RP, ECO, and SCO Tradeoffs

For the past several years, many farmers in the Midwest purchased Revenue Protection (RP) crop insurance at an 85% coverage level (RP-85%). Due to both higher projected prices and volatilities, RP-85% will have about double the premium costs in 2021 as compared to 2020. Some farmers may consider lowering the coverage level of RP while at the same time using Supplemental Coverage Option (SCO) and Enhanced Coverage Option (ECO). ECO is a new product this year that provides county coverage from a 90% or 95% coverage level down to 86% (see farmdoc daily articles on November 24, 2020, December 8, 2020, December 10, 2020, December 15, 2020, December 22, 2020, February 23, 2021 for more information). This article makes comparisons of alternative products.

Comparisons Made

This analysis uses RP-85% as the benchmark strategy. This benchmark strategy will be compared to four alternatives:

- RP-80%. This strategy lowers farm-level coverage so that it begins at 80%. This strategy will have roughly the same farmer-paid premium as RP-85% in 2020.

- RP-80% plus SCO. This strategy lowers the RP coverage level to 80% and then adds SCO. In this case, SCO provides county coverage from 86% to 80%.

- RP-80% plus ECO-90%. This strategy will provide farm coverage below 80%. ECO-90% provides county coverage from 90% to 86%. Because SCO is not purchased, there will not be county coverage from 86% to 80%.

- RP-80%, SCO, and ECO-90%. This strategy will provide farm coverage below 80% and county coverage in a band from 90% to 80%, with ECO from 90% to 86% and SCO from 86% to 80%.

These strategies are compared because they have lower or roughly the same farmer-paid premium as RP-85%. ECO is also available at a 95% coverage level and can provide valuable protection at the higher coverage level. However, ECO-95% is not included in these alternatives because of the substantially higher premium compared with ECO-90%.

Situation

These strategies are examined for a DeKalb County, Illinois farm having a Trend Adjusted Actual Production History (TA-APH) yield of 205 bushels per acre. Table 1 shows RP and SCO premiums for 2021 given a 100-acre enterprise unit. These premiums were generated with the 2021 Crop Insurance Decision Tool using a $4.58 projected price and a .23 volatility.

In 2020, DeKalb county farmers used RP-85% to insure 73% of acres, and RP-80% was used to insure 19% of acres. These two “high” RP coverage levels products were used on 92% of the corn acres insured in DeKalb County. In 2020, the farmer-paid premium was $12.30 per acre for a 100-acre enterprise unit for RP-85%. The 2021 premium for the same product is $23.02 per acre, an increase of $10.72 per acre. The 2021 premium is higher than 2020 premiums because:

- The 2021 projected price of $4.58 per bushel is higher than the $3.88 projected price for 2020. Higher projected prices increase the dollar value of coverage per acre, resulting in a higher premium.

- The 2021 volatility is .23 compared to a .15 volatility in 2020. The volatility measures the spread in possible prices at harvest time, with higher volatilities indicating higher chances of both low and high prices. Crop insurance premiums increase with higher volatilities.

SCO premiums also are shown in Table 1. SCO provides county coverage from 86% to the coverage level of the underlying farm-level product, in this case, RP. When used with an RP-85% product, SCO provides county coverage from 86% to 85%, a 1% band. The cost of this SCO product is $1.26 per acre. The SCO farmer-paid premium increases to $6.00 per acre when used with the RP-80% because the county coverage band is 6% from 86% to 80%.

The sum of the RP and SCO coverage costs also are shown in Table 1. The combination of SCO and RP-85% has a farmer-paid premium of $24.28 per acre, with $23.02 from the RP policy and $1.26 from the SCO product. The RP and SCO combination decreases to $17.22 per acre for the 80% coverage level, given an $11.22 RP-80% coverage leave and $6.00 SCO premium.

ECO can also be purchased at the following levels:

- $10.38 per acre for a coverage level for 90% to 86% (payment factor is 1.0),

- $28.57 per acre for a coverage leave of 95% to 86% (payment factor is 1.0).

RP 85%

Purchasing an RP-85% coverage level will have a cost of $23.02, significantly higher than the $12.30 premium for 2021. The 2021 guarantee given a 205 TA-APH for an RP-85% product is $798 per acre:

$798 guarantee = .85 coverage level x 205 TA-APH yield x $4.58 projected price.

While more expensive than the 2020 RP-85% product, the 2021 RP-85% product also has a higher guarantee. Last year, the projected price for corn was $3.88, resulting in the RP-85% policy with a 205 TA-APH yield having a guarantee of $694 per acre ($694 = .85 x 205 yield x $3.88 projected price), $103 lower than the 2021 guarantee.

The RP-85% will also allow for prevented plant payments. Under the standard prevent plant option, the prevent plant payments will be $439 per acre (55% of the guarantee).

RP 80%

Purchasing RP-80% coverage level has a farmer-paid premium of $11.22 per acre or $11.80 per acre lower than the $23.02 farmer-paid premium for the 80% coverage level. This coverage level will have a guarantee of $751 per acre:

$751 guarantee = .80 coverage level x 205 TA-APH yield x $4.58

which is $47 per acre below the 85% guarantee of $798 per acre. However, the RP-80% guarantee of $751 per acre is higher than the $694 guarantee associated with 2020 RP-85%.

RP-80% has lower prevent plant coverage than the 85% coverage level. When it occurs, the RP-80% prevent plant payment will be $413 per acre (55% of the guarantee).

RP-80% and SCO

Adding SCO to the RP-80% would increase the farmer-paid premium to $17.22 per acre, still below the $23.02 per acre for the RP-85% coverage level. For this combination, the farmer will have:

- A farm-level guarantee of $751 per acre from the RP-80% coverage level.

- Prevent plant coverage. When prevent plant occurs, the prevent plant payment will equal $413 per acre.

- County coverage from 86% to 80%.

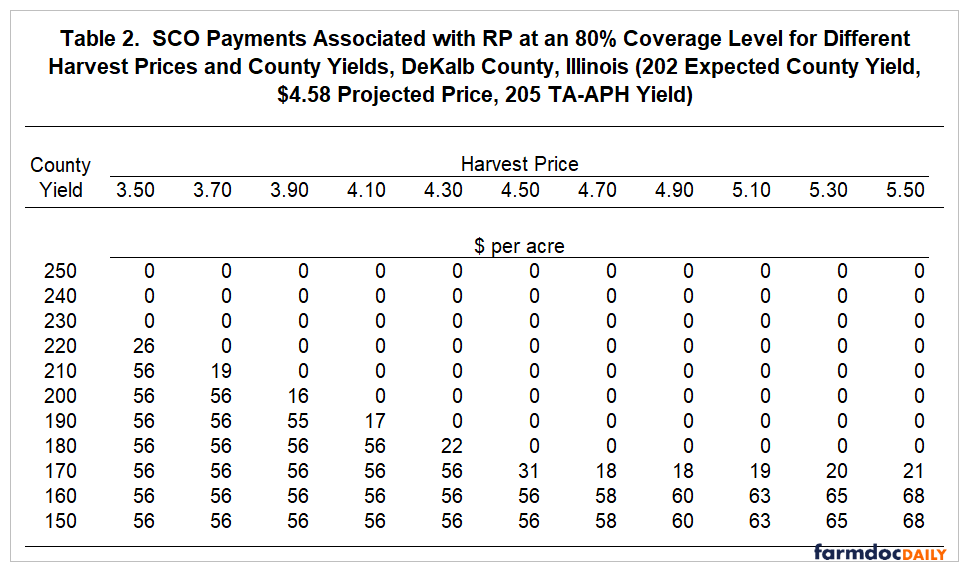

Table 2 shows SCO payments for this situation. Historical analysis suggests that SCO will pay in about 40% of years (see farmdoc daily, December 10, 2020). Given that premiums are rated correctly, SCO should pay out more than it pays in over time because it has a subsidy of 65%. A $6.00 premium will generate an average payment over time of roughly $15 per acre, for an average return of $9 per acre. Of course, 60% of the years, there will not be a payment to offset the $6 premium cost.

RP-80% plus SCO will have lower costs than RP-85%. Relative to RP-85%, RP-80% plus SCO will do two items:

- Replace the 85% to 80% band of farm coverage with county coverage from 86% to 80%. Over time, county coverage tends to trigger less than farm coverage because farm yields tend to be more variable than county yields.

- Lowers the size of the potential prevent plant payment from $439 per acre for RP-85% to $413 for RP-80%.

RP-80% and ECO-90%

An ECO-90% policy will have a premium of $10.38 per acre and will provide projection in a band from 90% to 86%. Table 3 shows payments from ECO-90% for different harvest prices and county yields.

ECO-90% will pay in roughly 50% of the years (see farmdoc daily, December 10, 2020). Over time, ECO will pay out more than farmer-paid premium given that ECO with RP is subsidized at a 44% rate. A $10.86 premium would be expected to generate a $17.06 per acre payment, or a positive return of $6.20.

RP% plus ECO-90% will have $21.70 in premium, still lower than the $23.02 premium for RP-85%. Relative to RP-85%, RP-80% plus ECO-90% will:

- Replace the 85% to 80% band of farm coverage with county coverage from 90% to 86%. ECO-90% will hit its maximum payment when county revenues fall to 86%. For county revenues below 86%, situations in which SCO will make payments, ECO payments will remain flat.

- Lowers the size of the potential prevented plant payment from $439 per acre for RP-85% to $413 for RP-80%.

RP-80%, SCO, and ECO-90%

The RP-80%, SCO, and ECO-90% combination will have a premium of $27.70 per acre, higher than the $23.02 premium for RP-85%. Table 3 shows ECO payments for the band from 90% to 86%. Table 4 shows payments from ECO-90% and SCO at different harvest prices and county yields.

Summary

The above alternatives above provide guidance for farmers considering a lower RP coverage level and purchasing SCO and ECO. There is no clear-cut choice between the above alternatives.

Farmers wishing to reduce premiums from RP-85% may consider one of the other two alternatives pairing RP-80% with either SCO or ECO-90%. Both provide a narrower band of farm level coverage and county coverage that when SCO and ECO-90% are used together but will also result in lower cost. Each of these alternatives is a valid option, the selection will come down to the personal choice of the farmer.

The following two alternatives result in similar farmer-paid premiums:

- RP-85% ($23.03 farmer-paid premium), and

- RP-80%, SCO, and ECO-90% ($27.70 farmer-paid premium).

The RP-85% premium will provide superior protection for farm yields. Losses experienced at the county level covered by SCO and ECO may not align with losses at the farm level. On the other hand, the second combination’s county coverage will provide higher levels of protection resulting from lower economic conditions (i.e., lower price or lower county yields). Both alternatives are good, and farmers who wish to maintain farmer-paid premium around $25 per acre will have to choose between those two alternatives.

References

Paulson, N., G. Schnitkey, K. Swanson and C. Zulauf. "Historical Analysis of the Frequency of Triggering Enhanced Coverage Option (ECO) Payments." farmdoc daily (10):209, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, December 10, 2020.

Paulson, N., G. Schnitkey, K. Swanson and C. Zulauf. "The New Enhanced Coverage Option (ECO) Crop Insurance Program." farmdoc daily (10):203, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, November 24, 2020.

Schnitkey, G., N. Paulson, C. Zulauf and K. Swanson. "Potential Payouts from Enhanced Coverage Option." farmdoc daily (11):27, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, February 23, 2021.

Schnitkey, G., N. Paulson, K. Swanson and C. Zulauf. "Payment Examples Under Enhanced Coverage Option." farmdoc daily (10):215, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, December 22, 2020.

Schnitkey, G., N. Paulson, C. Zulauf and K. Swanson. "Years in Which Enhance Coverage Option Pays." farmdoc daily (10):211, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, December 15, 2020.

Schnitkey, G., N. Paulson, K. Swanson and C. Zulauf. "Premiums for the Enhanced Coverage Option." farmdoc daily (10):208, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, December 8, 2020.

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.