Farm Bill 2023: Don’t Look Now, but Reference Prices Will Increase

Maybe unexpectedly, Congress temporarily avoided a shutdown of the federal government. When everything else failed, common sense and basic reason prevailed, thanks largely to the math of counting votes. Over the weekend, Congress quickly passed and President Biden signed a continuing resolution that provided a 45-day extension to the funding for the government (P.L. 118-15; Ferris and Carney, September 30, 2023; Perano, September 30, 2023; Ferris, Beavers, and Carney, September 30, 2023; Everett, September 30, 2023; Firestone, October 1, 2023). In general, expiring farm bill authorizations were continued but no extension was included for the Title I commodities (farm payment) programs. The temporary reprieve could theoretically open a window for Congress to complete the Farm Bill reauthorization process; reality remains at significant remove, however. Amidst the chaos in Congress, the skirmish over farm policy is minor but is further reviewed in context herein.

Background

Yesterday it was the historic vote to remove Kevin McCarthy (R-CA) as Speaker of the House of Representatives; last weekend it was the potential for a federal government shutdown; earlier it was the potential of a default on the full faith and credit of the United States. These things are distractions from the actual or substantive public policy issues, and there are more on the way (Beavers and Carney, October 2, 2023; Adragna, Beavers, Hill, October 3, 2023; Tully-McManus, October 3, 2023; Sotomayor, Caldwell, and Itkowitz, October 4, 2023; Hulse and Broadwater, October 4, 2023; Diaz, October 4, 2023). Funding the federal government or suspending the debt ceiling are not generally in dispute, even if there are disputes about what to fund or how much to spend (see e.g., Coy, September 29, 2023; Inglis, October 2, 2023; Peter G. Peterson Foundation, September 1, 2023). We have much cause for concern when negotiating tactics consume policy efforts and political theatrics or distractions debilitate deliberations, achieving little beyond disfunction and damage. The tactical or even strategic use of distractions by factional interests to achieve public policy ends that could not be achieved through normal competition in the political processes are real problems lurking behind the chaos. All of which has made for fertile ground for research and writing, magnified by modern developments in media and technology (see e.g., Weiskel, 2005; Stolberg, March 21, 2009; Jones and Jorgensen, September 5, 2012; Leibovich, September 1, 2015; Rasool, April 3, 2017; Garber, March 5, 2022). Such matters are relevant to the farm bill debate and provide ample food for thought.

As to reference prices and the Price Loss Coverage (PLC) program, recall that Congress added an effective reference price (ERP) calculation to the PLC program in the 2018 Farm Bill (P.L. 115-334). The ERP provides a mechanism to temporarily increase the price trigger in the program provided by the statutory reference price (SRP) when marketing year average (MYA) prices are high enough for multiple years. Specifically, the ERP calculation is the larger of the SRP or 85% of the five-year Olympic moving average of MYA prices (but not to exceed 115% of the SRP). (see e.g., farmdoc daily, June 29, 2022; February 7, 2023; August 10, 2023; September 14, 2023). Note further that any increase due to the ERP is already baked in because of the high crop prices in recent years. What might be most surprising is how little attention the ERP has received compared to the amount of attention focused on (or distracted by) political disputes about raising the SRP (see e.g., Hill, September 29, 2023). The discussion below offers a bit of a corrective.

Discussion

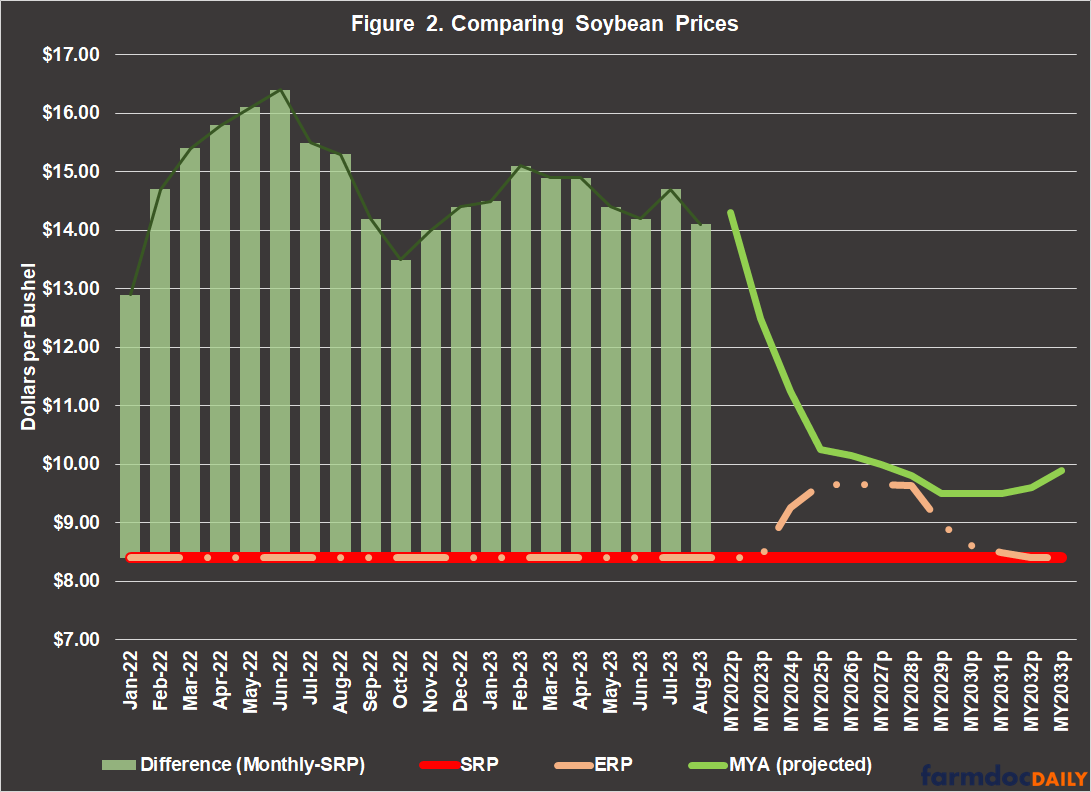

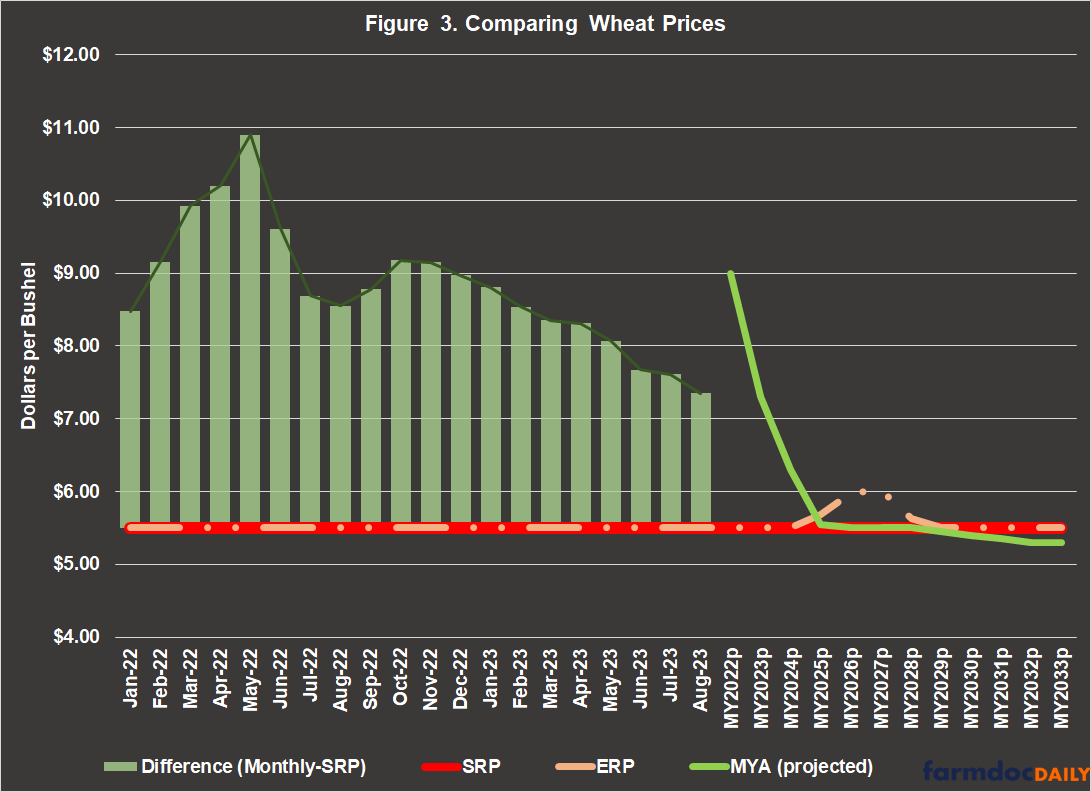

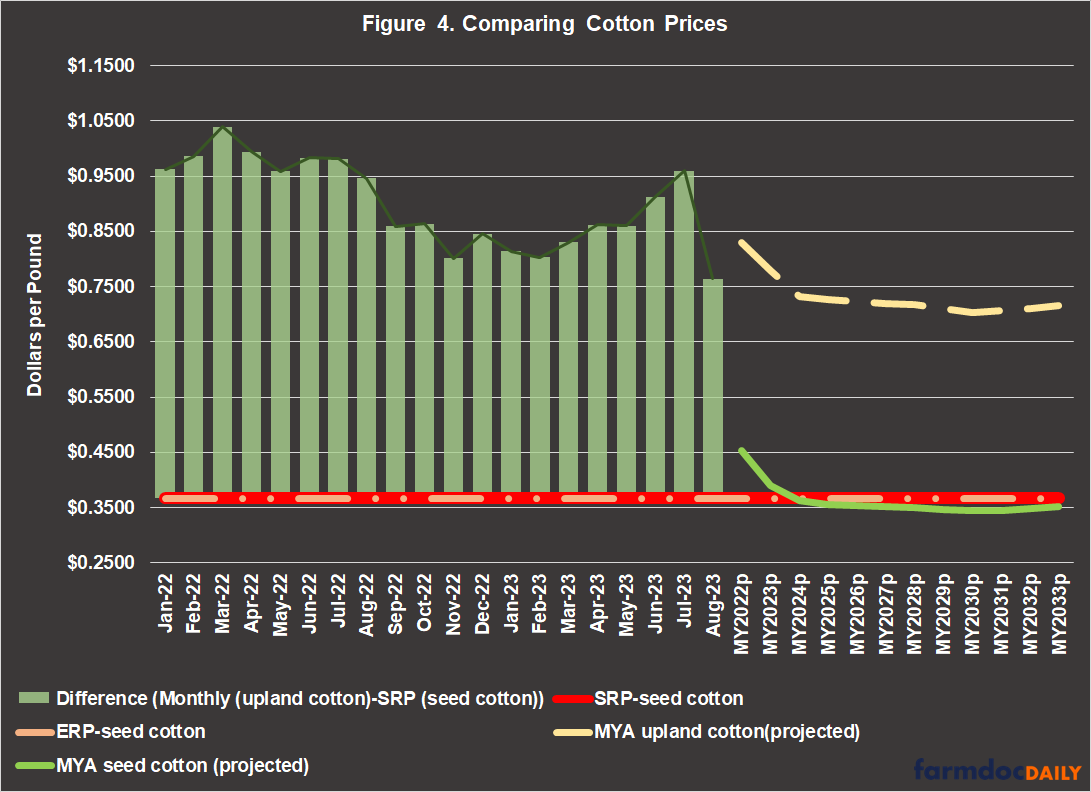

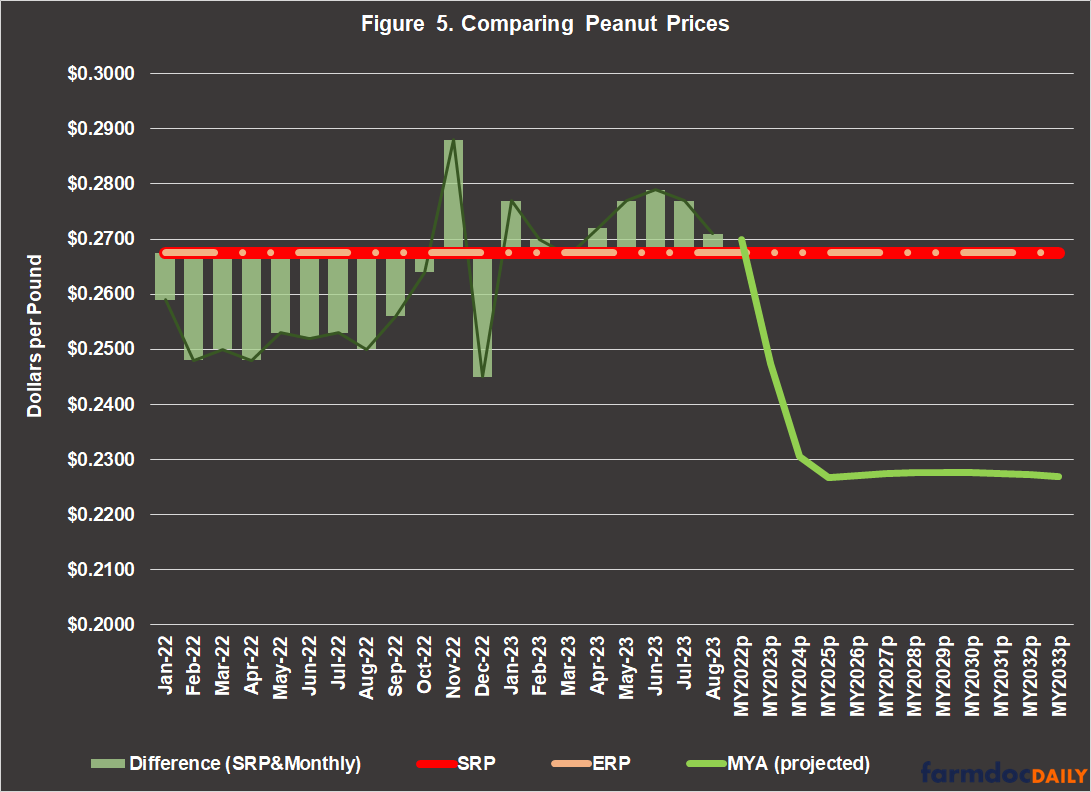

The following compares price data and projections for six of the major program crops: corn, soybeans, wheat, cotton, peanuts, and rice. For each crop, the statutory reference price (SRP; solid red line) and the effective reference price (ERP; pink dot/dash line), as projected by the Congressional Office (CBO) in the May 2023 baseline, form the base of each comparison. Because the 2022 marketing year recently concluded for most crops and the 2023 marketing year has only begun, the figures also include the monthly average prices received for each crop (light green bars) in 2022 and 2023, as reported by USDA (USDA-NASS, Quickstats). Finally, the marketing year price projections are also included from the CBO May 2023 baseline.

Figure 1 compares program-relevant prices for corn. For corn base acres, the effective reference price for corn is expected to increase for marketing year (MY) 2024 through MY2028. In three of those years, the ERP will increase to the maximum (115% of the SRP, or $4.26 per bushel).

Figure 2 compares the program-relevant prices for soybeans. For soybean base acres, the ERP will increase from MY 2024 through MY2031. In three of those years (MY2025-MY2027), the ERP will increase to the maximum (115% of the SRP, or $9.66 per bushel).

Figure 3 compares the program-relevant prices for wheat. For wheat base acres, recent high prices will trigger the ERP and wheat reference prices will increase under existing policy for MY2025-MY2028. Wheat MYA prices are not expected to increase enough to reach the maximum (115% of the SRP, or $6.33 per bushel) but the ERP will reach a high of $6.01 (109%) in MY2027.

As for cotton, Figure 4 presents the program relevant prices with revisions; because Congress created “seed cotton” as a covered commodity in 2018, Figure 4 provides both the monthly prices for upland cotton (reported by NASS), as well as the MYA for upland cotton (yellow dotted line). Note that because seed cotton is not an actual crop, NASS does not report monthly average prices for it and the comparison with the SRP does not work. The MYA calculated for seed cotton would trigger PLC payments when below the SRP and it is represented by the CBO projections (light green line).

Figure 5 illustrates the program relevant prices for peanuts. It is the clearest example of an SRP that is far higher than market prices. For peanuts, the SRP not only triggers payments every year, but even a run of high prices does not trigger the ERP. In fact, recent monthly high prices barely exceed the exceptionally high SRP for peanuts.

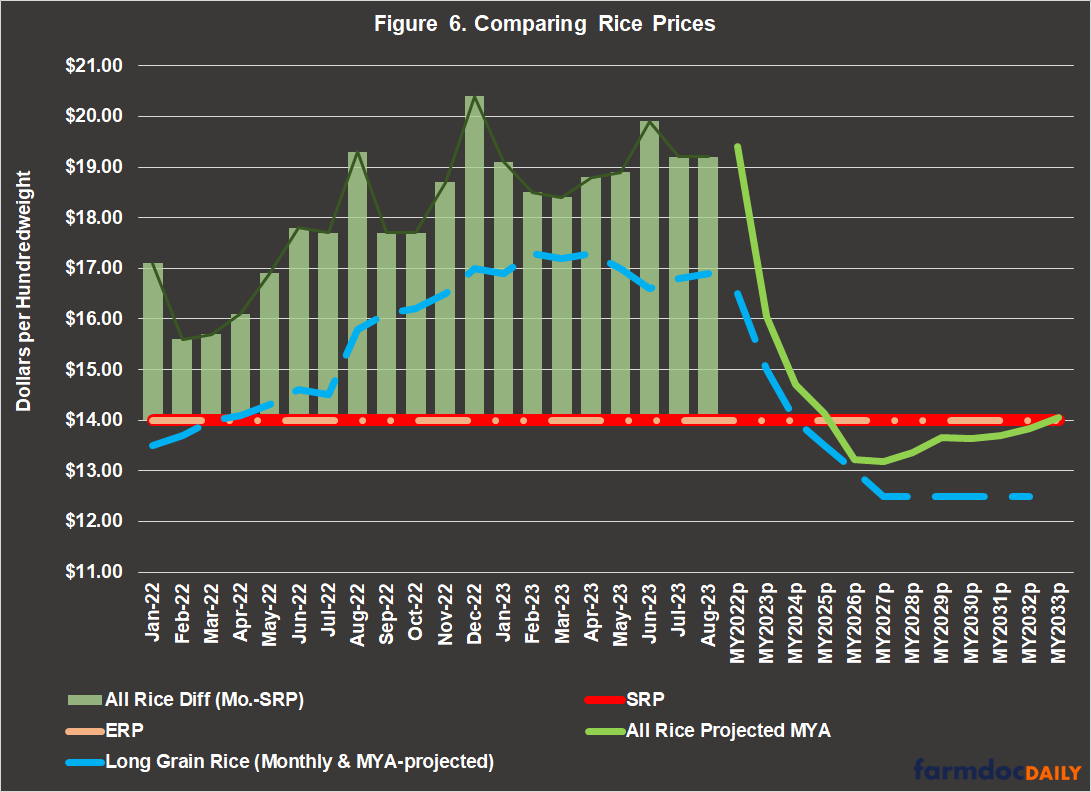

Finally, Figure 6 illustrates the program relevant prices for rice. The monthly average prices for all rice (including long grain, medium and short grain, and temperate japonica) is also compared to the prices for just long grain rice (light blue dashed line), which is grown predominantly in Arkansas (see e.g., USDA-ERS, “Rice Sector at a Glance” updated September 27, 2023). Each type of rice triggers payments separately, rather than at the all-rice prices. The program includes long grain, short/medium grain rice, as well as temperate japonica rice that is grown only in California (and receives much higher prices). The SRP ($14.00 per cwt) is the same for long grain rice and short/medium grain rice, but a higher SRP is available to temperate japonica rice. Notably, the brief period of high prices for long grain rice are not enough to trigger the ERP but may result in no PLC payments on rice base for MY2022 and possibly MY2023. USDA baseline projections from February 2023 are used for long grain rice and they drop to the SRP in MY2024.

CBO also reports out projections for the other feed grain crops (grain sorghum, barley, and oats), as well as other oilseeds (flaxseed, sunflowers, canola, safflower, mustard seed, and rapeseed) and pulse crops (dry field peas, lentils, large chickpeas, and small chickpeas). Of these, the ERP is most notable for oats as it will increase the price trigger beginning with MY2024 and carry the increase to MY20233, it will also reach the maximum ERP of 115% of the SRP ($2.76 per bushel in MY2025-MY2027). Grain sorghum and barley also have increased price triggers in the CBO projections for some years, as do flaxseed, rapeseed, and sunflowers. CBO does not project ERP above the SRP for the other crops included in the baseline calculations.

In total, CBO currently projects that 9 of the 19 program crops will have an ERP higher than the SRP in at least some of the years of the baseline but this is an understates the issue. Those 9 program crops accounted for 92% of all base acres enrolled in ARC and PLC in the 2020 to 2023 program years. They also account for nearly 86% of all base acres enrolled in PLC during those program years. In other words, almost every farm in the country will experience a reference price increase through the ERP for at least one crop.

Concluding Thoughts

Between the bardo and the baseline, the substantive farm bill policy deliberations and negotiations will take place. The basic decision point is whether to take funding from the Inflation Reduction Act conservation program appropriations—and thus increase the number of farmers in the bardo—in order to gamble it on crop prices and the Price Loss Coverage baseline (farmdoc daily, September 14, 2023; September 28, 2023). Much of the public discussion about raising reference prices appears to be missing this and other key points, however. With the effective reference price (ERP) calculation enacted in the 2018 Farm Bill, over 90% of all base acres in the United States will experience an increase in the PLC price trigger in the coming years without Congress needing to do anything more than extend those provisions.

A closer look at the ERP also exposes further the inequities in the statutory reference prices established by Congress. Each crop receives its own SRP, but they all have the same ERP calculation: 85% of the five-year Olympic moving average of MYA prices (up to 115% of the SRP). With recent high market prices for all crops, the ERP makes clear how high the SRP levels are for some crops, namely seed cotton, rice, and peanuts. Those three crops account for less than 8% of total base acres. This begs important questions for the substantive policy debate. One of those should be: what justifies the demand for higher reference prices if 90% of all base acres will see an increase and the reason the rest won’t is because the SRP is so high already? Other questions follow swiftly from the first. To sort these matters out, farm bill reauthorization will need to break through the chaos and the distraction.

References

Adragna, Anthony, Olivia Beavers, and Meredith Lee Hill. “Buckle up: McCarthy’s future to be decided on Tuesday.” Politico.com. October 3, 2023. https://www.politico.com/live-updates/2023/10/03/congress/mccarthy-wont-deal-with-dems-00119620.

Beavers, Olivia and Jordain Carney. “Its official: Gaetz to force vote on McCarthy’s speakership.” Politico.com. October 2, 2023. https://www.politico.com/live-updates/2023/10/02/congress/ouster-clock-starts-now-00119470.

Coppess, J. "Farm Bill 2023: NRCS Backlogs and the Conservation Bardo." farmdoc daily (13):177, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, September 28, 2023.

Coppess, J. "Farm Bill 2023: Trying to Reason with 1,000 CBO Scores." farmdoc daily (13):167, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, September 14, 2023.

Coppess, J. "Farm Bill 2023: The Intersection of Base Acres and Reference Prices." farmdoc daily (13):147, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, August 10, 2023.

Coy, Peter. “There Is Only One Way to Fix the National Budget.” The New York Times. September 29, 2023. https://www.nytimes.com/2023/09/29/opinion/government-shutdown-national-debt.html.

Diaz, Daniella. “Scalise and Jordan’s battle for centrists.” Politico.com. October 4, 2023. https://www.politico.com/newsletters/huddle/2023/10/04/scalise-and-jordans-battle-for-centrists-00120015.

Everett, Burgess. “Senators unanimously advance shutdown-averting bill.” Politico.com. September 30, 2023. https://www.politico.com/live-updates/2023/09/30/congress/senate-clears-stopgap-hurdle-00119298.

Ferris, Sarah and Jordain Carney. “House GOP stunner: Spending patch passes with mostly Dem votes.” Politico.com. September 30, 2023. https://www.politico.com/live-updates/2023/09/30/congress/stopgap-passes-00119280.

Ferris, Sarah, Olivia Beavers, and Jordain Carney. “’It is a surrender’: Why McCarthy reversed with his survival uncertain.” Politico.com. September 30, 2023. https://www.politico.com/news/2023/09/30/kevin-mccarthy-government-shutdown-deal-00119290.

Firestone, David. “Against the Wall, McCarthy Does the Right Thing.” The New York Times. October 1, 2023. https://www.nytimes.com/2023/10/01/opinion/mccarthy-shutdown.html.

Garber, Megan. “The Great Fracturing of American Attention.” The Atlantic. March 5, 2022. https://www.theatlantic.com/culture/archive/2022/03/americans-focus-attention-span-threat-democracy/626556/.

Hill, Meredith Lee. “Rare Senate spat threatens farm bill push with House in shutdown chaos.” Politico.com. September 29, 2023. https://www.politico.com/news/2023/09/29/rare-senate-spat-threatens-farm-bill-push-with-house-in-shutdown-chaos-00118904.

Hulse, Carl and Luke Broadwater. “Scalise and Jordan Announce Bids for Speaker as Vacancy Paralyzes the House.” The New York Times. October 4, 2023. https://www.nytimes.com/2023/10/04/us/politics/house-speaker-mccarthy.html.

Inglis, Bob. “My Fellow Republicans: It’s Time to Grow Up.” The New York Times. October 2, 2023. https://www.nytimes.com/2023/10/02/opinion/kevin-mccarthy-house-republicans-shutdown.html.

Jones, Michael D. and Paul D. Jorgensen. “The Politics of Distraction: A Call for a Fresh Look at Ad Effects.” Edmond & Lily Safra, Center for Ethics, Harvard University. September 5, 2012. https://ethics.harvard.edu/blog/politics-distraction-call-fresh-look-ad-effects.

Leibovich, Mark. “The Politics of Distraction.” The New York Times Magazine. September 1, 2015. https://www.nytimes.com/2015/09/06/magazine/the-politics-of-distraction.html.

Matthes, Jörg, Raffael Heiss, and Hendrik van Scharrel. “The distraction effect. Political and entertainment-oriented content on social media, political participation, interest, and knowledge.” Computers in Human Behavior 142 (2023): 107644. https://www.sciencedirect.com/science/article/pii/S0747563222004642.

Perano, Ursula. “Shutdown averted: Senate clears stopgap bill with hours to spare.” Politico.com. September 30, 2023. https://www.politico.com/live-updates/2023/09/30/congress/senate-votes-averts-shutdown-00119301.

Peter G. Peterson Foundation. “Voters Don’t Want a Governmetn Shutdown, They Want Action on the National Debt Instead.” September 1, 2023. https://www.pgpf.org/infographic/voters-dont-want-a-government-shutdown-they-want-action-on-the-national-debt-instead.

Rasool, Adnan. “Ruling by Distraction.” Midwest Political Science Association. April 3, 2017. https://www.mpsanet.org/ruling-by-distraction/.

Schnitkey, G., C. Zulauf, N. Paulson and J. Baltz. "2023 and 2024 Effective Reference Prices and the Next Farm Bill." farmdoc daily (13):21, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, February 7, 2023.

Sotomayor, Marianna, Leigh Ann Caldwell, and Colby Itkowitz. “Fight for speakership begins as House reels from McCarthy ouster.” The Washington Post. October 4, 2023. https://www.washingtonpost.com/politics/2023/10/04/house-speaker-fight-begins-amid-unsettled-state/.

Stolberg, Sheryl Gay. “The Art of Political Distraction.” The New York Times. March 21, 2009. https://www.nytimes.com/2009/03/22/weekinreview/22stolberg.html.

Tully-McManus, Katherine. “McCarthy out as speaker.” Politico.com. October 3, 2023. https://www.politico.com/live-updates/2023/10/03/congress/mccarthy-out-speaker-conservatives-oust-boot-00119732.

Weiskel, Timothy C. “From Sidekick to Sideshow—Celebrity, Entertainment, and the Politics of Distraction: Why Americans Are ‘Sleepwalking Toward the End of the Earth’.” American Behavioral Scientist 49, no. 3 (2005): 393-409. https://journals.sagepub.com/doi/pdf/10.1177/0002764205280203

Zulauf, C., G. Schnitkey, K. Swanson, N. Paulson and J. Coppess. "Effective Reference Price – Past and Future." farmdoc daily (12):97, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, June 29, 2022.

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.