Rewriting the RFS Playbook: Revised RVOs Backload Projected Biomass-Based Diesel Production and Feedstock Use into 2027

The EPA’s recent trilogy of RFS decisions represents one of the most consequential regulatory developments of the last decade for biomass-based diesel markets. Higher RVOs, more restrictive small refinery exemptions, and mandatory reallocation create substantially higher requirements for 2026-2027. In our most recent article (farmdoc daily, November 12, 2025), we projected dramatic increases in domestic biomass-based diesel production and feedstock use under the EPA’s proposed “half RIN” credit for imported feedstock and imported fuel. The purpose of this article is to review the projections and highlight a critical finding—the market impacts are heavily backloaded to 2027. The article builds upon the analysis of the renewable diesel boom found in a series of previous farmdoc daily articles.

Analysis

In our November 12th article, we derived updated projections of required D4 RIN (renewable identification number) generation for 2026-2027, incorporating three major EPA rulemakings: proposed RVOs for 2026-2027, comprehensive SRE decisions, and a reallocation policy framework. We accounted for recent SRE approvals announced in November 2024, totaling 740 million gallons across 2021-2024. The analysis considered two reallocation scenarios (100 percent and 50 percent) for historical SREs and assumed full reallocation of 2026-2027 SREs within their respective compliance years. The projections showed that average D4 RIN generation increases from 7.84 billion gallons over 2023-2025 to 9.43 billion gallons across 2026-2027—a 20 percent increase. These represent fixed requirements that must be met through various combinations of domestic and imported biomass-based diesel production.

The critical policy variable is the EPA’s proposed “half RIN” for domestically produced biomass-based diesel using imported feedstock and for imported biomass-based diesel. With D4 RIN prices around $1 per RIN gallon, the half RIN proposal translates to a roughly 80-cent per gallon credit reduction with a 1.6 RIN designation—large enough to fundamentally reshape production decisions.

We analyzed four scenarios differing primarily in import responses. The “EPA” scenario assumes imports remain fixed at 2024 levels. The “No Imports” scenario assumes zero imports given the credit disadvantage. The “Split” scenario averages the first two. The “Status Quo” scenario assumes no half RIN implementation. All scenarios share the same RVO assumptions but differ in how domestic versus imported production responds.

Under the three half RIN scenarios, FAME biodiesel production increases an average of 39 percent over 2026-2027 compared to the 2023-2025 average, while renewable diesel production rises 44 percent. These increases drive aggregate capacity utilization from an average 71 percent over 2023-2025 to rates approaching or exceeding 100 percent by 2027. By 2027, utilization rates reach or slightly exceed full capacity, marking a dramatic reversal from the recent period of oversupply.

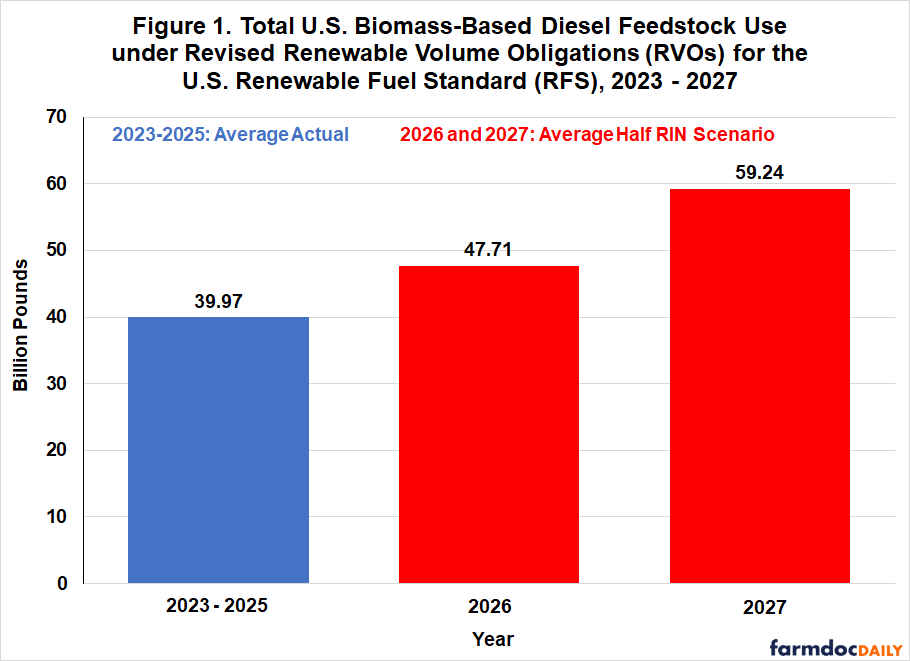

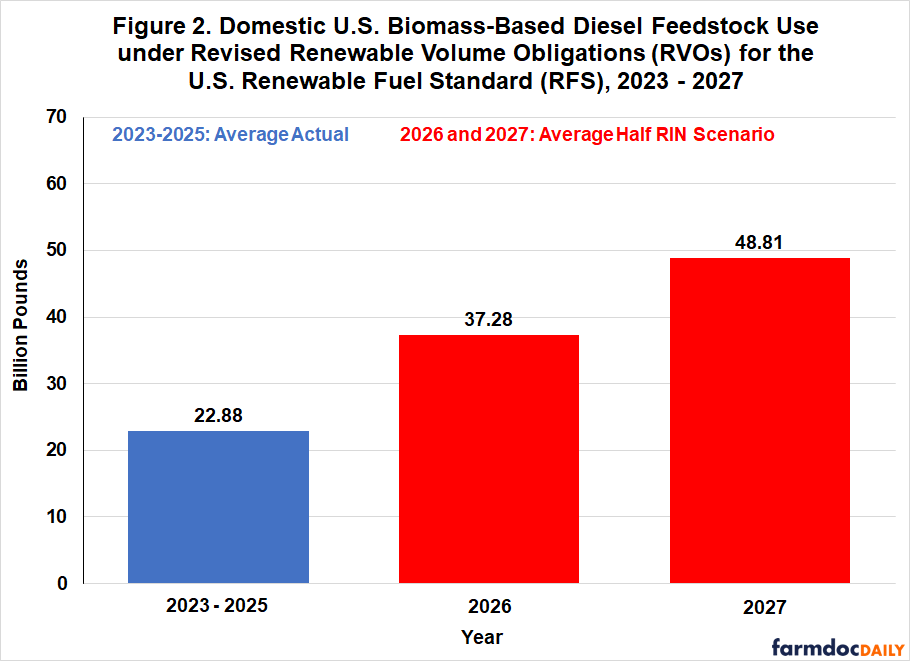

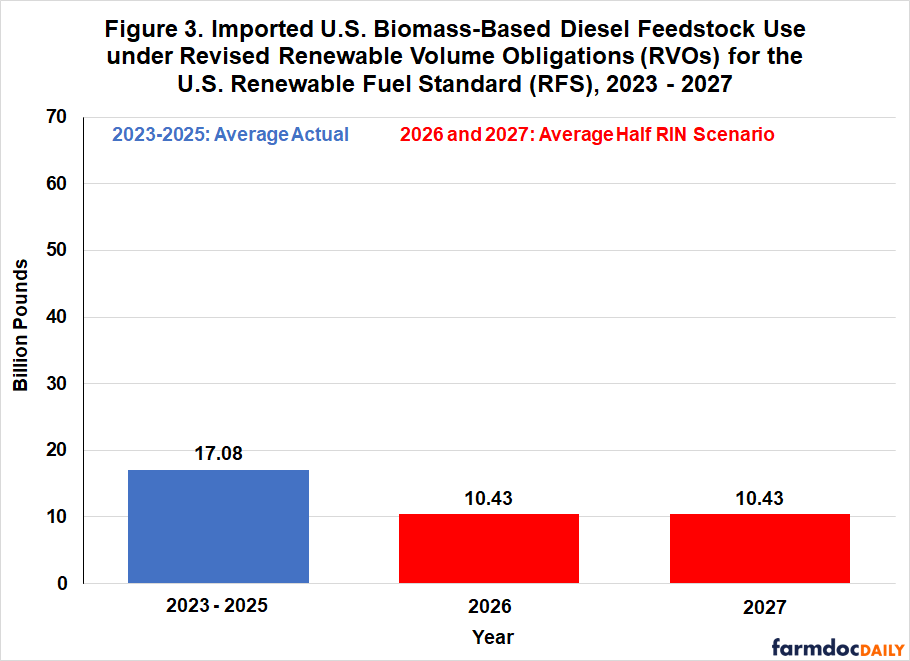

The backloading of feedstock impacts to 2027 is clearly illustrated in Figures 1 through 3. We calculate feedstock requirements using 7.55 pounds per gallon for biodiesel and 8.125 pounds per gallon for renewable diesel. Each figure compares average feedstock use during 2023-2025 with average projections for the three half RIN scenarios in 2026 and 2027.

Figure 1 shows total feedstock use increases substantially under all half RIN scenarios. The 2023-2025 baseline averaged 40.0 billion pounds annually. Under the half RIN scenarios, total feedstock use rises to 47.7 billion pounds in 2026 (a 19 percent increase) and jumps to 59.2 billion pounds in 2027 (a 48 percent increase). The increase from 2026 to 2027 alone represents an additional 11.5 billion pounds. The two-year average increase of 9.9 billion pounds represents 24 percent growth compared to 2023-2025.

The backloading effect is even more pronounced for domestic feedstock, shown in Figure 2. The 2023-2025 baseline averaged 22.9 billion pounds annually. Under the half RIN scenarios, domestic feedstock use increases to 37.3 billion pounds in 2026 (a 63 percent increase) and surges to 48.8 billion pounds in 2027 (a 113 percent increase). Averaged across the two years, domestic feedstock use increases by 20.2 billion pounds—an 88 percent increase. This dramatic shift reflects higher RVO requirements combined with the shift away from imported feedstock under the half RIN policy.

Figure 3 shows imported feedstock declining to 10.4 billion pounds in both 2026 and 2027 from a 2023-2025 average of 17.1 billion pounds—a 39 percent reduction. Unlike total and domestic feedstock, imported volumes show no backloading effect; they decline immediately in 2026 and remain at that lower level in 2027.

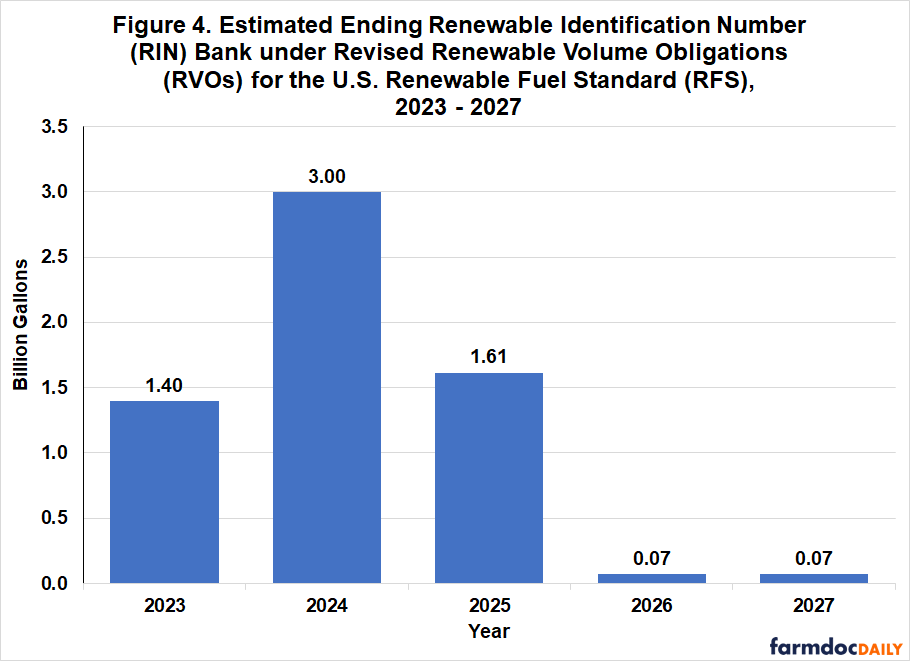

The key to understanding why feedstock impacts are backloaded lies in the D4 RIN bank. As shown in Figure 4, the bank exploded to an unprecedented 3.0 billion gallons in 2024—over three times the previous 2016 peak. This massive accumulation resulted from RIN generation substantially outpacing obligations during 2023-2024. The bank declines to 1.61 billion gallons in 2025 but remains extremely large by historical standards.

This enormous RIN bank provides a substantial buffer as the market transitions to higher RVOs in 2026-2027. Obligated parties can draw down the bank to help meet compliance obligations, blunting the immediate impact on physical feedstock demand. However, our projections assume the RIN bank reaches just 73 million gallons by the end of 2026, implying the existing inventory will be consumed during this year. The 2026 compliance year thus represents a major inflection point. To this point, delays in implementing the policies put forward by the EPA well into 2026 combined with the large D4 RIN bank create uncertainty that would allow reduced biodiesel production levels for meeting 2026 RVO’s deep into the year. Delays increase the likelihood of a stronger shock to both RIN and feedstock markets once the policy is finalized.

The magnitude of the projected feedstock increases warrants careful consideration. A recent USDA analysis (Bukowski, Swearingen, and Hubbs, February 2025) estimated total global supply of biomass-based diesel feedstock at 129 billion pounds for 2023-24. Our projected average annual increase of 9.9 billion pounds over 2026-2027 represents an 8 percent increase in global demand—substantial but potentially manageable at the global level.

The domestic picture is more dramatic. The USDA analysis estimated total U.S. supply at 80 billion pounds for 2023-24. Our projected average increase in domestic feedstock use of 20.2 billion pounds represents one-quarter of total U.S. feedstock supply. Moreover, this increase is concentrated in 2027, when domestic feedstock demand reaches 48.8 billion pounds—61 percent of estimated U.S. feedstock supply.

These comparisons provide only rough indicators, as feedstock supplies will likely respond to higher prices, and not all available feedstock currently flows to biomass-based diesel. Nevertheless, the scale of the 2027 increase suggests substantial adjustment pressures, particularly for animal fats and used cooking oil markets serving renewable diesel production. The soybean oil market may also see increased biodiesel demand, with potential spillover effects on vegetable oil prices broadly.

The D4 RIN market will likely experience significant volatility during this transition. As the massive RIN bank is drawn down through 2026, RIN prices should signal whether the market expects sufficient capacity and feedstock availability to meet 2027 requirements. If concerns emerge, RIN prices could spike well above recent levels.

Implications

The EPA’s recent RFS decisions will drive substantial increases in biomass-based diesel production and feedstock demand over 2026-2027, but the full impact is heavily backloaded to 2027. The massive D4 RIN bank—peaking at 3.0 billion gallons in 2024—provides a critical buffer moderating the immediate impact in 2026. However, as this bank is drawn down, the full force of higher RVOs and the half RIN policy will hit the markets in 2027. Total feedstock demand will increase 19 percent in 2026 and 48 percent in 2027 relative to 2023-2025. For domestic feedstock, the increases are even more dramatic: 63 percent in 2026 and 113 percent in 2027. This backloading means 2027 is the critical year when production approaches full capacity utilization and domestic feedstock demand reaches 48.8 billion pounds—61 percent of total estimated U.S. feedstock availability.

Market participants should anticipate a two-stage adjustment. In 2026, obligated parties will draw down the RIN bank while ramping up production, leading to moderately higher feedstock prices. In 2027, with the RIN bank at minimum levels, markets face the full policy impact. This suggests feedstock price pressures, production bottlenecks, and RIN price volatility will be more severe in 2027 than 2026. Important uncertainties remain. The EPA has not finalized the half RIN proposal, and a recent media report (Renshaw, 2025) suggests the Trump Administration is considering delaying the implementation by one or two years. In addition, feedstock supplies may respond more robustly to higher prices than anticipated. Nevertheless, the backloaded nature of the feedstock impact to 2027 appears robust across scenarios, making this a key consideration for strategic planning by market participants.

References

Bukowski, M., B. Swearingen, and T. Hubbs. “Special Article: Estimating Biomass-Based Diesel Feedstock Availability in Marketing Years 2018/19-2023/24.” Oil Crops Outlook, U.S. Department of Agriculture, Economic Research Service, Situation and Outlook Report, February 2025. https://ers.usda.gov/sites/default/files/_laserfiche/outlooks/110935/OCS-25b.pdf?v=96817

Hubbs, T. and S. Irwin. "Rewriting the RFS Playbook: The Impact of Revised RVOs on Projected Biomass-Based Diesel Production and Feedstock Use for 2026-2027." farmdoc daily (15):209, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, November 12, 2025.

Renshaw, J. “Trump Administration May Delay Biofuel Import Credit Cuts as Refiners Balk.” Reuters, November 19, 2025. https://www.reuters.com/sustainability/climate-energy/trump-administration-may-delay-biofuel-import-credit-cuts-refiners-balk-2025-11-19/

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.