Revised Variable Cash Lease Parameters

Today’s farmdoc daily article provides a revision to the rent factors used in a simple variable cash lease design. The revisions result in slightly smaller rent factors to be applied to measures of corn and soybean revenue to determine variable cash rents. While the decline in crop revenues from highs in 2022 results in larger reductions in variable cash rents than those observed in average cash rents, farmer returns and return projections remain negative for 2023 to 2026.

Variable Cash Lease

A previous farmdoc daily article from 2022 provided parameters for a simple variable cash lease (September 20, 2022). The parameters included:

- A minimum base rent level to provide a guaranteed rent for the landowner and ensure that Farm Service Agency (FSA) requirements are met to be considered a cash lease. A recommended level for the base rent was $100 per acre less than the average cash rent for similar farmland in the region.

- A maximum rent to provide the farmer tenant with a cap on the rent level paid to the landowner. A recommended level for the maximum rent was $100 per acre more than the average cash rent for similar farmland in the region.

- A measure of farm yield agreed upon by the tenant and landlord. Considerations should be given to how yield will be measured when the grain is delivered or stored off-farm vs on-farm, as well as grain quality measures such as moisture.

- A measure of market price to value the grain. An example could be cash price quotes at a delivery point and over a period of time agreed upon by the farmer tenant and the landlord.

- A rent factor that is multiplied by crop revenue (farm yield times market price) to determine the rent level (with the rent level being capped from below at the minimum rent level and from above at the maximum rent level).

In the 2022 revision to this variable cash lease design, suggested rent factors were provided for corn and soybeans for each of the 4 crop budget regions in Illinois (north, central-high, central-low, and south). Those rent factors were set so that the average variable cash rent was equal to the average cash rent observed on grain farms enrolled in Illinois FBFM in each region over the 2000 to 2021 crop years.

Here we provide another update to the rent factor parameters, setting each so that variable cash rents would equal average cash rents for each region over the 18-year period from 2007 through 2024. This time period was selected to roughly align with the current “new era” of corn and soybean prices that began shortly after passage and updating of the Renewable Fuels Standard (RFS) mandates in 2005 and 2007, respectively (see farmdoc daily article from September 27, 2023). Furthermore, it includes 2 cycles of higher price and income periods (2007-2013, 2020-2022) and lower price and income periods (2014-2019, 2023-2024).

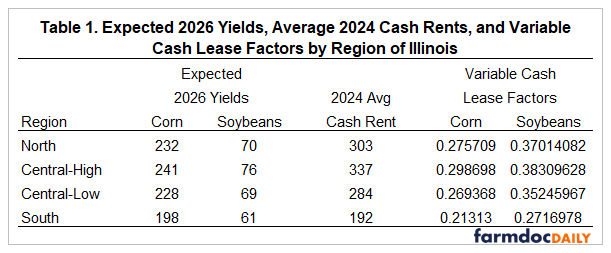

Table 1 provides the revised rent factors, along with expected (trend) 2026 yield levels and average 2024 cash rents for corn and soybeans in each of the budget regions of Illinois.

Rent factors for corn are 28% for the north, 30% for central-high, 27% for central-low, and 21% for the south region. These revised factors (based on equating variable rents to average cash rents from 2007-2024) are 2-3 percentage points lower than previous suggestions (based on equating variable rents to average cash rents from 2000 to 2021). Rent factors for soybeans are 37% for north, 38% for central-high, 35% for central-low, and 27% for south. These revised rent factors are 3-4 percentage points lower than the previous suggestions.

Variable Cash Rent Calculation

An example calculation is provided using averages for central Illinois, high productivity farmland. In 2024 corn yields and prices averaged 244 bu/acre and $4.30 per bu, respectively, generating an average of $1,049 per acre in crop revenue. Applying the rent factor of 30% results in a variable cash rent level of $313 per corn acre. Soybean yields and prices averaged 75 bu/acre and $10.05 per bu in 2024, resulting in average crop revenue of $754 per soybean acre. Applying the 38% rent factor results in a variable rent level of $289 per soybean acre.

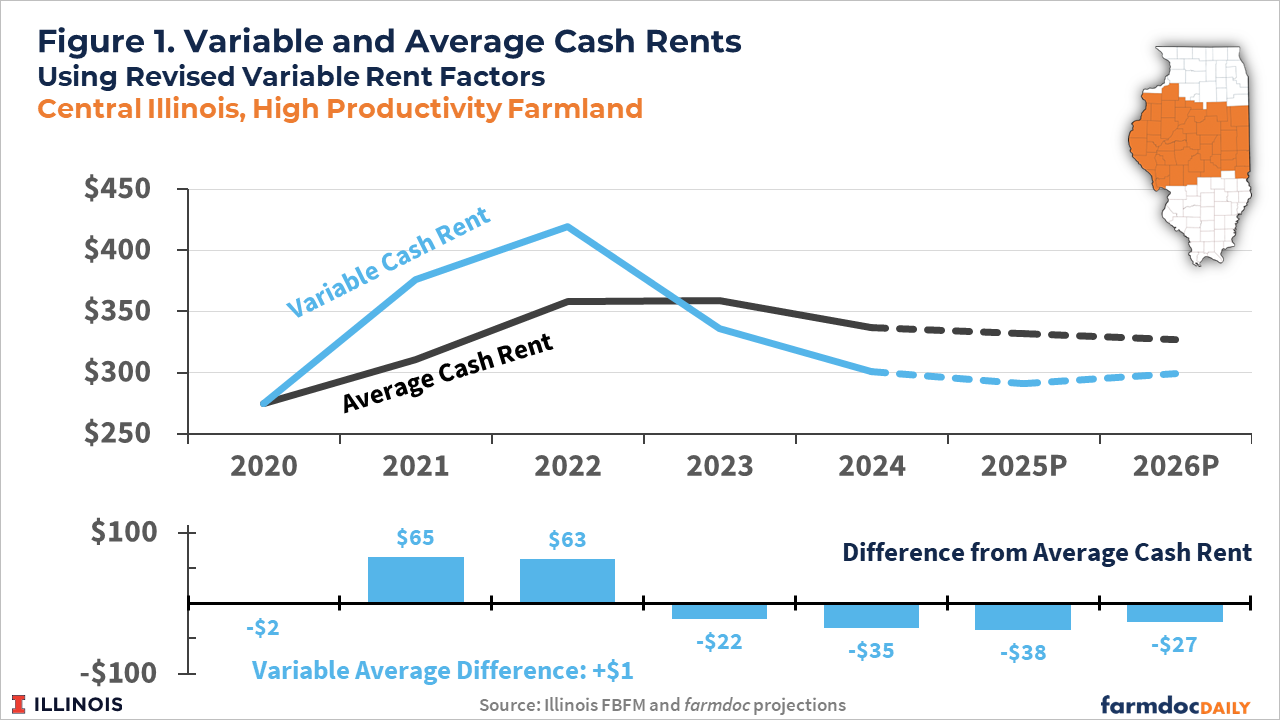

For a 50-50 corn-soy rotation the average variable rent level for 2024 would have been $302 per acre, or $35 below the average cash rent of $337 per acre. Figure 1 compares the rent levels for the revised variable lease and the average cash rent in central Illinois from 2020 to 2024 with current projections for 2025 and 2026. The variable lease provided a similar rent to the average cash rent in 2020, a significantly larger rent in 2021 and 2022, and lower rents compared with average cash rent levels for 2023 to 2026.

Discussion

The use of variable cash leases in Illinois continues to increase. The 2025 mid-year survey from the Illinois Society of Professional Farm Managers and Rural Appraisers (ILSPFMRA) indicated that 34% of rental agreements are now a form of variable lease compared with 21% of rental agreements being variable cash leases in ILSPFMRA’s 2020 Land Values Report.

Merits of variable leases include risk-sharing for the tenant and greater upside rent level potential for the landlord based on current economic conditions and relative simplicity compared with share rent agreements as they avoid the landlord needing to be involved with as many management decisions. While negotiating a variable lease may be more difficult in the beginning, the automatic nature of adjustments to economic conditions can alleviate the need for annual negotiations between the tenant and landlord.

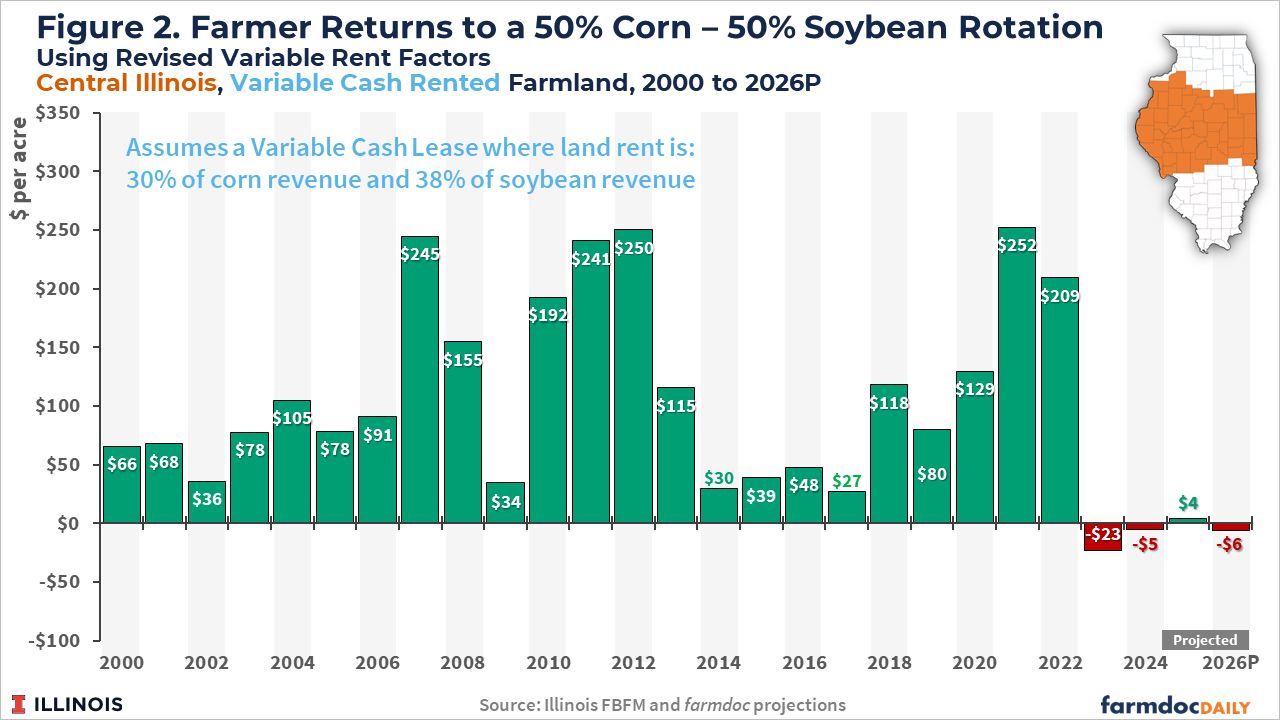

However, variable leases that base the rental payment on a percentage of crop revenues – like the simple design provided here – do not fully address the return situation currently facing farmers. Net farmer returns on cash-rented farmland in Illinois have been negative since 2023 and are expected to remain negative through at least 2026 (see farmdoc daily article from August 19, 2025). Figure 2 illustrates average net farmer returns under the revised variable lease presented in this article. While returns from 2023 to 2026 are improved relative to those in average cash rent situations, the variable lease also results in negative farmer returns for 2023, 2024, and projected for 2026. The projected return for 2025 is minimally above break-even at $4 per acre. While the lower crop revenues since 2022 result in lower variable lease rent levels, the variable lease rental arrangements still do not result in producers covering today’s high production costs.

Summary

Revised rent factors for a simple variable cash lease are slightly lower than those previously estimated in 2022. The revised variable lease is shown to provide larger downward adjustment in rent levels than have or are expected to occur with average cash rents. However, high non-land production costs continue to suggest negative farmer returns even under a variable cash lease from 2023 through 2026.

References

Irwin, S. and D. Good. "The New Era of Crop Prices: A 15-Year Review." farmdoc daily (13):176, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, September 27, 2023.

Paulson, N., G. Schnitkey, B. Zwilling and C. Zulauf. "2026 Illinois Crop Budgets." farmdoc daily (15):150, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, August 19, 2025.

Schnitkey, G., C. Zulauf, N. Paulson, K. Swanson, J. Coppess and J. Baltz. "A Straight-Forward Variable Cash Lease with Revised Parameters." farmdoc daily (12):145, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, September 20, 2022.

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.