Additional ARC/PLC Payments for 2025: Value of Receiving the Maximum Program Payment

Program enrollment decisions for the Agriculture Risk Coverage (ARC) and Price Loss Coverage (PLC) programs were made in March of 2025. However, the One Big Beautiful Bill (OB3), which was not passed and signed into law until July, resulted in farmers receiving the higher of the PLC or ARC payments for 2025. Total ARC/PLC payments for 2025 are currently projected at more than $13.5 billion with nearly $3.2 billion, or 24%, of those payments due to receiving the maximum payment rather than the payment of the program elected for 2025. These estimates are based on current price projections, and much can still change over the course of the 2025 marketing year.

Projected Payments for 2025

A recent article released payment projections for the seven covered commodities with the largest number of base acres (see farmdoc daily from November 18, 2025). Projected marketing year average (MYA) prices for 2025/26 used to arrive at the payment estimates are based on USDA projections in the latest WASDE report and ARC/PLC program data provided by the Farm Service Agency (FSA), both of which were updated and released on November 14th, 2025.

Per acre payment rate estimates for both ARC-CO and PLC are computed using simulation methods (see the Policy Design Lab webpage for additional visualizations of projected ARC-PLC payments). County-level data on enrolled base acres from FSA is then used to aggregate the projected ARC and PLC program payment rates for each county to total payment estimates.

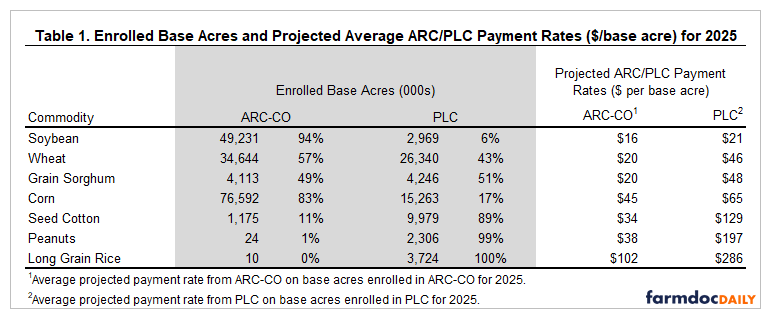

Table 1 reports enrolled base acres by program for each crop and average projected payment rates for ARC-CO and PLC for the 7 largest base acre commodities. Enrollment in ARC-CO and PLC varies across the commodities. The majority of corn (83%) and soybean (94%) base acres were enrolled in ARC-CO for 2025. PLC enrollment dominates long grain rice (100%), peanut (99%), and seed cotton (89%) base acres. Enrollment for grain sorghum and wheat base acres for 2025 is more balanced across the programs (49% in ARC-CO for grain sorghum, 57% in ARC-CO for wheat).

The payment rate estimates in table 1 are measured in $ per base acre and account for the 85% payment factor. Projected payment rates ($/base acre) are lowest for soybeans and largest for long grain rice. Average projected payment rates from PLC exceed those from ARC-CO for all of the commodities. Note that this does not imply that all farms are expected to receive the payment from PLC for 2025. There is variation across counties and farms. For some farms, projected payment rates for ARC-CO could exceed those from PLC. These national averages are provided to give readers some sense of the average levels of support currently projected to be triggered from both programs at the national level.

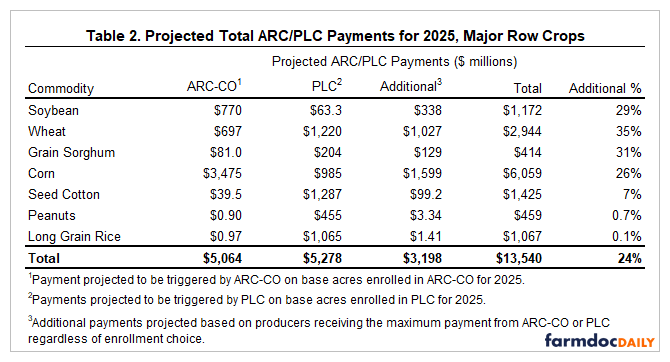

Table 2 reports total projected payments for the major row crops. These estimates include payments associated with ARC-CO and PLC based on enrollment decisions and “additional” projected payments. Additional payments are defined as those resulting from situations where the projected payment of the originally elected program is less than the projected payment for the alternative program. For example, if a base acre is enrolled in ARC-CO but the projected PLC payment is greater than the projected ARC-CO payment the additional payment is the difference (projected PLC minus projected ARC-CO).

Total ARC/PLC payments are projected to exceed $13.5 billion for 2025. The value of the additional payments is projected to total nearly $3.2 billion, or 24% of total projected payments.

For the PLC enrollment heavy crops (rice, peanuts, and seed cotton), the value of additional payments is relatively small. Additional payments are $1.4 million for rice (0.1% of total), $3.3 million for peanuts (less than 1% of total), and $99 million (7% of total) for seed cotton.

Since PLC is the program projected to trigger larger payments in most situations for 2025, the additional payments resulting from receiving the larger payment from the programs tends to be larger for the other crops with greater proportions of base acres enrolled in ARC-CO. Additional payments on corn base acres are projected at nearly $1.6 billion or 26% of total projected support for corn. Additional payments on soybean base are projected to be nearly $1.2 billion or 29% of total support projected for soybeans. Sorghum base acres are projected to receive $129 million in additional payments (31% of total projected support) while wheat base acres are projected to receive $1 billion in additional payments (35% of total).

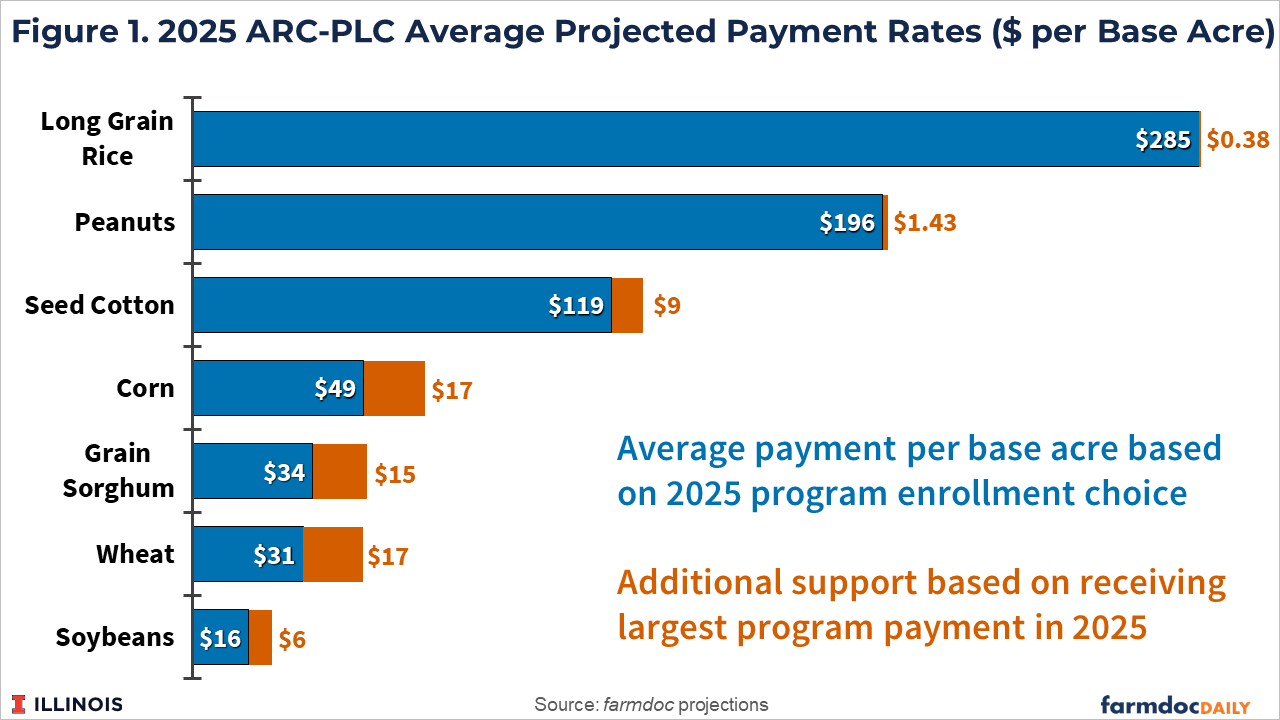

Illustrated in Figure 1, additional payments on a per base acre basis are largest for corn and wheat at roughly $17 per base acre. Additional payments to grain sorghum total $15 per base acre. Additional payments for seed cotton are projected to add $9 per base acre on average. Additional payments increase payments to soybeans by $6 per base acre. The value of additional payments to peanuts and long grain rice are smallest at $1.43 and $0.38 per base acre. Again, virtually all long grain rice and peanut base acres are enrolled in PLC which is the program projected to trigger the largest payments in 2025 for the vast majority of farms with long grain rice or peanut base.

Additional ARC/PLC Payments Across US Counties

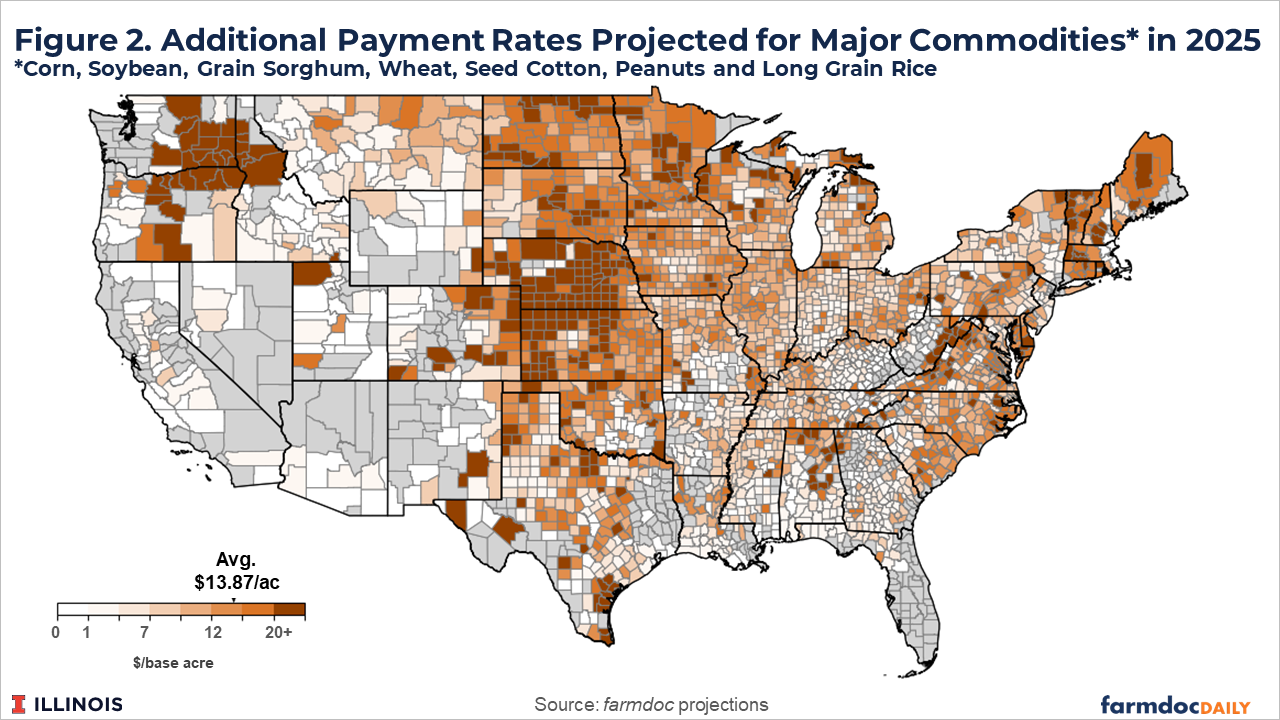

Figure 2 shows county-level estimates of additional ARC/PLC payments for 2025. The additional support payments are averaged across commodities, weighted by the crops’ total base acres in that county. On average, additional payments are projected to provide nearly $14 per base acre more in payments than if producers received the payment only from the program they elected in 2025. Larger additional payments can be seen in many counties in Nebraska and Kansas, and counties scattered throughout the upper Midwest in the Dakotas, Minnesota, Wisconsin and Michigan. Additional payment rates are also higher in areas of the Pacific Northwest and Northeast, although base acres and total program payments will be lower in these regions.

Summary

Producers will receive the larger of the payments triggered by ARC-CO or PLC for their farm’s base acres in 2025. Presumably the reason is that the OB3 Act was passed after producers had made enrollment decisions for 2025 and it contained changes to the 2025 programs. Annual enrollment decisions are expected again starting in 2026.

Providing the larger payment for 2025 is projected to provide additional support of nearly $3.2 billion, or 24% of the total support of more than $13.5 billion projected for 2025. Additional support is greatest for corn, soybeans, wheat, and grain sorghum – commodities with base acre enrollment split relatively evenly between ARC-CO and PLC, or more heavily towards ARC-CO for 2025. Payments per base acre are largest, but additional support is lowest, for long grain rice, peanuts, and seed cotton – crops with most of their base acres enrolled in PLC which is the program projected to trigger greater support in most situations in 2025.

Returns to major row crops in the US have been poor since 2023, with low to negative average returns projected to continue for 2025 and into 2026. Payments from ARC/PLC for 2025, if realized, will not be received by farmers until October of 2026, creating concerns over their timeliness and whether the need exists for additional aid in the coming months. Policymakers should be aware of the potential for support from existing programs such as ARC and PLC as they consider authorizing additional ad hoc assistance for farmers.

We emphasize that these are estimates based on current marketing year average price projections from the USDA. Actual program payments will be based on actual prices and, for ARC-CO, finalized yields from FSA, both of which are still months away from being determined.

References

Paulson, N., H. Monaco, G. Schnitkey, J. Coppess and C. Zulauf. "Projected ARC and PLC Payments for 2025." farmdoc daily (15):213, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, November 18, 2025.

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.