Farmer Bridge Assistance Program Payment Rates

The USDA recently announced payment rates for row crops eligible for the Farmer Bridge Assistance Program. Acres planted to corn ($44.36 per planted acre), soybeans ($30.88), wheat ($39.35), and 16 other eligible commodities should expect to receive FBA payments by the end of February. The average 1,500 acre grain farm in Illinois, with acres planted to corn and soybeans on owned and cash rented farmland, should expect to receive nearly $38 per planted acre or just over $56,000 in total FBA support.

FBA Program Information

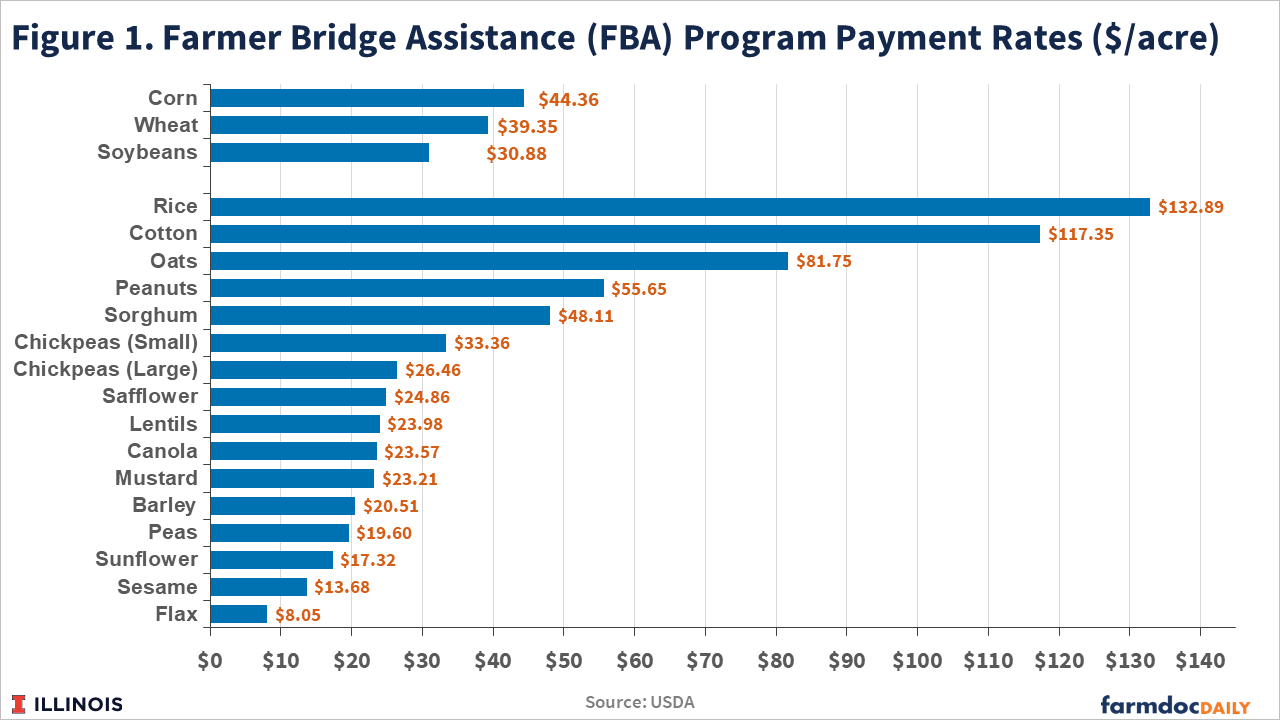

On December 31, 2025 the USDA released payment rates for row crops eligible for $11 billion of the $12 billion provided through the Farmer Bridge Assistance Program (FBA). Producers of eligible crops will receive a flat payment rate per acre planted to an eligible crop, with payments expected to be issued by February 28th, 2026. Information from the USDA indicates that producers will be provided with pre-filled FBA application forms through the Farm Service Agency (FSA). The payment rates for all eligible row crops are provided below in Figure 1.

Corn will receive $44.36 per acre, soybeans will receive $30.88 per acre, and wheat will receive $39.35 per planted acre. The largest payment rates were set for Rice ($132.89), Cotton ($117.35), Oats ($81.75), Peanuts ($55.65), and Sorghum ($48.11). Payment rates for Chickpeas, Safflower, Lentils, Canola, Mustard, Barley, and Peas are the in the $20-30 per acre range. Sunflower ($17.32), Sesame ($13.68), and Flax ($8.05) have the lowest payment rates.

Acres planted to eligible commodities in 2025, as reported to and recorded by the FSA, will be eligible for payments. In contrast to the Emergency Commodity Assistance Program (ECAP) payments provided last year, no 2025 prevent plant acres will be eligible for FBA payments. All intended uses are eligible except for grazing, volunteer stands, experimental acres, green manure, and acres left standing, abandoned, or planted as cover crops. For double crop systems, acres of the both the initial and subsequently planted crops will be eligible to receive payments. For example, producers in the southern half of Illinois who planted wheat for harvest in 2025 followed by a soybean crop will be eligible to receive the payment rate for both commodities.

The limit on FBA payments is $155,000 per person or entity, and average adjusted gross income (AGI) for the person or entity must be below $900,000 to be eligible. There are no linkages or requirements associated with crop insurance coverage to be eligible to receive FBA support. Recent ad hoc programs (ECAP in 2025, MFP in 2018 and 2019) provided payments in tranches. However, FBA program information provides no indication of the use of payment tranches suggesting producers will receive the full payment in one installment pending eligibility and processing of their application.

The USDA has provided a number of informational resources related to the FBA program. These include:

- Initial press release on December 8th

- Press release announcing payment rates on December 31st

- FBA Fact Sheet

- FBA Payment Calculator

Producers are encouraged to contact their local FSA office with additional questions.

Impacts of FBA for Illinois Producers

Corn-soybean rotations are the dominant cropping system in place on the majority of grain farms throughout Illinois. A farm with 50% of its acres planted to corn and the other half planted to soybeans would receive an average FBA payment of $37.62 per acre (0.5 x $44.36 + 0.5 x $30.88). The average size of a grain farm enrolled in Illinois Farm Business Farm Management (FBFM) is roughly 1,500 acres. Total FBA payments for the average grain farm with only owned and cash rented acres in Illinois with 750 acres planted to corn and 750 acres planted to soybeans in 2025 would be $56,430 ($44.36 x 750 corn acres plus $30.88 x 750 soybean acres). For acres farmed under share rent leases, FBA payments would be split between the tenant and landowner based on the sharing arrangement.

A farm business with a single operator would need to have more than 4,000 acres (assuming a corn-soy rotation) to reach the $155,000 payment limit. A farm business operated by a farming couple would need to have more than 8,000 acres to reach the payment limit. Smaller farm sizes could reach the payment limit with rotations that include more corn acres, or on operations with some acres in wheat and double crop soybean systems. Still, the vast majority of farm business entities in Illinois will not exceed the FBA payment limitation.

While FBA payments will be issued in 2026, they are intended to support poor returns earned by row crop producers for the 2025 crop year. Thus, FBA payments will impact cash-based incomes for purposes such as 2026 income taxes, but should be incorporated into 2025 accrual-based financials. Specifically, since payment rates were announced at year end, FBA payments will be included as an accounts receivable at the end of 2025, increasing 2025 income and current assets on a farm’s balance sheet.

Previous farmdoc estimates of payment rates from mid-December (see farmdoc daily from December 16, 2025) suggested that FBA support would help to raise average return estimates for 2025 to near or just above break-even levels for farms in northern and central Illinois, while average return projections for southern Illinois remain negative.

While the FBA support is substantial, average return projections at or slightly above break-even levels suggest that a significant proportion of Illinois grain farms will still be facing negative returns for the 2025 crop year following negative average returns in both 2023 and 2024. Producers should take care and caution in how they utilize the FBA support they receive. Our next crop budget update, planned to be released in mid-January, is expected to show another year of negative average returns projected for 2026 as production costs continue to imply break-even price levels that exceed current market conditions for corn, soybeans, and wheat.

References

Paulson, N., G. Schnitkey and C. Zulauf. "Impact of Estimated Farmer Bridge Assistance on 2025 Farmer Return Projections." farmdoc daily (15):231, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, December 16, 2025.

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.