Farm Bill Proposals to Enhance Supplemental Coverage Option (SCO)

Both the House and Senate versions of the farm bill include proposals to modify Supplemental Coverage Option (SCO) insurance. SCO crop insurance provides county-level coverage from the selected coverage level on a farm-level crop insurance product up to a fixed maximum coverage level based on county-level results. This article examines the impacts of the SCO version proposed by the House for corn in McLean County, Illinois. Overall, increasing SCO subsidy levels seems questionable as a policy objective. At best, farmers risk management is improved marginally at high costs to the Federal government. A better focus would be on enhancing the protection of the underlying farm-level product.

What are the Supplemental Coverage Option (SCO) and Enhanced Coverage Option (ECO) policies?

The House and Senate crop insurance proposals directly impact two county-level products: Supplemental and Enhanced Coverage Option (SCO and ECO). SCO and ECO are insurance policies that add county-level coverage to one of the underlying COMBO plans: Revenue Protection (RP), RP with harvest price exclusion,or Yield Protection (YP). SCO and ECO combinations mimic features of the underlying COMBO product used. For example, when combined with RP, SCO and ECO will provide revenue coverage with the potential of a guarantee increase. SCO and ECO would provide yield insurance if YP is used. Because most Midwest farmers purchase RP, the following discussion focuses on SCO with RP as the underlying product.

RP makes payments when a farm’s actual revenue is below the guarantee revenue at the selected coverage level. In the Midwest, coverage levels for corn and soybeans range from 50% to 85% in 5% increments, with higher guarantees resulting from higher coverage levels. Farm revenue is based on the actual yield and final guarantee price while the revenue guarantee is based on historical yields.

By contrast, SCO and ECO provide county-based coverage above the selected RP product coverage level. County coverage is not the same as farm coverage. The effectiveness of adding county revenue insurance to farm-level insurance depends on the correlation of farm-level yields with county-level yields.

SCO provides coverage from 86% down to the selected farm-level coverage level of the RP product. If the RP policy has an 85% coverage level, SCO protects from 86% to 85% of the county-level revenue. If RP has an 80% coverage level, SCO protects from 86% to 80% of the county-level product. ECO protects from either 95% down to 90% or from 95% down to 86% based on farmer election. With SCO and ECO combinations, a farmer can supplement coverage from the underlying RP product as follows:

- SCO alone: county coverage from 86% down to the RP coverage level,

- SCO-ECO-90%: county coverage from 90% down to the coverage of the RP plan and

- SCO-ECO-95%: county coverage from 95% down to the coverage of the RP plan.

It is also possible to use ECO without SCO and have county coverage from 95% to either 90% or 86% with a coverage gap from 86% down to the RP coverage level.

Essential facts about the SCO-ECO combination are:

- The RP and SCO-ECO policies act independently of one another. RP pays indemnities on farm revenue based on farm yields, while SCO-ECO pays indemnities on county revenue based on county yields. A farmer could receive payments from RP but not SCO-ECO. Alternatively, a farmer could receive payments from SCO-ECO but not RP. A farmer could receive payments from both RP and SCO-ECO, or by neither type of insurance.

- The Federal government provides a risk subsidy, paying a portion of the total premium. For SCO, the risk subsidy equals 65% of the total premium, meaning the farmer pays 35% of the premium. For ECO, the risk subsidy is 44% of the total premium, meaning that the farmer pays 56% of the premium.

- Farmers must select Price Loss Coverage (PLC) as their commodity title program when using SCO. They cannot use the Agricultural Risk Coverage (ARC) options if using SCO. There are no commodity title restrictions with ECO.

- Buying a SCO-ECO combination does not give complete protection to 86%, 90%, or 95% of the farmer’s actual revenue or yield. Instead, the policy provides a band of county coverage above the RP coverage level. The band may or may not match the actual farm-level results and as noted earlier, the county product may experience a loss but the farm does not suffer a loss; and vice versa.

House and Senate Proposals

Both the House and Senate propose changes that would increase the coverage and subsidy levels on SCO presumably in an effort to increase usage.

The House Proposal would:

- Increase the coverage level of SCO to 90%. Essentially, this proposal would replace the current SCO-ECO-90% combination for those farmers choosing PLC. The current ECO-90% likely would continue to exist for those farmers choosing ARC.

- Increase the risk subsidy to 80% from the current 65% level for SCO and the current 44% level for ECO.

The Senate Proposal would:

- Increase SCO’s coverage level to 88%, less than the House proposed 90%.

- Increase the risk subsidy to 80% identically to the House Proposal.

Neither proposal change the requirement that PLC must be used as the commodity title choice to be eligible for SCO coverage.

Impacts on Farmer-Paid Premiums and Risk Subsidies

Impacts are illustrated below of the House Proposal on farmer-paid premium and risk subsidies for corn in McLean County. The Senate Proposal would have slightly less impact because of its lower 88% coverage level.

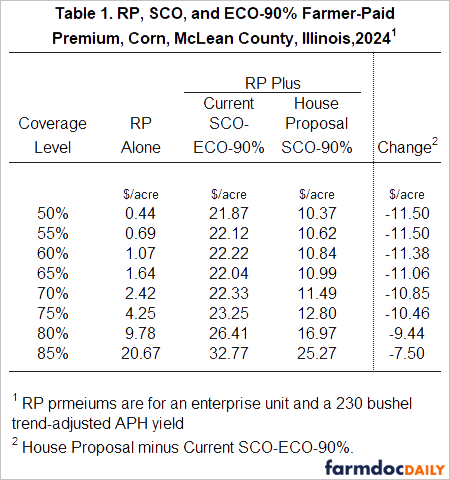

Table 1 shows farmer-paid premiums in 2024 for RP. The most used coverage level in McLean County is 85% (see farmdoc Daily, November 17, 2020, farmdoc Daily 2021). At 85% coverage, RP has a farmer-paid premium of $20.67 per acre. RP in combination with SCO-ECO-90% has a farmer-paid premium of $32.77. The House Proposal would lower the farmer-paid premium to $25.27, a $7.50 per acre reduction from current levels.

The new proposal would significantly lower the farmer-paid premiums and make extended coverage bands of SCO less expensive. As a result, some farmers would consider reducing their RP coverage from RP-85% to lower coverage levels and using SCO-90%. For example, the farmer-paid premium would be $12.80 per acre for RP-75% plus SCO-90% and $16.97 for RP-80% plus SCO-90%. Both those farmer-paid premiums are below $20.67 per acre for stand-alone RP at the 85% coverage level, but provide significantly different coverages as well.

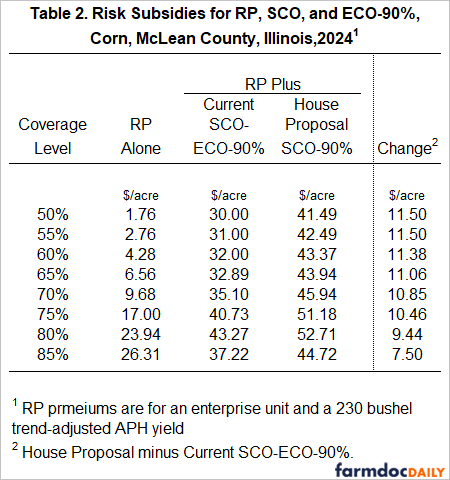

The opposite impact occurs for risk subsidies. Risk subsidies are the portion of the total premium paid by the Federal government. The lowering of farmer-paid premium in Table 1 are offset by increases in risk subsidies, as shown in Table 2. For an 85% RP coverage level and the 90% to 85% band of county coverage, the risk subsidy paid by the Federal government would increase by $7.50. Risk subsidies would increase by over $10 per acre for combinations with lower RP coverage levels.

The farmer-paid premium and risk subsidies in McLean County are among the lowest in the country for non-irrigated corn due to the relatively low yield risk in central Illinois. Changes in farmer-paid premiums and risk subsidies will be much greater in higher-risk areas outside the Corn Belt. Therefore, the House and Senate Proposals will have larger per-acre impacts outside the Corn Belt.

Risk subsidies are not the only federal Expenditure associated with crop insurance. Administrative and Operating (A&O) subsidies are involved as well. A&O subsidies are 12% and 18% of the total premium, with limits on total A&O for COMBO products (CRS, August 10, 2022).

Historic SCO Payments Under the House Proposal

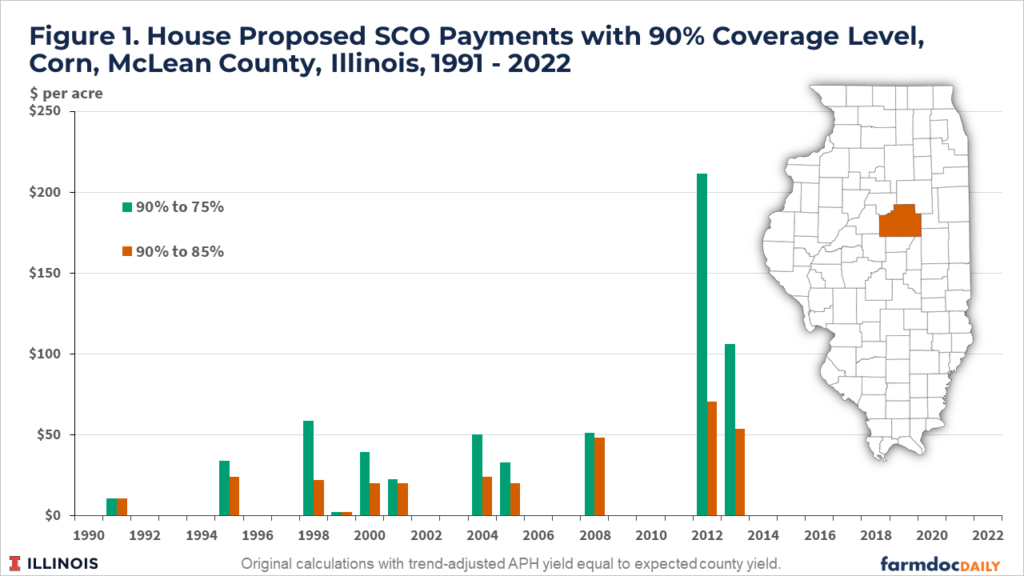

Whether farmers use SCO will depend on their expectations of payments for the product. The historical performance will impact those decisions. Figure 1 shows historic payments from two SCO products:

- SCO-90% to 85%. This SCO product would be used with a purchase of RP at an 85% coverage level. Farmers could take this policy while maintaining RP at 85%.

- SCO-90% to 75%. The SCO product would be used with a purchase of RP at an 75% coverage level. Farmers could take this policy while lowering RP coverage to 75%.

Results are shown from 1991 to 2022 (see Figure 1). County yields for 2023 have yet to be released at this point in time, so 2023 SCO payments cannot yet be calculated but there is a relatively high chance of some payments in 2023. As with all county products, payments from SCO will occur in June of the year after production. Prior to 2023, the last time a payment occurred was in 2013, with the largest payments occurring in the 2012 drought year. In 2012, SCO from 90% to 85% would have made a $70 per acre payment, and SCO 90% to 75% would have made a $211 payment.

The historical payments in Figure 1 suggest that the expected payment from SCO-90% to 85% will pay an average of $17.2e per acre, with payments occurring in about 34% of the years. As shown in the previous section, the farmer-paid premium for SCO-90% to 80% would be $4.60, resulting in expected payments being $7.23 higher than farmer-paid premium. Some farmers would find adding SCO to an RP-85% policy to be an attractive alternative, even with an historical loss ratio of .74 ($17.23 payment / $23.01 total premium) that is below a target loss ratio of .88. RMA is tasked with maintaining loss ratios near 1.0, with a loss provision resulting in a .88 target loss ratio. Having a higher loss ratio increase payments relative to farmer-paid premium.

As a result of the proposed changes, some farmers might drop coverage levels on RP. SCO-90% to 75% would pay $31.85, with a SCO farmer-paid premium of $9.07, yielding $22.78 per acre more in payments than in premium. At the same time, the drop in RP coverage would have reduced payments received on the underlying RP policy, offsetting some of the gains from the enhanced SCO.

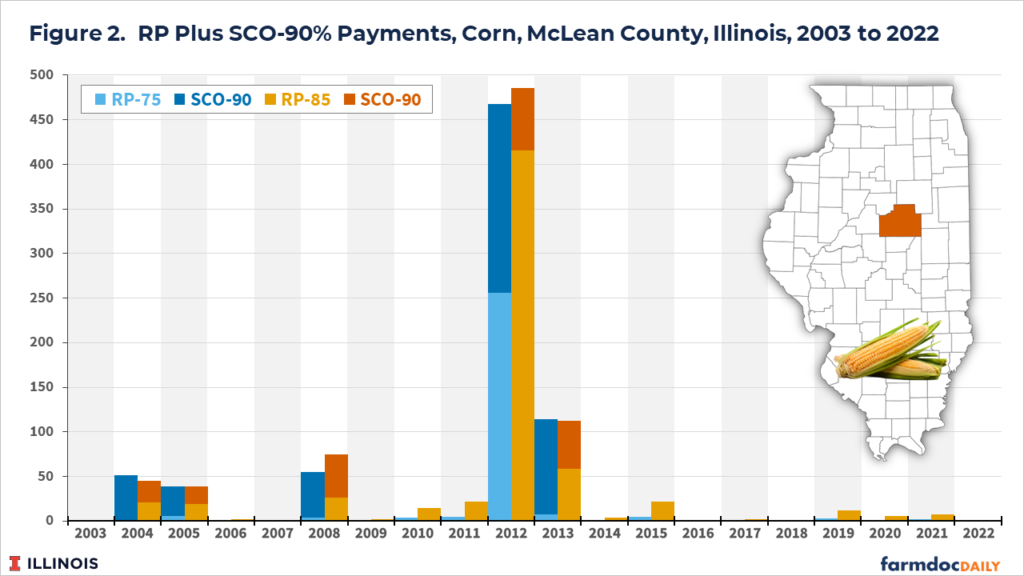

Figure 2 shows a combined payments from RP products at the 75% and 85% levels. These are average historical payments from RMA’s Summary of Business data. Note that they do not illustrate the variability in payments that exists across farms. The RP-75% plus SCO has average payments of $37 per acre from 2003 to 2022, slightly higher than RP alone at $32 per acre. RP-85% plus SCO had payments of $42 per acre.

Historically, moving from a stand-alone RP-85% policy to a RP-75% with SCO-90% would provide little gains to farms. Yet, the costs in additional risk subsidy would be high. In 2024, risk subsidy on a RP-85% policy is $26.31 per acre while the RP-75% plus SCO would have $51.18 in subsidy, almost a doubling in risk subsidy per acre. Similarly, provides SCO on top of an RP-85% policy would be costly, increasing risk subsidy from $26.31 per acre to $44.72 per acre, an increase of 69%.

Questions About SCO

The proposal to modify SCO raises questions:

Why focus on SCO? To date, Midwest farmers’ use of SCO has been relatively small (farmdoc Daily, August 9, 2022). Subsidy-level increases will increase use, and induce some shifts to lower RP levels which would reduce the correlation between insurance payments and actual farm revenue. Over time, farmers have gravitated to farm-level payments over their county-based alternatives (see farmdoc Daily, November 17, 2020). The rational for attempting to reverse this trend with an increase in subsidies on SCO is unclear.

An alternative to SCO would be to focus on improving farm-level coverages. Two alternatives immediately suggest themselves. The first is to offer a 90% coverage level for RP and other Combo products. Second, risk subsidies could be increased on higher coverage levels if the desire is to promote use of higher insurance coverage levels.

How does an improved SCO relate to ad hoc disaster assistance? Over the last several years, Congress has authorized disaster assistance programs, with the Farm Service Agency (FSA) implementing Emergency Relief Programs (ERPs). ERPs disincentivize farmers from purchasing higher levels of crop insurance (see farmdoc Daily, June 7, 2022). The continuation of ad hoc disaster assistance works to undermine insurance programs. Why offer an improve SCO that is offset by ad hoc disaster assistance programs?

How would regional impacts differ? Increases in SCO subsidies would have a larger impact on higher-risk regions and crops. Those regions and crops with higher risk will have higher total premiums, resulting in a higher per-acre risk subsidy. Higher risk areas will see a greater reduction in their premiums per acre when using SCO with a given RP coverage level. Given the high proposed risk subsidies, questions about the equitability of using the same rate for risk subsidy arise.

Are premiums for SCO fairly set across crops and regions? McLean County and many counties in the low-risk areas of the Midwest have had actual loss ratios been below target levels for the last ten years, particularly for soybeans (see farmdoc Daily, January 17, 2023). Having regions and crop receive the same target loss ratio is important for fairness.

Why have the restriction using PLC as the commodity title choice when using SCO? There is no obvious reason why a farmer should have to use PLC versus ARC.

Do other incentives matter? The crop insurance delivery system involves a complex set of channels and reporting mechanisms for establishing coverage and settling claims. Among the differences are that county product indemnities are paid much later than farm-level products. And, insurance agent compensation differs substantially on products that are “within the cap” versus outside the commission cap with SCO and ECO being potentially more lucrative to sell than farm-level products. County-level products are far simpler to adjust and settle compared to farm-based products. Finally, tying other commodity programs to insurance policy selections creates additional complexity without obvious improvements in coverage effectiveness.

Summary

Proposals to further incentivize SCO have been put forward by both the House and the Senate in their Farm Bill Proposals. The proposed SCO changes will have marginal impacts on farmer well-being in areas of lower yield risk and have unclear policy justifications compared to more direct possibilities for improving the intended performance of crop insurance programs.

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.