Off Base, Part 1: Reviewing Issues and Problems with Base Acre Policy

The term “off base” is defined as “not being in agreement with what is true” (Merriam-Webster.com). For farm policy, the term may conjure the base acre design for farm program payments because the payments are decoupled from the planted crop—payments claimed to help manage crop risks are not in agreement with what crop was, in truth, planted and at risk. On January 12, 2026, USDA’s Farm Service Agency (FSA) published the rule for changes to farm payment programs, including base acres, made by the Reconciliation Farm Bill and has indicated that it will prioritize allocating additional base acres to unassigned base acres, which are former upland cotton base acres (91 FR 1043; see also, USDA-FSA, Notice ARCPLC-123). It was also reported that signup for the farm payment programs is likely to be significantly delayed (Farm Policy News, January 12, 2026). These matters refocus attention on the base acre issue. This article initiates a review of base acres and potential concerns or issues with the policy design.

Background

The farm payment programs, Agriculture Risk Coverage (ARC) and Price Loss Coverage (PLC), make payments to farmers on base acres, rather than the acres planted to the crop for which the payment is made. Thus, farmers can receive payments for crops they don’t plant while planting other crops that might provide a better return. It can be a confusing aspect of farm policy design that obscures important realities on the ground. Base acres have been discussed multiple times and this background briefly reviews development of this particular policy design (see, farmdoc daily, July 20, 2023; August 10, 2023; August 17, 2023).

The base acre system is rooted in acreage allotments which were part of the parity policy design that developed out of the New Deal farm policies. The modern version began with the 1985 and 1990 Farm Bills, which also created the modern Conservation Reserve Program (CRP) (P.L. 99-198; P.L 101-624). The Federal Agriculture Improvement and Reform Act of 1996 decoupled payments from planted acres, further developing the base acre system as part of the most significant changes to farm policy since enactment in 1933 (P.L. 104-127). Congress provided an opportunity to update and increase base acres in the 2002 Farm Bill, the last time that option was authorized (P.L. 107-171). The 2014 Farm Bill allowed farmers an option to reallocate base acres but not increase them or bring new base acres into the program; it also removed upland cotton base acres from the program, redesignating them generic base acres, due to the World Trade Organization dispute with Brazil (P.L. 113-79). Budget legislation enacted in early 2018 brought cotton back into the programs as seed cotton base acres (farmdoc daily, February 14, 2018). The Reconciliation Farm Bill enacted in 2025 authorized an additional 30 million base acres to be allocated using recent planting records (farmdoc daily, July 1, 2025; July 11, 2025).

Discussion

The discussion that follows is the start of an attempt to review the issue of base acres in farm policy design and make progress towards answering questions or addressing concerns about it. Among them are the impacts for farmers producing the same crop but receiving vastly different payments, as well as how that may impact planting decisions. This discussion is only a start, however, and is not intended to be a full or final analysis. For one thing, it uses national average data. The intent is to frame the question or help set up the issue to be explored. State or county level data is needed to complete the analysis. Using national data is better than the back of a bar napkin but much work needs to be done.

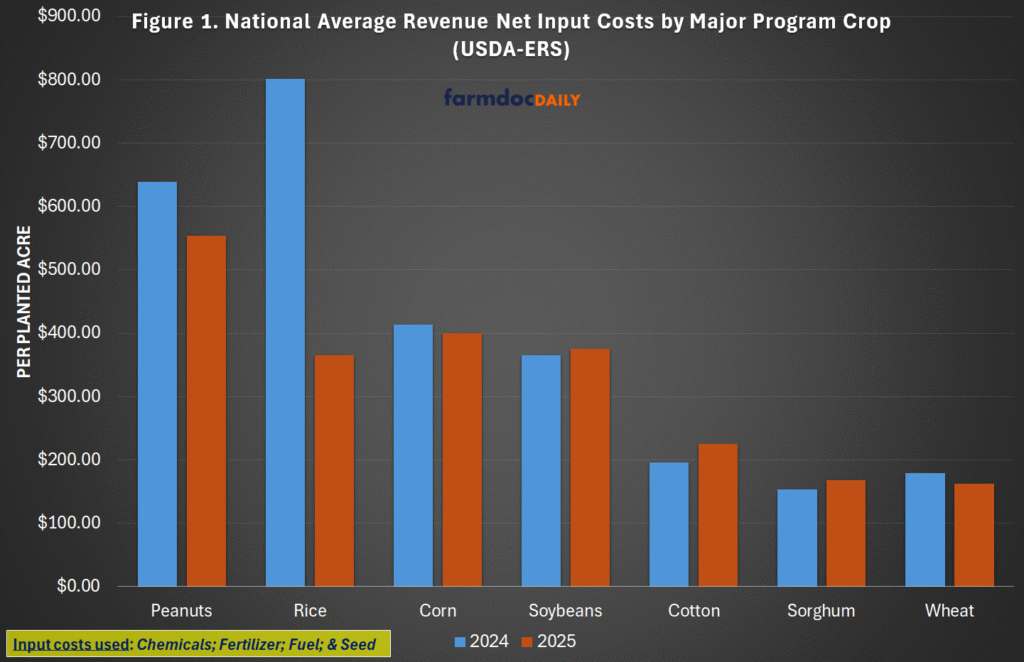

The first step is to compare crop returns for the major program crops (corn, soybeans, wheat, seed cotton, sorghum, rice, and peanuts) using the same category of costs. Figure 1 illustrates each crop’s national average revenue net (or minus) the input costs for the crop, also at national average levels. The input costs used for each crop are chemicals, fertilizer, fuel, and seed. The data is reported by USDA’s Economic Research Service and is for the 2024 crop year and the forecast for 2025 (USDA-ERS, Commodity Costs and Returns).

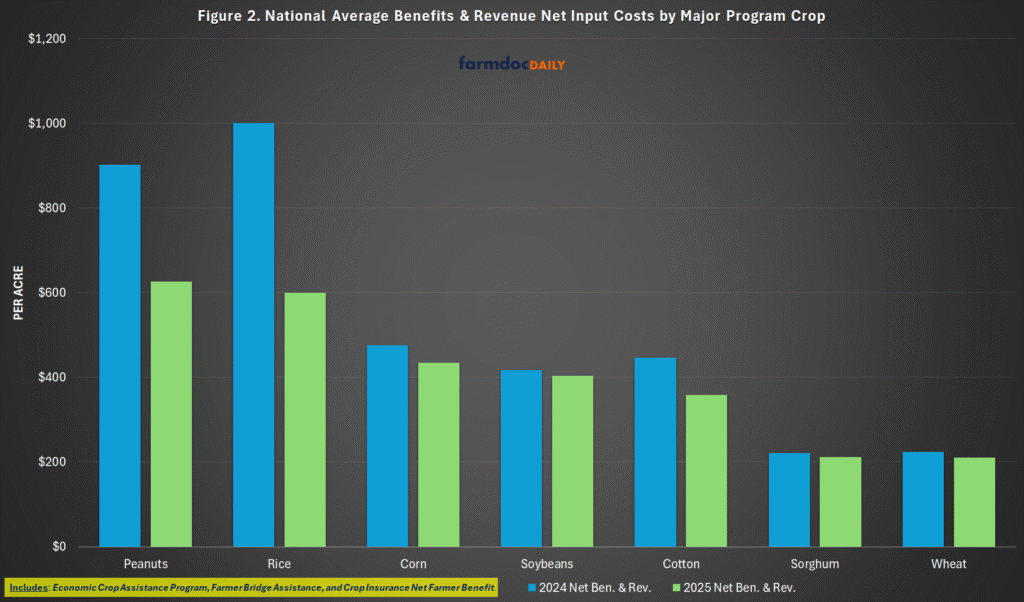

Figure 2 illustrates the net revenue (Figure 1) plus the federal policy benefits for each crop that are coupled to planted acres. Those benefits are the ad hoc payments from the Economic Crop Assistance Program (ECAP) for 2024 planted acres and the Farmer Bridget Assistance (FBA) for the 2025 planted acres, as well as the net farmer benefit from crop insurance. Net farmer benefit is the total indemnities received minus the portion of the premium paid by the farmer (net premium subsidy paid by federal taxpayer through the Federal Crop Insurance Corporation).

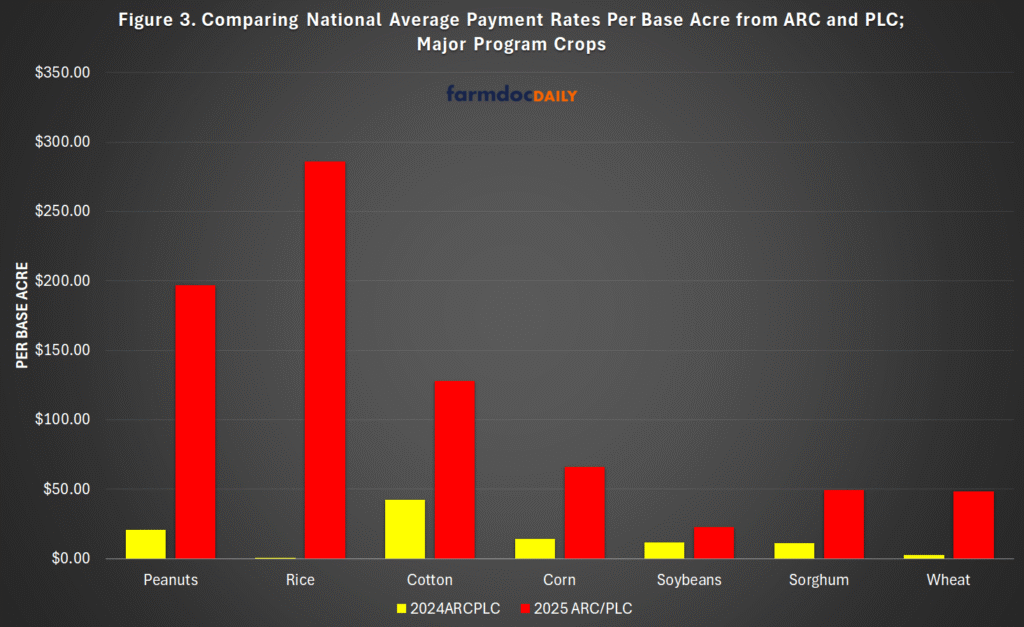

The calculations in Figures 1 and 2 are on the acres planted (including the acres insured), but ARC and PLC make payments on base acres rather than planted acres. Figure 3 illustrates those national average per base acre payments for the major programs for 2024 (paid in October 2025) and projected for 2025 (paid in October 2026) (farmdoc daily, November 11, 2025; November 18, 2025).

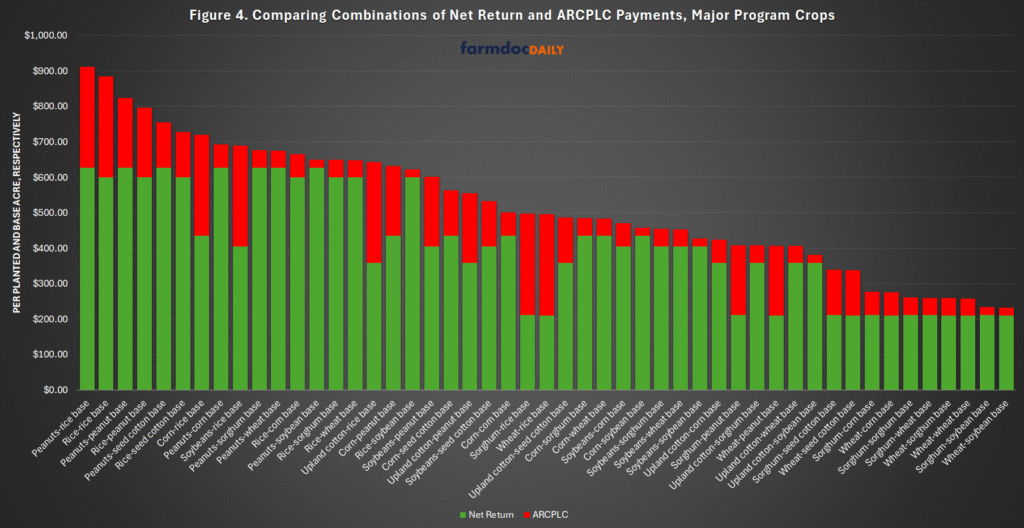

With base acres, a farmer can plant a different crop on the base acres. Doing so combines the ARC/PLC payment for the base acre crop (Figure 3) with the benefits and revenue of the planted crop (Figure 2). It presents a question about the best combination that produces the highest net return with the highest payment on the base acre. Figure 4 illustrates all combinations of planting and base acres for these crops, ranked from highest to lowest; because ARC/PLC payments were low for 2024, the comparison is for 2025 only.

Based on this measure, the highest returns are for planting peanuts on rice base and rice on rice base. The next highest returns were planting peanuts on peanut base and rice on peanut base. The conditions for growing peanuts and rice are very limited regionally to southern counties, as are the base acres for those crops. Notably, planting corn and soybeans on rice and peanut base are in the upper levels of returns.

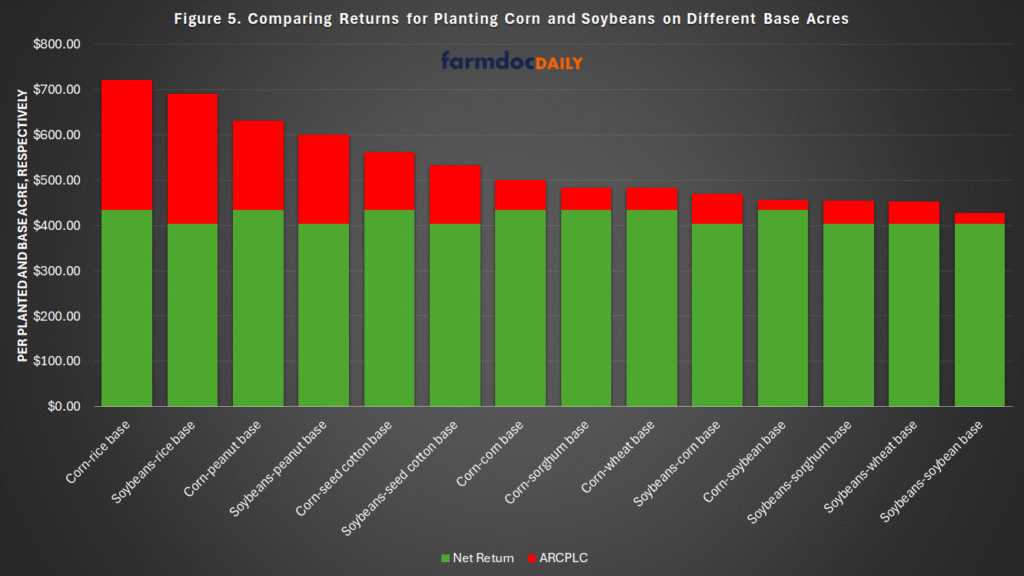

Figure 5 compares planting corn and soybeans across the different base acres. The highest total returns are for planting corn and soybeans on rice, peanut and seed cotton base (respectively). A farmer planting corn on rice base, for example, would have a total return of $720.39 compared to a farmer planting corn on corn base with a total return of $500.54 per acre (planted and base). This continues across all base acres for the southern crops, with higher returns for planting corn and soybeans than for planting corn and soybeans on corn base acres. This provides initial evidence that farmers can plant the same crop but end up with very different income outcomes only because of the policy design for federal payments.

Concluding Thoughts

The decoupled base acre policy design for farm payment programs is approaching its 30th anniversary. On April 4, 1996, President Bill Clinton signed into law the Federal Agriculture Improvement and Reform Act of 1996. In 1996, the Renewable Fuels Standard was a decade away (Energy Policy Act of 2005 and Energy Independence and Security Act of 2007) and major revisions to the Federal Crop Insurance Program been not yet been enacted (Agriculture Risk Protection Act of 2000). China was not part of the World Trade Organization (joined December 11, 2001) and the North American Free Trade Agreement was only two years old (January 1, 1994) (Morrison, August 3, 2004; Angeles, April 24, 2017). Finally genetically engineered seeds were commercially introduced in 1996, including herbicide tolerance traits (USDA-ERS, December 12, 2025).

Much has changed in the 30 years since this design was enacted but the policy, itself, has changed very little. It is possible that millions of base acres set to receive payments this October are based on planting decisions made more than three decades ago. The massive increase in ARC and PLC payments likely to result from changes in the Reconciliation Farm Bill put these matters in sharper focus. Among the concerns are that large payments on base acres for southern crops (rice, peanuts, and seed cotton) provide farmers with those base acres substantial financial advantages when they plant corn or soybeans on those base acres, adding high payment rates to corn and soybean returns. Not only is this a potential problem amongst farmers it may also create additional problems if it results in overplanting or oversupplying the corn and soybean markets. Much more analysis on these and related matters is needed.

References

Angeles, Villarreal M. “The North American Free Trade Agreement (NAFTA).” Congressional Research Service. R42965. May 24, 2017. https://www.congress.gov/crs-product/R42965.

Coppess, J. "Farm Bill 2023: Reviewing Pieces of the Base Acres Puzzle." farmdoc daily (13):134, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, July 20, 2023. https://farmdocdaily.illinois.edu/2023/07/farm-bill-2023-reviewing-pieces-of-the-base-acres-puzzle.html.

Coppess, J. "Farm Bill 2023: The Intersection of Base Acres and Reference Prices." farmdoc daily (13):147, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, August 10, 2023. https://farmdocdaily.illinois.edu/2023/08/farm-bill-2023-the-intersection-of-base-acres-and-reference-prices.html.

Coppess, J. "Farm Bill 2023: Another Perspective on Reference Prices and Base Acres." farmdoc daily (13):152, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, August 17, 2023. https://farmdocdaily.illinois.edu/2023/08/farm-bill-2023-another-perspective-on-reference-prices-and-base-acres.html.

Coppess, J., N. Paulson, G. Schnitkey and C. Zulauf. "Farm Bill Round 1: Dairy, Cotton and the President’s Budget." farmdoc daily (8):25, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, February 14, 2018. https://farmdocdaily.illinois.edu/2018/02/farm-bill-round-1-dairy-cotton-and-the-budget.html.

Morrison, Wayne M. “China and the World Trade Organization.” Congressional Research Service. RS20139. August 3, 2004. https://www.congress.gov/crs_external_products/RS/PDF/RS20139/RS20139.3.pdf.

Paulson, N., H. Monaco, G. Schnitkey, J. Coppess and C. Zulauf. "Projected ARC and PLC Payments for 2025." farmdoc daily (15):213, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, November 18, 2025. https://farmdocdaily.illinois.edu/2025/11/projected-arc-and-plc-payments-for-2025.html.

Paulson, N., G. Schnitkey, J. Coppess, C. Zulauf and H. Monaco. "Estimates of 2024 ARC-CO and PLC Payments." farmdoc daily (15):208, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, November 11, 2025. https://farmdocdaily.illinois.edu/2025/11/estimates-of-2024-arc-co-and-plc-payments.html.

Schnitkey, G., C. Zulauf, N. Paulson and J. Coppess. "Reconciliation Bill Proposals to Add Base Acres." farmdoc daily (15):120, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, July 1, 2025. https://farmdocdaily.illinois.edu/2025/07/reconciliation-bill-proposals-to-add-base-acres.html.

U.S. Dept. of Agric., Economic Research Service. “Adoption of Genetically Engineered Crops in the United States—Recent Trends in GE Adoption.” Updated December 12, 2025. https://www.ers.usda.gov/data-products/adoption-of-genetically-engineered-crops-in-the-united-states/recent-trends-in-ge-adoption.

Zulauf, C., G. Schnitkey and N. Paulson. "The New Base Acre Provisions in the 2025 Farm Bill." farmdoc daily (15):126, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, July 11, 2025. https://farmdocdaily.illinois.edu/2025/07/the-new-base-acre-provisions-in-the-2025-farm-bill.html.

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.