Rewriting the RFS Playbook: The Impact of Revised RVOs on Projected D4 Biomass-Based Diesel RIN Generation for 2026-2027

The U.S. Environmental Protection Agency (EPA) released a trilogy of decisions for the U.S. Renewable Fuel Standard (RFS) in recent months that represents some of the most significant regulatory developments for biomass-based diesel in the program’s history. The vast majority of biomass-based diesel produced in the U.S. and used to comply with the RFS is made up of FAME biodiesel and renewable diesel (farmdoc daily, February 8, 2023). The combined effect of higher renewable volume obligations (RVOs), more restrictive small refinery exemptions, and mandatory reallocation creates substantially higher biomass-based diesel requirements for 2026-2027 (farmdoc daily, October 25, 2025). This naturally raises questions about how these higher requirements will play out in terms of D4 RIN generation, physical biomass-based diesel markets, and underlying feedstock markets. Analysis of these issues is complicated by the fact that RINs can be carried over from year-to-year and that biomass-based diesel historically has served as the “marginal” gallon for filling multiple RVOs. The purpose of this article is to analyze the impact of the revised RVOs on projected D4 RIN generation for 2026-2027 using a balance sheet approach. The D4 RIN balance sheet incorporates factors that directly impact supply and demand of RINs, including carryovers. The article builds upon the analysis of the renewable diesel boom found in a series of previous farmdoc daily articles.

Analysis

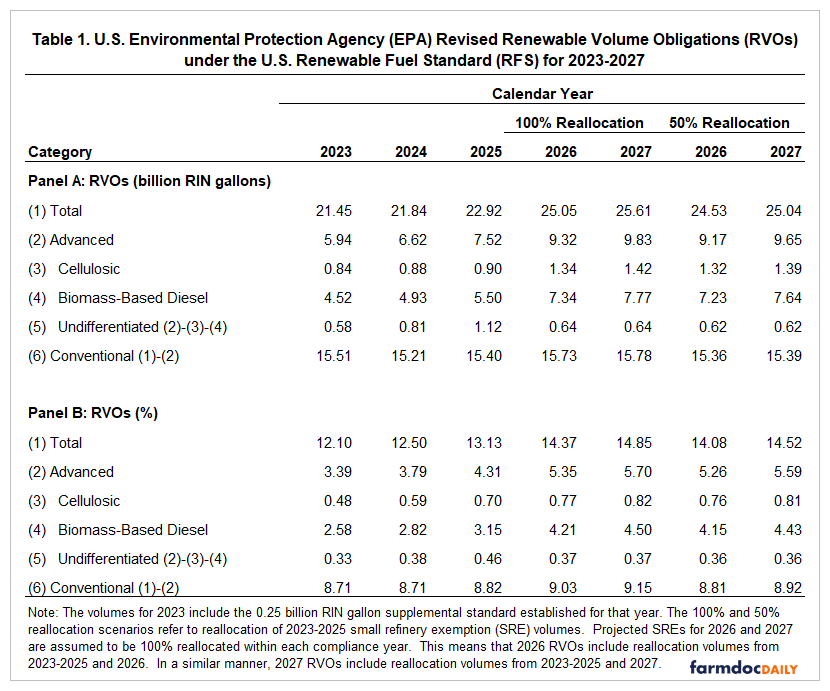

We begin by reviewing the revised RVOs for 2026-2027 presented in our most recent farmdoc daily article (October 25, 2025). The revised RVOs shown in Table 1 are based on three important EPA rulemakings: i) proposed renewable volume obligations (RVOs) for 2026 and 2027 released in June 2025; ii) a comprehensive rulemaking on small refinery exemptions (SREs) over 2016-2024 that was released in July 2025; and iii) a reallocation policy framework for small refinery exemptions published in September 2025. Panel A of Table 1 presents the revised gallon RVOs, and panel B presents the revised percentage RVOs. Compliance with annual RFS mandates is based on the percentage RVOs rather than absolute volumes (farmdoc daily, February 23, 2018). Two scenarios for reallocation of 2023-2025 SREs in 2026-2027 are presented: 100 percent and 50 percent reallocation. Projected SREs for 2026-2027 are also assumed to be fully reallocated within each compliance year.

The revised RVOs for 2026 and 2027 in Table 1 represent a continuation of the EPA’s approach of setting obligations that generally align with projected biofuel production capacity. For biomass-based diesel specifically, the proposed RVOs reflected the agency’s assessment of the continued expansion of renewable diesel production capacity while maintaining obligations that would keep the D4 mandate economically binding. The net result is a robust increase in the biomass-based diesel RVO from 5.50 billion gallons in 2025 to 7.77 billion gallons in 2027 under 100 percent reallocation, more than a two-billion-gallon increase. The revised biomass-based diesel RVOs average 4.98 billion gallons over 2023-2025. This compares to an average of 7.50 billion gallons across the two reallocation scenarios for 2026 and 2027, which represents slightly more than a 50 percent increase in volume. Lastly, it is important to emphasize that the RVOs presented in Table 1 have not been finalized, but, rather, are projections based on the June preliminary rulemaking, the July SRE decisions, and the September reallocation framework.

The large increase in RVOs over 2026-2027 in a relatively short period of time may have substantial impacts on biomass-based diesel and related feedstock markets. The first step in analyzing these impacts is to project the impact on D4 RIN generation over 2026-2027. As mentioned earlier, projection of D4 RIN generation is complicated by the fact that RINs can be carried over from year-to-year. Specifically, a RIN created in a given year can be used for compliance in the calendar year the RIN was produced or the next year. For example, RINs generated in 2025 can be used to meet compliance obligations in 2025 or 2026. Being able to “bank” RINs provides a buffer to fluctuations in biofuel supply and demand. However, banking of RINs by obligated parties cannot exceed 20 percent of the subsequent year’s RVO.

The other major complication is related to D4 RINs serving historically as the “marginal” gallon for filling multiple RVOs (farmdoc daily, July 19, 2017). Because RINs are nested based on greenhouse gas reduction scoring (farmdoc daily, May 17, 2023), D4 RINs can be used to fill not only the biomass-based diesel RVO but also the undifferentiated advanced (total advanced – (cellulosic + biomass-based diesel)) and conventional RVOs. D4 RINs function as the marginal gallon for filling these other RVOs when the supply of RINs used to normally fill these RVOs is limited, and D4 RINs are the least cost alternative RIN available. For example, if the conventional RVO is set above the E10 blend wall, not enough D6 RINs will be produced to fill the conventional mandate. Consequently, D4 RINs are produced in excess of the amount needed to fulfill the biomass-based diesel RVO, and these excess RINs can be used to “top off” the conventional mandate.

With this background, we can introduce the balance sheet framework that will be used to project D4 RIN generation over 2026-2027. The balance sheet identity offers a systematic method for evaluating the cumulative impact of multiple policy changes on D4 RIN supply and demand. The D4 balance sheet is constructed using the fundamental identity that governs RIN markets:

Beginning RIN Bank + RIN Generation + Current Year Deficit – RVOs – Exports – Previous Year Deficit – Ending RIN Bank = 0

Each component of this identity provides critical insights into market dynamics:

- Beginning RIN Bank: The stock of RINs carried forward from previous years.

- RIN Generation: New RINs created through biofuel production and imports.

- Current Year Deficit: Up to 20 percent of obligations may be waived.

- RVOs: The regulatory demand for RINs based on renewable volume obligations.

- Exports: RINs associated with exported biofuels that cannot be used for RFS compliance.

- Previous Year Deficit: Deficits from previous year must be made up in the following year.

- Ending RIN Bank: The stock of RINs carried forward to the following year.

The logic of the RIN balance sheet for a given year can be further demonstrated as follows:

Total Supply = Beginning RIN Bank + RIN Generation + Current Year Deficit

Total Demand = RVOs + Exports + Ending RIN Bank + Previous Year Deficit

Total Supply – Total Demand = 0

A balance sheet approach provides an easily interpretable supply and demand snapshot of the RIN market at the end of each compliance year. The key to building a RIN balance sheet is detailed accounting of RIN generation and usage based on EPA and other data. A number of assumptions are embedded in the D4 RIN balance sheet in order to generate reasonable estimates of D4 RIN generation under different policy scenarios for 2026 and 2027.

Because of the recent EPA decisions, 2022 is the last year for which compliance has been closed as of the present date. This means that we have to first project D4 RIN balance sheets for 2023-2025 before making projections for 2026-2027. The starting point for this earlier period is the beginning D4 RIN bank for 2023 (ending bank for 2022), which was estimated to be 81 million gallons by Gerveni, Hubbs, and Irwin (2025). In the draft regulatory impact analysis that accompanied the June 2025 proposed RVO rulemaking, the EPA reported that the bank of non-cellulosic advanced RINs (D4 and D5) at the beginning of 2023 equaled 98 million gallons. Gervini, Irwin, and Hubbs report the sum of these two RIN categories at the beginning of 2023 to be 99 million gallons, virtually the same total, which strongly suggests that 81 million gallons is very close to the correct value for the D4 RIN bank at the beginning of 2023.

Other important assumptions for 2023-2025 include:

- RIN generation for 2023 and 2024 is based on actual data reported by EPA. RIN generation for 2025 is forecast based on actual data for the first 9 months of 2025.

- RVOs are drawn directly from revised estimates in Table 1.

- The advanced gap is computed as the advanced RVO from Table 1 minus cellulosic and BBD RVOs minus D5 RIN generation for each year (projected for 2025 based on actual data for first 9 months of 2025).

- The conventional gap is computed as conventional RVO from Table 1 minus D6 RIN generation for each year (projected for 2025 based on actual data for first 9 months of year).

- Exports are computed based on D4 export RIN retirements reported by the EPA for each year (projected for 2025 based on actual data for first 9 months of year).

- Net deficit is the prior year deficit reported by the EPA minus the current year deficit. The prior year deficit and current year deficit are only known at the present time for 2023 because compliance has not closed for any subsequent years. We assume that the current year deficit for 2024 and 2025 is 101 million gallons, which is the average of the reported deficits in 2016-2019, which is a previous period with large D4 RIN bank levels.

Key assumptions for 2026-2027 include the following:

- RVOs are drawn directly from revised estimates in Table 1.

- The advanced gap is computed as the advanced RVO from Table 1 minus cellulosic and BBD RVOs minus D5 RIN generation for each year.

- The conventional gap is computed as conventional RVO from Table 1 minus D6 RIN generation for each year.

- D5 RIN generation is assumed to be 258 million gallons each year, the projection for 2025.

- D6 RIN generation is assumed to be 14.384 billion gallons each year, the projection for 2025.

- Biomass-based diesel exports are assumed to be 884 million gallons each year, the projection for 2025.

- The ending D4 RIN bank is assumed to be 73 million gallons, the average ending RIN bank for 2021-2023, years at the heart of the first renewable diesel boom. This is based on the assumption that RIN balances will be similarly “tight” as during the last boom. Starting with this assumption for the value of the ending RIN bank each year, net D4 RIN generation is imputed using the balance sheet identity as follows: RIN Generation = RVOs + Exports + Current Year Deficit – Previous Year Deficit + Ending RIN Bank – Beginning RIN Bank.

- The current year deficit is assumed to be 371 million gallons, which is the average of the reported deficits over 2021-2023, the most recent previous period with tight D4 RIN supply and demand balances.

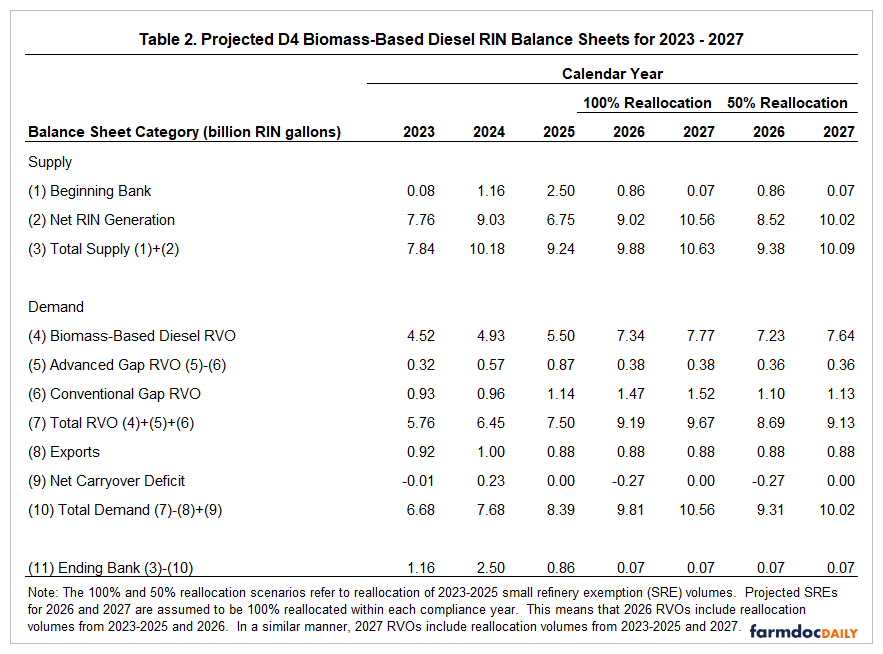

The estimated D4 RIN balance sheet for 2023-2027 is presented in Table 2. It reveals a dramatic shift in D4 RIN market fundamentals between 2023-2025 and 2026-2027. In 2023 and 2024, the analysis shows a massive buildup of the D4 RIN bank as RIN generation substantially outpaced obligations. The D4 bank peaks at 2.5 billion gallons in 2024, nearly three times the previous peak in 2016 (Gerveni, Hubbs, and Irwin, 2025). However, 2025 marks an inflection point where the growth in the RIN bank begins to slow and the size of bank falls under a billion gallons. Nonetheless, a bank of this size provides a historically large buffer going into 2026-2027. Note that the size of the ending RIN bank in 2026 and 2027 is assumed to be a fixed value of 73 million gallons, based on the argument that RIN balances are expected to be “tight” during years of sharply rising RVOs.

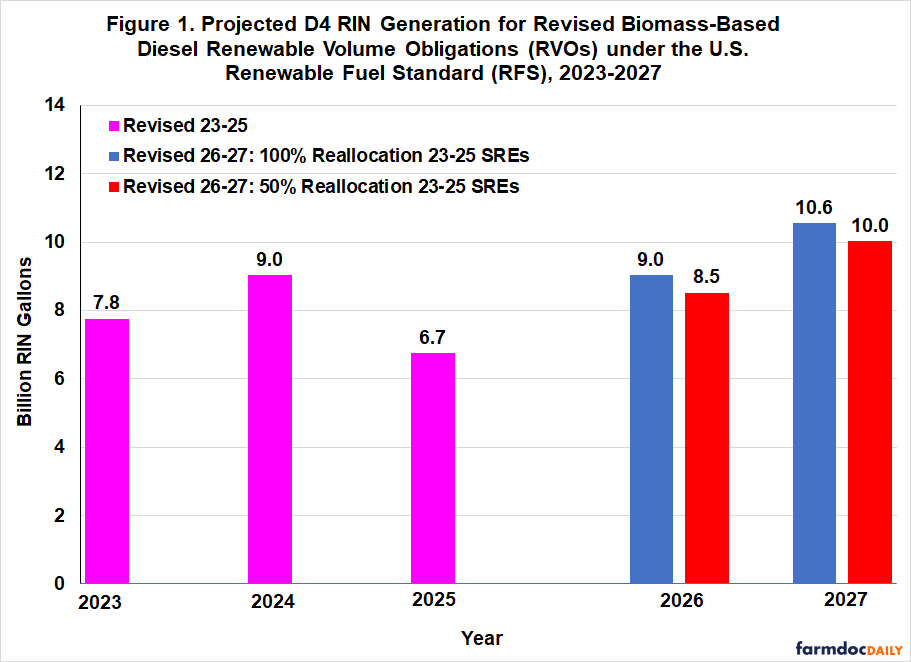

The estimates for D4 RIN generation in Table 2 reveal an interesting pattern. On average, D4 generation is 7.84 billion gallons over 2023-2025. This compares to an average of 10.56 billion gallons across the two reallocation scenarios for 2026 and 2027, a 22 percent increase. Required D4 RIN generation is presented graphically for 2023-2027 in Figure 1. While a 22 percent increase in RIN generation over a relatively short period of time is substantial, it is important to note that it falls well short of the 50 percent increase in RVOs for 2023-2025 compared to 2026-2027.

There are two reasons why the percentage increase in required D4 RIN generation is not as large as the percentage increase in biomass-based diesel RVOs. The first is the 860-million-gallon RIN bank that is projected to be available at the beginning of 2026. This stock of RINs has to be worked off before D4 RIN generation needs to ramp up. The impact of the large beginning RIN bank can be seen directly by comparing 2026 and 2027 RIN generation requirements. Averaged across the two reallocation scenarios, RIN generation in 2026 is 8.77 billion gallons compared to 10.29 billion gallons in 2027, a 1.52-billion-gallon difference. About half of the larger RIN generation requirement in 2027 can be traced to higher RVOs, with the other half explained by the sizable D4 RIN bank available in 2026.

The second reason the percentage increase in D4 RIN generation is smaller is that the total of the advanced and conventional gap RVOs shown in Table 2 is essentially unchanged, on average, between 2023-2025 and 2026-2027. D4 RIN demand is a function of all three RVOs—biomass-based diesel, advanced gap, and conventional gap. Only the biomass-based diesel RVO increases substantially between 2023-2025 and 2026-2027. The net result is that the sum of the three RVOs grows more slowly in percentage terms than the biomass-based diesel RVO alone.

Implications

The analysis presented in this article demonstrates that the EPA’s recent trilogy of RFS decisions will have a substantial impact on D4 RIN generation requirements for 2026-2027. We use a balance sheet approach to project a 22 percent increase in D4 RIN generation—from an average of 7.84 billion gallons over 2023-2025 to 10.56 billion gallons for 2026-2027—a large increase by any reasonable standard. However, two factors provide important context for understanding how these higher requirements may play out in the marketplace. First, the 860-million-gallon D4 RIN bank projected to be available at the beginning of 2026 provides a historically large buffer that will dampen the immediate need for increased RIN generation. This helps explain why RIN generation requirements in 2026 are projected to be 1.5 billion gallons lower than in 2027. Second, the fact that required D4 RIN generation increases by only 22 percent while biomass-based diesel RVOs increase by 50 percent highlights the importance of considering all three RVOs—biomass-based diesel, advanced gap, and conventional gap—when projecting D4 RIN market dynamics using a balance sheet approach. The advanced and conventional gap RVOs remain essentially flat between the two periods, which moderates the overall increase in D4 demand. Despite these moderating factors, the projected D4 RIN generation for 2027 exceeds the 10-billion-gallon threshold, an unprecedented level. The analysis suggests that biomass-based diesel production will need to resume a robust growth trajectory if the industry is to meet these higher obligations. We will examine the implications for physical biomass-based diesel production and feedstock use in an upcoming article.

References

Gerveni, M., T. Hubbs and S. Irwin. "Biodiesel and Renewable Diesel: What’s the Difference?" farmdoc daily (13):22, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, February 8, 2023.

Gerveni, M., T. Hubbs and S. Irwin. "Overview of the U.S. Renewable Fuel Standard." farmdoc daily (13):90, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, May 17, 2023.

Gerveni, M., T. Hubbs and S.H. Irwin. “Storage Dynamics in the RIN Market: Taking It to the Bank.” Working paper, Department of Agricultural and Consumer Economics, University of Illinois-Urbana-Champaign, September 2025.

Hubbs, T. and S. Irwin. "Rewriting the RFS Playbook: The Impact of Recent EPA Decisions on 2023-2027 RVOs for Biomass-Based Diesel." farmdoc daily (15):199, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, October 29, 2025.

Irwin, S. “How Much Will the Cost of a RINs Bundle Decline if the Conventional Ethanol Gap Disappears?” farmdoc daily (8):32, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, February 23, 2018.

Irwin, S. and D. Good. "Filling the Gaps in the Renewable Fuels Standard with Biodiesel." farmdoc daily (7):130, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, July 19, 2017.

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.