Additional Thoughts on 2025 Crop Insurance and Farm Program Decisions

The deadline to finalize 2025 crop insurance decisions is now less than a week away (March 17th). The harvest futures contracts for corn (December) and soybeans (November) have moved below projected prices established during February, pushing revenue insurance products closer to being “in the money” as the sales closing date nears. This reinforces the recommendations from recent articles for Illinois farmers to continue with the typical choice of Revenue Protection (RP) with relatively high coverage levels (80% or 85%) and to consider the Enhanced Coverage Option (ECO) for 2025 (see farmdoc daily articles from March 4, 2025 and February 11, 2025).

Questions also continue to arise about whether the county-level Supplemental Coverage Option (SCO) insurance product should be considered for this year. SCO would provide coverage from 86% to the coverage level of the farmer’s underlying COMBO product. However, using SCO requires a commodity program choice of Price Loss Coverage (PLC), which has a lower chance of making a payment than Agriculture Risk Coverage at the county level (ARC-CO). Herein, we further analyze this choice. In most cases, farmers likely will receive higher payments from ARC-CO than from PLC.

Decision Setting

We will look at this choice for the following situation:

- A focus on corn acres. We do not evaluate soybeans because ARC-CO has a much higher chance of payments than PLC for soybeans. Because of the higher chance of payments, the choice of ARC-CO and foregoing the use of SCO is viewed as the dominant choice in most situations.

- The farm will insure planted acres use Revenue Protection (RP) at a relatively high coverage level. In northern and central Illinois and across the Midwest, many farmers take RP at either 80% or 85%.

We consider three crop insurance scenarios for an example farm in Piatt County, Illinois. Insurance premiums are quoted using the 2025 Crop Insurance Decision Tool. Quotes are for an enterprise unit with a trend-adjusted Actual Production History yield of 225 bushels per acre:

- RP at an 85% coverage level. RP-85% has a premium of $22.72 per acre. In this scenario, SCO offers county-level coverage for a 1% coverage band from 86% down to the RP coverage level of 85%, a relatively small range of protection. For the highest protection level, SCO from 86% to 85% has a farmer-paid premium of $1.33 per acre and a maximum payment of $10.58 per acre. Because of the small coverage range, we do not consider the SCO coverage as a significant factor that should influence the commodity title choice between PLC and ARC-CO.

- RP at the 80% coverage level. RP-80% has a lower premium cost of $11.11 per acre, a decrease of $11.61 in farmer-paid premium compared with the 85% coverage level. Lowering the coverage level reduces the minimum revenue guarantee by $53 per acre (5% x $4.70 x 225 bu/acre).

- RP-80% plus SCO. At the highest protection level, SCO from 86% to 80%, has a premium of $6.15 per acre. The SCO product then provides county-level coverage between 86% to 80%, with a maximum payment of $63 per acre when harvest price is below the projected price. While the $63 payment band more than offsets the reduction in individual coverage resulting from the drop in RP coverage from 85% to 80% ($53/acre), the coverage from SCO is not the same as the higher RP-85% coverage level. The county-level coverage could fail to trigger a payment when revenue losses are experienced at the farm-level and vice versa. The total premium of the RP-80% plus SCO combination is $17.27, 24% less than the RP-85% premium of $22.72.

The three crop insurance coverage scenarios have made few payment in recent years. The Crop Insurance Summary of Business tool provides historical information on crop insurance performance. The tool reports net payments, which equal crop insurance payments minus farmer-paid premiums. From 2012 to 2023, the average annual net payments for Piatt County were:

- RP-80%: -$10.48 per acre

- RP-85%: -$17.36 per acre

Both numbers are negative, meaning that farmers have paid more than they have received. The last time RP made sizable payments was in 2012, the drought year.

SCO has been available since 2015. SCO has not triggered indemnity payments in Piatt County from 2015 to 2023. Payments for 2024 are not yet known because county yields will not be released until June 2025. Since no payments have been made, net indemnity payments for SCO have been negative, equaling the cost of farmer-paid premiums.

From a net payment perspective, the alternative with the least cost is RP-80%. Both the RP-85% and RP-80% plus SCO options provide greater revenue protection due to the higher coverage levels, but come at greater premium cost.

In the above scenarios, adding SCO to RP-80%, or option 3, is the only one that potentially impacts the farmer’s commodity title choice. Using SCO requires selecting PLC.

Commodity-Title Choices

The basics of the two commodity-level choices are:

Price Loss Coverage: The effective reference price for corn in 2025 is $4.26, meaning that PLC will trigger payments only if the 2025-26 Market Year Average (MYA) price is below $4.26. If that occurs, the PLC payment will equal the price deficiency multiplied by the farm’s PLC yield, paying out on 85% of the farm’s base acres. We use the average PLC yield for Piatt County of 188 bushels per acre to calculate payments at different MYA price levels for corn:

- $4.10 MYA price: $25 PLC payment per base acre ((4.26 – 4.10) x 188 PLC yield x .85 payment factor),

- $3.90: $57 PLC payment per base acre,

- $3.60: $105, and

- $3.30: $153.

PLC payments will continue to increase with lower MYA prices until the $2.20 loan rate is reached. Before that, payment limits at an individual level would likely become binding on total PLC payments to individuals or individual farm entities.

The MYA price differs from the projected and harvest prices used in crop insurance guarantees. Projected and harvested prices are based on futures prices, typically $.30 to $.40 per bushel higher than cash prices in Illinois. A $4.70 projected insurance (i.e. futures) price is roughly consistent with a $4.30 to $4.40 MYA price.

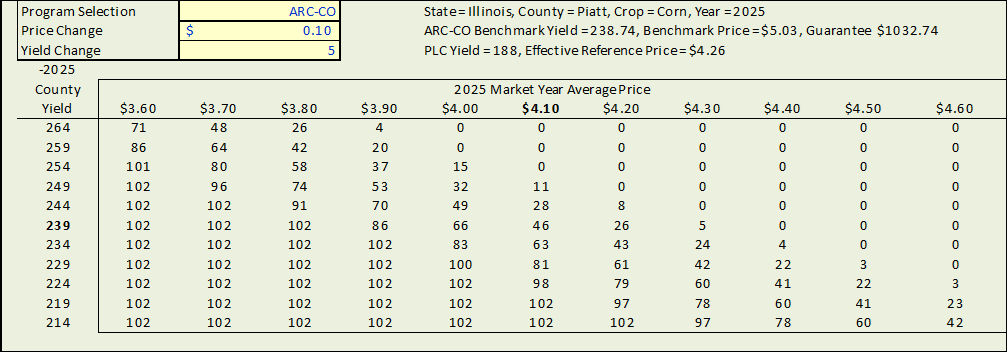

ARC-CO: For non-irrigated corn in Piatt County, ARC-CO offers a revenue guarantee that is 86% of a 238.74 benchmark yield and $5.03 benchmark price for 2025. Table 1 is generated from the 2025 Farm Bill What-If Tool, and shows ARC-CO payments under different 2025 actual yield and MYA price combinations. ARC-CO has a maximum payment that is 10% of benchmark revenue. This is then multiplied by the 0.85 payment factor to arrive at the maximum ARC-CO payment per base acre. For Piatt County, the maximum payment is $102 per base acre (0.85 x 0.10 x $5.03 x 238.74).

Table 1. 2025 ARC-CO Payments in Piatt County, Illinois for Different Prices and Yields

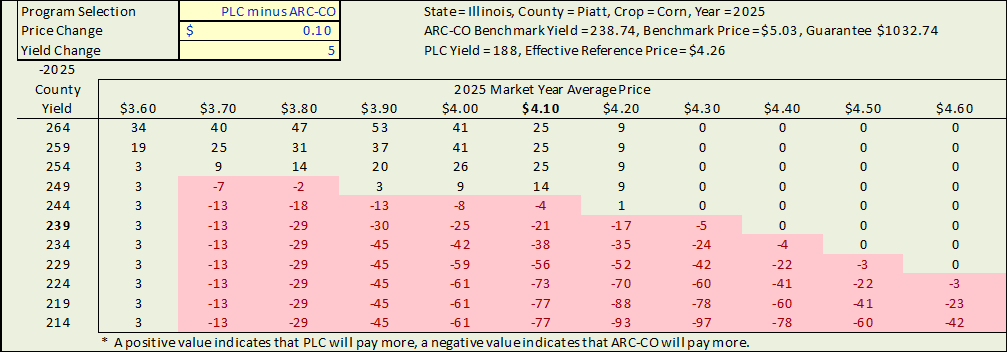

ARC-CO and PLC will trigger different payment amounts across MYA price and county yield scenarios (see Table 2). At MYA prices below $3.60, PLC would tend to trigger higher payments than ARC-CO. At an MYA price of $3.60, ARC-CO is triggering the max payment of $102 per base acre for the county yield scenarios of 254 bu/acre or lower, but PLC would trigger a payment of $105 per base acre. At higher county yields the ARC-CO payment would be lower, increasing the difference and advantage of PLC.

Table 2. PLC Minus ARC-CO Payments, Piatt County, Illinois for Different Prices and Yields

Under the most likely price and yield scenarios, ARC-CO will pay more than PLC. Current futures contracts would suggest 2025-26 MYA prices in the $4.10 range. At those price levels, ARC-CO is expected to pay more than PLC unless county yields are well above benchmark levels. At this point in the 2025 crop season, the best estimate for both farm and county yields would be at benchmark/trend yield levels.

The Choice

The commodity title with the highest expected payments under the most reasonable price and yield scenarios for corn in 2025 is ARC-CO. Still, a farmer may wish to consider PLC if they are concerned with the potential for much lower prices than current market indicators would suggest, such as $3.60 or below.

If the goal is to choose the alternative with the highest expected payments, then ARC-CO should be chosen. That would preclude taking SCO. However, SCO has made limited payments from 2015 to 2023 and has negative net indemnity payments across much of the Midwest (farmdoc daily, July 23, 2024).

Besides SCO, another county-level product, the Enhanced Coverage Option (ECO), is also available. ECO provides coverage from 95% to 90% down to 86%, the top end of SCO (see farmdoc daily, February 11, 2025). The choice of PLC or ARC-CO does not influence the producer’s eligibility to use ECO. ECO’s premiums subsidy was increased to 65% for this year, thereby lowering its premium. Like SCO, however, ECO has had limited payments in recent years, resulting in negative net indemnity payments even at the increased subsidy rate (farmdoc daily, November 5, 2024).

Weighing against the choice of SCO and ECO is the potential for another ad hoc disaster assistance program like ERP (see farmdoc daily, June 6, 2022). ERP and its predecessor, WHIP+, have topped up crop insurance coverage. In 2022, ERP used a 95% factor when either 80 or 85% coverage levels were selected. If crop revenue, including net crop insurance payments, was less than 95%, ERP would make a payment. At 80 and 85% RP coverage levels, use of SCO and ECO would not increase the 95% factor. However, insurance payments from all insurance products would be included in revenue calculations, and farmer-paid premiums would be subtracted. In essence, ERP in 2022 replaced SCO and ECO coverage, as well as the revenue guarantee difference between RP-80% and RP-85%.

The American Relief Act of 2025 included $21 billion for disaster assistance, which could result in a continuation of an ERP-like program for 2023 and 2024. Given the relative longevity of these ad hoc disaster assistance programs, future legislation could provide a similar program for 2025. If that occurs, then an ERP-like program could provide similar payments as SCO and ECO coverage. An ERP-like program for 2025 has not been legislated and will not be done by the time decisions are made. Nor do we know yet how the 2024 disaster assistance program will be implemented.

Should the Prospect of Tariffs Influence Choice

Tariffs and the resulting prospects for retaliation impact US agricultural exports could lower prices, which would make crop insurance coverage in 2025 even more valuable. Indeed, since the setting of projected prices, prices have declined. The December 2025 corn contract currently is near $4.50, below the $4.70 projected price. The November 2025 soybean contract currently is $10.20, below the $10.54 projected price. Those declines could be because of the prospect of tariffs, but the declines are not out of the ordinary. Final harvest prices will be influenced by many factors, with tariffs being one of them. It does not seem evident that price variability will be more pronounced in 2025 than in previous years. Tariffs likely have a longer-term impact, making the U.S. a more unreliable partner and spurring supply elsewhere.

Summary

ARC-CO has higher expected returns than PLC, suggesting ARC-CO as the choice for corn and soybean base acres. Historical experience does not suggest that SCO will make large payments in Illinois. As a result, making an ARC-CO seems reasonable, thereby precluding SCO. Purchasing ECO still is an option.

References

Paulson, N., G. Schnitkey and C. Zulauf. "Crop Insurance Decisions for 2025." farmdoc daily (15):41, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, March 4, 2025.

Schnitkey, G., N. Paulson and C. Zulauf. "Enhanced Coverage Option for 2025." farmdoc daily (15):26, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, February 11, 2025.

Schnitkey, G., N. Paulson, C. Zulauf, B. Sherrick and B. Goodrich. "Impacts of Higher Premium Support Rates on ECO Performance." farmdoc daily (14):201, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, November 5, 2024.

Schnitkey, G., B. Sherrick, C. Zulauf, N. Paulson and J. Baltz. "Performance of SCO and ECO in the Midwest." farmdoc daily (14):136, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, July 23, 2024.

Swanson, K., G. Schnitkey, C. Zulauf, J. Coppess and N. Paulson. "The Continuation of Disaster Programs in U.S. Agriculture: Emergency Relief Program." farmdoc daily (12):83, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, June 6, 2022.

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.