2014 Farm Bill Farm Safety Net: Summary and Brief Thoughts

Overview

This post contains a summary of key farm safety net provisions. Details are minimized to focus on key features. A few brief observations conclude the post. Mistakes are possible given the short turn-around time and interpretation of bill language. Apology is extended for any mistakes.

Title 1. Commodity Programs

- Direct payments are repealed except for reduced transition payments to cotton for the 2014 crop and even smaller payments for the 2015 crop under specified, limited conditions.

- Programs authorized for the 2014-2018 crop years and through December 31, 2018 for dairy.

- A crop farm has a one-time, irrevocable opportunity to elect either Price Loss Coverage (PLC) or county Agricultural Risk Coverage (ARC) on a crop by crop basis. The producer may also elect individual farm ARC, but this election applies to the entire farm. If no choice is made, the farm defaults to PLC. All producers on a farm must make the same election or face potential loss of payments for the 2014 crop.

- PLC payments occur if U.S. average market price for the crop year is less than the crop’s reference price. Reference prices are: wheat, $5.50/bushel; corn, $3.70/bushel; grain sorghum, $3.95/bushel; barley, $4.95/bushel; oats, $2.40/bushel; long grain rice, $14.00/hundredweight (cwt).; medium grain rice, $14.00/cwt.; soybeans, $8.40/bushel; other oilseeds, $20.15/cwt.; peanuts $535.00/ton; dry peas, $11.00/cwt.; lentils, $19.97/cwt.; small chickpeas, $19.04/cwt.; and large chickpeas, $21.54/cwt.

- County ARC payments occur when actual crop revenue is below the ARC revenue guarantee for a crop year. County ARC guarantee is 86% of county ARC benchmark revenue. Coverage is capped at 10%, meaning coverage is between 76% and 86% of the county ARC benchmark revenue. County ARC benchmark revenue is based on the Olympic average (removes high and low values) of county yields and U.S. crop year average prices for the 5 preceding crop years.

- Individual farm ARC is a whole farm, not individual crop, program. In essence, it is based on the average covered commodity experience on the farm.

- For both PLC and county ARC, payment acres for a crop are 85% of the farm’s base acres for the crop plus any generic base acres (former cotton base acres) planted to the crop. Individual ARC payments acres are 65% of the sum of the farm’s total base acres and any generic base acres planted to covered crops on the farm.

- Total base acres on a farm are the same as current base acres. However a farm can elect to reallocate base acres among the farm’s covered crops according to each covered crop’s share of the farm’s total acres planted to covered crops over the 2009-2012 crop years.

- The Secretary of Agriculture is to develop procedures for identifying and eliminating base acres on land that has been subdivided and developed for multiple residential units or non-farming uses and is unlikely to return to agriculture uses.

- PLC payment yields can be updated to 90% of the farm’s average planted yield over the 2008-2012 crop years.

- The 2008 Farm Bill’s nonrecourse marketing loan and loan deficiency payment program and associated loan rates are extended, except for modifications to the loan rate for cotton, which now can range between 45 and 52 cents per pound.

- The Dairy Product Support and MILC programs are replaced with a Dairy Production Margin Protection Program based on the difference between the price of milk and feed cost of producing milk. A producer elects a coverage level between $4 and $8 per cwt. No premium is paid for the $4 coverage level; premiums are paid for higher coverage levels. Premium schedules are specified for production of 4 million or fewer pounds and for production greater than 4 million pounds. No supply control provision is included.

- A Supplemental Agriculture Disaster Assistance program is funded permanently. It includes a Livestock Indemnity Program for livestock losses from adverse weather or attacks by federally reintroduced animals; a Livestock Forage Program for losses resulting from drought or fire; a program of emergency relief to producers of livestock, honey bees, and farm raised fish not covered by the two previous programs; and a Tree Assistance Program for natural disasters.

- The so-called permanent laws of 1938 and 1949 are not repealed.

- Payments indirectly or directly received by a person or legal entity under Title I are limited to $125,000. Limit for a person and spouse is $250,000. A separate payment limit for peanuts is retained. The only Title 1 crop program not included in this single payment limit is the benefit derived from forfeiting nonrecourse loans.

- USDA is to write new regulations defining “active engagement in farming.”

- The two (farm and nonfarm income) adjusted gross income (AGI) limitation tests are replaced with a single $900,000 AGI limitation for certain commodity as well as conservation programs.

Title 11. Crop Insurance

- Supplemental Coverage Option (SCO) provides farms the option to purchase county level insurance that covers part of the deductible under their individual yield and revenue loss policy. Coverage level cannot exceed the difference between 86% and the coverage level in the individual policy. Subsidy rate is 65%. SCO is not available if enrolled in ARC. A slightly different Stacked Income Protection Plan (STAX) is offered for cotton. Implementation begins the 2015 crop year.

- The higher subsidy levels for enterprise insurance are made permanent.

- A new revenue-minus-cost margin crop insurance contract is authorized. The initial target is rice for the 2015 crop year.

- Several provisions encourage data sharing, with a focus on U.S. Department of Agriculture agencies. One objective is to increase availability of county-based insurance products.

- Insurance plug yields are increased from 60% to 70%. A producer may exclude a yield for a crop year in which the county planted acre yield was at least 50% below the average county yield over the previous 10 consecutive crop years.

- Budget limitations are placed on renegotiations of the Standard Reinsurance Agreement, including budget neutrality with regard to the crop insurance programs.

- Insurance benefits are reduced if a farm tills native sod for production of an annual crop.

- Insurance coverage is to be offered by dryland and irrigated acres of a crop.

- Beginning farmers and rancher are eligible for a higher subsidy rate on insurance.

- Proposal to reduce the level of insurance subsidies for high income individuals was deleted.

- The Risk Management Agency is given a clear mandate to focus on developing insurance products for underserved commodities. Immediate priorities are revenue insurance for peanuts, margin insurance for rice, and a specialized irrigated policy for grain sorghum. Studies are authorized of insurance for swine and poultry catastrophic disease, poultry business interruption; and food safety. Insurance for organic crops is to offer price elections that reflect the retail or wholesale price, as appropriate. Index-based weather insurance pilot programs are a priority.

First Look at PLC – County ARC Comparison

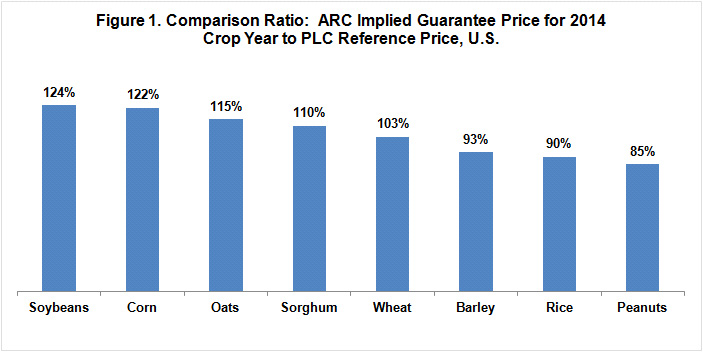

The PLC – ARC decision involves many considerations, but a key one is the level of downside protection. Figure 1 presents a very crude, first look at this consideration in the context of the PLC – county ARC decision (individual ARC is not considered here). Figure 1 compares the estimated implied guarantee price for ARC to the PLC reference price for the 2014 crop year. The ARC implied reference price equals ARC’s coverage level of 86% times the Olympic average U.S. price for the 2009-2013 crop years. This comparison suggests that for 2014 ARC’s’ price coverage level is more favorable for corn and soybeans while PLC’s reference price is more favorable for peanuts, rice, and barley. The figure implies the same farm may choose different programs for different crops, a feature this farm bill allows. However, Figure 1 is only a starting point because the decision involves all 5 crop years between 2014 and 2018 and comparing price (PLC) vs. revenue (ARC) programs, fixed (PLC) vs. moving average (ARC) programs, and other important differences. Farmdocs will offer more detailed and complete discussion of these decision options in the future.

Summary Thoughts

- Much has been made of the delay in completing this farm bill, including the implication that the farm lobby has lost power. I suggest caution. It is quite an accomplishment to complete a farm bill in the current divided political environment. Few initiatives have gotten this far.

- This farm bill was the first to be distinctly impacted by multilateral international trade agreements. Cotton will eventually have no safety net against multiple year low returns, an unlikely outcome without the World Trade Organization ruling in the U.S.-Brazil cotton case. It should give pause to U.S. farm safety net supporters about the consequences if programs become too generous.

- Due to its size but also expansion in this farm bill, cost and performance of crop insurance will likely be a notable focus of the next farm bill debate.

- Last, this farm bill did not settle the question of what is the best policy for multiple year assistance, price or revenue and fixed vs. moving targets. The next farm bill will continue this debate but with experiences that at present appear likely to be based on a more normal, potentially low, income. In other words, the context of the next farm bill debate will likely significantly differ from the context of this farm bill debate, raising the potential for different outcomes.

This publication is also available at http://aede.osu.edu/publications.

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.