Potential Payouts from Enhanced Coverage Option

Payments from the crop insurance add-on Enhanced Coverage Option (ECO) at different prices and yields are illustrated in this article (see farmdoc daily on November 24, 2020, December 8, 2020, December 10, 2020, December 15, 2020, December 22, 2020 for more information). Since ECO coverage levels are high, ECO will make payments in many years. Given premium support involved, ECO should average higher payments than farmer-paid premiums over time. However, in any given year, a payment may not occur, and the farmer will still have the premium outlay. The decision to take ECO likely will come down to how much farmers desire to pay for crop insurance premiums. In particular, the ECO premiums at the 95% coverage level are high relative to the profit expected from an acre of corn.

Background

ECO is a crop insurance product that can be used in conjunction with an underlying Revenue Protection (RP), RP with harvest price exclusion (RPhpe), or Yield Protection (YP) product. Most farmers choose RP, and this article illustrates RP use (see farmdoc daily, November 17, 2020). RP provides protection using on-farm yields in the determination of payments. Unlike RP, ECO provides county-level protection with two coverage-level choices.

- 90% to 86%, hereafter referred to as ECO-90%, and

- 95% to 86%, hereafter referred to as ECO-95%.

ECO can be used in conjunction with Supplemental Coverage Option (SCO), which provides protection from 86% to the underlying RP policy’s coverage level (see farmdoc daily, November 24, 2020).

ECO uses county yields calculated by the Risk Management Agency (RMA) in determining payments. Expected yields are used to set guarantees, and are determined using procedures that account for trends in yields, resulting in expected county yields that are roughly similar to trend-adjusted Actual Production History yields used to set guarantees for RP. County yields used to determine revenue will not be known until June of the year following production. If payments occur, ECO purchased for the 2021 year will not make payments until June 2022.

Example Situation

ECO will be illustrated for the following situation:

- Corn in McLean County, Illinois. McLean County is a relatively high-yielding county in central Illinois.

- Revenue Protection (RP) is the underlying COMBO product. ECO will have the same coverage as the underlying COMBO product. RP has a guarantee increase which can cause crop insurance payments to increase when the harvest price is above projected price. A choice of RP with the harvest price exclusion (RPhpe) would cause the guarantee increase to not be part of ECO.

- A $4.50 projected price will be used. The 2021 projected price for corn is likely to be around $4.50 per bushel. The projected price for corn is based on the December 2021 contract’s settlement prices during the month of February. February is not over, and the 2021 projected price is not known with certainty.

- A .22 volatility will be used as an estimate. The actual volatility is based on values for the last five days of February. A .22 volatility are close to current volatility levels.

- The 2021 expected yield for corn in McLean County is 212.0 bushels per acre. RMA sets expected yields in each county where county-level policies are offered. Expected yields are already known for each county.

- The farm has a Trend-Adjusted Actual Production History (TA-APH) yield of 200 bushels per acre. Even though ECO is a county-level product, the farm’s guarantee yield used to set the RP guarantee will influence the size of ECO’s payments. Higher TA-APH yields will result in higher payments and vice versa.

The farmer-paid premiums for this example were generated using the 2021 Crop Insurance Decision Tool, a Microsoft Excel spreadsheet available for download from the farmdoc website. ECO has the following farmer-paid premiums for the example scenario:

- $10.38 per acre for ECO-90%, and

- $27.98 per acre for ECO-95%.

ECO’s premiums are subsidized at a 44% rate for RP and RPhpe (YP is subsidized at 51%). In setting rates, RMA determines what it believes the payments will be over time, or the actuarially fair premium. The actuarially fair premium is then loaded to account for contingencies and then the subsidy is applied. Using a .88 load factor, a policy with an actually fair premium of $10 would have a farmer-paid premium of $6.36 ($10 actuarially fair premium / .88 load factor x (1 – .44 subsidy ate).

Because of the subsidies, farmers should expect to receive more back in premiums over time than is paid in the farmer-paid premium. A factor can be multiplied to determine the expected payout on a farmer paid premium, given that RMA has correctly estimated premiums. The factor is 1.57 (.88 load factor / (1 – .44 subsidy rate). Given this load factor:

- The $10.38 farmer-paid premium for ECO-90% (coverage from 90% to 86%) has an expected payment rate of $16.30 ($10.38 x 1.57 factor), and a return of $5.92 per acre. Of course, that return will not occur every year.

- The $27.98 farmer-paid premium for ECO-95% (coverage from 95% to 86%) has an expected payment rate of $43.93 ($27.98 x 1.57 factor), and a return of $15.95 per acre. Of course, that return will not occur every year.

ECO 90% Payments

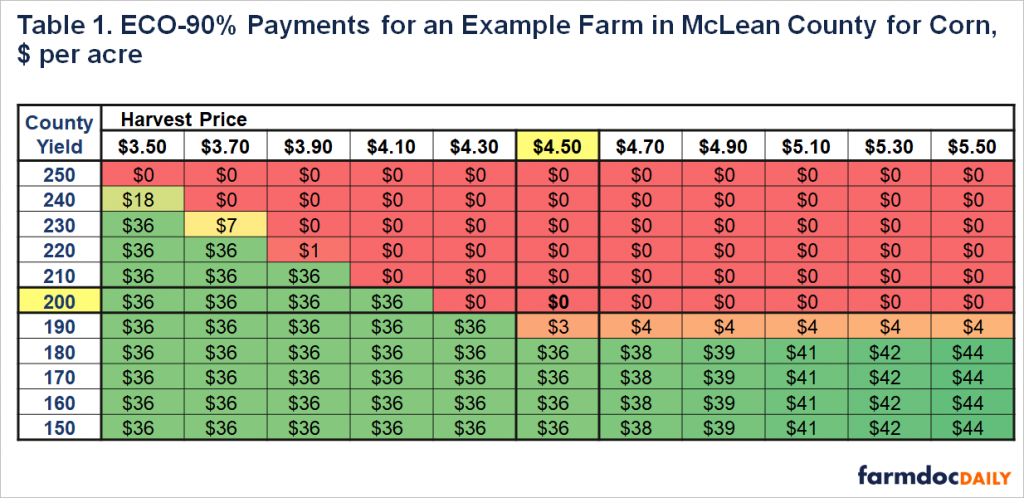

The 2021 Crop Insurance Decision Tool has a utility for calculating ECO and SCO payments. Payments in Table 1 were calculated using that utility for the McLean County corn situation described above.

ECO at the 90% coverage level (ECO-90%) will hit its maximum payment when county revenue as a percent of expected revenue is below 86%. In this case, the entire protection offered by ECO-90% will be triggered. When harvest price is at or below the $3.50 projected price this maximum payment is $36 per acre, which occurs through some combination of low yields and low prices. At a $4.50 harvest price, the maximum payment occurs for county yields at or below 180 bushels per acre (see Table 1). At a $3.90 harvest price, the maximum payment will occur for yields at or below 210 bushels per acre.

ECO payments can be greater than $36 per acre for cases when the harvest price is above the $4.50 projected price and results in a higher revenue guarantee level. Because RP has a guarantee increase provision, RP payments may increase when harvest price is above the projected price. The same applies to ECO when RP is the underlying project. The maximum payment increases to $38 for a $4.70 harvest price, $39 for a $4.90 price, $41 for a $5.10 harvest price, and so on (see Table 1).

ECO-90% has about a 50% likelihood of making a payment each year (see farmdoc daily, December 10, 2020). Over time, the expected payment from ECO-90% will average about $6.30 per acre. Over time, farmers should expect to receive $16.30 per acre and pay $10.38 in premium, for an average return of about $6 per acre. However, about one-half the time ECO-90% will not make a payment.

ECO will provide payments when yields or prices are low, thereby providing risk management benefits. These benefits will need to be weighed against the $10.38 cost, and the 50% chance of not having a payment during a year.

ECO-95% Payments

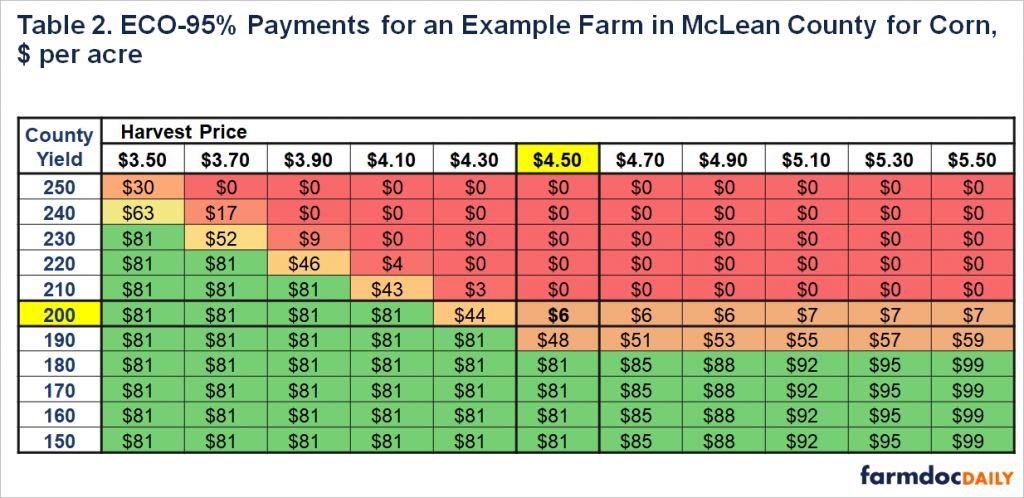

ECO-95% payments are shown in Table 2. ECO-95% will pay in more situations than ECO-90%. At a $4.50 harvest price, ECO 95% will have a $6 per acre indemnity payment at a 200 bushel per acre county yield, while ECO-90% has a $0 payment.

ECO-95% will always make larger payments than ECO-90%. The maximum payment for ECO-95% for harvest prices at or below the $4.50 projected price is $81 per acre, $45 per acre higher than the $36 per acre maximum payment for ECO-90%.

ECO-95% has a 67% chance of making a payment in any given year or will make payments in roughly two-thirds of the years (see farmdoc Daily, December 10, 2020). ECO-95% will have average payments of $58 per acre. Given the $27.98 farmer-paid premium, ECO-95% will be expected to have a $15.95 per acre return ($43.93 average payment – $27.98 premium). Of course, one-third of the time, a payment will not be received, and farmers will still pay the farmer-paid premium.

ECO-95% will provide payments when yields or prices are low, thereby providing risk management benefits. These benefits will need to be weighed against the $27.98 farmer-paid premium and the 33% chance of not having a payment during a year.

Summary

ECO has risk management benefits and should return more than its farmer-paid premium over time. Because of its high coverage levels and high likelihood of payment, ECO has a relatively high premium.

The current expected farmer return for central Illinois high-productivity farmland in 2021 is $13 per acre. While ECO will have a positive return, purchasing ECO could result in significant reductions in returns during the years in which it does not make a payment due to the relatively high premium cost.

References

Paulson, N., G. Schnitkey, K. Swanson and C. Zulauf. "Historical Analysis of the Frequency of Triggering Enhanced Coverage Option (ECO) Payments." farmdoc daily (10):209, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, December 10, 2020.

Paulson, N., G. Schnitkey, K. Swanson and C. Zulauf. "The New Enhanced Coverage Option (ECO) Crop Insurance Program." farmdoc daily (10):203, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, November 24, 2020.

Schnitkey, G., N. Paulson, K. Swanson and C. Zulauf. "Payment Examples Under Enhanced Coverage Option." farmdoc daily (10):215, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, December 22, 2020.

Schnitkey, G., N. Paulson, C. Zulauf and K. Swanson. "Years in Which Enhance Coverage Option Pays." farmdoc daily (10):211, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, December 15, 2020.

Schnitkey, G., N. Paulson, K. Swanson and C. Zulauf. "Premiums for the Enhanced Coverage Option." farmdoc daily (10):208, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, December 8, 2020.

Schnitkey, G., N. Paulson, C. Zulauf and K. Swanson. "Revenue Protection: The Most Used Crop Insurance Product." farmdoc daily (10):198, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, November 17, 2020.

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.