Revenue Insurance Payment Scenarios for Corn and Soybeans in 2024

A recent farmdoc daily article discussed the increasing pessimism surrounding corn and soybean return prospects for the current 2024 crop year (see farmdoc daily, July 30, 2024). This is mainly driven by continued declines in corn and soybean prices as growing conditions through July across the US suggest good to excellent crop yields, on average.

Today’s article examines potential revenue insurance payments for corn and soybeans for a range of prices and yields around current expectations. Price declines thus far would not trigger payments from individual products like RP and RP-HPE at even their highest coverage level unless small yield losses also occur. Payments would however be triggered for the supplemental plans, SCO and ECO, if county yields equal, or come in below, expected levels. Given the lower revenue guarantees for 2024 compared with 2022 and 2023 because of lower prices, downside return risk is higher even for farms with revenue insurance at high coverage levels.

Revenue Insurance Payment Prospects

While above trend yields may partially offset the decline in prices, recently updated crop budget numbers reflecting these lower price and higher yield expectations suggest even larger negative returns than were projected in our June crop budget update (see farmdoc daily articles, June 25, 2024 and July 30, 2024).

Crop revenue insurance products such as Revenue Protection (RP) and Revenue Protection with the Harvest Price Exclusion (RP-HPE) are designed to provide revenue risk protection, compensating farmers for revenue losses from a covered percentage of a revenue guarantee. For 2024, the projected prices used to set those revenue guarantees were much lower than in recent years – $4.66 per bushel for corn (compared with $5.91 in 2023 and $5.90 in 2022) and $11.55 per bushel for soybeans (compared with $13.76 in 2023 and $14.33 in 2022). This has resulted in much lower revenue guarantees for the RP and RP-HPE products than in 2022 and 2023. Coupled with persistently high production costs, lower revenue guarantees result in increased downside return risk even at high crop insurance coverage.

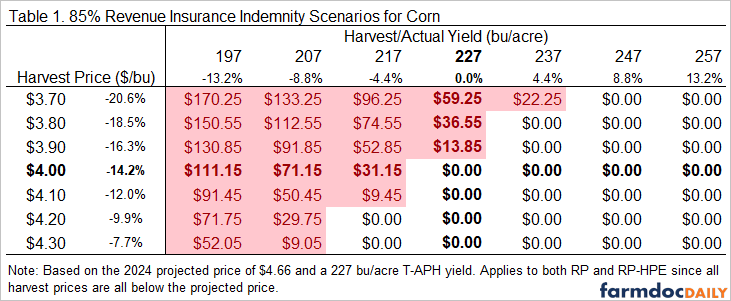

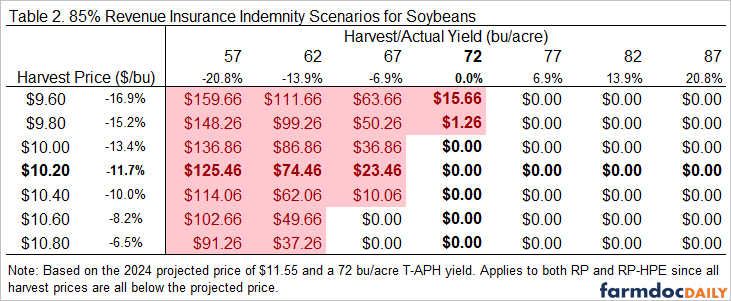

Below we present potential insurance payment scenarios for corn and soybeans for an 85% revenue policy. Since harvest prices considered are below the projected price, the payment calculations apply to both RP and RP-HPE coverage. We also briefly discuss the potential for payments from the supplemental area plans, SCO and ECO, given current price and yield expectations.

Corn

December corn futures have been trading close to $4.00 per bushel in recent days. A harvest insurance price of $4.00 would be 14.2% below the $4.66 projected price for 2024. This price decline would be insufficient to trigger indemnities on RP or RP-HPE policies, even at the 85% coverage level, if a farm’s yield comes in at or above their trend-adjusted actual production history (T-APH) yield used to set their insurance guarantees.

Individual revenue insurance (RP or RP-HPE) payment scenarios for corn, assuming a 227 bu./acre T-APH yield, are provided in table 1. The revenue insurance payments are computed for 85% coverage which, for this farm, guarantees $899 per acre in revenue (0.85 x $4.66 x 227 = $899/acre). Indemnity payments are provided across a range of harvest prices (rows) and harvest farm yields (columns). The percentages next to the harvest prices and below the harvest (actual) yields indicate the percentage difference relative to the projected price and T-APH yield, respectively.

If harvest yield equals the farm’s T-APH yield of 227 bu./acre, 85% revenue insurance payments would be triggered if harvest price is below $3.96 per bushel (15% below the $4.66 projected price). Indemnities for 85% coverage would increase if prices are lower than $3.96 and/or harvest yields are below the farm’s T-APH. A harvest price of $4.00 and harvest farm yield of 217 bu/acre would trigger a $31/acre revenue insurance payment.

Prices would need to fall further to result in revenue losses at yields above the farm’s T-APH. For example, a $22/acre indemnity would be triggered at a harvest yield of 237 bu./acre if harvest price is $3.70.

A harvest price of $4.00 for corn coupled with actual county yields at the levels used to set guarantees for area products would current trigger support from the supplemental area plans SCO and ECO. However, current expectations are for above average county yields for corn in 2024. Yields above expectation will tend to offset, and maybe eliminate, any revenue payments at SCO’s 86% coverage level and ECO’s 90% and 95% coverage levels.

Soybeans

November soybean futures have recently traded as low as $10.20 per bushel. A harvest insurance price at this level would represent an 11.7% decline relative to soybean’s projected price of $11.55 in 2024. Table 2 provides some soybean revenue insurance payments at different harvest price and farm yield levels for a farm with a T-APH yield of 72 bu./acre. This example farm would have a $707/acre revenue guarantee with 85% revenue coverage (0.85 x $11.55 x 72 = $707/acre).

Yields at or above T-APH levels for soybeans would require the harvest price to fall below $10.00 per bushel to trigger 85% revenue coverage payments. Farm yields above T-APH levels would require insurance harvest prices well below $10.00.

A harvest insurance price of $10.20 would trigger payments from both ECO coverage levels (90% or 95%) with county yields at the expected levels used to set guarantees for those programs, but county yield losses would be needed to trigger SCO payments given its 86% coverage level. As with corn, current expectations for overall favorable yields in 2024 reduce the likelihood of payments being triggered from both insurance products.

Summary

Market price declines for corn and soybeans this summer have led to even lower return projections for the 2024 crop year. However, the price declines have not been large enough to result in a high likelihood for revenue insurance payments on individual farm policies like RP and RP-HPE.

Moreover, a major factor driving the price decline is the generally good growing conditions experienced this summer and the increasingly likely prospect of good to excellent corn and soybean yields. Harvest yields above levels used to set insurance guarantees will partially offset the impact of lower prices on revenues, further reducing the size and potential likelihood of revenue insurance payments this year.

The current extent of price declines for corn could lead to payments being triggered from the supplemental area plans, SCO and ECO, with county yields at expected levels used to set guarantees for those programs. Price declines for soybeans would not trigger payments from SCO but would trigger payments from ECO if county yields equal their expected insurance levels. However, as with individual products, prospects for excellent county yields could partially or fully offset any revenue losses even with the lower harvest prices for those products.

Given the above findings, a higher level of downside return risk exposure exists for producers in 2024. Potentially large negative returns could result on individual operations, even if crop insurance payments are triggered.

As a small silver lining, current price and yield expectations are likely close to the “bottom” in terms of potential revenue outcomes for most farms carrying higher levels of revenue coverage, especially for corn. While individual farm experience will vary, in general, further price declines will start to be offset by revenue insurance payments or by the increased crop yields that would likely lead to those additional price declines.

In an upcoming article we will discuss current prospects for support from commodity programs – ARC and PLC – in addressing lower prices and revenues for the 2024 crop year.

References

Paulson, N., G. Schnitkey and C. Zulauf. "Revised 2024 Illinois Crop Budgets." farmdoc daily (14):118, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, June 25, 2024.

Schnitkey, G., B. Zwilling, N. Paulson, C. Zulauf, B. Rhea and J. Baltz. "Increasing Pessimism About 2024 and 2025 Corn and Soybean Returns." farmdoc daily (14):141, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, July 30, 2024.

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.