The Reconciliation Farm Bill: Top Five Most Problematic Changes to Farm Policy, #3

Coming in at number three on this top five list is a familiar issue (farmdoc daily, August 14, 2025 (#4); July 31, 2025 (#5); see also, farmdoc daily, August 6, 2025; July 30, 2025; July 15, 2025; July 3, 2025; May 20, 2025; May 16, 2024; May 14, 2024). It is also the most expensive change by far. The third most problematic change to farm policy in the Reconciliation Farm Bill belongs to the large and unbalanced increases in statutory reference prices for farm program subsidies. As a companion to the discussion in this article, modeling for the projections of ARC/PLC payments has been updated and released on the Policy Design Lab (Policy Design Lab, ARC/PLC Payments, 2025 Reconciliation Farm Bill; farmdoc daily, July 3, 2025). Further discussion of that work will be forthcoming in a future article, while today’s discussion reviews some of the basics on this policy design issue.

Background

Reference price increases have dominated the farm policy discussion in these recent years of high crop prices and input costs. Among other things, higher crop prices have resulted in low or no payments for base acres accustomed to receiving large payments each year. The cost and challenges of increasing reference prices was the primary barrier to completing Farm Bill reauthorization the last two years. It took the massive omnibus reconciliation bill to carry it into law.

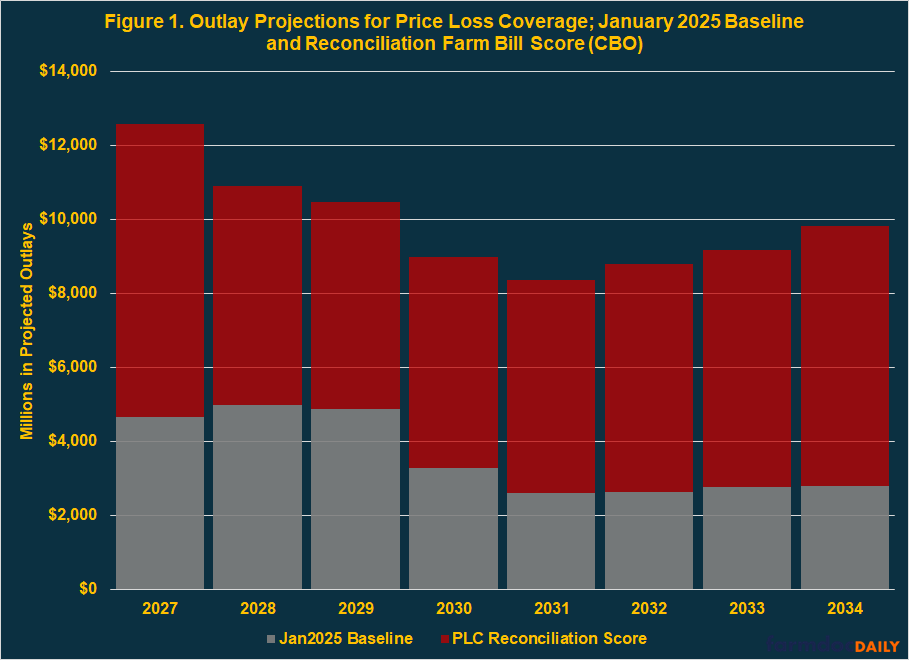

Section 10301 of the reconciliation bill (P.L. 119-21) increases statutory reference prices, the fixed-price based trigger for farm program subsidies. According to the Congressional Budget Office (CBO), this single change will cost $50.5 billion over the next ten fiscal years, although it presumably includes the additional 30 million base acres as well (CBO, July 21, 2025). Figure 1 illustrates the CBO score, added to the January 2025 baseline for the relevant fiscal years (FY2027 to FY2034). Because ARC and PLC include a timing shift, the costs do not appear in the score until FY2027 (paid October 2026 for the 2025 program year) when the programs are projected to cost an estimated $7.9 billion. The CBO score goes only to FY2034, capturing eight out of the 10 fiscal years resulting from the change in policy.

Even without two fiscal years, the CBO score represents a near doubling of the total cost projections for PLC. As with all other changes to farm policy in the Reconciliation Farm Bill, the PLC increased costs were covered by cuts to food assistance in the Supplemental Nutrition Assistance Program (SNAP). At an average benefit per person per month in the CBO January baseline for SNAP ($210 per person per month), or $2,521 per person per year, the PLC costs would cover the costs of food assistance to an average of 2.5 million people each fiscal year. For its costs alone, increasing reference prices enters the top five most problematic policy changes, but the cost of it is only part of the picture.

Discussion

Understanding reference prices remains a challenge, obscured by the decoupled nature of the policy design and the different price levels and units of production for the different covered commodities; how to compare dollars per bushel or hundredweight to cents per pound, for example. Figure 2 provides perspective, presenting reference prices as an average ratio to the marketing year average (MYA) prices. The green bars are the average ratio of the reference prices in the 2014 and 2018 Farm Bills compared to the actual MYA prices from 2014 to 2024. The blue bars are the increased reference prices in the Reconciliation Farm Bill compared to the MYA price projections by the University of Missouri’s Food & Agricultural Policy Research Institute (FAPRI, April 3, 2025). The light pink area is 1.0, or a reference price even with MYA on average in the years.

As in each previous analysis of reference prices, those for base acres of peanuts, long grain rice, and seed cotton are disproportionately higher than for the other major crops. The reference prices for these Southern crops were the highest relative to actual prices in the last two Farm Bills (note: seed cotton was created in 2018 and has been applied back to 2014 in Figure 1). They are even higher than price projections going forward. Corn and soybeans continue to lag these Southern crops significantly.

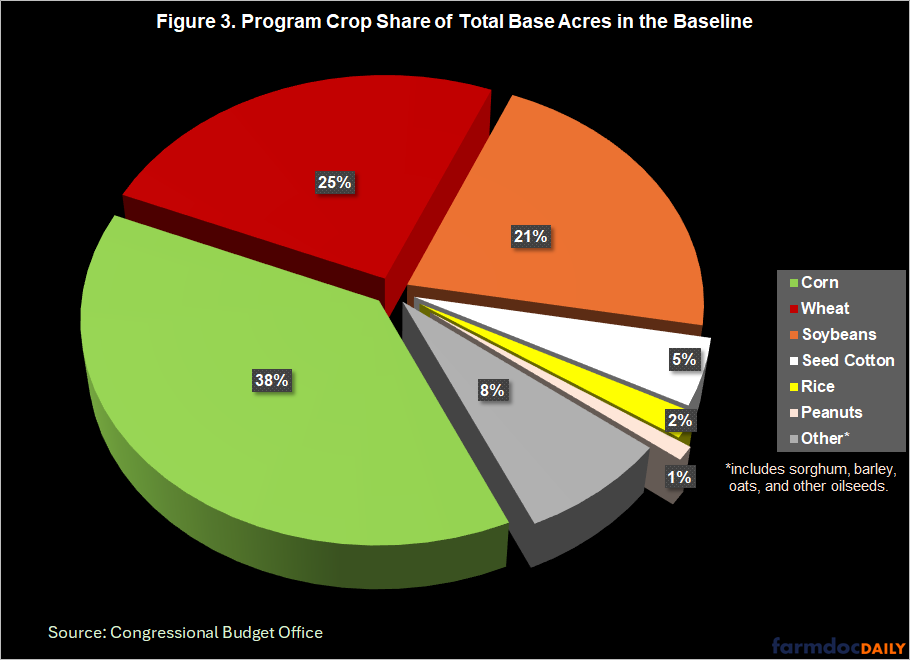

Base acres or baseline? One telltale about any farm subsidy policy discussion is whether the reference is to a single crop’s share of CBO baseline or the crop’s share of base acres. Again, farmers do not farm the baseline, lobbyists do. Farmers receive payments on base acres, and they receive those payments (if triggered) regardless of whether they planted the crop or not. Focusing on the share of CBO baseline by one crop or the other is misleading at best. Corn base acres, for example, constitute 38% of total program crop base acres and receive 47% of the CBO January baseline for ARC and PLC, whereas rice base acres receive nearly 9% of the baseline with less than 2% of the base acres (CBO, January 2025). Figure 3 illustrates each of the major program crop’s share of total base acres in the CBO baseline.

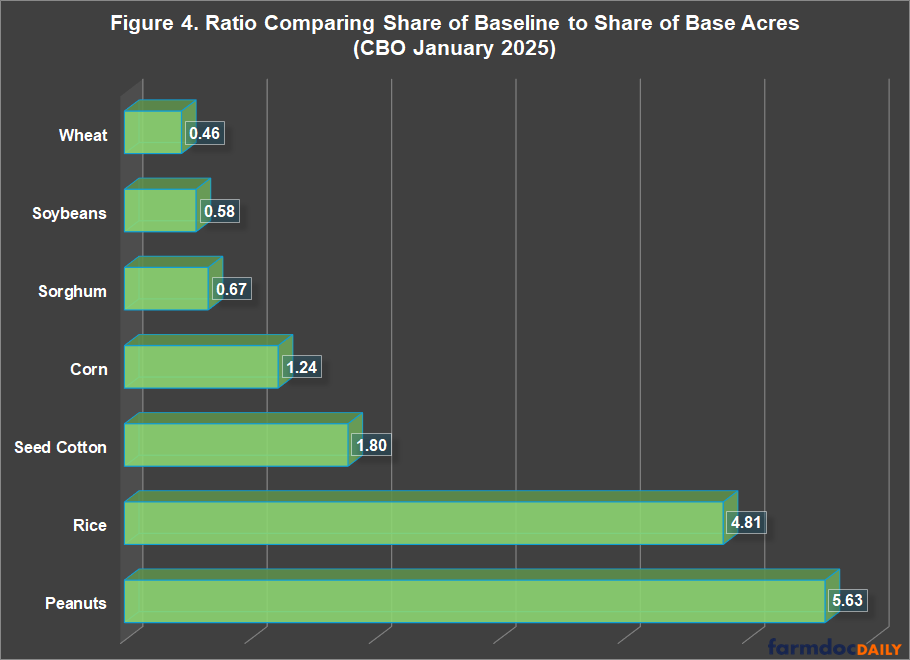

Figure 4 illustrates this telltale further with each of the major program crop’s ratio between its share of the baseline compared to its share of base acres. Peanuts, for example, has a ratio of 5.5, meaning the crop’s share of baseline payments is five-and-a-half times its share of base acres, while the ratio for wheat is 0.46 (share of baseline less than half share of base acres).

The disparities amongst the crop base acres are the direct result of the reference price levels in the PLC design. Figure 2 causes the outcomes in Figure 4 and the cost increases in Figure 1 but are obscured by the acreage differences in Figure 3. Inequitable increases in reference prices will worsen the disparities among base acres which, in turn, worsen the disparities among farmers with different base acres.

Concluding Thoughts

The single most important thing for any honest discussion on these policies is the decoupled design: reference prices are not connected to planting or farm risk; payments are made on base acres, not acres planted to the actual crop. This means a farmer can receive a payment on the base acres of one crop but plant, and receive the market returns, of another crop. Any inequities in the reference prices established by Congress can increase the income of farmers inequitably even when planting the same crops and selling into the same markets, due solely to which base acres the farmer has on file with FSA. It is the base acre that matters for the payment.

Another important telltale in farm policy discussions is the tendency to focus on individual program crops, rather than acknowledging the realities of farming and crop rotations: farmers do not farm only a single crop, nor do they have base acres of only a single program crop. Narrowing the policy discussion to individual crops, however, does have political benefits. Siloing the matter in this way, on a crop-by-crop (or crop vs. crop) basis, favors the crops with the smallest base acres and shares of CBO baseline. The individual crop framework favors seed cotton, rice, and peanuts politically.

Doing so also helps hide the fact that PLC payments are not made in isolation of other farm assistance such as crop insurance. For example, a farmer can plant and insure the same crop for which the farm has base acres. If an ARC/PLC payment and a crop insurance indemnity are both triggered, it raises concerns that the farmer is receiving a double benefit. The decoupled design also means that a farmer can insure the planted crop (with premium subsidy offsetting the costs of insurance) and possibly receive indemnities on it, while receiving the PLC base acre payment for a different crop. The ARC/PLC payment becomes an additional subsidy on top of the net farmer benefit (indemnity minus what the farmer paid for the policy) from crop insurance. The higher the reference price relative to market prices (Figure 2), the more likely a payment is triggered. On average from 2014 to 2023, for example, nearly two million out of more than 4.5 million base acres of rice are planted and insured to crops other than rice each year. Those farmers can collect the rice PLC payment rates per base acre in addition to crop insurance and market benefits for crops other than rice. Similarly, nearly one million of the 2.3 million base acres of peanuts are also planted and insured to crops other than peanuts.

With that past as prologue, the projected payment rates per base acre available on the Policy Design Lab website—updated for the enacted version—provide the primary perspective for the reference price increases (Policy Design Lab, ARC/PLC Payments, 2025 Reconciliation Farm Bill; farmdoc daily, July 3, 2025). Policy design decisions should be understood in context rather than isolation. Coupling common sense with the data cuts through the fog of political spin. The enacted increases in reference prices, at different rates by program crop, add to existing inequities in the policy design to worsen the disparities amongst farmers. Combined with the cost of this change to farm policy ($50.5 billion),the reference price increases come in at number three in the top five most problematic changes to farm policy in the Reconciliation Farm Bill.

References

Congressional Budget Office. “Estimated Budgetary Effects of Public Law 119-21, to Provide for Reconciliation Pursuant to Title II of H. Con. Res. 14, Relative to CBO’s January 2025 Baseline.” Cost Estimate. July 21, 2025. https://www.cbo.gov/publication/61570.

Congressional Budget Office. “USDA Mandator Farm Programs.” January 2025 Baseline Projections. https://www.cbo.gov/system/files/2025-01/51317-2025-01-usda.pdf.

Coppess, J. "The Reconciliation Farm Bill: Top Five Most Problematic Changes to Farm Policy, #4." farmdoc daily (15):147, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, August 14, 2025.

Coppess, J. "The Reconciliation Farm Bill: The Top Five Most Problematic Changes to Farm Policy, #5." farmdoc daily (15):139, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, July 31, 2025.

Coppess, J., G. Schnitkey, N. Paulson, B. Sherrick and C. Zulauf. "Reference Price Disparities & Why It Matters to Farmers." farmdoc daily (14):93, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, May 16, 2024.

Food & Agricultural Policy Research Institute (FAPRI). University of Missuoir. “2025 U.S. Agricultural Market Outlook.” April 3, 2025. https://fapri.missouri.edu/publications/2025-us-agricultural-market-outlook/.

Monaco, H., J. Coppess, N. Paulson and G. Schnitkey. "Farm Bill in Reconciliation: ARC/PLC Payment Projections; Policy Design Lab Update." farmdoc daily (15):122, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, July 3, 2025.

Schnitkey, G., N. Paulson, C. Zulauf and J. Coppess. "Impacts of the Commodity Title Changes Under the One Big Beautiful Bill Act (OBBBA) for Midwestern Farms in 2025." farmdoc daily (15):128, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, July 15, 2025.

Schnitkey, G., N. Paulson, C. Zulauf and J. Coppess. "Spending Impacts of PLC and ARC-CO in House Agriculture Reconciliation Bill." farmdoc daily (15):93, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, May 20, 2025.

Schnitkey, G., N. Paulson, C. Zulauf, J. Coppess and B. Sherrick. "Statutory Reference Prices and the Next Farm Bill." farmdoc daily (14):91, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, May 14, 2024.

Zulauf, C., G. Schnitkey and J. Coppess. "Support Price, Market Price, and the 21st Century." farmdoc daily (15):142, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, August 6, 2025.

Zulauf, C., N. Paulson and G. Schnitkey. "Support Price, Cost of Production, and the 21st Century." farmdoc daily (15):138, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, July 30, 2025.

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.