2015 Gross Revenues for Corn: Likely Characteristics of Low, Middle and High Revenue Years

In 2015, gross revenues for corn on high-productivity farmland in Illinois are expected to be in the mid-$800 per acre range. At this point, both price and yields are uncertain, resulting in many possible levels of crop revenues, crop insurance payments, and commodity program payments. Therefore, actual gross revenues could vary from the mid-$800 projection. Historical price and yield changes suggest that gross revenues could fall within a $317 per acre range. From a historical perspective, low gross revenues of below $750 likely will be associated with harvest prices considerably below projected price and yields at or near trend levels. Mid-revenue cases likely will be associated with yields near or above trend levels and harvest prices near to slightly below the projected price. High gross revenues of over $900 per acre require either harvest prices well above projected prices or yields significantly above trend levels. A significant drought could result in a high revenue year. However, even the high gross revenue cases in 2015 likely will be lower than average revenues from the years between 2010 through 2013.

Possible 2015 Gross Revenues

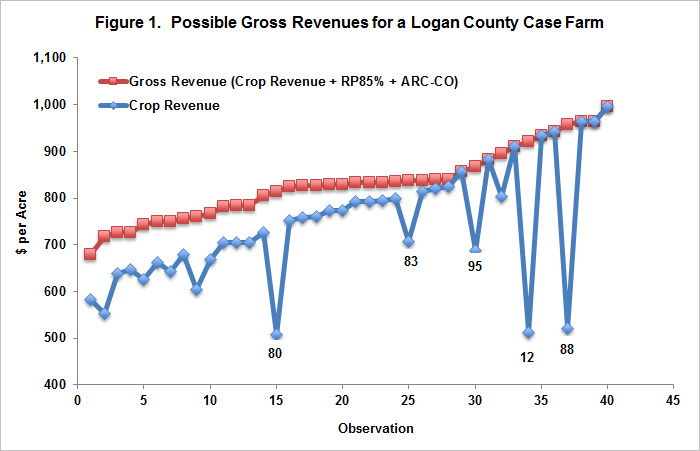

Figure 1 shows possible 2015 gross revenues for a farm located in Logan County, Illinois which is in central Illinois and has high-productivity farmland. There are 40 gross revenues shown in Figure 1. Conceptually, these estimates represent gross revenues given that conditions like one of the past 40 years occur in 2015. Gross revenues are centered on spring price levels (projected price used for crop insurance of $4.15 per bushel) and current trend yield levels (185 bushels per acre for Logan County yield and 196 bushels per acre for the farm yield).

For each of the forty years, price and yield changes are used to calculate alternative 2015 harvest prices, Market Year Average (MYA) prices, county yields, and farm yields. To illustrate, take 2012 as an example. In 2012, the projected price was $5.68 per bushel and the harvest price was $7.50 per bushel, resulting in a harvest price divided by a projected price of 1.32. ($7.50 harvest price / $5.69 projected price). The 2015 harvest price in this case then is $5.48 ($4.15 projected price x 1.32). The 2012 county yield for Logan County was 96.5 bushels and the trend yield was 181.6 bushels per acre, meaning that the 2012 actual yield was .54 of the trend yield (.54 = 96.5 actual yield / 181.6 trend yield). The county yield for this case is 98 bushels per acre (185 expected yield x .54). This implies that if a year like 2012 happens in 2015 the harvest price would be $5.58 per bushel, and county yield would be 98 bushels per acre. This case’s harvest price ($5.58) is lower than the 2012 actual harvest price ($7.50) because prices in 2015 are beginning lower than in 2012 ($4.15 projected price in 2015 compared to $5.69 in 2012). The 2015 yield is projected higher than the actual 2013 yield because of technological change.

Gross revenue includes 1) crop revenue, 2) Revenue Protection insurance at the 85% coverage level (RP 85%), and 3) Agricultural Risk coverage – County Coverage (ARC-CO) commodity program payments. Crop revenue equals farm yield times MYA price. Note that in some years MYA price differ substantially from harvest price, resulting in crop revenue plus RP 85% that differ from what are perceived to be the guarantee. ARC-CO payments are generated for a Logan County farm situation.

Two lines are shown in Figure 1. Crop revenue is the blue line. Gross revenue given by the red line includes crop revenues, RP 85% payments, and ARC-CO payments. Gross revenue is ordered from lowest on the left to the highest on the right. Gross revenue is always at least as great as crop revenue. No RP 85% and ARC-CO payments occur for cases in which gross revenue equals crop revenue, which occur mostly at high gross revenue levels.

Characteristics of Low, Middle, and High Gross Revenue Cases

Possible gross revenues have a $317 range from a low of $679 per acre to a high of $996 per acre. At low gross revenues, ARC-CO and RP 85% payments occur (see Figure 1). Fewer years have ARC-CO and RP 85% payments at higher gross revenues. In the following sub-sections, characteristics of low, middle, and high gross revenue cases are examined.

Characteristics of Low Gross Revenue Cases

Seven of the cases, or 17.5% of the years, have gross revenues less than $750 per acre. In all these cases, the harvest price is below the projected price, and the harvest prices average 27% below projected prices. For 2015, a 27% decline would result in a harvest price of $3.30 per bushel. In these low revenue cases, yields did not decrease substantially. Farm yields ranged from a low of 188 bushels per acre to a high of 213 bushels per acre. The low 188 bushels per acre yield is 8 bushels below the expected yield of 196 bushels per acre. In all these cases, ARC-CO payments are at the maximum of $79 per acre. RP 85% made payments in all years, with payments being triggered by having harvest prices substantially below projected price. The case years ranked from the smaller to higher revenue are 1981, 1998, 2000, 1999, 2001, 2008, and 1977. Four of the seven years occur from 1999 to 2001, a period of relatively low prices and revenue in agriculture.

Note that none of the low gross revenue years occurs because of low yields caused by droughts. Those drought years are indicated in Figure 1 by the year of the drought next to its crop revenue. RP 85% and ARC-CO payments occur to cause gross revenue to not be in the lower end of the distribution.

Using history as a guide, lower gross revenues likely will be associated with lower prices and near average yields.

Characteristics of Middle Gross Revenue Cases

Attention is given to the ten middle years of gross revenue. For these ten cases, gross revenues range from $825 per acre to $831 per acre. In all these cases, harvest prices and yields are relatively close to the expected levels. Harvest prices range from $3.04 per bushel up to $4.51 per bushel, with an average of $3.88 per bushel. Yield range from 185 bushel per acre to 205 bushels per acre. In all ten cases, ARC-CO makes payments. RP would make a payment only in one year. Cases years associated with the middle years are 1976, 1978, 1982, 1984, 1965, 1990, 1991, 1996, 2002, and 2009.

A generalization of middle gross revenue years is that yields are near or above trend and harvest prices are at or below the projected price. Neither yields nor prices are especially low. Lower revenues are not low enough to trigger large RP 85% payments.

Characteristics of High Gross Revenue Cases

There are eight cases with revenue above $900 per acre. Characterizing these cases is more difficult than for the low and middle revenue cases. There are three types of situations resulting in these high gross revenues:

- Higher yields with moderate prices. These are years in which central Illinois have above trend yields and harvest prices remain above $3.50. Cases years associated with these conditions are 1975, 1987, 2004 and 2007.

- Higher harvest prices with yields near to slightly below trend. These cases result in no RP 85% payments. These would be associated with above $5.00 harvest prices, but yields are not drought stricken. This occurred in 2006 and 2010.

- Droughts associated with higher prices. These years would trigger crop insurance payments. ARC-CO payments would also occur. Gross revenue would be very low without these insurance and ARC-CO payments. Case years associated with these conditions are 1988 and 2012.

Overall, high gross revenue cases are likely associated with either higher harvest prices or higher yields. Given inverse correlation between prices and national yields and the importance of Illinois in overall supply, it is difficult to have both a higher price and higher yield.

For 2015, high revenues are projected at over $900 with a maximum of $998 per acre. This 2015 highs are below $1,052 per acre, the average gross revenue from 2010 to 2013 on central Illinois farms on high-productivity farmland enrolled in Illinois Farm Business Farm Management (see Table 1 of the April 21st farmdocDaily https://farmdocdaily.illinois.edu/2015/04/projected-2015-corn-revenue-with-comparisons.html). Historical price and yield changes suggest that 2015 gross revenue will be below averages for 2010-2013 range.

Summary

Historical price and yield changes are used to examine possible gross revenues in 2015. Overall, revenues are projected lower than in 2010-13. History price and yield changes suggest lower gross revenue years will be associated with low prices. Due to crop insurance programs, low yields do not result in low gross revenues. Middle gross revenue years likely will be associated with lower harvest prices and yields near or slightly above trend. High prices or high yields are needed for gross revenues above $900 to occur.

These examples assume an RP 85% crop insurance and ARC-CO program choices. Lower coverage levels would result in a different gross revenue distribution. Similarly, a choice of PLC or different base corn acres relative to planted acres would result in a different gross revenue distribution.

References

Schnitkey, G. "Projected 2015 Corn Revenue with Comparisons to Revenues from 2010 to 2014." farmdoc daily (5):73, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, April 21, 2015.

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.