Off Base, Part 2: The View from the CBO Baseline

Release of the CBO Baseline is an annual ritual required by federal budget policy, pursuant to which the Congressional Budget Office (CBO) projects spending on certain programs ten years into the unknowable future (2 U.S.C. §907). CBO released its February 2026 baseline ahead of schedule, providing a new look at agricultural policy after enactment of major changes in the Reconciliation Farm Bill (CBO, February 2026). This article continues a review of concerns with base acres in farm subsidy programs, adding perspectives from the CBO baseline (farmdoc daily, January 15, 2026). Among the perspectives are warnings and portents, adding further concerns about this peculiar policy design.

Background

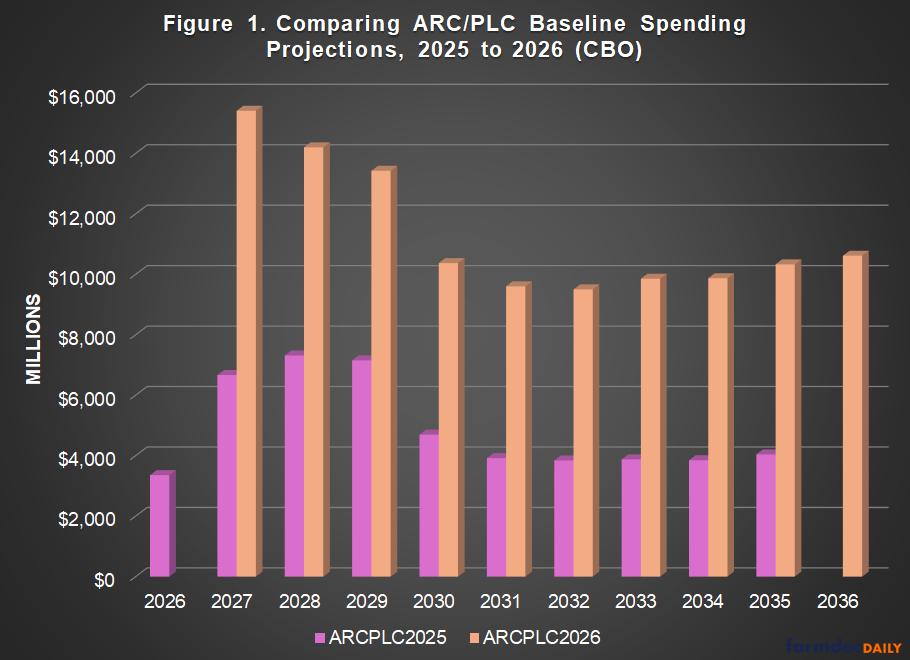

The CBO baseline, among other things, provides a new look at the changes to farm policy from the Reconciliation Farm Bill, namely increased payment thresholds and base acres. Figure 1 compares the ten-year spending projections for ARC and PLC from the previous baseline (CBO, January 2025) and the new baseline (CBO, February 2026). Note the new 10-year budget window: FY2026 to FY 2035; FY2027 to FY2036. Note also that ARC and PLC are designed with timing shifts, such that payments for the 2024 crop were made in October 2025, which is FY2026. Payments for the 2025 crop—in which the Reconciliation Farm Bill altered such that base acres will receive the higher of the two payments—will be made in October 2026, which is FY2027.

The changes enacted in the Reconciliation Farm Bill have had a massive impact on spending from ARC and PLC. In total, the ten-year spending projections went from $48.7 billion (January 2025) to $113.2 billion (February 2026), more than double the previous ten-year spending estimate. The February 2026 baseline also marks the first time these programs have exceeded the $100 billion level in a CBO baseline. Most of the projected spending is in PLC, which went from $32.8 billion to $94.7 billion, a nearly three-fold increase. ARC-CO experienced a modest increase going from $14.8 billion in 2025 to $16.9 billion in 2026, although CBO booked all spending for the 2025 crop (FY2027) in PLC at a total of $15.4 billion. This projection is higher than an earlier estimate but, as will be discussed, is likely due to CBO’s allocation of the additional 30 million new base acres (farmdoc daily, November 18, 2025; November 25, 2025). Note that projected spending from ARC-IC is also included but is less than $2 billion (2% to 1.5%) in both baselines and increased little ($1.1 billion to $1.7 billion). Additionally, crop insurance is projected to increase spending by nearly $23 billion (17% increase) to over $155.5 billion (FY2027-2036). Total projected spending for conservation is projected to increase by $14.9 billion (26% increase) for the ten-year totals, however, the Conservation Reserve Program (CRP) is projected to spend $1.15 billion less in the ten fiscal years of the February 2026 Baseline.

Discussion

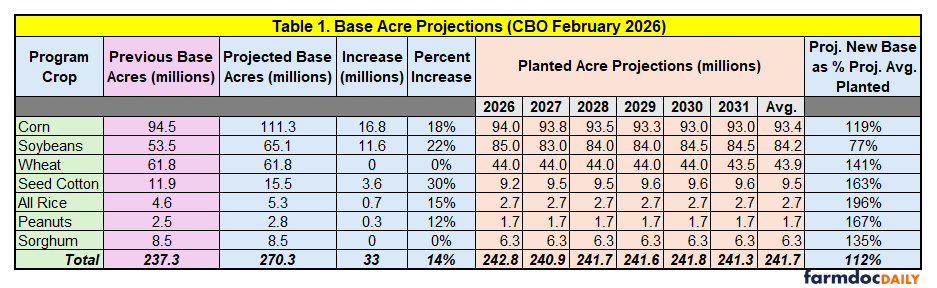

This discussion begins with CBO’s projection for the allocation of the additional 30 million base acres provided for in the Reconciliation Farm Bill. CBO projects a total of 33.1 million new base acres, with the largest increase (30%) for seed cotton, followed by soybeans (22%). CBO also projects no additional base acres for either wheat or sorghum. Table 1 provides the projections for new base acres, as well as CBO’s projections for planted acres during the crop years 2026 to 2031.

It is, by now, a familiar story that the programs are purposefully designed to deliver large disparities in ARC/PLC payments. The February baseline is another reminder. It also emphasizes how much the Reconciliation Farm Bill changes have made it worse. The following are average payments per base acre—total ARC/PLC payments divided by total base acres—for the major program crops projected by CBO for the years of authorization (crop years, 2025-2031; fiscal years 2027-2033).

|

First Class Base |

Economy Class Base |

| · Peanut base, $279.99 per base acre

· All rice base, $233.44 per base acre · Seed cotton base, $118.52 per base acre |

· Corn base, $39.14 per base acre

· Wheat base, $32.86 per base acre · Sorghum base, $26.87 per base acre · Soybean base, $19.08 per base acre |

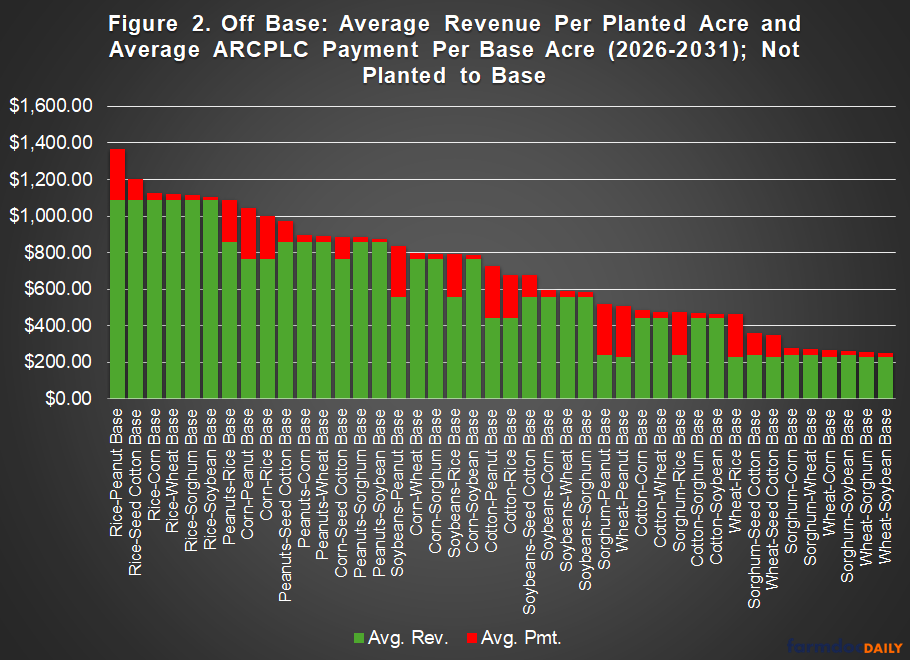

The disparities are clear: Southern crops (peanuts, rice, seed cotton) are projected to receive vastly larger payments. Problems magnify when farmers plant the same crop on different base acres and the federal payments make the difference among farmers producing the same crop. Figure 2 illustrates using the CBO projections for average revenue per planted acre and average ARC/PLC payment per base acre for crop years 2026 to 2031 when a different crop is planted to the base acre (e.g., corn planted to soybean base). The combinations are ranked from highest total income to lowest. As before, this is a very rough and imperfect measure that sets up questions more than answers them.

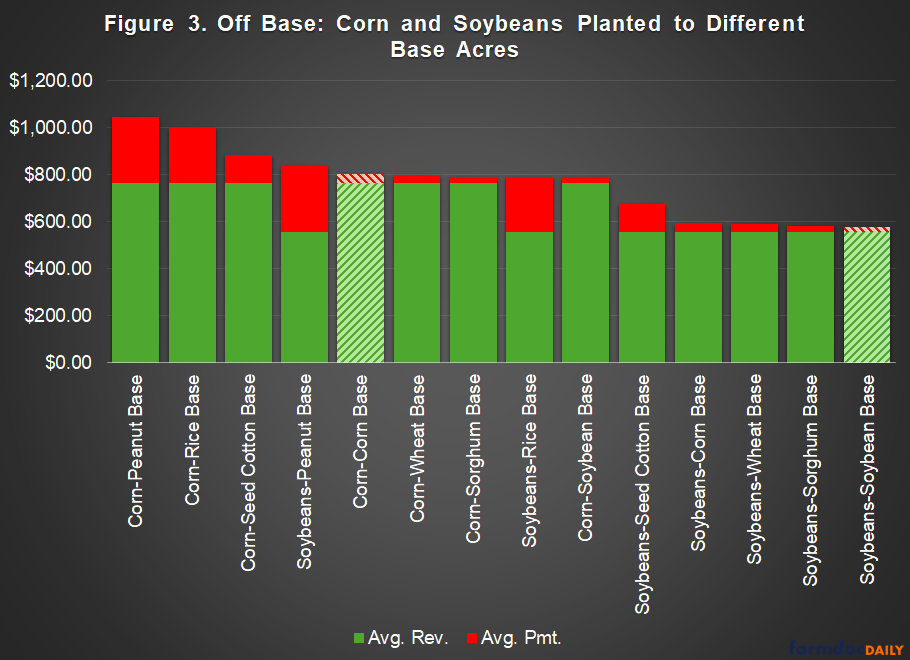

Peanuts, rice and cotton are regional crops, grown only in the South with base acres available only to southern operations. Corn, soybeans, and wheat are national crops planted almost everywhere, while sorghum can be planted in most places but is generally produced in the drier regions of the southern Great Plains. This means that farmers in the Midwest cannot plant rice, peanuts or cotton to corn and soybean base, nor can they plant corn and soybeans on peanuts, rice or seed cotton base. Figure 3 illustrates the same average revenue and payment combinations as in Figure 3 but narrowed to just planted acres for corn and soybeans, including on base planting (striped columns).

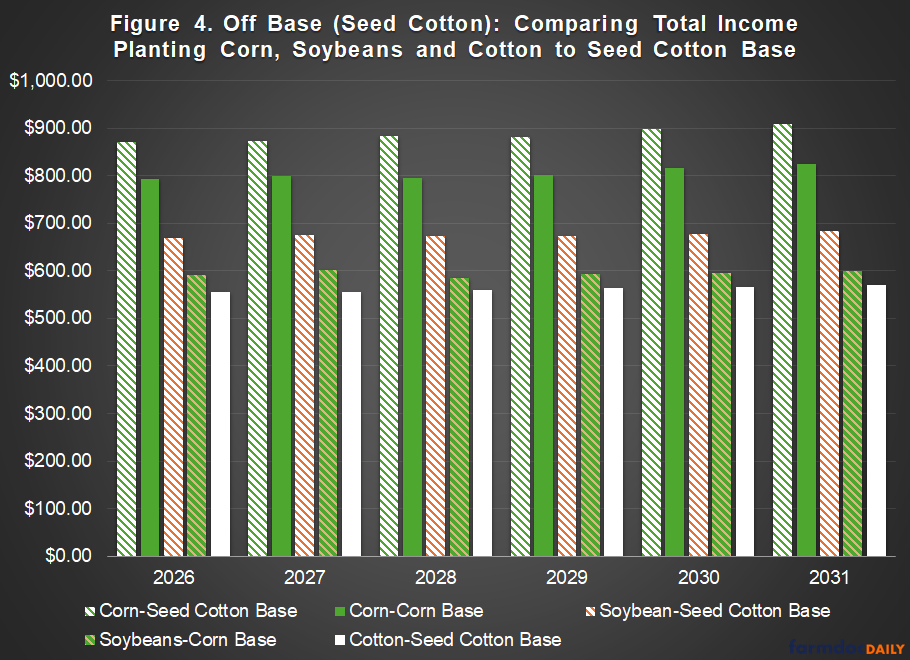

Seed cotton base acres arguably best illustrate; with the third highest average payment rate, CBO projects cotton revenue per planted acre to be lower than corn and soybean revenue each of the next six crop years (2026 to 2031). CBO also projects a 30% increase in base acres of seed cotton. As a result, each of those six crop years is projected to have approximately six million more base acres of seed cotton than acres planted to cotton—six million acres that will be planted to another crop.

Using CBO projections for planted acre revenue and ARC/PLC payments per base acre to highlight this, Figure 4 illustrates that farmers with seed cotton base have incentives to plant those base acres to corn or soybeans. Farmers with seed cotton base can earn the higher crop revenues for corn and soybeans, combined with the high payment rates for seed cotton. Each combination—corn on seed cotton base, soybeans on seed cotton base, as well as corn on corn base and soybeans on corn base—provides a higher projected income per acre than cotton planted to seed cotton base. This could cause problems for corn and soybean prices, as well as many more farmers.

Concluding Thoughts

Tariff tantrums and mercurial management are fueling market instability and worse. One result is that the squeeze on farmers due to lower crop revenues and higher costs is likely to worsen substantially. Farm policy appears to be broken, however, likely to cause more harm than provide help. As base acres become the problem they were designed to prevent, the design leads a growing list of policy failures, from massive ad hoc payments to an increasingly unsound crop insurance program and ineffective conservation programs.

We peer into the future as through a glass darkly. CBO projections, for example, are merely an educated guess about a future that cannot be known. Those projections will be wrong in one direction or another. They are useful, however, for perspectives and to highlight developing problems, such as those with base acres discussed herein.

One problem (among many) with the Southern farm faction is not that they are not facing serious problems and challenges, it is that the faction acts as if they are the only ones, or that their problems are more significant and important. They compound matters with a willingness to respond in ways that do not help and often hurt others—greedily capturing short term gains without regard to longer term consequences. Farm operations with base acres of peanuts, rice, or seed cotton receive significant advantages from policy designed to deliver extraordinarily large payments only to themselves. Those payments likely support planting crops with better revenue, such as corn and soybeans for which the Renewable Fuels Standard helps drive domestic demand. At some point, the additional bushels will outrun that demand, especially with continued export market problems. When that happens, oversupply will drive down prices and revenues for more crops and farmers.

If history provides any guidance, it is that broken farm policy will unfortunately break many farmers. A cliff appears to be approaching at an accelerating rate of speed. Multiple course corrections are needed immediately.

References

Congressional Budget Office. “Details About Baseline Projections for Selected Programs: USDA Mandatory Farm Programs.” January 2025. https://www.cbo.gov/system/files/2025-01/51317-2025-01-usda.pdf.

Congressional Budget Office. “Details About Baseline Projections for Selected Programs: USDA Mandatory Farm Programs.” February 2026. https://www.cbo.gov/system/files/2026-01/51317-2026-02-usda.pdf.

Coppess, J. "Off Base, Part 1: Reviewing Issues and Problems with Base Acre Policy." farmdoc daily (16):7, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, January 15, 2026.

Paulson, N., H. Monaco, G. Schnitkey, J. Coppess and C. Zulauf. "Projected ARC and PLC Payments for 2025." farmdoc daily (15):213, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, November 18, 2025.

Paulson, N., H. Monaco, G. Schnitkey, J. Coppess and C. Zulauf. "Additional ARC/PLC Payments for 2025: Value of Receiving the Maximum Program Payment." farmdoc daily (15):218, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, November 25, 2025.

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.