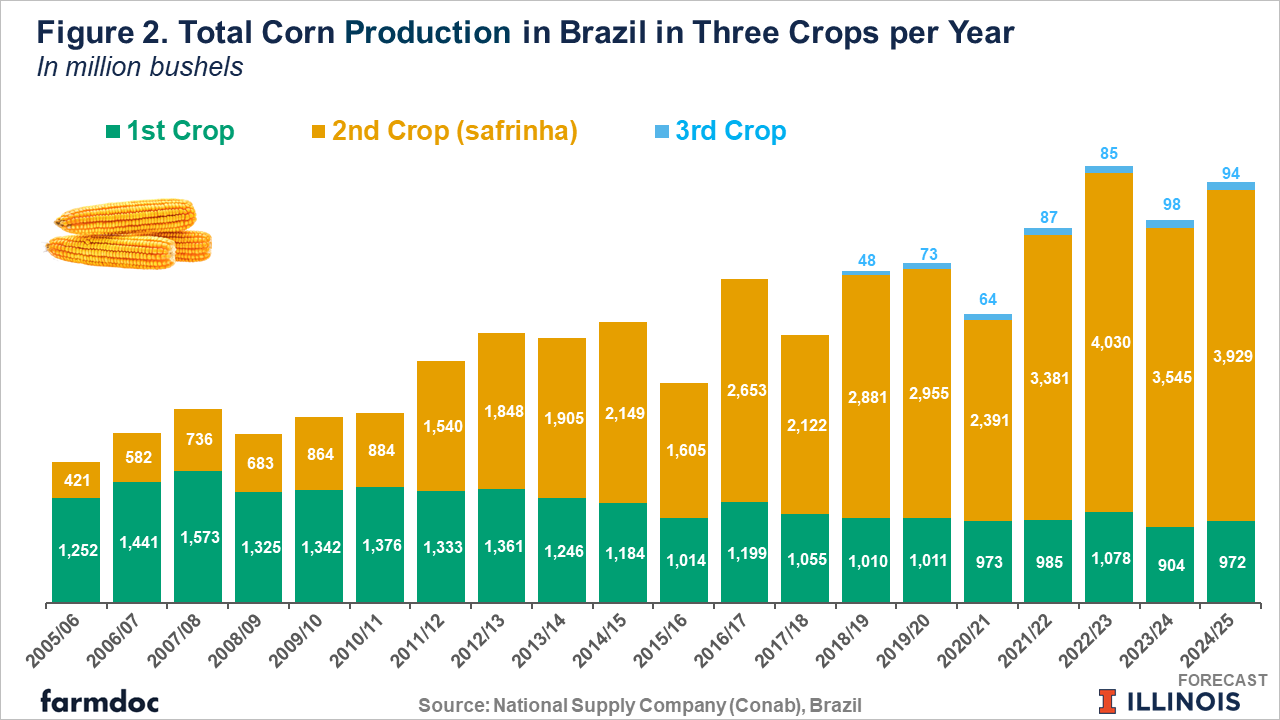

Responsible for 78% of Brazil’s total corn production, second-crop corn benefited from good rainfall in April and May across most production regions, except for parts of São Paulo and Minas Gerais in the Southeast. In contrast, the Center-West region—which accounts for almost 60% of Brazil’s second-crop production—received favorable rainfall and is now expecting a full harvest. As a result, second crop production is expected to increase by 11% to 3,929 million bushels, the second-best result in history (see Figure 2). Harvesting began in early June and is expected to continue through early August.

Over the past 20 years, Brazil’s second corn crop has grown nearly ninefold—from 421 million bushels in the 2005–06 season to almost 4 billion bushels in the current crop year. In contrast, the first crop (planted during the summer season) has declined by 22%, dropping from 1,252 million bushels to 972 million bushels. Primarily grown in the southern states, Brazil’s first crop is typically harvested between January and April. The higher profitability of soybeans during the summer and lower weather risks have led many crop producers in the South to reduce the area planted with corn over the past two decades.

Finally, the outlook for Brazil’s third corn crop—which has been officially included in Conab’s projections since the 2018–19 season—is 94 million bushels, down 4% from the previous cycle (see Figure 2). This crop is primarily grown in the northern and northeastern states of Bahia, Sergipe, Alagoas, Pernambuco, and Roraima, with harvest occurring mostly between September and December. Although it accounts for just 2% of total corn production, the third crop has growth potential, driven by rising corn demand in the Northeast for both animal feed and corn ethanol production.

Brazilian Exports are Projected to Decline

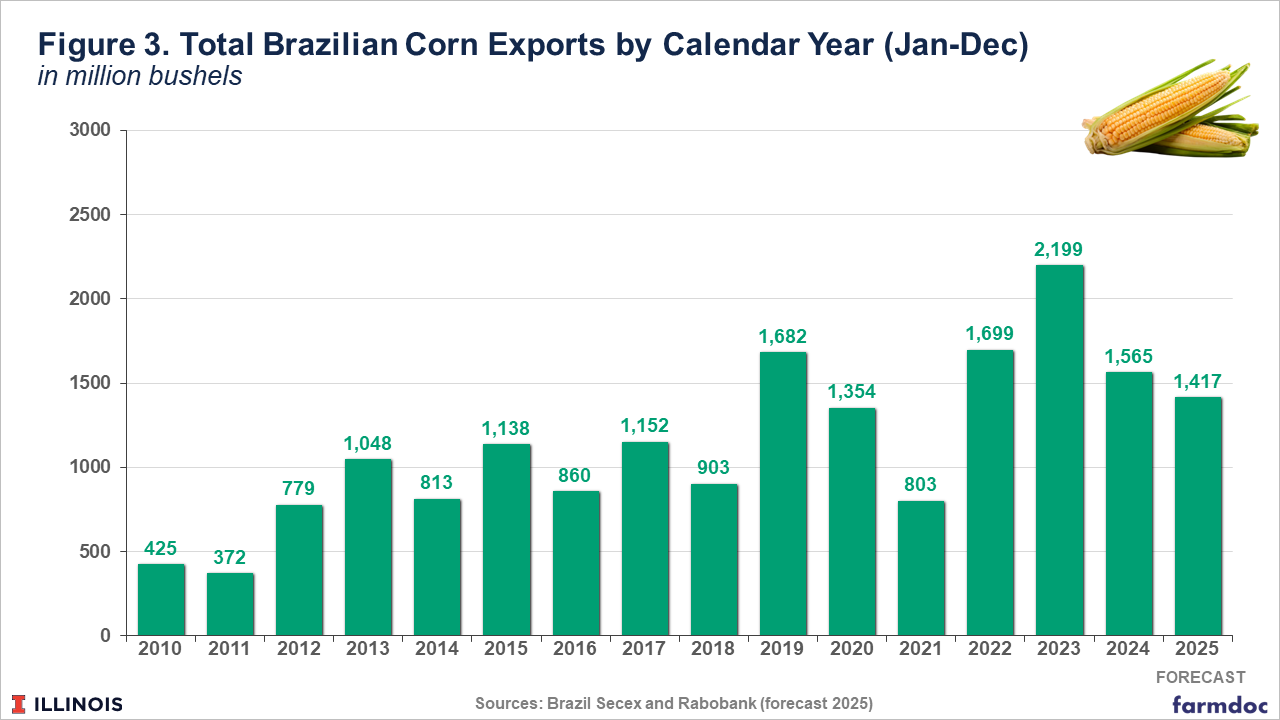

Despite a larger harvest, Brazil’s corn exports in 2025 are projected to decline compared to last year. From January to December, exports are forecast by Rabobank at 1,417 million bushels—a 9% drop from the 1,516 million bushels shipped during the same period in 2024 (see Figure 3). The main drivers of this decline are rising domestic demand from the livestock sector and the growing corn ethanol industry in Brazil, which has expanded significantly over the past decade.

In 2024, Brazil recorded all-time highs in cattle, chicken, and pig slaughter, fueled by corn-based animal feed. Conab estimates that 3,516 million bushels of corn from the 2024–25 crop will be consumed domestically in Brazil throughout 2025—a 6.3% increase compared to the previous season. Of this total, the animal protein industry is expected to account for about 70% of consumption, while the ethanol industry will use around 15%. The remainder will go to seed production and food industrial uses.

Brazil, the world’s second-largest ethanol producer behind the United States, has seen a significant expansion of corn-based ethanol processing plants across the Center-West states—a region where second-crop corn production has grown rapidly over the past decade (see farmdoc daily, June 30, 2023). Brazil currently has 25 operational corn ethanol plants, with another 15 under construction, according to data from the Brazilian National Agency of Petroleum, Natural Gas and Biofuels (see farmdoc daily, April 14, 2025).

While Brazil is expected to slightly reduce its corn exports in 2025 due to higher domestic consumption, the U.S. Department of Agriculture projects 2024–25 U.S. exports at 2,598 million bushels—second only to the 2,748 million bushels exported in 2020–21, when China was a major buyer. U.S. corn has recently maintained competitive pricing relative to Brazil, and export sales in recent weeks have remained well above average. As of May 29, U.S. corn exporters had committed 99% of USDA’s full-year export forecast for 2024–25, which ends on August 31. This marks the highest level of coverage by this point in the season in a decade, and the figure would generally indicate that the current export target is too low (Braun, 2025).

Final Considerations

Brazil’s total corn production across its three crops per year is on track to reach the second-highest volume in the country’s history, exceeding initial expectations. This strong result is driven primarily by the second crop, known as safrinha, which benefited from favorable rainfall over the past two months. Despite the larger harvest, Brazil is expected to export less corn this year due to rising domestic demand from the livestock sector and growing corn-based ethanol production. For U.S. exporters—who have seen corn exports exceed expectations in the first five months of the year—Brazil’s slower export pace is likely to continue creating windows of opportunity throughout the year, especially when U.S. corn remains price competitive.

Data Source and References

Braun, K. “Bumper Brazilian Corn Crop Could Spoil U.S. Exporters’ Fun.” Reuters, June 6, 2025.

Conab, National Supply Company. Crops Time Series. Corn Production. Brasília, Brazil. May 2025.

Conab, National Supply Company. 8th Grain Crop Survey Report, 2024/25 – 8th Assessment.

Colussi, J., G. Schnitkey and N. Paulson. “Ethanol Boom Drives Sharp Rise in Brazil’s Corn Consumption.” farmdoc daily (15):69, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, April 14, 2025.

Colussi, J., N. Paulson, G. Schnitkey and J. Baltz. “Brazil Emerges as Corn-Ethanol Producer with Expansion of Second Crop Corn.” farmdoc daily (13):120, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, June 30, 2023.

U.S. Department of Agriculture (USDA), Foreign Agricultural Service. World Agricultural Production. “Brazil Corn: MY 2024/25 Production Higher on Abundant Rainfall Through April”. May 2025.

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.