The Number and Composition of Legal Entities Engaged in Farming: Initial Evidence from FSA Payment Files

Note: This article was written by University of Illinois Agricultural and Consumer Economics M.S. student J.R. Glenn and edited by Joe Janzen. It is one of several excellent articles written by graduate students in Prof. Janzen’s ACE 527 class in advanced agricultural price analysis this fall.

Farm payments are intended to aid farmers by supporting incomes, reducing risk, and achieving conservation goals. However, payments may change farmer behavior in ways that are market distorting (Zulauf 2013). Such changes may include the choice of an individual to farm and the choice of the business structure or legal entity by which that individual engages in farming.

Farm program payments made by USDA’s Farm Service Agency (FSA) are paid to individuals and other legal entities engaged in farming. These may include partnerships, corporations, and trusts. However, farm program payments have generally included payment limits that cap the amount paid to individuals (not legal entities, but the individuals who own them) under each program in each year. These caps may incentivize individuals to create legal entities to become “producers” to evade payment limits. FSA regulations specifically prohibit the adoption of entity ownership schemes to avoid payment limitations to individuals under federal farm subsidy payment programs (Farm Service Agency, 2021), but there have been instances where farming operations have been alleged to use a multiple entity farm structure to evade payment caps.

The impact of farm payments on the incentive to form legal entities is complicated. To be eligible for FSA farm payments, the person or entity must be actively engaged in farming. To satisfy the active engagement requirement, a person or entity must have a significant contribution of capital, land, equipment, or a combination of the same, as well as actively manage the farming operation. Payment limitations are controlled by direct attribution. Program payments made directly to a legal entity are attributed to the individuals that have either a direct and/or indirect interest in the subject legal entity, with payments to the entity being reduced by the pro rata share of the person. Attribution is tracked through four levels of ownership. In the end, payments are attributed to an individual through the legal entity structure. (Farm Service Agency, 2021) While the payment limitation rules are complex, they appear to incentivize more individual producers and more legal entities, not less.

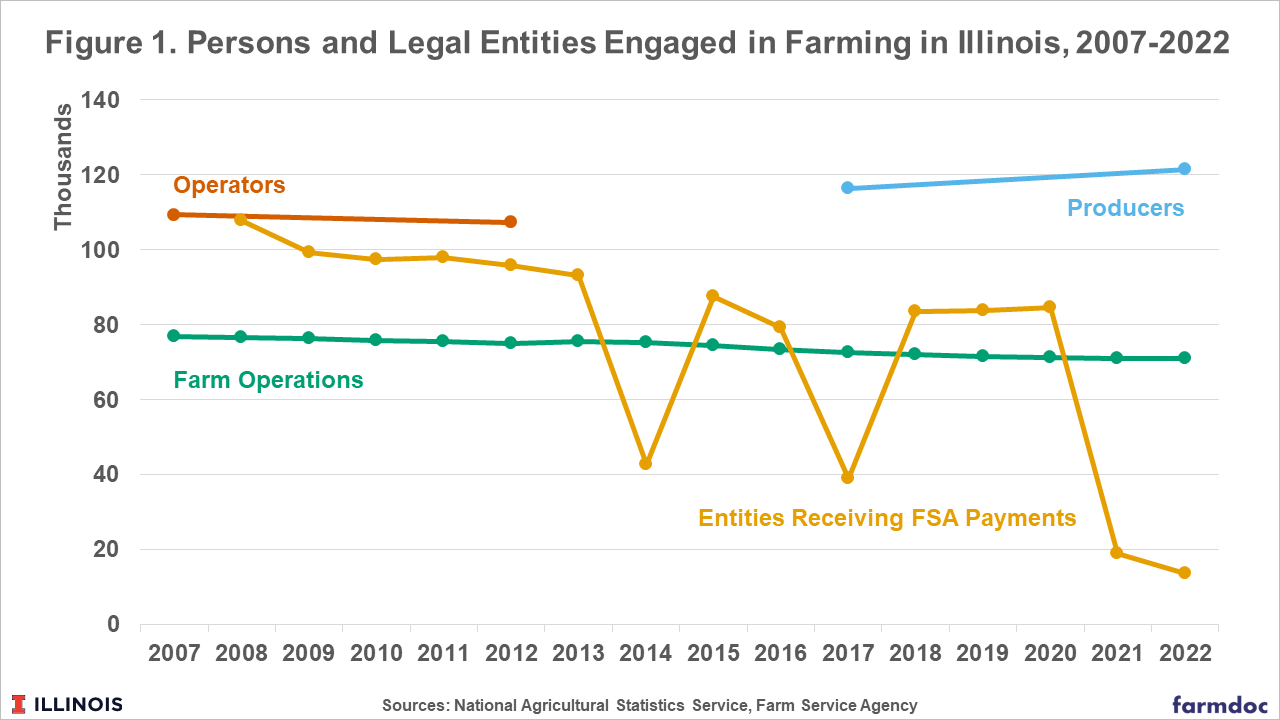

The number of farms, operations which may include multiple individuals or legal entities engaged in farming, has steadily declined in Illinois over time. However, the number of persons farming has not. Figure 1 shows the number of farms declined from 76,600 to 71,100 between 2008 and 2022. The number of individual producers is about 50% greater than the number of farms and actually rose between 2017 and 2022. Longer-term comparisons of producer numbers are complicated because USDA has changed how they measured the number of individual producers, previously termed operators, between the 2012 and 2017 Censuses of Agriculture (Pilgeram, et al., 2020). These diverging trends in farm and farmer numbers could be the result of farm operations choosing to add individuals and legal entities to maximize farm payments.

We know relatively little about the number of legal entities engaged in farming. National Agricultural Statistics Service data is usually specific to persons or farms. FSA payments data (Farm Service Agency, 2025) show the number of individuals and other legal entities receiving payments in Illinois has also declined over time. While the number of payment recipients varies from year to year, mainly because farm programs do not always trigger payments every year, the number of payment recipients has fallen over time.

Figure 1 shows the number of recipients declined from 107,800 in program year 2008 to 84,611 in 2020, a proportionally larger decline than in the number of farms. When farm programs are widely triggered, the number of payment recipients exceeds the number of farms, suggesting that a substantial number of farming operations have multiple operators. There was a substantial drop in 2021 and 2022 as fewer FSA payments were triggered during these high price years. This broad trend toward fewer recipients does not, however, connect farming operations to persons or legal entities who received payments or assess the types of legal entities chosen by individuals in response to particular economic or policy conditions.

This article seeks to demystify the complex connections between farms, farmers, legal entities, and farm payments using data from the FSA Payment Files. We begin by briefly reviewing the different types of entities that may be engaged in farming and receive farm payments. We discuss a methodology for identifying the prevalence of different entity types in publicly available FSA data and apply this method to payment data for Illinois for program years 2008 to 2022. We find significant trends, particularly in the use of Limited Liability Companies (LLCs) over time. LLCs comprise a larger share of all entities receiving farm payments and an even greater share of payment dollars over time. However, these trends are not specifically correlated with policy changes such as the passage of new Farm Bills or the rise of ad hoc farm payments that began in 2018.

Farming Business Entity Structure

A business structure is chosen to balance a variety of competing interests, such as tax considerations, liability protection, and estate planning among others. The complete evaluation of the appropriateness of a certain legal structure for a particular farm operation is beyond this analysis and should be made after consultation with both tax and legal counsel.

The most basic structure is a sole proprietorship—in other words operating as an individual. Operations with two or more owners may form a partnership and share the profits, losses, assets, and liabilities of the business. Partnerships come in a variety of forms such as a general partnership, limited partnership, limited liability partnership, or limited liability limited partnership.

Operators might also choose to form a legal entity such as a limited liability company (LLC) or a corporation (the main two being either a C Corporation or a S Corporation named after their respective subchapter of the Internal Revenue Code). Despite their differences, either is essentially an artificial person, created by law, that has legal rights, just like a natural person, including for transacting business—like holding property. Some farm operations are also held in trust. Like anything else, there are several types of trusts that can be used depending on the goal(s) for the creation of said trust. Asset protection and estate planning are largely the most notable advantages and reasons for establishing a trust. These structures also tend to be more complex in creation.

It is reasonable to assume that historically one of the primary drivers of legal entity creation was to take advantage of liability protection. To that end, farmers often create a legal entity to house land, machinery, or other high dollar assets as a means of shielding those assets from a third-party claim to ownership to satisfy a judgment against the farmer owner.

Arguably the easiest of these entities to form, maintain, and dissolve is an LLC. Given its combination of liability protections, usefulness in estate and transition planning, and easy of formation, maintenance, and dissolution, we anticipate that efforts to use entity creation to circumvent payment limits placed on farm program payments could be correlated with an increase in the formation of LLCs.

Identifying Trends in Entity Types Receiving Farm Payments

Based on the business structures described above, we consider five types of FSA payment recipient entities: individuals, partnerships, corporations, trusts, and LLCs. Publicly available FSA Payment Files list every payment made by FSA, including the payee name, address, program, and dollar amount. Business structure is not listed, so we use the payee name to classify payments by entity type. We search the payee name for the strings of characters that would identify a particular entity type, e.g., “(space) LLC” in the case of Limited Liability Companies. (A space is included to avoid classifying individuals with the string ‘LLC’ in their name.) Similar procedures are used for other entity types. Payment recipients who are not flagged by this procedure are assumed to be individuals/sole proprietors. FSA Payment Files include records for more than 5.8 million payments made in program years 2008 to 2022 in Illinois. A program year indicates the year in which farming activity occurred to trigger a given payment, not the year the payment was received by the entity. We limit our analysis to end in 2022 because payments for program years 2023 and after may not have been made when the most recent data were made publicly available.

Our method is suitable for measuring changes in the prevalence of entity types over time. However, our method has potential for error; specifically, it is likely to undercount entity types when recipients do not have their type indicated in their name. Since we apply the methodology consistently over time, these misclassifications should be similar across years so that the results should be informative of changes in the use of particular business structures. We hypothesize that LLCs may be particularly responsive to policy shifts that incentivize creation of legal entities that can receive government payments, given their ease of creation. For instance, there were no notable changes to the Limited Liability Company Act in Illinois, that might explain sharp changes in the prevalence of entities immediately before and after the passage of the 2014 Farm Bill. Changes in LLC use around policy shifts would support the idea that entities are being created to maximize payments, but would not rule out alternative explanations for changes in LLC use over time.

Changes in Entity Numbers and Payment Receipts by Type

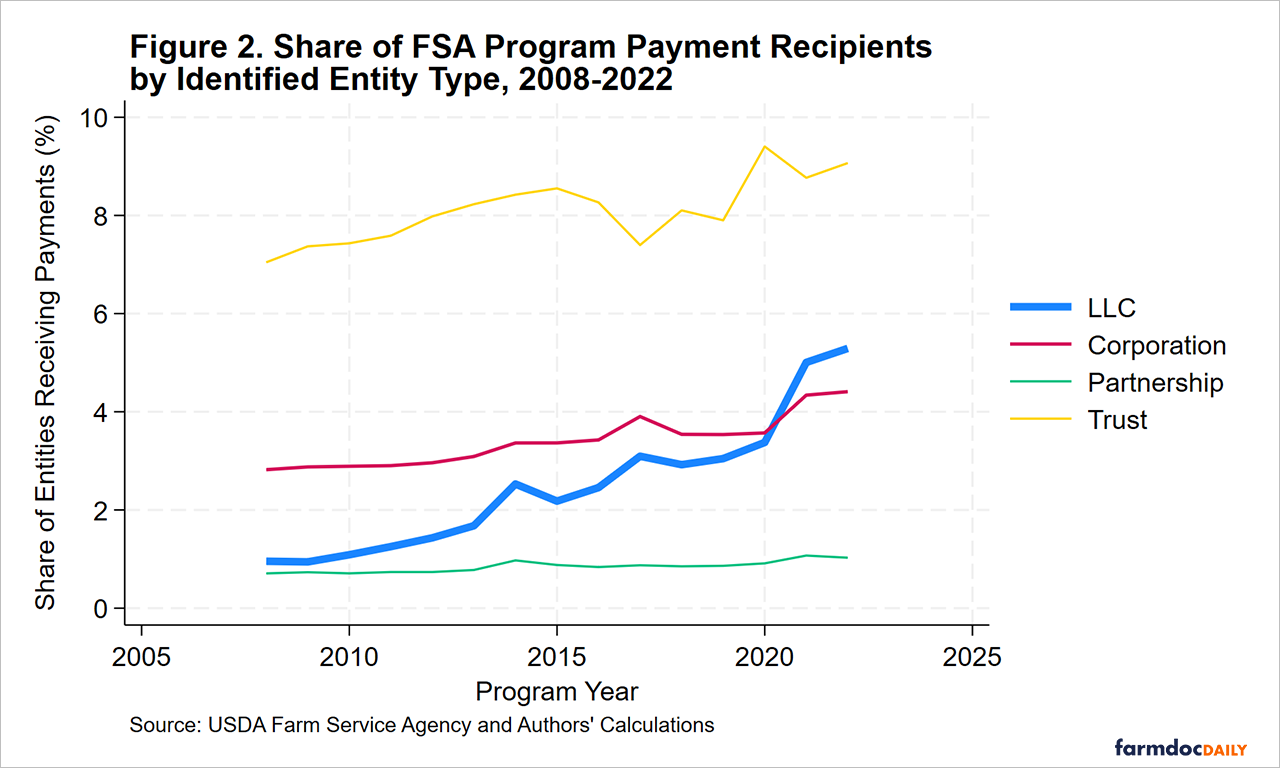

We describe changes in the prevalence of different business structures for entities receiving FSA payments in two ways. First, we calculate each entity type’s share of the number of entities. The denominator is the number of entities shown in Figure 1. Figure 2 shows the share for all entity types by year. The formation of LLCs is rising over time with the share of LLCs identified in FSA data increasing fairly steadily from about 1% to 5% between program years 2008 and 2022. The sharpest year-over-year increases occur in 2014 and 2022 when the number of entities receiving payments dropped. These years are associated with policy changes, specifically the 2014 Farm Bill and the end of ad hoc payments. Figure 2 also shows that the prevalence of trusts also increased over this period, but the increase was smaller and not as smooth as for LLCs. Payments to entities identified as corporations or trusts remained steady.

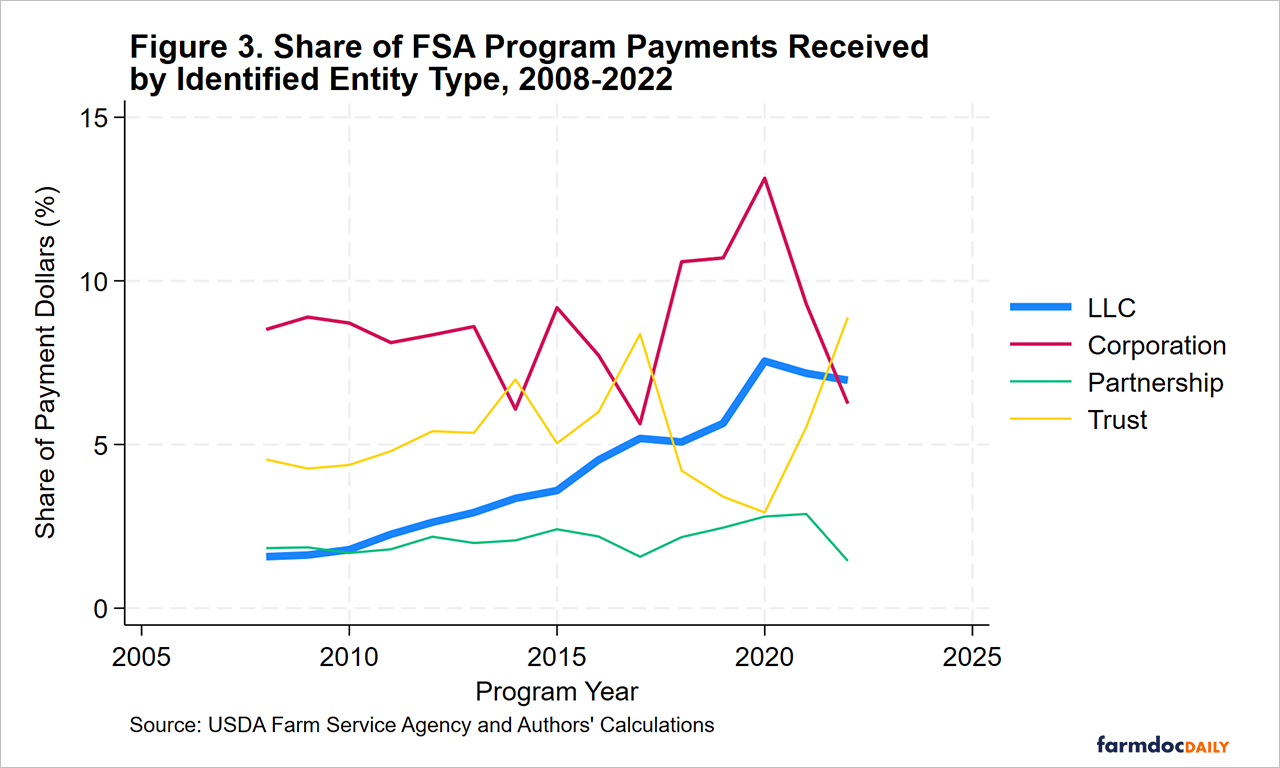

As the prevalence of LLCs among farm payment recipients in Illinois increased, so did the share of payments received by LLCs. Figure 3 shows the share of farm payments going to LLCs, corporations, partnerships, and trusts for the same 2008-2022 period as Figure 2. Each payment share is greater than the entity share, suggesting that individuals receive relatively small payments and other entity types are more prevalent among larger farms. Again, LLCs are steadily growing in prevalence over this period with their share of payments increasing roughly sevenfold from about 1% to 7%. (Note this increase starts from a fairly low base rate in 2008 and should not be interpreted as indicative of the overall prevalence of LLCs in Illinois agriculture.)

Summary Discussion

Our analysis of FSA payments data shows the number of entities receiving payments has declined over time, dropping faster than the number of farms and falling even when the measured number of individual producers, those actively engaged in farming, has been increasing in NASS data. However, the composition of entities receiving payments has changed. In particular, the prevalence of LLCs as a business structure appears to have increased steadily and substantially. While our methodology for identifying entities may measure the level of LLCs with error, it is suitable for identifying trends over time. We see a substantial increase in farming entities operating as LLCs with corresponding decreases in the use of sole proprietorships. We do not see dramatic shifts in the prevalence of entity types in the data around major farm program policy changes. That is, we cannot determine from aggregate data whether farm program payment limits have changed the incentives for individuals to engage in farming and use specific business structures such as LLCs to do so. Analysis that follows specific entities over time may be helpful in answering questions about farm payments impact on business structure choice, a possible unintended consequence of US farm policy.

References

Farm Service Agency. April 2021. “Payment Eligibility and Payment Limitations” https://www.fsa.usda.gov/sites/default/files/documents/payment-elligibility-limitations-factsheet.pdf

Farm Service Agency. November 2025. “Payment Files Information” https://www.fsa.usda.gov/tools/informational/freedom-information-act-foia/electronic-reading-room/frequently-requested/payment-files

Pilgeram, R., K. Dentzman, P. Lewin, and K. Conley. 2020. “How the USDA Changed the Way Women Farmers Are Counted in the Census of Agriculture.” Choices. Quarter 1. Available online: http://www.choicesmagazine.org/choices-magazine/submitted-articles/how-the-usda-changed-the-way-women-farmers-are-counted-in-the-census-of-agriculture

United States Attorney’s Office. January 29, 2014. “Dowson Farms Pays $5.4 Million To Resolve False Claims Allegations Related To Farm Subsidy Payment Limits” Press Release, https://www.justice.gov/usao-cdil/pr/dowson-farms-pays-54-million-resolve-false-claims-allegations-related-farm-subsidy

Zulauf, C. "Market Distortion and Farm Program Design: A Case Examination of the Proposed Farm Price Support Programs." farmdoc daily (3):110, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, June 7, 2013.

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.